How to Best Handle Old Credit Card Accounts

One of the best things you can do to build awareness of your financial condition is to view your credit report. Your financial condition — as perceived by potential lenders — can cost or save you thousands of extra dollars throughout your credit repayments, such as the life of a mortgage, for instance.

You can get them for free these days, too. In fact, you are entitled to three credit reports, one from each of the three major reporting bureaus, each year. You can either get them all at once or visit annualcreditreport.com (the government’s official free credit report source) three times a year, to space the credit reports out evenly. Personally, I prefer the latter approach.

What You’ll Probably Find

Well, if your credit report is anything like mine, it contains a list of credit cards with basic information like partial account numbers, a credit limit, and payment history. Some probably date back to college, when you signed up for a credit card in exchange for a free t-shirt at freshman orientation. You may not even know where to find the actual credit card anymore.

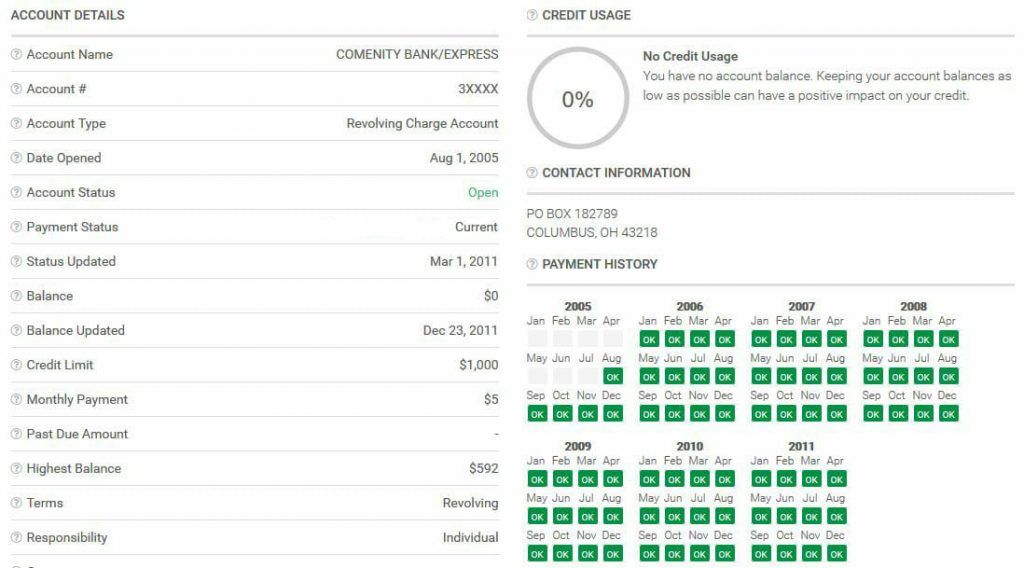

For example, here’s a snapshot of one of my own records. This card account hasn’t been touched since 2011, but here it is, on my 2017 report:

There are a number of reasons that I keep this card active, though.

Reason 1. It’s one of my oldest accounts. I opened this card back in 2005 when I was a college freshman (cliché, I know). It’s the second oldest credit card I have, and even though I don’t use it, I like to keep my credit score’s Average Age of Accounts as high as possible.

Average Age of Accounts and How Your Credit Score Is Calculated

Were I to cancel this card, that number — an average of the credit length of all my revolving accounts — would go down. No, it wouldn’t be substantial, but I would still rather avoid it unless necessary. Which leads me to…

Reason 2. It doesn’t have an annual fee. Since I don’t use this credit card, it just sits around collecting dust (actually, I shredded it years ago, so that’s just a figure of speech). It doesn’t have any sort of fees involved, so I’m alright with that. However, if I were being charged an annual fee to hold the account, I would close it faster than you could say “Semi-Annual Sale.”

Many rewards credit cards do have annual fees; whether they’re worth it or not is up to you. If you’re using the card and earning great cash back (that more than negates the fee), go for it. If not, then you’re just throwing money away. And with a mere $1,000 credit limit impacting my credit utilization ratio, it wouldn’t be worth my cash to keep the account open.

Before closing an unused card due just to an annual fee, though, try calling the issuer. Sometimes, they will be willing to waive the cost for you — at least for that year — just to retain your account. Others may have a version of the card that doesn’t have an annual fee, and would happily switch your account over to that product instead. It would keep the benefits of the account on your credit, while avoiding the unnecessary drain of a fee every 12 months. Win-win.

Reason 3. I am still paying off balances on other cards. That credit utilization I just mentioned? This is where that comes into play.

If you don’t hold balances on any of your other accounts (i.e.: you have no credit card debt), closing a card like this won’t really impact you. I, on the other hand, am still paying off some old credit card balances… so closing an account with a $1,000 limit would ding my credit score in yet another way.

