Mint.com Will Provide Personalized Financial Advice: Beta Test the New Features

Starting today, Mint will begin beta testing some significant new features. Mint, a web application that helps you track your financial transactions, account balances, debt and budget, is branching into financial advice. For a few weeks, beta testers will have exclusive access to these new features described below. I have 200 invitations to share with Consumerism Commentary readers who would like to be part of this beta testing group. Keep reading to find out how you can receive an invitation to the beta testing program.

Almost two years ago, Consumerism Commentary contributor Sasha reviewed Mint, freshly minted. As I mentioned at the time, I figured I would not become a regular user of this software. I am a devoted user of Quicken Home and Business, and I am comfortable with my process. When Smithee noticed that Mint.com had been offering new features earlier this year, I still didn’t pay too much attention.

But I had the chance to speak today with Mint’s CEO Aaron Patzer and experience a preview of the new features the company plans to release to the public in a few weeks. To prepare, I signed into my Mint account for the first time in several months. I was pleasantly surprised to see Mint now supports automatic updates of a variety of investment accounts, loans, and house values, as well offers the option for manual entry accounts for cash expenditures. The charting and reporting functions are much improved.

New features now available for beta testers

Mint wants to get the word out about new additions that take the application’s financial insight and visibility to the next level: action steps to help you improve your financial situation. The developers worked with real, live financial advisers to develop five broad principles for guiding their users towards making healthy financial decisions: knowing your money, spending less than you earn, using debt wisely, investing your savings, and preparing for the unexpected.

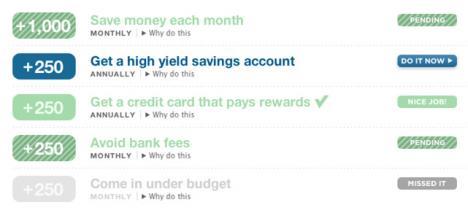

A number of tasks are provided for each of these principles, and when you complete these tasks, Mint awards you points. The more points you earn, the higher your score. Mint also explains why each of these tasks is important for a financially fit lifestyle. Here’s what their task suggestions look like:

For each of the tasks, Mint walks you through the decision making process. Based on what Mint knows about your finances — and if you use Mint right, it will know just about everything — the application will provide you suggestions for high-yield savings accounts, even giving you a breakdown of the fees and minimum balance requirements if anything. For optimizing your credit card debt, Mint takes the amount you pay towards your debt each month and tailors its suggestions to your particular spending and payment habits. Based on a few assumptions, Mint explains how much you will save by switching.

It’s true that Mint has a relationship with many banks and credit cards. In other words, if you sign up for a savings account or credit card through Mint, these companies will pay Mint a small fee. According to Aaron Patzer, the choices are presented without preference towards these companies. If the best card for you is the Schwab Bank Invest First Visa Signature Card, it will be listed first, even though Mint may not get paid if you sign up for that particular credit card.

As I mentioned earlier, you receive points for making sound financial decisions. Some examples are surviving a month without being charged bank fees, reviewing your transactions each month, checking your credit report for errors annually, and investing for retirement. The points system is based on a game; you are awarded “trophies” for consistently performing well, a fun incentive for making the right choices.

There is some work to be done. Although the options presented for many of the tasks are personalized, the tasks themselves are only those that would apply to everyone. For example, while health insurance is covered in the fifth principle, life insurance is not. Right now, Mint does not know whether you are someone who would benefit from life insurance. This personalized level of suggestions is not yet possible through Mint. When asked about this, Aaron explained that Mint would not ask participants whether they have dependents, which would help determine more personalized financial advice. They may, however, use home ownership as a trigger; those who own homes are more likely to have dependents and would therefore benefit from life insurance. These enhancements might be developed later.

The competition for online financial management is intense, with Geezeo adding new features frequently as well. I may be too stubborn to discard all that I have done with my desktop software in favor of a web-based application, but as these online applications mature, I’m starting to see the value for people other than financial novices.

How to become a Mint beta tester

I have 200 invitations available for those who would like the chance to enjoy these new features of Mint several weeks before the broader public, and importantly for the software developers, provide feedback and suggestions. Here is all you need to do in order to receive access.

- If you haven’t already, set up an account at Mint. It’s free and secure.

- Send an email to consumerism-getfit@mint.com requesting access and include the email address you use to log into Mint.

In a few days, you will be inducted into the beta testing program and you will receive access to these new features.

Article comments

There is a reason we don’t do this sort of thing at Thrive (www.justthrive.com), though we’re glad to see that Mint has learned from our site’s Financial Health score in creating their “Financial Fitness” criteria. The concern is for token economies.

To provide some of the psych background, in a token economy, people start taking actions so that they can gain “points” instead of because itself is worthwhile or enjoyable. This actually works tremendously well at getting people to do things…as long as they keep “playing”. The moment they stop getting rewarded with points, they stop engaging in the behavior, because the tokens were the only reason they started behaving that way in the first place.

Thrive displays your Financial Health as a way of helping you track how you are doing, and to help users understand how various financial health elements can affect their lives. We’re doing more to expand it and make it a better educaitonal tool that helps you sum up at a glance how your behaviors are affecting your life. But – and this is imporatnt – it isn’t used extensively as a motivator.

People already have the motivation: they have the dreams, wants, and desires, and they know they need money to accomplish them. What they need is not simply temporary reinforcement that works only as long as they with the program (and the “points”), but rather practical, quality advice that helps them achieve those goals and continue to grow financially, even when they aren’t online. And that is what Thrive seeks to enable by providing easy-to-understand, easy-to-use financial advice that actually helps people change.

But don’t take my word for it. I’m commenting here because I think people need to be able to compare for themselves, and it is important to understand not only where the ideas are coming from, but how they are being implemented by different sites. We invite people to see for themselves why Thrive created Financial Health and how we are using it at http://www.justthrive.com

And as always, feel free to give us your feedback by e-mail at feedback@justthrive.com or you can grab me at matt@justthrive.com or even call us with specific questions – you’ll get one of our team. Maybe even me! =]

It looks like they’ve already rolled this out to a few people (my boyfriend and I both found this financial health tab in our mint accounts). I agree with Jake that there are some kinks that need to be ironed out and other functionalities that would be very beneficial. Some of my accounts aren’t updating anymore on Mint, even with all updated account information.

I like the “financial health” idea. It’s similar to what Thrive (https://www.justthrive.com/) has.

Stephanie: Mint randomly selected 10% of their user base to receive the new features early. But anyone who wasn’t in that 10% can use the email address I listed to join the group.

I wish they would focus on rolling out cash flow and period to date budget functionality vs. these financial advice features but I guess they have to find a business model to generate revenue….

Cool Cool – thanks for the heads up!

Thanks for this amazing offer to be included.

I can’t wait to see the beta version.

Wesabe also recently updated their site, so I’m curious to see the differences!