How to Intelligently and Responsibly Buy a Car

Car companies want you to buy their products on impulse. They would, generally, prefer that the step of thinking is removed from the consumer’s process. This is evident in the commercials you see around the holidays in which a spouse is surprised when he or she notices a gift wrapped in a large red bow sitting in the driveway or in one maker’s “sign, then drive” promotion, prompting customers to believe that the car-buying process is better when it takes thirty seconds.

Buying a car is a significant financial decision, and it can affect your financial stability for years. The process should not be taken lightly. It’s important to start at the beginning by asking yourself a series of questions.

What are my needs versus my wants?

We haven’t reached the point of discussion whether to get the convertible or the sedan. First, we have to determine whether we need to buy a car in the first place. There are many other options to consider.

Are other forms of transportation available? Although I was living in the suburbs, I took a bus and a train to my job a few years ago and could use public transportation to get wherever I needed to go. Bicycles are less expensive to own than cars, and walking is yet another choice.

Are other forms of transportation available? Although I was living in the suburbs, I took a bus and a train to my job a few years ago and could use public transportation to get wherever I needed to go. Bicycles are less expensive to own than cars, and walking is yet another choice.- Is carpooling an option? While usually viewed as inconvenient, the thousands of dollars you could save makes carpooling attractive.

- Can my spouse and I share a car rather than buying a second? You may be able to coordinate schedules so one can drop the other off and pick the other up at work.

- Will a program like ZipCar suit my needs? If you don’t need to drive constantly, you may be able to sign up for a car-sharing service. You can reserve a car for only the hours you need one.

- Can I get more out of my current car? Modern cars can easily last beyond 200,000 miles if properly maintained. Put off a purchase as long as possible, and don’t succumb to the desire to trade in for the latest model every few years.

If you can determine you don’t need a car, you may want to stop here. The process is complete for you. On the other hand, if you do have the money available, you may be willing to pay for convenience. You don’t need a car, but you want one, and that will cost you. So carefully consider saving as much as you can on the purchase.

Should I buy a new car or a “pre-owned” (used) car?

In almost all cases, the answer to this is simple: buy a reliable used car. If you complete the appropriate research, a used car will almost always save money when compared to a new car. Depreciation is what quickly kills the value of a new car faster than a used car. But if you agree to drive the car until it dies rather than replacing it and trading it in before its useful life has ended, depreciation is irrelevant.

Life often gets in the way of these plans, and you find yourself trading in your vehicle before you’ve driven it into the ground, so you must be honest with yourself and evaluate how likely that is for you.

Life often gets in the way of these plans, and you find yourself trading in your vehicle before you’ve driven it into the ground, so you must be honest with yourself and evaluate how likely that is for you.

Buying a new car also ensures that the car has not been used by someone who does not know how to take care of it. That’s usually not a problem if you buy a gently used car that has recently returned from a lease, and you buy that car from a dealership, but these used cars are often more expensive. The “certified used” is the marketing dealerships like to use for these more expensive used vehicles, and that often leads to the incorrect belief that card sold by owners directly are less reliable or worthless.

I bought a new car several years ago. I strongly believed I would drive the car well beyond 200,000 miles. I needed a car that would be absolutely reliable for a long time due to my job responsibilities. The price for the new car was only a little more than prices for late model used cars. I could have saved a few thousand dollars by buying a used version of the same car (a Honda Civic LX four-door sedan) but opted for new, 2004 model purchased when the 2005 models were already out.

I allowed myself to satisfy some of my wants (such as power windows and an extra few years of reliability), and I’ll know when I decide to replace the car, either by need or by desire, whether this was the better choice.

I probably should have purchased the used car, which would have likely been just as reliable, with the only differences being the price and having to replace it a few years sooner.

What car do I like?

It’s important to look at finances to determine which car, among hundreds of makes and models, to buy. The True Cost to Own from Edmunds.com makes that evaluation easy. You can simply pick the vehicle that has the lowest overall cost and you’ll be safe. Personal preference needs to play a role in the decision-making process. If you plan on spending hours in your car every week — I spend eight to ten hours a week in my Honda Civic — it’s important that you don’t hate sitting in the driver’s seat and operating the vehicle.

