Sallie Mae Bank Savings Account Opening Review

At the beginning of March, the banking arm of Sallie Mae, a publicly-traded corporation whose main business is student loans, began offering high-yield savings accounts. As I’ve mentioned before, “high-yield” is currently a joke; just a few years ago, you could deposit cash in high-yield savings accounts and count on slightly beating inflation.

It is likely your money in a savings account will lose purchasing power until rates increase again. Even then, with the proliferation of online savings accounts, the marketplace might look much different than the last time rates here high.

I’m not normally a fan of chasing high interest rates; the time and effort generally don’t outweigh minor gains in after-tax income. I suggest finding a bank that offers consistently high interest rates and sticking with them until you have a problem with the bank or could earn at least a hundred dollars more by moving your money.

Because I review banking products, I have many active savings accounts. With Sallie Mae, I am adding one more. Like Discover Bank, opening my account at Sallie Mae Bank was very easy.

Opening a Sallie Mae Bank Savings Account

The first page of the account application announces the process will take ten minutes, and I found this to be an accurate estimation.

In order to proceed with the application, you will need your Social Security number, personal identification such as a driver’s license, and the banking information for your linked bank account. I grabbed the routing number and account number for my Electric Checking account at ING Direct and my New Jersey driver’s license, and I was ready to go.

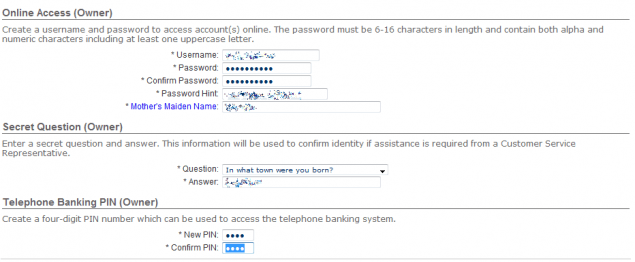

Sallie Mae integrates the online access set-up with the application process. This is a much more efficient way of handing account set-up than the processes used by many other banks. You can see below I was able to create an online account and a PIN for use when calling customer service.

After confirming the information entered is correct, Salle Mae verifies identity by asking the familiar questions derived from data points on the customer’s credit report. Once Sallie Mae completes the identity verification, the bank offers an option for entering a routing number and account number for an externally linked bank account from which the initial deposit will be withdrawn.

Sallie Mae requires no minimum balance, so I started with an initial deposit of only $100. Given the bank’s higher rates, I may move more funds from ING Direct to Sallie Mae in the future.

Using the Sallie Mae Bank Savings Account

After completing the above process, I was able to view my new Sallie Mae bank account with a zero balance. One enticing feature about Sallie Mae’s high-yield savings account is the ability to link the account to a Upromise account. I’ve been using Upromise for many years, but I no longer use a Upromise credit card. Even without the branded credit card, I earn a few dollars a year.

With a Sallie Mae bank account, I will be able to withdraw any balance over $10 from Upromise. Until recently, the only way to withdraw money from Upromise was to invest it directly into an education investment account, use it to pay off certain student loans or to request a check for balances over $200.

I was disappointed to see that the only format options for downloading transactions are “Money,” a software no longer in production, and “Excel.” There is no support, either through Direct Connect or Web Connect, for Quicken. In the Quicken desktop software, Sallie Mae is not listed as a supported bank for downloads. Additionally, neither Mint nor Yodlee currently supports Sallie Mae. This bank account is a new offering, so this situation might change within a few months.

Once the external funding account is verified, through the typical micro-deposit technique, you will be able to transfer funds at will as well as establishing an automatic recurring transfer.

Conclusion

Sallie Mae’s high-yield savings account may be too new to make a final judgment. The account opening process was the smoothest I’ve ever experienced, even quicker than Discover Bank’s process. I did not need to refer to an email or a welcome package in order to access my account online. The Upromise integration is exciting. This account is a must for anyone with a Upromise account who does not have any education-related savings or investing needs.

What do you think of Sallie Mae Bank’s high-yield savings account?

