Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

About HSBC

HSBC is the largest bank in Europe and the seventh-largest in the world. The bank handles both business and personal clients, as well as corporate accounts.

In the US, they operate as HSBC Bank USA, NA, headquartered in both New York City and McLean, Virginia, and employ 43,000 workers nationwide.

They offer the full range of banking services, including four different checking accounts–Basic, Choice and Premier. Let’s dig down and see which checking account may work best for you.

1. HSBC Basic Checking

HSBC does offer its basic checking account, comparable to checking accounts with other banks. It provides online banking, including Bill Pay and eStatements. The account comes with an HSBC Debit MasterCard with no transaction fees on purchases. (With Bill Pay, you can pay virtually anyone in the US instantaneously, the same way you might with a check.)

HSBC does offer its basic checking account, comparable to checking accounts with other banks. It provides online banking, including Bill Pay and eStatements. The account comes with an HSBC Debit MasterCard with no transaction fees on purchases. (With Bill Pay, you can pay virtually anyone in the US instantaneously, the same way you might with a check.)

Minimum initial deposit: $0 when your account is opened by a bank representative, $1 when its opened online

Maximum daily online limit: $350,000

Interest bearing account: No

Account Fees: Basic Checking charges a monthly account maintenance fee of $3 regardless of account balance

Other fees:

- Excess Withdrawal Fee, no charge for the first eight checks or withdrawal slips you write, but there will be a fee of $0.35 per check or withdrawal on additional transactions.

- Incoming wire transfer fee, $15 per transfer

- Foreign transaction fee, 3% of the transaction amount in US dollars

- Insufficient or Unavailable Funds, $35 per transaction, to a maximum of three per day combined. (Overdrafts resulting from ATM transactions will not be paid.)

- Account closing fee, $25

- Chargeback return checks, $10

- Stop payment, $30

Bonus: N/A

Should you sign up for the HSBC Basic Checking account?

HSBC’s Basic Checking account does not stand out compared to the competition. Basic Checking has a low monthly maintenance fee, but also requires you to pay for checks and withdrawals if they total more than eight per month.

On the bright side, HSBC does offer some excellent alternatives. If you meet the minimum requirements for the Choice account (which we’ll review next) you should definitely consider that one. So, without further ado, let’s dive into the HSBC Choice Checking account.

The information, including rates and fees, presented in the review is accurate as of the date of the review. Please refer to issuer website and application for the most current information. Deposit products are offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.

2. HSBC Choice Checking

Choice Checking provides free online and mobile banking, including Bill Pay, as well as the HSBC Debit MasterCard. The debit card gives you access to HSBC ATMs worldwide, most with no withdrawal fees. This account comes with unlimited free checking.

Minimum initial deposit: $0 when your account is opened by a bank representative, $1 when its opened online

Maximum daily online limit: $350,000

Account Eligibility: You must maintain a minimum account balance of at least $1,500 in total combined personal deposit and investment balances with HSBC, or have at least one recurring direct deposit from a third-party into your account per month.

Interest bearing account: No

Account Fees: Choice Checking charges a $15 monthly maintenance fee. But the fee is waived if you maintain at least one ongoing direct deposit per month, or a minimum account balance of at least of $1,500 in total combined personal deposit and investment balances with HSBC.

Other fees:

- Excess Withdrawal Fee, N/A giving you unlimited checking

- All other fees, same as for Basic Checking

Should you sign up for the HSBC Choice Checking account?

If you can afford to step up from the HSBC Basic Checking account then this is a great option for you to pursue. The Choice, together with the Premier, comes with free, unlimited checking. Choice Checking also has very basic and attainable requirements to waive its monthly maintenance fees.

All in all, this amounts to a very healthy deal.

The information, including rates and fees, presented in the review is accurate as of the date of the review. Please refer to issuer website and application for the most current information. Deposit products are offered in the U.S. by HSBC Bank USA, N.A. Member FDIC.

3. HSBC Premier Checking

This is HSBC’s top-of-the-line checking account. Just like the other checking accounts, HSBC Premier Checking provides free online and mobile banking (including Bill Pay), an HSBC Debit MasterCard, and access to HSBC ATMs worldwide, most with no withdrawal fees. Premier Checking also comes with unlimited free checking.

It offers the following benefits, above and beyond those available for Basic and Choice:

- Access to a Relationship Manager who can make all HSBC programs and benefits available to you.

