A Review of Betterment - Robo Advisor

Is Betterment a smart way to invest your money? Our detailed Betterment review gives you everything you need to make a sound investing decision.

Betterment is a different type of brokerage. Most discount brokerages want to get customers to trade as frequently as possible. But Betterment is looking to be your asset manager.

Currently, the brokerage is offering an incentive for new customers. But the way they do business is a bit different than most brokerages you may be familiar with. This uniqueness is evident as early as the account sign-up process.

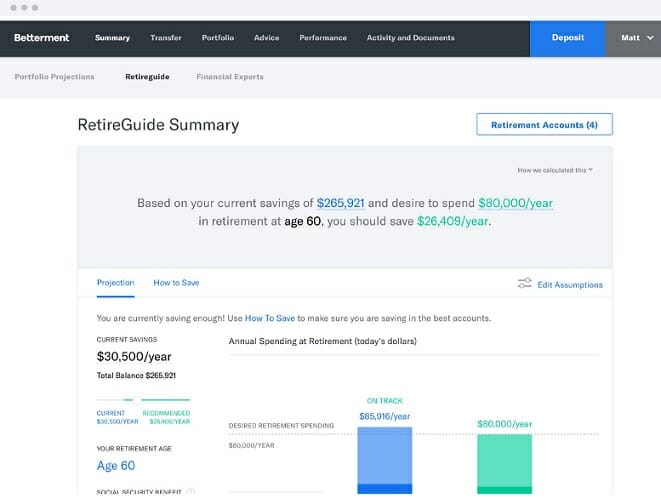

When you apply for an account with a typical discount brokerage, the application asks about income, net worth, and investment experience. Betterment asks about the goals and purposes of your investments. The service encourages each new account holder to designate a main account goal, like retirement, a major purchase, or a vacation. Betterment will also ask how many years you expect to take to reach that target or the age at which you’d like to achieve a goal.

What is Betterment All About?

The core philosophy for investing with Betterment is the asset allocation. This is the type of simplicity that I’ve seen with 401(k) accounts. These retirement investments often try to take an important concept of investing–asset allocation–and make it simple. This way, busy employees can simply submit a risk profile, and the investment will use this information to determine their ideal mix of stocks and bonds. Betterment takes this concept further, making the process incredibly simple.

Fees

![]() Because of this simplicity, Betterment’s fees can be lower than other forms of investing. Although you could have a free account with a discount brokerage and never pay a transaction fee, you may still be subject to fees built into the investments, like expense ratios or front-end load fees. Betterment’s approach is to charge a percentage of your account’s value–or assets under management. This is the custom among professional asset managers who generally work with high-net worth clients.

Because of this simplicity, Betterment’s fees can be lower than other forms of investing. Although you could have a free account with a discount brokerage and never pay a transaction fee, you may still be subject to fees built into the investments, like expense ratios or front-end load fees. Betterment’s approach is to charge a percentage of your account’s value–or assets under management. This is the custom among professional asset managers who generally work with high-net worth clients.

This fee might depend on how much you invest with Betterment. For those looking to have a hands off approach, the annual fee is 0.25% (digital plan). For those looking to take advantage of the premium service ($100,000 account minimum) the fee is 0.40%. The premium service includes everything in the digital package plus in-depth advice on investments outside of Betterment and access to their CFP professionals.

And now for a limited time, Betterment is offering a promotion of up to 1 year managed for FREE. Three different levels and timelines are available for the bonus; outlined below.

- $15,000 – $99,999 – 1 month free

- $100,000 – $249,999 – 6 months free

- $250,000+ – 1 year free

Investment Management

With Vanguard investing, you’re mostly on your own. You alone decide your asset allocation, and many investors do not consider asset allocation at all. Betterment can be more expensive, but they are also providing a service that, depending on your needs and interests, may be worth the extra cost. At the same time, it’s less expensive than having a dedicated asset manager while offering many of the same features.

You’d have to be a hands-off individual to like the type of service offered by Betterment. You don’t choose your own investments like you would with a typical full-service or discount brokerage. Betterment chooses the investments for you, and their selections are based on a mix of index exchange-traded funds (ETFs). Betterment reinforces the idea that individual investors should not try to beat the market. For the most part, investors fail when they try. And their investments would have fared better had they remained diversified across a broad selection of investments and refrained from changing their risk profile.

Betterment Investments

Betterment‘s investments include baskets. Each basket represents exposure to a type of assets. To help an investment portfolio match a risk profile, the portfolio could include a combination including a stock market basket and a treasury bond basket. Betterment will rearrange the balance between the different stock index ETFs as it sees fit, but investors control the relationship between stocks and treasury bonds through the risk profile.

The treasury bond basket is split evenly between two investments, TIP: iShares Barclays TIPS Bond Fund and SHY: iShares Barclays 1-3 Year Treasury Bond Fund. The stock market basket includes these investments:

- (VTI) Vanguard Total Stock Market

- (VTV) Vanguard US Large-Cap Value Index ETF

- (VOE) Vanguard US Mid-Cap Value Index ETF

- (VBR) Vanguard US Small-Cap Value Index ETF

- (VEA) Vanguard FTSE Developed Market Index ETF

- (VWO) Vanguard FTSE Emerging Index ETF

Betterment IRAs

Previously Betterment’s investing plans were limited to the form of a standard brokerage account. But the service now offers IRAs. You can now use the government-designated accounts for saving for retirement through Betterment’s service. Some of the benefits of owning a Betterment IRA are:

- IRA fees are a fraction of a standard 401(k) provider

- You choose your personal risk strategy

- Betterment regularly rebalances your portfolio

Betterment Checking Cashback Rewards

Betterment first launched its checking account as a no-frills, fee-free alternative to mainstream banks. Within months it had added its first perk – mobile phone insurance. It has since added cashback rewards from thousands of local and national merchants.

