Pros and Cons of Interest-Only Mortgage Payments

Interest only mortgage payments appeal to many because of the low monthly payment. But are they a good way to go? We list the pros and cons.

A while back, a Consumerism Commentary reader named Ryan suggested I write about interest-only mortgages. I thought this was an interesting request. So I definitely wanted to address the topic.

First and foremost: there is no such thing as an “interest-only mortgage.”

Wouldn’t that be nice? To have a mortgage that did not require you to pay any principal back to the lender? Unfortunately, though, that’s not going to happen. When you become a borrower, your lender will insist that you pay both interest and, at some point, principal.

What does exist, however, is an interest-only payment option for mortgages.

What Is An Interest-Only Payment Option?

The interest-only option can apply to adjustable-rate mortgages and fixed-rate mortgages alike. The purpose is to allow borrowers to reduce monthly payments for a period of time, usually somewhere between three and seven years at the beginning of the mortgage term.

For example, let’s say that you buy a home with a monthly payment of $1,200. At first, $600 goes to interest, and $600 goes to the principal. If you use the interest-only payment option for a while, your monthly payment would start out at just $600. You would pay this interest-only amount for a predetermined number of years. During that time, the actual loan principal balance remained unchanged (unless you chose to pay extra). Then, at the end of the term, your payment would jump up to the original amount ($1,200). At this point, you would begin repaying the principal, as well.

Banking Deal: Earn 1.55% APY on an FDIC-insured money market account at CIT Bank. See details here. CIT Bank. Member FDIC.Who Uses It?

There are many types of people who would likely consider interest-only loan terms. These include:

- Those who want to buy a home, but want to buy more than they can actually afford right now.

- Buyers who know they’ll sell the home quickly, and so don’t want to tie up extra funds in a higher monthly mortgage payment.

- Buyers in a financial situation where they need lower payments now, but know that they’ll be able to afford higher payments later on.

- Those who want to take invest the money saved each month, confident they can get a better rate of return this way than with paying down their mortgage principal. This could also apply to buyers who want to pay off high-interest debt with the money saved.

The lower monthly payments during the interest-only period are good for households with irregular income. This comes into play with those who receive commission payments less frequently than on a monthly basis. It’s also beneficial for households with unpredictable income, such as a business owner who is expecting low income while the business is in a period of growth.

Interest-only payment options also allow borrowers to “afford” a more expensive home than their bank account says they can. This can be important for an executive who needs to entertain clients at home. A home’s appearance can be crucial to success in these cases. Buyers may also want to buy a home that’s simply beyond their means for the time being. Perhaps parents want to get their children into a certain school district. They just can’t budget for a full mortgage payment but can afford interest-only payments.

Things to Consider

This repayment option is a dangerous prospect, especially in an environment where you can’t be sure whether the value of the house will rise in the short term.

While making interest-only payments, the borrower is not building equity in the house. If the borrower is not building equity, they are essentially renting their own home. This is especially true if home values are stagnant or falling. The borrower is never paying down what they ultimately owe on the home.

When house values are declining, this problem is compounded. Here, the borrower owes the full purchased value of the house while making the interest-only payments. And the house’s declining values means the borrower will quickly owe more than the home is worth.. Then, if the borrower has to sell, they could wind up owing the lender more than they get from the sale of the home.

In another negative situation, some interest-only payments don’t cover the full amount of interest due each month. This is especially true if the mortgage is at an adjustable rate (ARM), which may increase over time. The excess, non-paid interest is then tacked onto the principal. This means the buyer owes even more in principal than they did originally.

This is called negative amortization. Not only is the borrower not adding equity at that point, but they’re digging a hole even deeper. And they haven’t even reached the increased monthly payment period yet!

Another downside to utilizing this interest-only option is that many people are not disciplined enough to invest or save the difference each month. Instead, they spend it. This means that they put themselves in a tight position with their home for no reason. And they may have nothing to show for it in the end.

When the Interest-Only Period Ends

Interest-only payment options don’t last forever.

After the determined period of time ends, the lender will expect the borrower to start paying back the principal, as well. This usually means a significant increase in the monthly mortgage payment.

What if the borrower’s income hasn’t increased as expected or if their business has not moved past the “growth” stage? In this case, the new payment might simply be unaffordable. Plus, the payment will typically be even larger than it would have been had the buyer chosen a standard 30-year mortgage to begin with.

So, what’s a borrower to do? They have a few options.

The buyer can find a way to increase monthly payments. So they can pay down the mortgage principal and any negative amortization quickly. Then they can sell the home. Or if they want to keep the home, they can refinance the mortgage. They could check out a lower interest rate or do yet another interest-only payment period. Or they can stretch the balance back out over 30 years to make the payment more affordable.