Bank data

| Sallie Mae Bank | |

|---|---|

| Routing (ABA) number | 124385119 |

| Established | November 28, 2005 |

| FDIC certificate | 58177 |

| Savings interest rates | 1.25% APY as of March 9, 2010 |

| Location | 5217 South State Street, Suite 201, Murray, Utah |

| Direct Connect | Not supported |

| Web Connect | Not supported |

| Mint/Yodlee | Not supported |

Article comments

Been with Sallie Mae almost from their beginning, now nearly 15 years, and their Money Market Account (with limited checkwriting) has usually been the best rate out there and pretty convenient to access via free ACH transfers.

They have changed recently, however. Not crazy about their new website and some policy changes. For example, without notice, their money market account is now considered a savings account for ACH purposes when it used to be a checking account. They gave no notice of the policy change and simply removed the ACH guidance on this entirely from their FAQ’s. I also can’t get prior year 1099’s anymore, even though website says they are available (had to call representative to get it emailed).

Today, I also had a very big disappointment with them worth bringing to everyone’s attention. Although the bank offers same-day domestic wire transfers for a $20 fee and accompanied by photo ID, and even has a special wire transfer request form to specify the destination party and account, etc., somebody at this bank has seriously misinterpreted their own Deposit Agreement to mean that all wire transfer requests are “preauthorized transfers” and can only be made to one of your linked accounts for online ACH transfers. That means no wire transfers may be sent to third parties, and even no same day transfers to a new external account of your own (as to be an eligible linked account, it also must be ACH verified via trial deposits first).

I tried arguing with their representatives that a wire transfer request is not a preauthorized transfer, and the section of the Terms and Conditions Agreement which describes the wire transfer service makes no mention that a wire can only be sent to a verified linked account, but of course they won’t budge. I’m likely going to submit a dispute claim with their compliance team on the matter for the money that I have now lost due to their refusal to execute the wire request, but who knows where that’ll go…

Honestly, somebody there seems to have lost their mind by limiting wire transfers to only external accounts for which 2-day ACH transfers can already be performed by the customer (up to $500,000). And the information collected on their wire transfer form and photo ID requirement is totally unnecessary and ridiculous if they still only allow wire transfers into previously linked accounts, which they already know about and have verified that you own!

Hi Everyone, I’m putting some feelers out there to see if there’s anyone interested in making a pretty substantial amount of cash in a short amount of time. Only thing this requires is that you have an active bank account or credit card. No cash is required up front to start. Which means your account can be on a zero balance and that’s completely fine.Text +1(314) 856 1730, lets talk about the next deal

Sallie Mae Bank is still same old Sallie Mae. Unfortunately, Sallie Mae was both my student loan servicer and my bank for the Savings Account mentioned on this article. Do not trust them. Believe me, their notorious Sallie Mae customer service is the same with their bank. They don’t give a **** about you and to them you’re just another number. Credit unions are different. I love credit unions and I generally get great rates from them. I have tried HSBC, AMEX and others. Try to stay away from Capital One as well.

I got a vague error message during the account opening process, saying I should call them. After 11 minutes on hold, they told me they were unable to generate my identity questions, so I have to fax or email a copy of my driver’s license, social security card, and a utility bill.

They could not explain why this happened, even though I told them I’ve opened several online accounts before, and had no trouble with the identity questions. They said the soft credit inquiry did go through.

Frustrating stuff — I’m considering giving up on this account.

Luke, I just read your excellent article on Sallie Mae – very informative- and I’m about to take the plunge into the internet banking. I really have tow items that I would like for you to please address, if you can:

1) Is there a documentation trail – like the old paper trail – that can be used to prove that funds were indeed moved? With checks, it’s easy as they provide it, but I’m not sure what exists with electronic transfer, to prove that it occurred. This may involved significant amount of money, which makes it even more important to know..

2) Accessibility of the funds – do these type of accts – internet acct – have a time restriction ie once request for transfer is made, a certain # of days will elapsed before the actual transfer is made .