- Global View and Global Transfers: Access to your eligible worldwide HSBC deposit accounts online, with the ability to transfer funds between them. (Not available in all countries.)

- International Services: Gives you priority service and emergency financial support at HSBC branches worldwide.

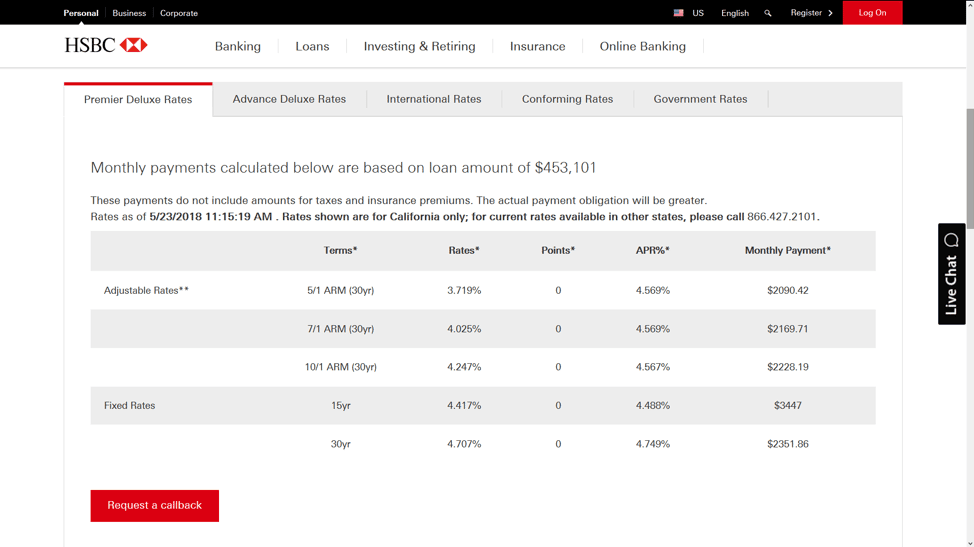

- Access to Home Financing Services, including up to $3 million in financing. Entitles you to the best rates on Premier Deluxe Mortgages, with slightly lower interest rates than other mortgages.

Minimum initial deposit: $0 when your account is opened by a bank representative, $1 when it is opened online

Minimum initial deposit: $0 when your account is opened by a bank representative, $1 when it is opened online

Maximum daily online limit: $350,000

Account Eligibility. You must maintain a minimum account balance of at least $75,000 in total combined personal and commercial deposit and investment balances with HSBC OR recurring direct deposits totaling at least $10,000 per month in deposit account or investment balances OR have an HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of multiple mortgages. Home Equity products are not included.

Interest bearing account: 0.01% APY paid on all balances $5 or more

Account Fees: HSBC Premier Checking charges a $50 monthly maintenance fee, which is waived if you maintain at least $75,000 in combined US personal and commercial deposit and investment balances OR make $10,000 in recurring direct deposits each month OR have an HSBC mortgage with an original balance of $500,000 or more.

Other fees:

- Excess Withdrawal Fee, N/A giving you unlimited checking

- Incoming wire transfer fee, $0 per transfer

- Foreign Transaction fee, 0%

- Insufficient or Unavailable Funds, $0

- Account closing fee, $25

- Chargeback return checks, $10

- Stop payment, $0

Bonus: Get up to a $500 Cash Bonus for eligible new customers who open an HSBC Premier checking account with qualifying activities.

- Open an HSBC Premier Checking Account before June 30, 2022

- Set up recurring direct deposits

Should you sign up for the HSBC Premier Checking account?

Premier Checking is a top-of-the-line product, earning interest and offering unlimited checking and virtually no fees.

The interest rate yield on the Premier Checking is currently just .01% APY, a tiny tick above zero.

Once again, HSBC offers a healthy welcome bonus for opening the Premier account.

The catch is that you must maintain at least $75,000 in deposits and investments with HSBC OR have direct deposits of at least $10,000 per month to avoid the monthly maintenance fees, eliminating small-sized investors. But if you can maintain that balance (and a hearty congratulations to you is in order here), the Premier is a great checking account to consider.

Current HSBC Promotions

HSBC currently offers up to $2,000 when you refer friends who open a qualifying HSBC account. You earn $100 per referral for the first two referrals. From the third referral, you earned $200 each, up to a maximum of $2,000 per calendar year.