The problem with selling or refinancing is that it’s largely contingent on the home’s value and equity at the time. If the mortgage is now upside down, it will be difficult to make either move. You’ll end up owing money to the lender if you sell. And in order to refinance, you may need to have extra cash on hand.

Is Interest-Only Right for You?

Determining whether an interest-only option is right for you can be tricky. After all, you’re playing a very risky numbers game that requires discipline.

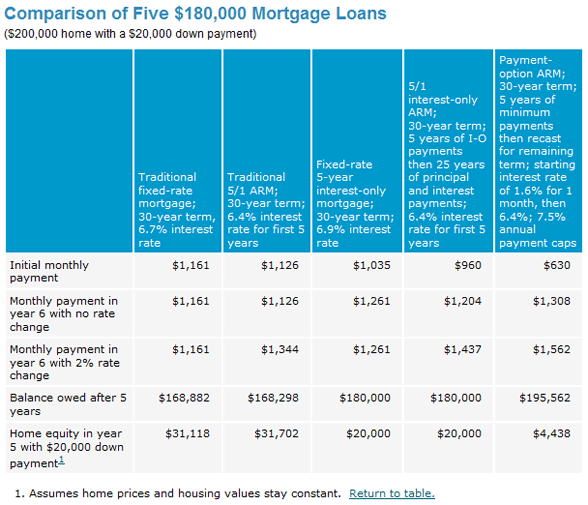

Let’s take a look at just how different your situation will be if you go the interest-only route versus simply paying off your mortgage traditionally. To demonstrate this, the Federal Reserve Board has a helpful comparison chart outlining the differences in payments you might expect if you choose an interest-only payment option, reproduced below. Notice how low the equity is in the last column, identifying borrowers who opt for the interest-only method.

- If saving/investing the money–Am I disciplined enough to invest the difference each month? Am I also as certain as can be that I will earn a higher return on this money by putting it elsewhere than I would save by paying off my mortgage on a typical schedule?

- If expecting income to increase–What is the likelihood that my income will increase as expected over time, so that I can meet my increased payments after the interest-only period ends? What are my options if this doesn’t happen?

- If planning to sell soon–What is my reason for selling after a short period of time, and what are the odds that this could change? Can I still afford this home if I don’t sell or am unable to sell?

- Do I have additional savings at the ready, so I am safe if I wind up underwater on my mortgage? In that case, I may need to put down an additional payment for a refinance or to close out with the lender if I sell.

Best Lenders for Interest-Only

Since interest-only mortgages played a role in the foreclosure crisis of a decade ago, banks don’t tend to offer them nearly as often. When they do, there are often high qualification requirements, usually in the form of excellent credit and high asset wealth. With the former, this ensures that the borrower can still afford the payments when they suddenly increase, avoiding the “payment shock” that has plagued many.

Some lenders do still offer these types of mortgages, but you’ll have to look a little harder. You can start by looking up basic mortgage rates through an online aggregator. Then request additional information from the lender regarding interest-only payment options. Be prepared for them to confirm your excellent credit and higher net worth before approval. And be ready for the loan to (likely) be an adjustable-rate mortgage (ARM).

Banks like Navy Federal Credit Union, Wells Fargo, and Bank of Internet USA still offer this option. You can also look into interest-only mortgage options through SoFi.

Do you have or have you had an interest-only payment option on a mortgage? Please share your experiences or opinions.

Article comments

Hi Everyone, I’m just putting some feelers out there to see if there’s anyone interested in making a pretty substantial amount of cash in a short amount of time. Only thing this requires is that you have an active bank account or credit card. No cash is required up front to start this. Which means your account can be on a zero balance and that’s completely fine. Text +1(314) 856 1730, lets talk about the next deal

I opt for an IO loan and up to this point it has faired well for me. Each year I get a fairly large income tax check which I place more than half to the principle of the loan. It is my hope that when I reach my 10th year and it switches to I+P my efforts to reduce the loan amount will be worth it. The interesting thing about this is eveytime I make a principle payment the loan readjusts and my IO is reduced. Im not sure if the rates will go up 8 years from now but maybe I'd be able to refi at that time. That is the best I can do.

I opt for an IO loan and up to this point it has faired well for me. Each year I get a fairly large income tax check which I place more than half to the principle of the loan. It is my hope that when I reach my 10th year and it switches to I+P my efforts to reduce the loan amount will be worth it. The interesting thing about this is eveytime I make a principle payment the loan readjusts and my IO is reduced. Im not sure if the rates will go up 8 years from now but maybe I’d be able to refi at that time. That is the best I can do.