I realize that you probably get a lot of these but I sure hope to hear from you soon. Thanks in anticipation, for your time.

In answer to this question. I am reading this page to help me decide if I want to transfer money from my current account which just went from .70% to .50% APY. So I cannot answer the question based on Sallie Mae, but I have had several online bank accounts. Anytime you set up a transaction or transfer, a page with transaction details and a confirmation number comes up with a suggestion to print the page for my records. When I enter transactions in Quicken, I type the transaction number in the note area —but I have never had a problem with a transaction failing. The only thing I see here that I question is the 5-10 day wait for money to be available. On my current account, if I put in a transfer today, the money is there tomorrow, but when I look at the account summary, it might say my balance is $1000, but only $800 is available (based on a $200 deposit.) I’ve never checked to see how long it actually takes for it to be available, but it might be 5 days or so. SInce APY’s are terrible everywhere, I figure I might as well get the best I can find. Sallie Mae’s rate is more than double what I am getting now.

Their ACH hold policy is pretty bad. They place a 5 day hold on ACH deposits, which is much longer then most banks, S&L, or NCUs. I quote from their email..

—————————————-

Dear Mr. ____,

Thank you for contacting Sallie Mae Bank.

For all deposits made by check or electronically in the amount of $5,000 or less, funds will be held for five (5) business days from the effective date for those funds, which is the day that we credit your Account for that deposit.

Deposit hold for ACH transfer is not only by Sallie Bank, it is both a Regulatory and Bank Standard Hold Policy.

Thank you,

Sallie Mae Customer Service

Part of me doesn’t want to give Sallie Mae any more money than they already have from me.

Think of it more as them giving YOU money for a change. 1.30% in your pocket just for letting them keep an eye on your nest egg.

If you are a conservative investor with a _bad_ feeling re the likelihood of an upcoming (yes say the word) depression, you may want to consider the possibility of sallie Mae going under. Even the possibility of Sallie Mae going under, and the FDIC (under an R administration) saying “ooh, sorry, we’re broke now, we ‘can’t’ cover the losses”. Nonperforming loans at Sallie are now incredibly low, and their alleged “coverage” is high. But they have a liquidity problem. Think about what’s likely to happen to those particular loans if in fact a (say it again) full fledged 1930’s depression actually happens.

Yes if we have another Great Depression many will be SOL. This is no more risky than any other bank.

Has anyone successfully opened their account with way less than $100? Anyone ever been denied of an account? I can’t tell when this article was written, but Sallie Mae is currently offering 1.30% which sounds like a pretty good deal.

I opened a Sallie Mae account about 3 months ago and they told me that you can open a high yield savings account with no minimums. I made my deposit through my Upromise.com account (a great website, owned by Sallie Mae, to get money back through qualified purchases through affliated retailers,) and it was under $100. But I was told by a Sallie Mae representative that you can open with no money down, but I had a balance on my Upromise account that is not earning interest which I used to open my Sallie Mae account. Also, Upromise.com has a program where they will annually match 10% of your Upromise account earned balance when you make a $25 monthly deposit into your Sallie Mae account from a linked banked account. Here is a statement from Upromise.com about ths:

“To be eligible for the 10% annual match on your Upromise earnings from Upromise you must link your High-Yield Savings Account to your Upromise Account and, within 90 days of opening your High-Yield Savings Account, either: (1) set up an Automatic Savings Plan with a monthly deposit of $25 or more, or (2) fund the account with $5,000 or more. Upromise will match 10% of your Upromise earnings posted as “funded” to your Upromise Account during the calendar year of January 1 through December 31. Your 10% annual match will be deposited into your High-Yield Savings Account in February of the following year provided that both accounts remain active and are in good standing at the time of transfer. Visit the FAQ’s to Learn more. Upromise may change or terminate the 10% annual match offer at any time without notice. Other terms and conditions may apply. Upromise Accounts are not FDIC insured, carry no bank guarantee and may lose value. ”

You can make deposits by linking to another bank account by transferring funds electronically via ACH transaction or by mailing a check to them. Unforutnately, the downfall is that they will ‘hold’ all deposits from 5-10 days (10 days for initial deposits and for amounts over $5000.) Other than that, having a Sallie Mae account has been good to me so far.

