5 Budget Categories to Create the Best Budget

Creating a budget can be a challenge. How exactly do we go about categorizing our spending? Here we show you how to create the perfect spending plan using just 5 high level budget categories.

When I started my first real budget as an adult, the concept was not difficult. I knew I had to track my spending.

Tracking my spending would keep me from spending too much. And that would help me control and fix my financial situation. I was trying to reverse the trend of increasing my debt every month. So I came up with a simple spending plan that suited my needs.

Experimenting with My Budget

At the time, I used a free version of MoneyDance, a budgeting tool. I also experimented with GnuCash. I categorized my expenses into at least twenty categories. But I quickly found that complicated budgets don’t work that well. Instead, what worked best for me was a simple plan that broke spending down into a few core components.

I started working towards J.D. Roth’s Balanced Money Formula. He suggests approaching your very basic budgeting categories this way:

- 50% of after-tax income goes towards needs

- 30% of after-tax income goes towards wants

- 20% of after-tax income goes to saving

These ratios were my goal. But, for one thing, I wasn’t quite there yet. And for another, this isn’t a complete solution. It laid the groundwork. But I needed to examine my spending with a little more detail. So I started asking myself a few questions.

Asking the Right Questions

The questions I asked, and answered for myself, included:

- What’s a need, and what’s a want? For an entrepreneur whose business relies on internet access, good internet access is a need. But what about those who only use the internet for personal entertainment and browsing?

- Does a cell phone count as a want or a need? What about a Smartphone versus a basic phone?

- Where does charitable giving fit in?

- How about food? Eating is, of course, necessary for survival. But what about dining out?

This is just how I started dividing out my spending among J.D.’s broad categories of spending and saving. These questions are complicated and can be difficult to answer. Plus, in order to answer some of them, you need to know what you’re already spending in these categories. We’ll get to that later.

Maslow’s Hierarchy of Needs

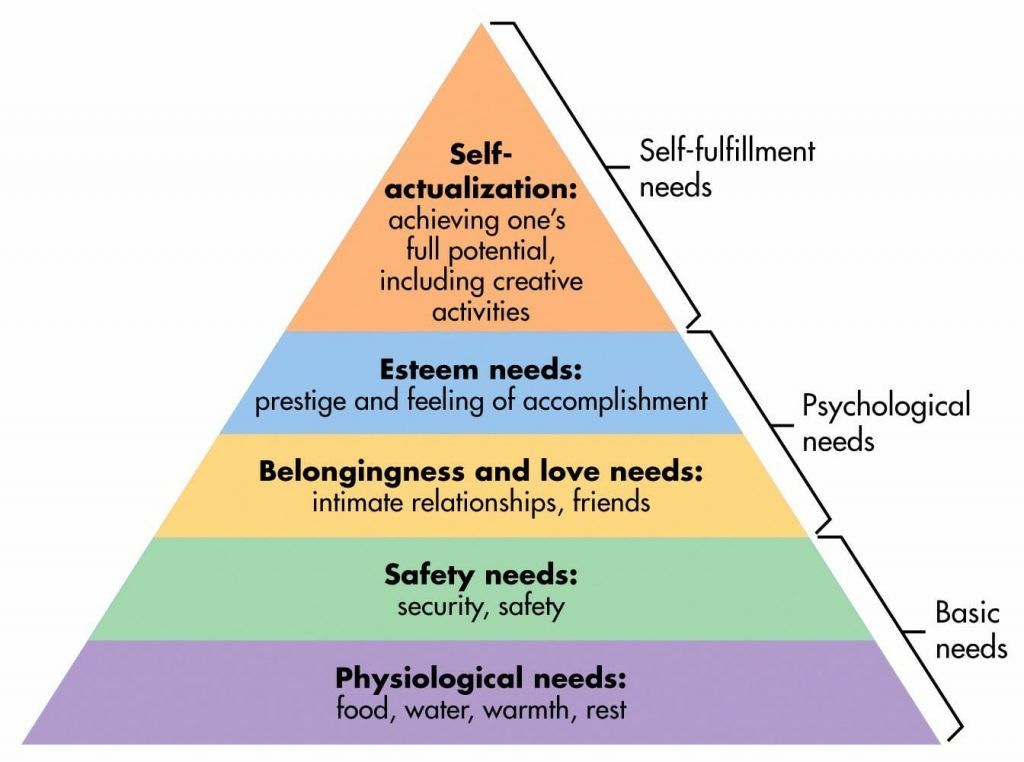

So instead of just using those broad categories, I referred to Maslow’s Hierarchy of Needs.

