How to Close Your Wells Fargo Savings or Checking Account

Two years ago, Wells Fargo changed its customer agreement, taking away the rights of customers to resolve disputes with the bank through the typical legal process afforded citizens of the United States. Current Wells Fargo customers tacitly or knowingly agreed to sign away these rights in favor of an arbitration system that favors wealthy corporations.

Although I wrote about the change on Consumerism Commentary, changes like these go largely unnoticed and don’t get a lot of attention in the media, even from consumer-focused outlets.

To be honest, I still have personal and business accounts at Wells Fargo. I’m continuing to look for a credit union that is convenient enough for me to move my primary banking. I’ve opened and closed dozens of bank accounts to review the companies for Consumerism Commentary readers, and one of these days, I will close my account at Wells Fargo.

The process of closing a checking or savings account is thankfully straightforward, and Wells Fargo will not make you jump through hoops in order to complete the process. Before you close your account at Wells Fargo, though, be sure to download the latest version of the Bank Switch Kit and Checklist. I also strongly recommend you prepare an alternative. Check out our list of the best online saving accounts and figure out how you can maximize your money.

The Bank Switch Kit has specific tips and forms for making sure your account is ready to close. First, you’ll have to make sure you have no automatic deposits or withdrawals. That might involve changing your direct deposit instructions at your job or changing your bill payment accounts. A standard form included in the Kit takes care of the first issue.

After ensuring you have no future deposits or withdrawals, you have to move your balance to zero. If your balance is less than zero, Wells Fargo will not let you close the account before paying what you owe. If you don’t pay what you owe, even if you don’t believe it’s your fault the account is negative, the account will go into collections and it will be more difficult for you to open a bank account anywhere else.

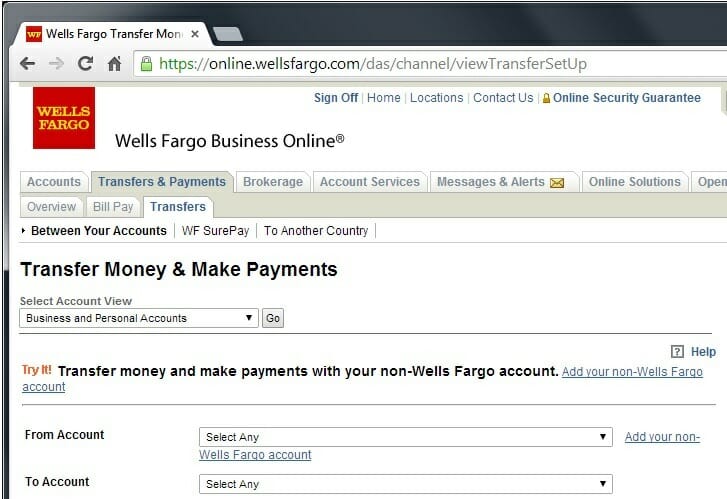

Banking Deal: Earn 1.55% APY on an FDIC-insured money market account at CIT Bank. See details here. CIT Bank. Member FDIC.Most likely, your balance is above zero, and you have to clear the balance out before closing the account. With Wells Fargo, you can either transfer the balance to an external bank account linked to your Wells Fargo account. If you don’t have an external bank account linked to your Wells Fargo account, you can add the external account by logging into your account online, selecting “Transfers & Payments” from the menu, then selecting the “Transfers” page.

There are several links on this page to add your non-Wells Fargo account for transfers. It will take a few days to confirm that you own the external account.

If you already have a linked account you can use this page to transfer your full balance out of Wells Fargo into a different financial institution.

Another option for moving your balance to zero is to request an official bank check (a cashier’s check). You can do this in any Wells Fargo branch or you can request a check through the mail. Unfortunately, Wells Fargo charges a fee for cashier’s checks, whether you request them at a branch or through the mail. To request a check through the mail, send a notarized letter requesting the check and the closure of the accounts, and a confirmation of the address on the account, to the following address:

Wells Fargo

350 SW Jefferson Street DP5

Portland, Oregon, 97201

Once the above is complete — you will have no future automatic deposits or withdrawals and your balance is zero — you can officially close the account. If you do not do this step, you will continue to have an account at Wells Fargo with a zero balance. If that’s the case, you could run afoul of minimum balance requirements. You will be charged a monthly fee for your low balance, and your account will have a negative balance. You will owe the bank money.

Make sure you continue the process to close the account. You have three options for doing so.

Option #1: The internet. Log onto your Wells Fargo account online. Select “Contact Us,” a link at the top of every page on wellsfargo.com. On the right side of the Contact page, under “Other Ways to Contact Us,” select “Email Us.” You can choose the account you’d like to close, and choose “Account questions or requests” as the subject of your email.