Just be aware that they put 20 yes!! “twenty” days hold on money you transfer from another bank. This is the longest hold period I’ve ever seen.

When did they state this; after you transferred the money? Is this still affecting your account? I’m thinking about setting up an account so I was just curious!

Two things separate Sallie Mae’s OSA from others. The first is UPromise…this integration is one of the more innovative components of an OSA i’ve seen over the past year. The second is the rate. Since it’s inception Sallie Mae has had one of the best (if not the best) online savings or money market rates on the market. Even after last weeks drop to 1.30% APY from 1.40% APY it still seems to be the best available.

So they have an Excessive transaction fee. It is changed monthly if you make more than 6 withdrawals and they will not even give you a warning or have any humanity when you call. I called to discuss the fee and the first answer I was given was that they do not charge fees. Second they called me a 6am to discuss why there was a fee. I called to ask some more questions like is there a warning period or refund because it was my first time, like at Capital One, and all I got was please read your terms and conditions and the FAQ.

They do have an Excessive Transaction fee and I found it under their legal information agreement (I have an account with Sallie Mae.) It states:

“Excessive Transactions Fee: Federal regulation for savings accounts mandates a maximum of 6 withdrawals per statement cycle. There is a $10 charge per withdrawal transaction for withdrawals beyond the allotted six per statement cycle.”

You can view it yourself at their website.

The best way to avoid the charges is to avoid making more than 6 withdrawals per statement cycle (usually 3-4 months.) If you can’t avoid making numerous withdrawals, then you may need a different type of account besides this.

All savings accounts are subject to the six transaction limit. Different banks handle it differently. The banks usually don’t block transactions over the limit, but they can send you warnings that your account will be closed or charge you a fee.

My account opening process wasn’t as smooth. When it came time to verify my identity, I had to answer a series of questions. Most were straightforward (which of the following streets have you lived on, which state was your SSN issued in), but then a question came up like this:

“In what year was the construction on your building XXX Xth Street completed?

A. 1995

B. 1990

C. 1900

D. None of the Above”

I was baffled- I live in a high rise building. So, I randomly picked one and of course my application failed and I had to call. It was such an odd question. Who knows these things?

I just opened a new account with Sallie Mae and I received the same weird “identity type” questions. Based upon the “context” of my questions, it seems to me that they derived their questions based on what is on my credit report. This is my theory. Did you ask the representative where and how they derive your particular “identity” questions? I’m curious as to what they told you.

I’ve had no problems with Sallie Mae Bank so far. Go for it.

I am in the same boat as Whitney. I am trying to find a savings account with a high APY for a house mortgage in the not to far future. Is this a good option for saving and if not what do you recommend?

I’m a newlywed, and a college student and I’m trying to find a good high yield savings account. Would this be a good one to start, or do you have a better recommendation? I don’t have a u-promise or sallie mae loan, and I really dont’ know anything besides checking and your basic savings account, I’m just looking to start putting a nest egg aside, maybe for a house deposit or something later

Hmm – I have not had the same speedy experience at sign up. I’m not sure if it is because I was once in default with them (around 7 years ago my measly student loan was paid in full), or if it is because I haven’t lived at the same address for a full 2 years?

I called Sallie Mae and was impressed with the Customer Service, believe it or not. Carlos put me on hold when he didn’t know the answer to my question (why am I being delayed?, he must be in training) and then gave me the correct answer – “No, you aren’t going to be denied a savings account because you once defaulted on your SL. Yes, you should recieve your confirmation email in the next few days.”

I wanted to point out that you can actually request a check from Upromise at any time for the full balance of your Upromise savings and there is no minimum balance. Details on how to do so are at http://bit.ly/b2dbzC.

Debbie: Thanks for the update!

do you have to have a credit history to be eligible for Sallie mae savings account?