How Student Loans Affect Your Credit Scores

This is an article by Gerri Detweiler. For the past twenty years, Gerri has been an advocate helping consumers find reliable answers to their credit questions.

Just as student loans can be “good debt” or “bad debt” depending on how they are used, they can be good or bad for your credit scores, depending on how you handle them. Obviously, they can help your credit scores when you’re able to pay them on time, and hurt them when you can’t. But there are important nuances that can make the difference between earning a great score and a mediocre one.

When student loans = good credit

A student loan can provide a student’s first credit reference. That’s especially true now that the Credit CARD Act makes it more difficult to load up on credit cards before you turn 21. Student loans differ from credit cards in an important way, though; they are installment loans, not revolving loans like credit cards. That’s a plus when it comes to building a well-rounded credit file. “Our research has shown that (all things being equal) consumers with a wider range of credit experiences tend to be better credit risks than those with only limited credit experience,” says Anthony Sprauve, public relations director for FICO.

A student loan can provide a student’s first credit reference. That’s especially true now that the Credit CARD Act makes it more difficult to load up on credit cards before you turn 21. Student loans differ from credit cards in an important way, though; they are installment loans, not revolving loans like credit cards. That’s a plus when it comes to building a well-rounded credit file. “Our research has shown that (all things being equal) consumers with a wider range of credit experiences tend to be better credit risks than those with only limited credit experience,” says Anthony Sprauve, public relations director for FICO.

What about the fact that many students graduate with not one, but many, student loans? Unlike maxing out a bunch of credit cards, the fact that your report lists multiple student loans is not necessarily harmful. That’s true even if the balances are high. “While having many revolving type accounts with high balances can hurt your score — even when paid on time — the FICO scoring formula doesn’t place nearly as much importance on the debt amount and the number of loans when considering installment loans,” says Sprauve.

But, of course, it can be hard to keep track of due dates on multiple loans, so the greater the number of loans, the greater your risk that you’ll miss a payment. If you consolidate some or all of your loans it will be easier to keep track of your due dates, but don’t expect a boost to your credit scores. “Typically (consolidation) wouldn’t have a major impact on the score because it’s installment credit and the amount you owe is still the same,” says credit scoring expert Tom Quinn.

When student loans = bad credit

Missing payments on your student loans hurts your credit scores. If you pay a few days late, say on the 5th of the month when the loan is due on the 1st, it’s unlikely the loan will be reported as late. But once a payment is thirty days late, it will likely be reported to the credit reporting agencies, and your scores will suffer as a result.

If you can’t make your payments, check out flexible repayment options, such as the Income Based Repayment Program (now dubbed “Pay As You Earn” by President Obama), graduated repayment, or income-contingent repayment. Or find out if you are eligible to put your loans in deferment or forbearance. Repaying your loans through one of these programs is not likely to hurt your scores, says Quinn.

But be careful. Some students who apply for deferment or forbearance think it’s a done deal and stop paying, only to discover it was not finalized and they are considered delinquent on their loans. Make sure you have something in writing from your lender before you reduce or stop making payments.

Quinn also warns about a common misconception that loans in deferment or forbearance are ignored when

credit score are calculated. “It’s still considered because you are obligated to pay it,” he says, adding that, “Delinquencies are reported even if the loan is deferred.”

What if damage has already been done? Late payments can stay on your credit reports for up to seven years and simply paying the past due amount won’t remove those late payments. But if your federal loan goes into default, you may be able to improve your credit by rehabilitating your student loan. You’ll have to make nine monthly payments on time over a nine to ten month period, depending on your type of loan. Once you do, you can apply for rehabilitation and, if successful, the notation that your loan was in default will be removed from your credit reports.

More student loan and credit scores tips

- Feel free to prepay. Pay off your student loans early and you’ll save money on interest. Doing so shouldn’t hurt your credit scores, though, Sprauve warns that without other installment loans you could see your scores drop slightly.

- Keep meticulous records. From the time you take out your first student loan, you should start a file and keep copies of loan documents, statements, etc. This documentation may prove to be invaluable if you experience payment problems.

- Pay on time. This can’t be emphasized enough. If you move, notify your lenders of your new address. A statement that goes missing does not let you off the hook for a payment. Never heard from a lender about a loan you took out? Track down the lender and find out when payments are due.