It’s important to look at finances to determine which car, among hundreds of makes and models, to buy. The True Cost to Own from Edmunds.com makes that evaluation easy. You can simply pick the vehicle that has the lowest overall cost and you’ll be safe. Personal preference needs to play a role in the decision-making process. If you plan on spending hours in your car every week — I spend eight to ten hours a week in my Honda Civic — it’s important that you don’t hate sitting in the driver’s seat and operating the vehicle.

Before you’re ready to buy, spend a lot of time at dealerships test driving vehicles. Take your friends’ cars for a drive (with their permission, of course). You may annoy the salespeople who want to spend time with you only if they believe a sale is imminent, so you might have to talk creatively.

Read online reviews written by owners so you are prepared for any issues that you might come across. You can find discussion boards for every model, where owners, fans, and even experts discuss minutiae related to the vehicle you may be considering. Read ratings and reviews offered by reputable publications in order to fully understand how the car performs with important features like safety.

What’s a good price for the car I want?

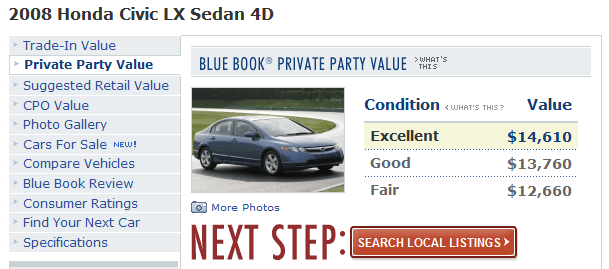

The Kelley Blue Book has long been the standard bearer for the typical price for an vehicle you can find in a dealership or through a private party sale. Here is what I found for a 2008 Honda Civic LX sedan, with automatic transmission and side airbags.

As of today, a good price for this used car, when purchasing a vehicle in excellent condition from a private party, not a dealer, is $14,610. If the buyer opts for a “certified pre-owned” version of the same vehicle from a dealer, it could cost an extra $3,000, putting the cost of this used 2008 car close to the price of a new Civic with the same features.

The prices on Kelley Blue Book give you a starting point when you begin negotiations. Look at the prices for “good” and “fair” condition as well to aid your purchase, though I would not recommend buying a car that is in anything less than excellent condition.

Where should I buy a car?

If you’re buying a new car, you will need to go to the dealer. Even if you are ordering a car from the manufacturer, choosing the options you want and having the car custom built for you, in most cases you’ll have to complete the order through a dealer.

If you’re buying a new car, you will need to go to the dealer. Even if you are ordering a car from the manufacturer, choosing the options you want and having the car custom built for you, in most cases you’ll have to complete the order through a dealer.

You have more options when you buy a used car. I’m a fan of Craigslist simply because I sold a car there. Rather than trading in my older Honda Civic at the dealer when I purchased the new 2004 Honda Civic, which would have provided me with only $1,000 off the price of the car at the most, I spent a few minutes taking photographs of the car, posting an ad online, and letting a potential buyer take a test drive.

Craigslist is my top recommended method of searching for a used car and getting a good price. But if you are willing to pay extra for additional guarantees, like a warranty and the satisfaction of knowing the dealer is going to stand by the sale, you may want to spend more money for a “certified pre-owned” vehicle from the dealer.

How do I negotiate for the best price?

If you need financing, you’re going to need to negotiate on two fronts — the price of the vehicle and the loan interest rate. It’s best to be fully prepared by both. In addition to researching the price, seek out pre-approval for a car loan from a number of banks. If you are financing the purchase and buying from a dealer, it’s good to let them know.

Although I once believed that dealers would be willing to accept a lower vehicle price if they knew they were getting cash, the opposite seems to be true: the dealer makes money when they extend financing, so they are usually more willing to lower the price if they believe the dealer’s preferred lender — usually a related subsidiary of the manufacturer’s parent company — is going to be extending the loan.

The best tactic seems to be negotiating the price first — negotiate the full price, not the monthly payment — and then find out about financing. If the rate they offer is higher than the rate you received from your bank, then go with your bank.

