A Review of GEICO Auto Insurance

Have you ever seen a GEICO commercial? Of course, you have. In fact, I bet over the last few years, you’ve seen hundreds of them. Every month it seems this auto insurance giant is releasing a new ad to lure customers in.

Originally, it was take 15 minutes and save 15% on your car insurance. Today, their marketing has evolved into a litany of funny and serious commercials that are both memorable and effective. But does a massive advertising budget translate into a quality auto insurance product?

I’d like to look at three main areas to determine the quality of GEICO auto insurance: Cost; Product Quality; Customer Service. These are the three attributes I hold valuable when figuring out where to park my business for just about anything.

GEICO Customer Service

GEICO promises to help customers save up to $500 in 15 minutes if they sit down to get a quote online or over the phone. The company delivers when it comes to low rates with decent coverage. But J.D. Power ranks GEICO somewhere near the middle in terms of customer satisfaction when compared to all of the other auto insurance providers in the country. The company earns three out of five stars across the board in the categories of overall satisfaction, service interactions, appraisals, repair processes, rental car experiences, and settlements.

GEICO doesn’t have a huge number of agents or offices like many other auto insurance companies. This means you may have to take more of a do-it-yourself approach when it comes to signing up for coverage, filing claims, or making changes to your policy if you live in an area that doesn’t have any offices close by. You may want to check if there is a GEICO agent in your local area before getting a quote if having an office nearby is important to you.

GEICO is an attractive option if you’re looking for affordable coverage from a reliable company. Representatives are available to assist customers with claims 24 hours a day by phone or online. This even includes holidays.

You can contact GEICO through any of the links below, or my mail if needed.

- By phone at (800) 207-7847

- By email through their secure form online

- Through online chat

GEICO

Attn: Region 8 Policy

PO Box 9506

Fredericksburg, VA 22403-9500

GEICO Policy Costs

I had my very first auto insurance policy through GEICO. At the age of 20, I was in school and needed a nice, cheap policy. After doing research for a few days online, GEICO proved to be the cheapest policy for my Ford Mustang. Eventually, however, I landed with Progressive insurance and have remained there for the last decade.

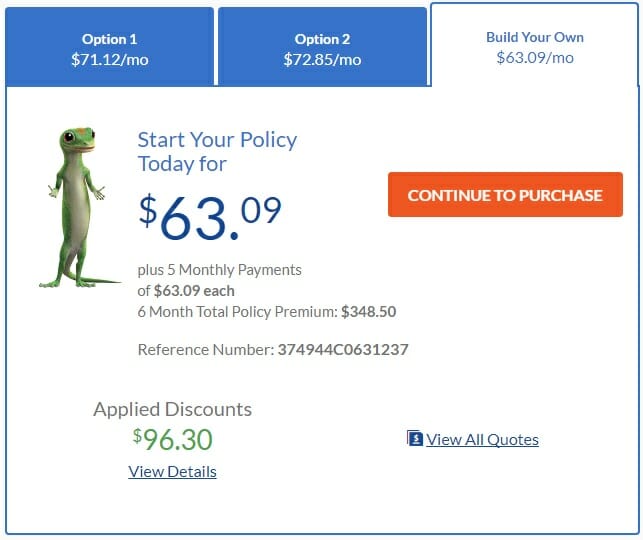

I thought this would be a good time to take a second look at GEICO and see if their quotes were cheaper than my current auto insurance premiums. Driving a 2015 Toyota Highlander, I ran a quote to see what it would cost me for the very same coverage I have through Progressive. The result was quite close. As you can see from the graphic below, a six month policy at my deductible rates ($2,000 collision / comprehensive) is $348.50.

My current policy with Progressive has a total cost of only $288, so GEICO is actually a bit more expensive. However I receive a loyalty discount with Progressive for being with them so long. And I get a bundle discount there since they also insure my home. Seeing the difference between costs is only $60, the policies are likely very close in price if I had those same discounts with a GEICO policy.

My overall impression of their quote engine is highly positive. They list individual coverage costs, so I know exactly how my policy costs are comprised. And I only had to answer a few quick questions to get a quote.

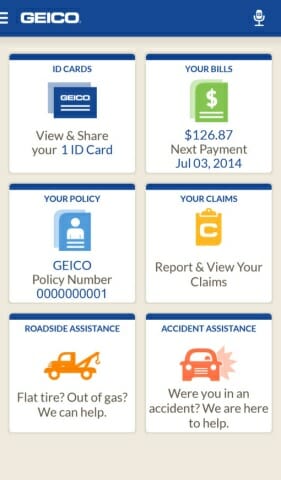

GEICO also touts a mobile app that lets you control your account from anywhere. From here, you can pay your bills, file a claim, change your policy, or do just about anything you can do from a desktop computer.

GEICO Discounts Available

GEICO’s ability to offer discounts is essentially unparalleled in the industry. The company offers discounts for everything from safe driving records to customer loyalty. Here’s a glance at how much you could potentially expect to have slashed from your premiums if you go with GEICO:

- 25% off your premium using a multi-car discount

- 15% off certain coverage categories for good academic records for students between the ages of 16 and 24

- Between 25% and 40% off the medical payments or personal injury protection portion of your premium if your vehicle has airbags

- 5% off the collision portion of your premium if you have an anti-lock braking system

- 26% off your premium if you’ve been an accident-free driver for five years

- 15% off the medical payments or personal injury protection portion of your premium if you always wear a seatbelt

- 15% off total car insurance premiums for military members

- 25% off premiums for military members who are deployed

There’s a good chance that you’ll fall into at least one of the discount categories above. What if you don’t? In addition to GEICO’s main discounts, customers could enjoy additional discounts if they belong to any of the 500 organizations on the company’s list of discount partners.

Should You Insure with GEICO?

You would have a hard time finding anyone to say that going with GEICO is a bad option. Customers certainly do sometimes have to take initiative and follow through with filing and monitoring claims online once they are in process because of the bare-bones approach to infrastructure the company takes with its agent offices.

However, this approach is ultimately why GEICO is able to offer a quote that is typically anywhere between $100 and $500 cheaper than the closest competitor. The bottom line on GEICO is that it’s a solid choice if your primary goal is to get a low rate above experiencing exceptional customer service.

Article comments

This has to be “paid for by Geico.” It will be interesting to hear how you feel after a claim. From experience, they are the absolute worst at making sure that your car is fixed correctly with quality parts and processes at high quality shops. Buyer beware.