This image is one you often see in a Psychology 101 class in college. The basic theory is that in order to fulfill higher-level needs, you must first fulfill lower-level needs. In other words, it’s really hard to feel safe and secure if you don’t have adequate food. And it’s hard to create relationships when you’re struggling to meet your basic physiological needs.

It’s pretty easy to use this hierarchy to prioritize your finances. In fact, using the Hierarchy of Needs is a great way to decide how to spend your money when there’s not enough to meet all of your expenses. Think about it this way:

- First, consider basic physiological needs. This includes adequate food, running water, heating in the winter, housing, and basic clothing. Given how much we rely on electricity, you can probably put paying the electric bill here, too. The most important spending is on these items.

- Next, spend on things that are essential for your safety and security. This includes health insurance, especially if you’re one medical emergency away from bankruptcy. Affordable term life insurance can give you peace of mind for your family’s future, too.

- After this, spending, you’ll start moving from wants into needs. Some items, like the internet access we talked about above, are a gray area. You may have certain “wants-like” expenditures that enable you to continue earning money so that you can pay for your needs. For instance, this could include daycare for your children or transportation costs.

You might put your spending in slightly different categories, but here’s a basic breakdown of what this might look like:

Level 1: Physiological Needs

- Housing: rent or mortgage payments

- Basic sustenance: groceries, cooking, and water

- Clothing: non-designer brand essential wear

Level 2: Safety Needs

- Power (electricity, gas)

- Basic telephone service

- Insurance: health, home, and life

- Vehicle or other transportation

- House repairs and maintenance

- Expenses related to operating your business

Level 3: Love and Belonging

- Gift-giving

- Charitable contributions

- Entertainment

- Spending time with friends and family

Level 4: Esteem

- Work-appropriate clothing

- Education and professional development

- Dining out

- Fitness beyond basic health needs

Level 5: Self Actualization

- Hobbies

- Internet, if not needed for generating income

- Television

- Vacations, non-essential travel

- Luxuries

Creating Your Budget Based on the Hierarchy

So what do you actually do with this information? Here are some steps to take when creating a needs-based budget, especially if you can’t pay all your expenses every month:

- First, budget for your most basic physical needs. If you can pay for nothing else, pay for these.

- Next, budget for the safety and security related needs.

- After this, you can start budgeting for the next two levels lumped together. For instance, some months, you might need to budget for a wardrobe upgrade or a new suit. To do that, you might need to cut back on dining out with your family. That’s technically mixing up the hierarchy, but it still makes sense.

- When you have extra money, use it on the self-actualization categories.

As you get better at budgeting, you may not need to be so strict with your categories anymore. But when you’re starting out, it helps to divide things down to their basic components. This is a great way to get going!

For a great budgeting tool, check out Personal Capital Financial Dashboard. It’s totally free, and you can track all your spending, credit cards, bank accounts, and even investments.

Article comments

I just like the helpful information you provide to your articles.

I will bookmark your weblog and test again here

frequently. I am quite sure I’ll be told a lot of new stuff proper right here!

Good luck for the next!

this is a good list flexo, but there are few i may have set differently. to me, power should be in level 1. my only other comment would be about “entertainment.” this is such a broad category, i just do not know how i feel about it. there are a couple of items listed in higher levels that could easily be with entertainment.

that said, great post! it is making me think.

Your list is well organized.

I would consider shelter, food, basic clothing as needs, and everything else as wants. Even though safety issues are addressed in level 2 above, I feel they are under the shelter catagory.