For any used car, ask the seller to provide a CarFax report. If there were any major problems with the car, it should be listed on this report. It requires the car’s VIN, which a seller should provide if you’re not around to write it down yourself. If the seller won’t work with you to determine the car’s history, either move on to a different car or buy the report yourself. They’ve increased the price to $35 for one report, but if you research five cars at a time, it’s only an extra $10.

For any used car, ask the seller to provide a CarFax report. If there were any major problems with the car, it should be listed on this report. It requires the car’s VIN, which a seller should provide if you’re not around to write it down yourself. If the seller won’t work with you to determine the car’s history, either move on to a different car or buy the report yourself. They’ve increased the price to $35 for one report, but if you research five cars at a time, it’s only an extra $10.

Any mechanical problems with the car should signal you to move on, but any visual problems can aid you in lowering your offer.

Herb Cohen is a master negotiator, trusted by Jimmy Carter and Ronald Reagan. Listen to our interview with him for excellent thoughts on negotiation and take a look at his book, You Can Negotiate Anything, for specific tips.

One aspect you want to include with your negotiation, particularly with a private seller, is to make sure there are no currently undetected or unannounced problems with the car. Either agree to take the car to an independent mechanic before the purchase is finalized or require the seller to cover any problems discovered by a mechanic immediately after the sale.

What’s next?

Responsibility doesn’t end when you drive the car away. If you want the money you spent to go far, you need to properly maintain the vehicle. Start by reading the manual to understand as much as possible about the operation of the car. Consider learning how to do some basic repairs yourself. Follow the maintenance schedule and keep records of all the work that is done on your vehicle.

You don’t need to change your oil every 3,000 miles, and beware sales tactics designed to get you to spend more money. Part of owning a car is paying for maintenance, so if you considered that when determining what you could afford to spend, barring any major repairs not covered by insurance, you should be set.

If you financed the car, I recommend continuing your car payments to yourself after you stop paying the lender. Set up a “Car Fund” account at ING Direct or your favorite high-yield savings account and send your payments there. This will better prepare you for any maintenance needed as your car ages or for buying the next car when the current one eventually dies.

Driving isn’t always fun when the primary purpose is commuting in traffic to and from your office. But it would be even less fun with the knowledge you didn’t get a good price. Driving for leisure can be more pleasurable, and this is the reason people are often to pay more for a car with better performance and higher-end features than the basic low-cost alternative.

I’m fine with paying more for a car that goes beyond just the basic necessities as long as that’s done with the full knowledge of what you’re paying extra for and with the money available so paying more than necessary doesn’t strain your finances.

What is your advice for buying cars?

Photos: Guttorm Flatabø, TheBusyBrain, DeusXFlorida, hill.josh, Paul Stevenson

Article comments

Thank you.

I had the same experience with the cash versus financing question–I was surprised to learn that paying cash made zero difference.

I’m a little surprised leasing isn’t discussed here, which for many people, is the best option. Now there, I have done well negotiating; by once offering to pay the entire lease price upfront and forego monthly payments, I got a significant discount from the bargained-for price.

Also, the idea of a “reliable used car” is a great theoretical concept and a difficult practical application. I’ve driven leased cars and returned them. You could argue they were “fine”, but I would not have ponied up the price that the dealer was then asking after 3 years of being owned by me (lived in city, lots of rain/snow/ice, lots of driving in traffic).

Thanks for the informative post!

My advice is after you figure out what you want, go home and get price quotes from several dealers. Make them compete with each other for your business to get a low price. Work your way down from the most expensive to least expensive quote, asking each dealer to beat your best price. Once you’ve reached a satisfactory number, go to that dealership to finalize the paperwork and pick up your car.

I bought my current vehicle from a private party back in 2005. I did quite a bit of research online about how to negotiate for a vehicle before making a purchase.

My understanding from back then is that the Kelley Blue Book is based on dealerships’ asking price for vehicles, not necessarily what they sold for. Edmunds.com True Market Value is based on the actual price vehicles sold for, and is thus a better representation of what a car should cost.

That actually made negotiating really easy. I simply printed out the TMV of the car ($3,500 below the person’s asking price, which was KBB), and showed it to them. They accepted the offer on the spot.