In true Betterment style, aside from standard offers available to everyone, you also get personalized offers based on your spending history. These are unique to you and become more tailored the more you use your account.

You also get near-real-time notifications when you receive a reward, so you can immediately see how much you’ve earned when you spend. And rewards are automatically deposited in your account – there are no complicated hoops to jump through.

Betterment promise thats these are just the beginning of the perks available to checking customers. Coming so soon after adding mobile phone insurance, we can believe them.

Opening a Betterment Account

Opening my account at Betterment was easy, and they approved my account right away. Like any new financial account accepting electronic deposits from other banks, I needed to confirm my ownership of the linked account through the familiar process of verifying test deposits. I’m waiting for my external checking account to receive the test deposits so I can begin investing with Betterment.

Betterment is a fairly new player in the word of finance. This is an industry where the major companies have been around for a century or more. But Betterment protects your assets just like any other major investment firm. Betterment is a Registered Investment Advisor with the Securities and Exchange Commission and is regulated by FINRA and the SEC. Accounts are insured by SIPC up to $500,000 per owner.

This doesn’t protect investors from having their investments lose value, but it does protect the value if the brokerage were to fail. If Betterment were to go bankrupt or to go into receivership, the insurance coverage would allow you to access your account.

>>Try Betterment Investment Account Now<<

Why Use Betterment?

For the micro-manager, Betterment might not be the perfect way to invest. It’s also not the appropriate service for someone who wants to trade their investments frequently or delve into investing in individual companies. Betterment’s services may be right for investors with the opportunity to save for their future outside of retirement accounts who want the simplicity of diversified investments, risk-based asset allocation, and a buy-and-hold-and-rebalance investing philosophy.

Their published returns are nothing to scoff at, and their fee structure works especially well for smaller investors who are looking to avoid day to day interaction.

Article comments

The article is not quite correct about the fee structure. It is a flat 0.25% for what they call the “Digital” plan, and the balance can be anything. That gets you the basic management using their algorithms, plus access to CFP through email and maybe chat (to ask basic personal finance questions). The “Premium” plan provides what the Digital plan offers, but gives you “unlimited” access to CFP professional and they will also provide guidance on outside investments (e.g., 401k, real estate and individual stocks). They obviously have to charge more for that type of service, and that’s where the 0.40% comes in. I have used them for more than a year now and I’m happy with what they do. I don’t have the Premium plan, so I can’t comment on that.

Betterment still has a long way to go. For some reason they don’t look at all your assets in total and manage it as a whole. For example, an IRA and joint account each has to have goals and they come up with a mix for each. So if you have $500k in each account and want a 50/50 stock/bond mix, they won’t split it for you. They will put 50/50 in each account, which isn’t tax wise. If you want all the bonds in the IRA to avoid income taxes each year, you have to choose 100% of what you want in each account. Then it tells you, when looking at your account, that your IRA is too conservative, and your joint account is too risky. In this day and age of computers, this is pretty weak.

Pretty nebulous information, both on this “review” and Betterment’s website.

Remember, if it sounds too good to be true…………………….

I want to bring this to the attention of clients of betterment that betterment charges a fee up to $400 if you want to do a direct (in-kind) transfer from betterment to another brokerage. I have been trying to do a direct transfer of Roth IRA from betterment to another brokerage firm and was quoted this amount.

This fee is also listed in their customer agreement in section 23. Please be aware that your only option could be an indirect roll over if you don’t want to pay $400 in transfer fees.

Betterment does not openly advertise this fee, which I think they must do when they list any or all fees on their website.

Hi F@B,

Katherine from Betterment here. Thanks for the comment. As I posted in response to you on a few other blogs, you are correct, there is a fee that would be assessed should a 3rd party direct transfer be requested. This is because it would involve a 3rd party to complete the action – it is not a feature provided with your account. Betterment will NOT charge any transaction fees to allow you to complete an indirect transfer of your account, and is our recommended method.

While we apologize that the new brokerage may charge fees for the trades of moving funds into your account as cash, we do our best to provide an option that does not cost anything extra.

Thanks,

Katherine

Intriguing concept, but not for me. For starters, it is not for a retiree who is looking for dividend and dividend growth income, and there is no option to click on.

This is really for an investing novice with no previous financial experience and who has no interest in gaining such knowledge. It is not for the person who wishes to manage their own money.

Duh. Of course it is not for the person who wants to manage their own money. That’s what they do…manage money. And it is not just for the novice. It’s also for someone who doesn’t want to have to choose the mix and rebalance it periodically. It’s convenience…

thanks for the post flexo. Betterment is a company that I’ll need to do some reserach on.

This is a very intriguing company. Can you update us on this after you have used it for awhile? Thanks for the info.

Flexo and hakwuzhere can you both post updates after 6 months or so?

Ive been looking for something like this as I have been disatisfied with my online savings. I have been very wary of moving my emergency savings into my regular investment account, this looks to be the best of both worlds… will try to report back after a few months.

Using an online savings account fulfills a different need than investing. I wouldn’t put an emergency fund into the stock market, for example, but you may be able to use the treasury bond basket at Betterment for a similar purpose. Let us know what you think!

I do have my regular savings at my bank with about 1 month reserve… Ive just been looking for something for the additional savings. My PNC virtual wallet is like .3% and my HSBC was .8%…

yikes, just looked at my growth account.. its .85% for my balance.. thought it was less… I think its better than HSBC was.. lol.