I agree with most of the levels except Level 3. I think the levels and entries may change depending upon how self confident and assured you are in yourself. But all in all, this was an interesting article and gives me something to thing about.

As Ramit from another blog might say. Don’t just think, do. The principle here got me to rethink my budget and reorder the categories we use in our budget. I think the exact grouping is not the most important issue. Putting your budget categories into a priority list is the key point. Dave Ramsey tells people this all the time, If you ever don’t have enough to cover all you bills you must do this to decide who or what gets paid. Doing it before then might just help keep the bottom spending categories from taking money that puts you into a situation where you can’t pay everything. Great job Flexo.

I think this is a really interesting idea. Our budget differs slightly because our financial planner had us think about what do we need to be able to effectively work our jobs. So of course we need food, shelter, etc, but we also need to prioritize transportation to work, work clothes, and whatever else we need to complete our job. Of course you can’t go crazy on any of those work-related expenses, but it did get us thinking about how we need to keep our jobs so we would then have money to budget!

I like the way this is broken down in general. I think a lot of people need to break down wants versus needs a lot better than they already do.

One question :

Entertainment is in level 3 but then level 5 has several items I consider to be sub-sets of entertainment like TV, hobbies and travel. How does the entertainment item in level 3 differ from those items in level 5?

I think power should go in level one, being warm is key to survival (shelter). I think phone service isn’t necessary. And having a personal mode of transportation is a luxury (same with entertainment and dining out).

Where does savings/retirement fit in your hierarchy? In my budget, I deduct savings/retirement first and fit my needs and wants in on what is left. I periodically review my choices based on my priorities and cost. For me, this works because of its simplicity.

Savings and retirement doesn’t fit into the hierarchy, at least in this post, because I’m basing the categories on the Balance Money Formula, which puts savings in a separate category, away from “needs” and “wants.” But for a complete picture, I believe saving and investing fits on the second step of the hierarchy, Safety Needs. Savings provides financial security, and security is related to safety.

I may be missing the point of doing this…but what does this do that actually affects how a person budgets? Cause people to re-evaluate their priorities? It seems like you’d still end up with roughly the same categories for expenses…

There are two points — determining the right categories that make sense for you (which you can do with or without a framework like Maslow’s, but a framework can get you thinking in the right direction) and prioritizing those categories and determining which are needs and which are wants.

This whole idea makes the grand assumption that people have anything left for wants. CNBC just today reported that more people were losing their health insurance and/or going without medical care and prescriptions this month. This is going to break the bank for lots of people and businesses if it isn’t controlled.

The concept of budgeting doesn’t assume someone has something left over for wants — in fact, for anyone who needs to focus solely on covering needs, budgeting is much more imperative. That’s the point of organizing a budget using Maslow’s Hierarchy of Needs. It highlights what needs to be satisfied first in your budget.

I think the idea of breaking a budget down in this way is a super idea, Flexo.

I don’t think you need to make one decision to go simple or complicated with a budget. Lots of people like a simple budget for day-to-day living. But drilling down deep and putting things into categories like this can provide HUGE information feedback benefits. So do that too! I like to do an in-depth budget on New Year’s Day. What you learn from doing the in-depth budget can help you put together the more simple one that you can use day to day if you prefer.

Some spending items will fall into more than a single category on your hierarchy of needs. I understand that you were joking with your “Spending on Sex” comment. But the full truth is that we ARE spending on sex when we buy a red sports car or a tech gadget that costs more because it is the latest and coolest. The tricky part is that we are not spending ONLY on sex. We really do need a car to get around and the tech gadget for whatever it does. To fully appreciate where your money is going, you need to allocate the spending in percentages to different categories.

Some will look askance at this idea on grounds that it is not practical. But in the long term it has a big dollars-and-cents effect. It helps you understand WHY you are spending and that helps you manage spending much more effectively. I could give lots of examples of things I’ve learned from these in-depth budget sessions. The benefit is not in the budget document itself. The benefit is the learning experience that digging down deep brings on.

Rob