Smithee's First Stock Sale

Well, I sold my first stock. I agonized over when would be the right time, but then I just pulled the trigger, anyway.

Earlier this year, I started using the “free money” I was getting from this credit card to buy some stocks.

In March, we paid our tax bill of over $3,300 using that card, so the 2% rewards were higher than normal. I asked a friend of mine who knows a lot more about the stock market than me what stocks were catching her eye, and on her unofficial recommendation I bought 60 shares of CAR, the Avis car rental people.

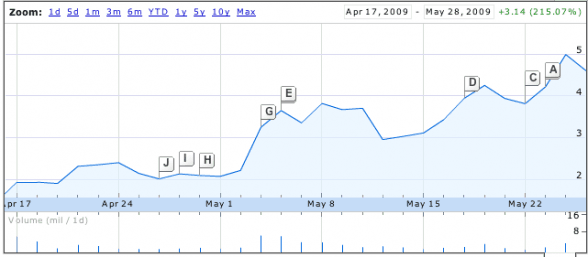

That was April 17th. The stock price was $1.50. With a $9.95 commission at Sharebuilder, I ended up “spending” a total of $99.95.

And then I watched as the stock price just rose and rose and rose.

On about May 20th I started wondering if I should sell my proceeds. We’ve had rather more pet problems than usual and I was a little worried that our upcoming vacation might suffer as a result. The “overall return” on that investment, according to Google Finance, was hovering around 200%, which is a heck of a lot more than the 7 to 9% we’re taught to expect from long-term investments.

So I sold it on May 27th. I was a bit alarmed to see that there was yet another commission of $9.95. To me, that’s like paying a toll over a bridge going in each direction.

Stock proceeds: $282.24

Minus original investment of $99.95: $182.29

Now, if I’m reading this Capital Gains Tax table correctly, we’re going to be hit with a 25% of the “cost basis” come next April. If the cost basis is the amount I spent on the investment, that’d be the $99.95 number again, which means a tax of about $25.

Profit minus upcoming tax: $157.29

So I spent $99.95 and got $157.29, a real profit of 157%. Not the nearly 200% that Google Finance was teasing me with, but not shabby, either.

The other way to look at it is that since the $99.95 was free money in the first place, I made a profit of infinity dollars.

More importantly, when we take our vacation next month, we’ll have $157 that we otherwise wouldn’t have had. That’s one fancy dinner with some very good wine. I’m looking forward to it.

Article comments

Smithee, keep saving your money and wait until you have enough to make the commissions much less painful. Pile up the cash in a no load, no commission mutual fund that gives you diversification and minimizes fees. You will be ready to start picking stocks when you can own 5 positions (remember to stay diversified) and the total transaction costs will be less than 1% of your investment. That means if you pay $9.95 x 5 in fees you should have a total of about $5,000 split equally over your 5 selected stocks. Then every time you hit the $1,000 mark you can add another stock that you want to hold. The $5,000 starting target also matches nicely with the max annual Roth IRA contribution. On January 1 every year you should take $5,000 and drop it into 5 stocks (or ETFs) that you want to buy. ETFs are a great way to get the benefits of stocks but the diversification of a mutual fund (a much better idea imho than picking individual stocks). Now start piling up the cash!

I am sure Flexo has an affiliate link – but I would check out Trade king – 5 buck trades. That would be additional 10% more or so!

I think it’s because he’s using the Schwab account by default since that’s where his cash back is deposited. Nonetheless, the commissions are expensive.

Your commission is ridiculous. There are so many brokers with 1/3 of that or even 0 commissions.

Also, as a recommendation, don’t bother starting with that little money on stock market..commissions you will eat you alive.

Oi! If you are going to have such tiny positions, find someone who offers zero commission trades. You really shouldn’t pay more than 1% in commissions each way and even that is pushing it.

Congrats on your first stock sale! I’ve wanted to do this myself but was afraid of all the fees attached eating into any real profit. Are there other competitive trading sites/services you would recommend in which one would not rack up all the added costs?

Michael –

IMO, Interactivebrokers.com is one of the best for low cost. Most equity trades will cost you $1. There software takes some getting used to, but is well worth it versus the $8 – $12 average for most brokers.

I think you’re calculating your capital gains tax wrong. The tax is on the capital gain, not on the cost basis. The cost basis is your purchase price, adjusted for commissions (both purchasing and selling). The capital gain is your sales proceeds minus your cost basis.

In your case:

Cost basis = Total purchase price + commission when buying + commission when selling

Cost basis = 60 x $1.50 + $9.95 + $9.95

Cost basis = $109.90

It looks like your sales proceeds number is actually your selling price subtracted by the selling commission (since you use that number to calculate your profit). That means your actual sales proceeds is $292.19 before commission, which makes sense if you sold at the beginning of the day on 5/28. Then your capital gain is calculated as follows:

Capital gain = Sales proceeds – cost basis

Capital gain = $292.19 – $109.90

Capital gain = $182.29

The tax on your short-term capital gain would be more like $45.57, leaving you with a net profit of $136.72.

The reason why your return is significantly lower than Google’s return is the crazy commissions you were charged. I hope you don’t plan to continue short-term trading with those commissions!

Lily is right. You pay tax on the profit. The tax applies to the gains which is the proceeds minus the costs.

I’d also point out that your 25% rate is because this is a short term capital gain and (I assume) 25% is your marginal tax rate. If this was a long term capital gain that you’d held for over a year then you’d be payin 15% tax rate on it.

Cool; congratulations! They won’t all work out that well, but that’s awesome nonetheless.

-Erica