Leave the next three fields blank (Transaction Date, Transaction Amount, and Account Number), and state in the Questions or Comments box that your account has a zero balance and you would like the bank to close it. Click the Submit button at the bottom of the form and wait for confirmation from Wells Fargo.

Option #2: The phone. Call the bank at 1-800-869-3557. You will be asked to enter your account number right away, and then you’ll be given the options. Choose to speak to a customer service representative to close your account over the phone.

Option #3: In person. Walk into any Wells Fargo branch and a manager can complete the process for you.

Read More: Axos Bank Review: The Future of Full Service Banking

Open a New Checking or Saving Account

Thankfully, the process for closing a Wells Fargo bank account is easier than it is for other banks. Do you plan to close your Wells Fargo checking or savings account? If so, why? If you’ve already closed your account, were you pleased with the process?

Article comments

We were happy with the service until we tried to close our account.

I tried closing one of my WF Account today. It was more difficult than I anticipated. I told the banker I wanted to close a WF checking account and transfer those funds into my WF savings account. She transferred the funds leaving the WF checking account with a $0 balance. But, then she told me the computer would not “let her” close the WC checking account because the transfer is “pending”. I may have to wait two days and then go back to WF to close the account! She assured me that I would not be charged a fee due to the zero balance and she’d take care of any fees in case WF charged my WF Checking Account due to the zero balance.

Regardless, this is absurd. I should not have to wait two days to close an account. WF is notorious for setting up fake accounts. Now that they got caught, they are making it difficult to close an account.

The WF Executive Office is a waste. They don’t help at all. The CFPB has no power, so they are useless!

Won’t let me log in

Closing my account saving. That’s all

Those who have not failed may not have succeeded

Have been thinking about it for the past few years, ever since the CFPB found them flagrantly breaking laws and working with loopholes, some of which affected me and my bank account. I’ve been with them for over 20 years (formerly wachovia, and prior to that i don’t even remember)… but enough is enough. Thanks for this article – i’ve started the process already.

The CFPB is useless and powerless. The Banks ino it.

Yes, I’m planning to close my Wells Fargo accounts. I have my Checking and Saving accounts with them, and I have applied twice for a credit card and they have denied my application because they weren’t able to confirm my identity. I even went to a branch with all my documents! How is that possible? I really want to say F*** you, Wells Fargo.

Anybody out there?? I’m just putting some feelers out there to see if there’s anyone interested in making a pretty substantial amount of cash in a short amount of time. Only thing this requires is that you have an active bank account or credit card. No cash is required up front to start. Which means your account can be on a zero balance and that’s completely fine. +1(314) 856 1730, lets talk about the next deal

Yes Tom, I am certainly interested in making some cash and I do have a couple accounts that are open and in good standing.

Yes Tom I am interested as well..i will leave my email to contact me

I to have recently had a horrible experience with Wells Fargo I had a fraud claim that they said would take 5 to 7 days to come up with their decision from the resolution team I didn’t even make it home from the branch within 45 minutes and they came up with the decision and denied my claim stating that they cannot cover the fraud highly highly do not recommend drinking at Wells Fargo

I disagree, walking into Wells Fargo with a bottle of Tequila is the most pleasant experience you will ever have drinking at Wells Fargo

Yes Don, that does sound like a good time. Lol

Wells Fargo did not support me for a charge dispute. After calling when I discovered the fraudulent charges, they said they would investigate. About 5 days later I received a letter saying my claim was invalid and closed the investigation. That’s it. No explanation. The company in question has an NR (not rated) rating with the BBB and dozens of negative reviews. Also, after researching on my own, I discovered that this company has recently changed names. Sounds fishy.

In the end, I blame myself for not doing my due diligence in researching this company. But Wells Fargo seemed to make little effort in doing the right thing. Guess I should have researched them as well

Im canadian. I wanted to close my account after inactivity.

One agent told me to write a letter and gave me an address…. it was no good I got my mail back sent to my house.

Then I called again, one agent told me I could wire transfer if i logged in to my online banking. tried but couldn’t’ log in. They transferred me to online banking. Even after passing security questions, they had ‘required’ some more security questions with this department but ran out of questions. Told me I had to go to an outlet. BUT I LIVE IN CANADA. The closest one would be new york….

I call again, i ask for a supervisor and explain to her that I just want to close my account but it’s not my fault if they don’t have anymore security questions to ask me(after i even confirmed my PIN and i answered many of them). She tells me she will help me……….. COLD TRANSFERS me to another agent.

This other agent tells me I need to write a letter. Gives me the form.

Completely wasted so much time. Now I have to pay for a notary , etc JUST TO CLOSE my account.

seriously, I spoke to at least 5 agents( i spared you all the details). Almost each one had another version of what I need to do.

