Top Ten Personal Finance Start-Ups

The financial industry has been mostly static for centuries, with companies doing business and offering services not much different from how the companies operated for earlier generations of consumers. When there is innovation in the industry, it generally comes from smaller companies and entrepreneurs looking to fill a need that isn’t covered by larger, less flexible entities.

While today’s start-up companies are changing how customers interact with their money, most of these small business owners have the ultimate goal of selling their businesses to larger, more established companies who will then incorporate these new services if the start-up companies cannot become industry leaders without help. In the mean time, start-ups compete for funding from a growing community of investors in the industry.

Here are ten customer-facing personal finance start-up companies that could help change the way consumers interact with money. Some have already been thriving for a few years, while others are new to the industry. These are not in any particular order.

BrightScope

401(k) plans are tough to evaluate from the plan descriptions and prospectuses offered by plan administrators to employees. Employees can’t always choose the best investment options for them due to limitations by plan administrators. Additionally, plan administrators often change available investment options and automatically transfer employees’ money from one fund to another without sufficient notification to the investors.

401(k) plans are tough to evaluate from the plan descriptions and prospectuses offered by plan administrators to employees. Employees can’t always choose the best investment options for them due to limitations by plan administrators. Additionally, plan administrators often change available investment options and automatically transfer employees’ money from one fund to another without sufficient notification to the investors.

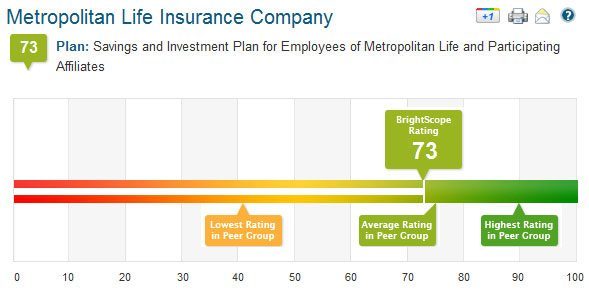

BrightScope lets employees evaluate their company’s 401(k) plan. If, for example, you have two job offers and you’re comparing compensation, you can take the quality of the 401(k) plan into account by researching these companies. Each company receives an overall rating as well as scores in important categories including total plan cost, company generosity, and participation rate. You can directly compare each company with its industry peers.

The above image shows the overall rating for MetLife. For comparison with other companies in its industry, MetLife’s score of 73 is below Morgan Stanley’s 83.8.

LendingClub and Prosper

As technology advances, it brings manufacturers and customers closer together, often eliminating the need for companies that stand in between, adding to the cost of products and services. In some ways, the financial industry is a “middle man.” Banks take deposits in the form of savings and checking accounts, and turn that money around and lend it to individuals and businesses in need of capital. Peer-to-peer lending companies like LendingClub and Prosper take deposits out of the process; lenders can choose borrowers and lend money directly or invest in a group of loans packaged as an investment product with measured risk.

As technology advances, it brings manufacturers and customers closer together, often eliminating the need for companies that stand in between, adding to the cost of products and services. In some ways, the financial industry is a “middle man.” Banks take deposits in the form of savings and checking accounts, and turn that money around and lend it to individuals and businesses in need of capital. Peer-to-peer lending companies like LendingClub and Prosper take deposits out of the process; lenders can choose borrowers and lend money directly or invest in a group of loans packaged as an investment product with measured risk.

State regulations prevent peer-to-peer lending from being available to all United States citizens, and the primary concern is that customers who may not be able to take advantage of loans from a bank turn to these options where they can be charged nearly-usurious rates. For many people, however, peer-to-peer lending has provided a solution that banks have been unable to fill, whether for borrowers or investors.

Jemstep

For your investments that are not locked in a 401(k) with limited options, like your personal IRA or your taxable investment account, the variety of mutual funds and ETFs available is staggering. And unless you work with an unbiased financial planner, it can be difficult to choose the investments that will give you the best chance of making the most of every dollar you invest.

For your investments that are not locked in a 401(k) with limited options, like your personal IRA or your taxable investment account, the variety of mutual funds and ETFs available is staggering. And unless you work with an unbiased financial planner, it can be difficult to choose the investments that will give you the best chance of making the most of every dollar you invest.