This is because of my debt-to-available credit ratio. Also called credit utilization, this is the ratio of how much debt you owe (your balance) versus your line of credit (the available credit). Let’s look at an example.

- If you have three credit cards, adding up to a total of $10,000 in available credit, but keep a $0 balance on each one, closing a $1,000 limit card won’t hurt. Your utilization will remain at 0%.

- However, if you have $10,000 in credit but hold balances adding up to in $5,000 in debt, your ratio is already 50%. If you close down that $1,000 card with a $0 balance, your debt-to-credit ratio just jumped up to 55.6%!

So, take into account where your credit already stands before closing an unused card. If you don’t hold any debt, you’re probably fine to close the card and won’t notice much of a difference. If you need that line of credit to boost your utilization or need the account to factor into your average age of accounts, perhaps it’s worth keeping the plastic around.

Related: Millennials Aren’t Using Credit… But Should They?

Still Want to Close the Card?

So, the above reasons don’t impact you, and you’re still ready to cut up some cards? Go right on ahead… but take these three steps into account.

Step 1. Save your best, oldest card. Find the credit card with the longest, cleanest history, and keep this card. If you don’t know where the credit card is, call the company to update your address information and ask them to send you a new card. This probably isn’t the card you want to use moving forward, though. Just keep the credit history clean, and spend on earn rebates with newer cards.

Step 2. Close all other inactive accounts. You can do this by calling the phone numbers that are listed with the information for each card. If you have an active card with the same company, ask to move your credit limit from the inactive card to the active card, and then close the inactive card. This will keep your credit history long and your credit report short.

Step 3. Choose the best card to use. If you are struggling to get out of debt, you should choose a low-interest card with no perks. If you are managing your money well, this should be the card that offers the best perks (like cash back, airline miles, etc.) for you and your lifestyle.

Try looking through lists of cards like

You may not have to apply for a new card if you already have one by the same lender; just call customer service and ask to convert your card. They may have some additional options for you, too.

How to Get Your (Legitimately) Free Credit Report

If you want to improve your credit score and get the lowest mortgage rates, the bottom line is you want to keep your oldest, cleanest credit card to show a long, solid history of responsible credit. You also want to have a low debt-to-income ratio and credit utilization ratio (by paying off your balances every month).

Doing these will help you to improve your credit score, qualify for the best interest rates, and receive some of the best credit products (such as rewards credit cards).

Article comments

The biggest problem with forgotten credit cards may be fraudulent charges that will take a while before you can notice (since you don’t look at the statements). Otherwise, leaving an old credit card shouldn’t do you any harm.

PAY OFF all credit cards completely and CLOSE all of them. Who said you need them?? This country is drunk on their stupid credit cards. Just have a few months of living expenses stashed away in a checking acct. You don’t need open credit accts. to get a mtg. Just go to a company that does manual underwriting.

I just want to clarify.. I have six credit cards open at the time all different companies. I payed all of them off. Should I cancel all of them except my oldest credit card? Or should I keep open the card that I made the most on time even though its not the oldest card?

Remember if you close out a long standing credit card you lose all positive credit history associated with that card. So even if you pay off that high balance card and you swear to never use it again it will be in your best interest to cut up the card but keep the account open instead of closing it. You want potential creditors to see that you maintained a high balance for an extended amount of time and you always paid your bill even if there were a few blips along the way. This is positive information regarding your ability to pay something back. Don’t throw it away by canceling your card.

I didn’t know that having a low available credit to income ratio factored into how lenders determine a mortgage rate. We’re not currently looking to buy, but it’s good to know for the future, considering that Her and I have a lot of accounts with no balances that add up to a lot of credit.

Thanks for this useful information. I have good-to-excellent credit, and I am working on simplifying my life. My question is about store credit cards. It bothers me to keep these cards because I never use them. How would closing these accounts affect my credit score? Is there a way to get rid of them to minimize any negative effects of closing the accounts? Close one each month versus closing all six at one time? Other ideas?

mac101: Thanks for the insightful comment! I think we actually agree on most points… I do believe that consolidating cards (and their credit limits) from the same company is a good idea, as long as you don’t eliminate your oldest card. In fact, consolidating your credit limits onto the *older* card of two will actually *increase* your average length of credit history, the component that, along with total length of history, makes up 15% of your credit score (using FICO’s old formula which is being changed this year). But if that older card has a fee, then it’s probably not worth it, so there are other things to weigh.

Excessive new cards being opened will hit your credit score, but opening one card, 6 months before you apply for any mortgages, won’t ding your score.