When I bought my home, I had no money to put down. I know that’s a horrible sign but the bank was fine with doing it. I didn’t want PMI if I could avoid it so the bank did an 80/20 loan. The 20% was IO for 10 years and then regular P&I for the remaining 20 years. And it is a fixed rate over the life of the loan.

I’ve set my bank to automatically over pay the interest only loan each month. It isn’t much but it is more than I would have been paying on that amount even if it was a standard loan. It is slowly going down and I plan on having it paid off before the interest only period runs out. If I change nothing, it will be 4 years and 2 months before the interest only period is over. But I do have the flexibility to reduce my payment if I run into tough times. I am really going to hammer it as long as I can because I am currently upside down in my house.

And that is the downside. I am upside down in my house. And it is by a fair amount right now. It is not a major issue because I am not planning on moving for a while. But if I lose my job, it could make things very hard. I think I wouldn’t have got my mortgage in today’s current market because of my debt to income ratio. It isn’t that I bought more house than I can afford… but with my student loans, I don’t have enough money coming in each month to really afford anything. But I am working on that too. And should be done with those and the 2nd mortgage in just under 5 years from now. Until that time, life is probably more stressful than it would be if I had made different choices. I am happy with my choices right now but they weren’t the easiest ones.

I have a mortgage that’s IO for 10 years, then regular P&I for the last 20 years and is a fixed rate. The rationale is that while there’s no equity building in the house, in 10 years, our income will be appreciably higher, meaning that we can make the higher payments. Though we’re actually refinancing because rates dropped enough to lower our payment AND build equity. It’s worth noting that the equity built in the first few years of a mortgage, while real, is tiny, and that IO does beat renting because of the tax deduction.

I have a neighbor who has an interest only mortgage for 10 years. I think he and his wife decided on the interest only mortgage so that they could move into the house the wanted. They are very disciplined and aware of the various risks involved. For example, they have been paying back some of the principal to the same tune of a regular mortgage or even more. But when I last talked to him about the mortgage a few months ago, they had just stopped making these extra payments since they wanted to preserve cash. I thought this was a sensible choice at a time when the credit market froze up. They seem to make very rational financial decisions and really take advantage of the flexibility an interest only mortgage affords them. As for me, I would not want to go that way. I am very happy with my 30-year fixed mortgage on which I also make extra payments. I would also only recommend an interest only mortgage in very few cases.

We are about to close on a house and are using an interest only loan. We are very financially disciplined with no debt except our mortgage, which is at 4.75%, and we will be moving out of our house in 5 years. We have an emergency fund.

We just plan to “pay ourselves the principal.” Initially we are going to take half of the principal and invest in our IRAs, and keep the other half in CDs or just a savings account. If we see the housing market starts to level out or appreciate, we’ll probably shift more of that principal into higher risk investments. I still feel over the long term, i.e., 25-30 years, equities will beat 4.75% fairly handily.

I do agree that for the vast majority of Americans interest only loans are not wise decisions. However, with the fairly low rates, I think for some financially stable persons IO loans can be good tools. Sure there are

Another possible benefit to the IO loan is it free money to pay down a second mortgage/HELOC/CC/student loans. I agree that there is risk involved; risk always should be considered.

As I understand it, interest-only mortgages are promoted as useful for people who don’t plan to keep their homes for a long time, e.g. flippers or people just planning to move in a few years. Since they plan to move before the payments go up, it does sort of make sense. However, a lot of people got stuck with a house they couldn’t sell and a mortgage they couldn’t afford.

Five years ago, my husband and I got a regular, fixed-rate mortgage on a house that was affordable and are happy we did so — especially since many of our friends pay more than we for apartments half the size (and we have 1/3 of an acre, too).

I remember a lot of the bad advice we were given, even by smart people close to us with “experience” in these sorts of things. For example: “Buy as much house as you can afford, because your income and house values will only go up.” And, likewise, “You can always refinance. Housing always goes up. They aren’t making any more land.” And there was so much said about building equity and “Your home is your best investment”, etc. It seems ridiculous, but lots of people said and believed those things! (And I hope they question them now!)

We considered an interest-only loan at one point, just because the rate was lower that of a conventional fixed-rate mortgage so we could have made the same total payment but chipped away at more of the principal. In the end, though, we’re too risk-averse to rely even on ourselves to pay the extra every month even though we didn’t “have” to. We still pay extra now, but it fluctuates from month to month depending on our expenses.