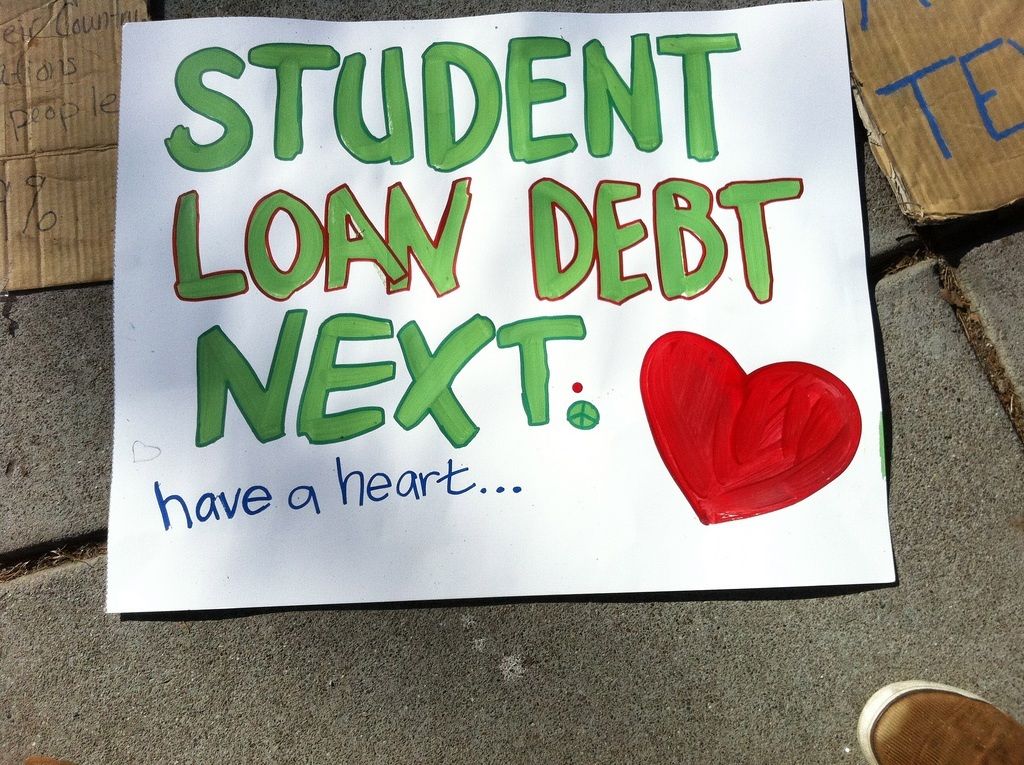

Photo: a_mina

Department of Education

Article comments

I made a large payment against a loan balance right after graduation from my BS and as I was starting my MS. So, I was still classified as a student when I paid. That payment covered all the unsecured student loan debt. Since then, while I’ve been a grad student, I’ve been making monthly payments against the secured student loan. When I hit the 6 months out of school mark, I will have a small loan amount left. My question is 1) is there any reason to try to pay the entire thing off before it starts drawing interest at the 6 month out of school mark? 2) Is there any benefit to letting this remaining balance linger and to make minimum monthly payments at the 6 month mark. I don’t have a credit card. Just a debit card. I don’t have any other things that would build a credit score. I want to re-finance a car into my name and take over those payments from my parents soon. thank you.

Something i ran into with an IBR plan. Loans that you’ve paid ahead might be rejected from any Income Based Replayment plan. I have 6 students loans and was paying ahead on just one. When i filed for IBR that one was rejected because it was paid in advance. Once the prepayments got caught up then it was able to be grouped into the IBR but i had to file paperwork on just that one to add it.

They really do make it complicated don’t they? You’d think paying ahead is a good thing…Thanks for the tip!

I was fortunate enough to finish college with no student loans, and I’m trying like crazy to give my kids that same opportunity; however, I can understand how student loans can be a necessary evil. This is a good article, though, and I’m passing it to a friend who’s husband has amassed a huge amount of student loan debt. Thanks.

Some solid info here. My partner is getting close to finishing her masters, thesis due tomorrow! Anyway means that she needs to think about those loans and how on earth to pay them back very soon!

Glad you found it helpful. Make sure your partner checks out the Income Based Repayment Program for federal loans. Good program if you qualify.

good information gerri, I paid off my student loans a few years ago and glad i’m out of that debt.

Thanks for feedback and congrats on paying back your debt.

One thing to note, that happened to me. It so happened my loans were deferred for a few months after 9/11 – or so I thought. Only the federal subsidized loans were and not my bundle of perkins loans. That bundle had only 1 payment, but was really 4 loans. I had no idea it wasn’t also deferred (at this time…checking these things online wasn’t as easy as it was now, plus I was much younger:). So I had a late payment, which i had no idea until I got the next bill (by which time it had aged to > 30 days). Because it was really 4 loans that put *4* 30 day lates on my credit report that I couldn’t do anything about – an otherwise spotless credit report!

The moral being that if you make a single late payment, depending on how it’s setup it can be many marks on your report! Often within a single lender you can have several loans and likely you have just one payment notice for them all.

Juggler – excellent warning! Thanks for including it.

I have just begun to consolidate my loans. I have several student loans and I have to start paying on them soon. I like the ability to put my loans in forebearance while I get the consolidation completed. My goal is to pay off my student loans within 5 years instead of the 10 that is scheduled.

Make sure when you check out forbearance that you also check out the IBR Income-Based Repayment Program. There are times when it is more favorable.