Keep in mind that the goal isn’t only to save money on mortgages… other goals include simplifying your financial life by cutting out clutter and staying on top of how the rest of the world perceives you by keeping a clean credit report on which you are familiar every item.

You don’t want to look at your credit report one day and say, “What card is this, that I haven’t used in 5 years!? I didn’t even know I had that account.”

Wrong, wrong, wrong.

Mortgage rates, like credit card rates, are more often tied to your FICO score.

FICO ranges from 350 to 850. 350 is the base, and the other 500 is based on the following factors:

payment history – No lates = higher score. About 35% of the 500

Ok, you got this part correct. Cleaner is better. Got one account with a 30 day late 2 years ago? Send a Goodwill letter to the Credit Card company. Point out how you have made payments on time for the past X months and ask them to remove the late from the credit report. Worst they can do is say no, best is that you get another clean aged account.

amounts owed – Low utilization. Limit of 1k, balance of 900 = 90% = bad. Limit of 10k, balance of 1k = 10% = good

about 30% of the 500 points

OK, you do have that mentioned. Low debt to available credit, or utilization.

Closing cards with no activity hurts here because you lose credit limits, without balances (0% utilizatin cards). If people close the card and open a new one with a lower limit, then utilization is shot. Not all companies will allow credit line consolidations.

length of credit history – Higher Average age = better score

about 15% of the 500 points

Here is where I disagree. Closing Inactive cards and opening new ones will lower your average age.

new credit – opening a new credit card, new loan, etc.

about 10% of the 500

excessive inquires will negatively affect the score, and could cause other card issuers that perform reviews to lower credit limts, or up APR. So while some new is good, too much can be a negative.

types of credit – Credit mix, loans, credit cards, store cards

Best advice for preparing for a mortgage.

1) Pull reports – check for any inaccuracies. I beleive the FTC found that 70% of reports contain some sort of error in reporting, which could be negatively impact your score. This should be done 6 months prior to applying, since disputing inaccurate information takes time.

2) If you must open new accounts, this should also be done 6 months before hand. This is primarily to let the negative affect of any inquires age, and have less weight.

There are a lot of sources for credit information out there.

From the site:

Once a year from each of three = three different credit reports each year.

You can get a report 3 times a year from https://www.annualcreditreport.com/cra/index.jsp? It says on the site once every 12 months. Do you have a secret you’re not telling? 🙂

Re: remembering to check your credit report regularly – I found a tip somwhere (I read a lot of PF blogs!) and bookmarked all three of the free reports like so:

Oct – TransUnion

Feb – Equifax

Jun – Experian

So I just had to go look at my bookmarks to see if it was time to run one, and if so, which one. This is the first time I’ve relied on this trick and it worked like a charm – I’m running my report right now.

Re: high available credit amounts – so if I have two credit cards with ~12k limits on each, and no balance, should I ask the lenders to lower the limit?

aaa: Your income doesn’t factor in the typical credit score, but it factors in the lender’s consideration of the size of loan you’ll qualify for, and the ratios are factored into the ultimate cost of the mortgage. When you apply for a mortgage you provide your income amount (with documentation unless it’s a “non-documentation mortgage” — stay away from those) so they get the info directly from you, not from your credit score.

does income really a factor in the credit score? what reports (obviously not the credit report) show our income?

42: A low *available credit* to income ratio is good for the lenders because it makes you appear less of a risk. A high available credit to income ratio means it’s entirely possible you could run up your credit cards to the point of not being able to meet your debt obligations…

“have a low available credit to income ratio”

why is this positive?

I have a high available credit to debt ratio, not sure about available to income but it’s nearly 1:1

thanks Flexo and Mrs. Michah! Thats good to know!

Mrs. Micah: Good point. I’m writing from the point of view that any cards being closed are inactive (no payments, no balances) and you may not have even remembered you opened these accounts until checking your credit report. But combining balances and interest rates is a valid concern if you want to consolidate active cards.

Make sure, when you combine two such cards to straighten out whether or not there’s different interest on balances you had before the combination. And then ask how to pay off the higher-interest balance first. It may require writing something on the payment.

I just wrote a post about this, actually: link

DarkAlly: credit limits on active cards from the same bank or issuer (for example, a Chase Miles Visa, a Chase Rewards Visa, a Chase MasterCard) can usually be combined by calling customer service.

when you say ‘active card with the same company'(in step 2) does company mean visa or mastercard or does that mean chase or bank of America? Hope that is clear :-/

Good advice for preparing for a mortgage.

If one isn’t getting a mortgage or big loan like that, credit reports/scores are often higher if you have a good debt-to-credit ratio, meaning leaving more accounts open than just the oldest (though not necessarily all). But for mortgages, close ’em down.