Jemstep is like an unbiased investment adviser with an immense set of data available to help you make investing decisions. You can create a profile for yourself that reflects your attitudes about investing. Most online investment recommendation engines stop at risk and time profiles, but Jemstep goes much further. You can decide how important fees are, whether you’re looking for actively managed funds or index funds, and whether potential tax plays a role in your investing decisions.

After calibrating your profile, Jemstep can evaluate your current portfolio and offer investment suggestions that are better suited to you.

Today, Jemstep announced it completed its Series A round of financing. Start-up companies look for funding from outside sources to grow their businesses before the business generates enough revenue on its own to finance its own operations. In total, Jemstep has raised $10.5 million from early investors in order to fund product development and hire employees.

HelloWallet

There’s a need for consumers to better manage their own personal finances. Over the last decade, this has been the realm of software like Quicken and Microsoft Money, but the latter has disappeared from the market and the former is increasingly seen as an outdated piece of software. In recent years, a number of companies had been developing personal finance management software for a new generation, incorporating mobile options and focusing on reporting and trending rather than reconciliation, though the depth offered could not compete with Quicken. Many of these companies have disappeared, and the apparent winner, Mint.com, was purchased by Intuit, the makers of Quicken.

There’s a need for consumers to better manage their own personal finances. Over the last decade, this has been the realm of software like Quicken and Microsoft Money, but the latter has disappeared from the market and the former is increasingly seen as an outdated piece of software. In recent years, a number of companies had been developing personal finance management software for a new generation, incorporating mobile options and focusing on reporting and trending rather than reconciliation, though the depth offered could not compete with Quicken. Many of these companies have disappeared, and the apparent winner, Mint.com, was purchased by Intuit, the makers of Quicken.

HelloWallet has emerged as a new competitor for Mint.com, but while Mint.com is now free, HelloWallet charges users a fee of $8.95 per month. For the fee, you can be sure that the recommendations you receive are unbiased — companies and products do not pay HelloWallet for advertising placement within the service. The goal of HelloWallet is focused more on overall financial advice than tracking. Mint.com has moved in this direction, as well, however.

Dwolla

Merchant account service is a big business rules by large companies. Each time you swipe your credit card or debit card, a number of companies get paid in addition to the retailer from which you’re buying a product or service. Small business that need to operate on tight profit margins to compete with larger businesses suffer in these situations, because a larger proportion of their revenue is dedicated to paying these fees.

Merchant account service is a big business rules by large companies. Each time you swipe your credit card or debit card, a number of companies get paid in addition to the retailer from which you’re buying a product or service. Small business that need to operate on tight profit margins to compete with larger businesses suffer in these situations, because a larger proportion of their revenue is dedicated to paying these fees.

PayPal entered the marketplace and attempted to shake up the industry, offering a new way for retailers to accept credit card payments and for individuals to initiate person-to-person payments without the help of a bank. Dwolla has taken this model and, rather than relying on linked credit cards, has found away to put the focus on cash. The cash focus could be more financially responsible for a large percentage of customers.

Dwolla charges lower fees and allows users to send cash from person to person or to pay for a purchase using your phone. Customers can transfer payments using e-mail, the web, or social media applications within Facebook and Twitter. By default, the $0.25 fee is paid by the store or the recipient, though the individual initiating the payment can change this option. Transactions less than $10 are free.

SecondMarket and SharesPost

The buzz today is about Facebook’s imminent initial public offering (IPO) of stock. Soon, Facebook will be a public company, and investors will be able to trade shares of the company in a liquid stock exchange. For most people, this will be the first opportunity to invest in Facebook, a company that has grown significantly over the last few years. Of course, those who own part of the company already, like early and current employees, will see the biggest benefit after an IPO, assuming the company continues to grow.

The buzz today is about Facebook’s imminent initial public offering (IPO) of stock. Soon, Facebook will be a public company, and investors will be able to trade shares of the company in a liquid stock exchange. For most people, this will be the first opportunity to invest in Facebook, a company that has grown significantly over the last few years. Of course, those who own part of the company already, like early and current employees, will see the biggest benefit after an IPO, assuming the company continues to grow.

You don’t have to be an employee to own and trade shares of Facebook, however. Two companies have specialized in creating a market between a small number of common or preferred shareholders — usually employees but also capital funds — with the wider audience of investors. I signed up with SharesPost (review here) last year to gain access to Facebook shares.