And that’s not all – the friend you refer also gets a new account bonus. If the friend opens the account by January 31st, 2021, the bonus schedule looks like this:

- Premier Checking, $450

- Choice Checking, $100

- Basic Checking, N/A

To take advantage of the bonus, you must log on to your account and get a personalized referral code from your Share the Experience referral page. You then share your personalized referral code with your friend(s). The friend must open the account at an HSBC branch or over the phone, and the account remains open for 15 business days. The referral bonus will be deposited into your checking account within eight weeks of the friend’s account opening.

Other HSBC Products

As a full-service bank, HSBC provides a full range of banking services. This includes savings, certificates of deposit, credit cards, and lines of credit.

They also provide international banking financial support in over 30 countries and territories worldwide. They can connect an HSBC checking account with international accounts, arrange fund transfers between linked accounts, and provide US mortgages for international borrowers at up to 75% of the property purchase price.

They also provide international banking financial support in over 30 countries and territories worldwide. They can connect an HSBC checking account with international accounts, arrange fund transfers between linked accounts, and provide US mortgages for international borrowers at up to 75% of the property purchase price.

Investing and Retiring

HSBC offers fixed-income investments, stocks, and exchange-traded funds, mutual funds, and structured products. And if you have a minimum of $25,000 to invest, they offer their HSBC Spectrum asset allocation solutions, which provide you with five different asset allocation models.

They also offer IRAs, annuities for retirement, and various education savings programs.

Insurance

HSBC provides both term life insurance, and long-term care coverage.

HSBC Checking Pros and Cons

- The HSBC Checking Bonus program is generous for both you as the referrer, and the friend who you refer.

- Premier Checking offers no fee checking.

- HSBC has a strong international presence, and is an excellent banking choice for those who conduct international transactions on a regular basis.

- Interest rate yield on Premier Checking is currently just .01% APY.

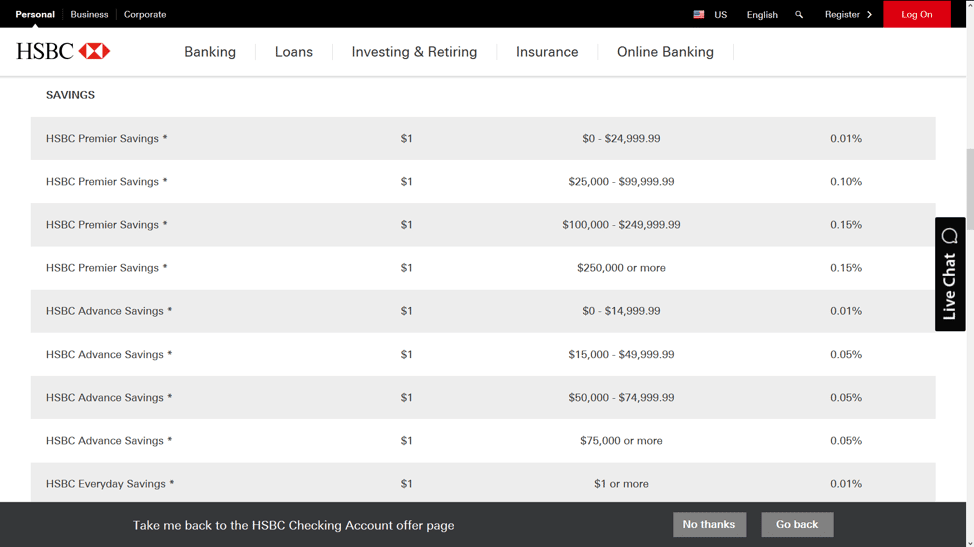

- HSBCs savings accounts and CD rates are not competitive with the top online banks (this may be important since monthly account fee waivers depend on combined account balances).

- You must maintain a minimum balance of $75,000 in your HSBC deposit and investment accounts in order to qualify for the waiver of the $50 monthly maintenance fee on the Premier Checking account.

By now you likely have an idea if any of these accounts can fit your needs. The bonuses can be appealing, especially if you have a network of friends and colleagues that can benefit from HSBC checking. Getting them on board with you to open an account can really pay off. Plus, if you’re a serious investor and can maintain that $75,000 minimum balance, HSBC is ready to win you over.