Wells Fargo is the worst bank in the United States.. The charge to many fees.. Also I went to another country and I went to a Wells Fargo and they charged me fees for using their bank. I have a Wells Fargo account.

I’d like to close my account. I have the Everyday Checking. Is there a fee to close the account?

I have the same question as Anna. An Everyday Checking account requires a minimum balance of $1500. If I transfer all my money out and then ask to close the account by email, will they penalize me?

I also find that many of their tellers are not up to par. I once asked for 1500 in 100 dollar bills and waited nearly a half hour only to get 1500 in ones! The managers are always being shifted, so they could care less! One time a bling bling teller gave 9 one hundred dollar bills, andcthevtenth was a dollar! When I showed it to her she made a face. You of course could not fire her.

I am so disgusted with Wells Fargo. They seem to have a policy now of hiring very few whites now for either tellers or platform, and most of their managers are also non-white. I think it is called Reverse Discrimination. But we of course are not suppose to say that!

I didn’t know we were still living in the sixties.

I lost some documents so I called Wells Fargo right away and they said they could only freeze my accounts over the phone but if I went to a branch they could do more for me. So I had my accounts frozen and they gave me a list of numbers so when I went to the bank I could unfreeze the accounts. I went to my nearest branch and it was a mess, they said that my accounts had not been frozen they were very much active. Luckily, no activity on them. I then asked to have new account numbers and to close the old accounts. They went ahead and did this for me. I called the 1800 # and used an old “closed” account number and I while I had a 0 balance on the account, I was still able to switch accounts and access all the new accounts. WTF? Wasnt the point of me closing those accounts so no one would have access to them anymore.

I have been banking with Wells Fargo for quite sometime now and have experienced a complete lack of customer service and lack customer satisfaction. This has been by far the worst banking experience I ever received in my years of trusting a third party to hold my hard earned cash. The display of unrealistic exceptions they put on their customers are inexcusable to say the least. It saddens me to see, an American bank , using- what I like to call- a display of communism. Locking hard working American in a threshold of imperative methods to ensure their is no growth in their pockets nor accounts. Closing account today 🙂

TERRIBLE SERVICE ! Absolute worst experience with a bank . Anyone have an alternate bank they trust and have had any good experience with ? Looking

To cancel my account asap !

I recently had a professional hacker gain access to my checking and credit card information with Wells Fargo. They presented as a online support service I had a contract with and gained access to my computer by stating the company was going out of business and was issuing refunds. Once they had remote control of my computer they extorted almost $9,000.00 out of my banking and credit card account. I immediately reported these claims while the account were still in the processing stage. I had this credit card since 2013 and never used it once. The bank states that it will contact you if any suspicious activity shows up on your account Even though it took a day to get back control of my computer I was amazed that Wells Fargo didn’t acknowledge that someone maxing out my credit card which previously had no action on it for 3 years. Now wells Fargo is not only denying my claim of fraud with my checking account by denying the claim that any fraudulent activity is covered by their guarantee. Right now I am seeking legal resources to help resolve the matter, but if anyone has had a similar experience and found a solution I’d appreciate your response. Meanwhile they made out with $2,900.00 dollars from my checking account and wells Fargo refuses to back up my claim and so far have added $70.00 to my credit card charges for what they termed cash advances

Their customer service is TERRIBLE and only recently have they responded promptly to complaints. But they just respond with lip service, no resolution to my problem was done. I am in the process of closing my account now. They have too many “other” offices and neither knows what the other is doing and even if you give the name of the bank staff and branch who spoke to you, it does not help.

I am british and have been trying to close down my dead sisters account in Utah for two and a half years and it is still not resolved. Now they tell me they have lost some of the paperwork and I have to go through this all again, its a nightmare dealing with them, they take two months to answer your mail and your passed on to different offices who do not know what your talking about. British banks have told me that US banks are a nightmare to deal with.

u r the worst thieves Ivee ever come across I will sure nobody I know ever does bus with u thieves

I closed my Wells Fargo account when they bought out Wachovia. I had a bad experience with them in the past and didn’t want to deal with them again. I walked into the branch and had a cashiers check of all my money in about 20 minutes.

Recently moved to the USA from Canada, I find the banking choices overwhelming. My wife was with USAA and we love it. I especially like the ability to bank by phone including photographing my check for depositing. I haven’t stepped into a bank branch since I moved here.

i closed a wells fargo checking account a few years ago. At the time they would not close it for me online and i was told i had to close it in person at a branch. It was easy to close in the branch. I had very little cash in the account (under $50) and it was given to me in cash. Total time in the branch was about 15 minutes. 10 waiting to speak to the manager, 5 to complete the process.

Since moving back up to Anchorage I’ve been using a credit union and I like it a lot. Hope you find a match for your own money.