Occasionally, SharesPost holds an auction of shares held by investors who wish to liquidate their holding for the best price, and investors interested in buying can participate in the auction by naming the amount of shares they’d like to purchase and the price willing to pay. If there’s a match, SharesPost handles the transfer of shares. Surprisingly, the share price for Facebook’s Class B common stock has been stable over the past year, particularly given the volume of trading is significantly lower than it would be on an open market. The price has moved from $33 to $34 per share. It will be interesting to see how the stock performs on the open market.

SecondMarket is similar to SharesPost in that it creates a market for financial products that don’t have an accessible exchange for trading. With SecondMarket, you can trade public equity, fixed income and bankruptcy claims in addition to private shares.

Google Wallet and mFoundry

With technology changing quickly, smaller companies are able to jump on new technology. Google is not exactly a smaller company, but the company’s development operations function like a start-up. Google also has the size to buy smaller companies with innovative ideas early in their development. Google Wallet, however, was developed in-house. New technology in mobile phones makes it easier to transmit information securely in close range, and retailers are using that technology to accept payments without swiping a card. An application stores credit card information, and when a receiving device is in range and the consumer initiates the transaction, his or her device sends the information securely to the retailers.

With technology changing quickly, smaller companies are able to jump on new technology. Google is not exactly a smaller company, but the company’s development operations function like a start-up. Google also has the size to buy smaller companies with innovative ideas early in their development. Google Wallet, however, was developed in-house. New technology in mobile phones makes it easier to transmit information securely in close range, and retailers are using that technology to accept payments without swiping a card. An application stores credit card information, and when a receiving device is in range and the consumer initiates the transaction, his or her device sends the information securely to the retailers.

As more mobile devices incorporate this NFC technology, contactless transactions will continue to increase. This was a hot topic in the media several months ago, and I explained why Google Wallet would not catch on as quickly as people were predicting. Today, Google Wallet is still limited to using only Citi MasterCard credit cards or Google’s own reloadable debit card.

There’s a smaller company that has seemed to penetrate this market deeper from Google. Among mobile payments, mFoundry works with banks and credit unions to develop their own applications based on the company’s technology. I’ve focused on start-up companies that face the public rather than other businesses in this article, but mFoundry does both. Mobile banking has a long road to becoming a mature and ubiquitous service, but it’s these companies that will help bring the innovative services to consumers and bigger financial institutions.

There are many other personal finance start-up companies worth mentioning, but I limited this list to ten across a broad spectrum of personal finance to keep this article interesting and not too long. If you feel I’ve missed something substantial, please feel free to share your thoughts in the discussion area below this article.

Normally, I do not allow business spokespeople to promote their companies in the comments on Consumerism Commentary, but as long as it’s relevant, I’ll allow short comments intended to note companies looking for broader exposure in the personal finance space, but I still reserve the right to edit, moderate, or delete promotional content.

Article comments

Hi Flexo, I came across this post again and thought I might mention that Jemstep is launching a new product – Jemstep Portfolio Manager – in the coming months. We’ll keep you and your readers posted.

Thanks again.

Regards,

Kevin

thanks for the post flexo. I’ll need to do my own research on these startups.

I am really interested to see how Google Wallet progresses. This type of system really intrigues me.

Hi Flexo,

Many thanks for including us in this great list. We really appreciate it and hope to add value to your readers and all investors who use the service.

Thanks again.

Kevin

COO, Jemstep

JEMSTEP has one big obstacle that should scare some folks off. I can not find any way to manually enter my portfolio. They require that you “give-up” your login credentials for the financial institutions you want to include in their analysis.

This is common among most PFM software. After a few years, I’ve come to accept that the software vendors are not lying when they say this banking information is not stored. When you provide your financial account login and password to a PFM software, it is communicated securely (encrypted) and the bank (or a service like Yodlee) creates a secure key that links your PFM account to the financial accounts. The login ID and password are never used again unless you change them. The bigger concern is someone getting access to your PFM software password… but even if they do, account numbers are obscured and the access to the accounts is read-only.

That all relies on the PFM software being legitimate.

Thanks for the additional info! Jemstep was the one that caught my eye off the list. Interested in checking it out.

Hi SteveDH,

Thanks for your comment and feedback. Comments like these help us improve the service and we appreciate it. We have received several requests for manual entry and will certainly be looking at this.

Thanks again.

Kevin

COO, Jemstep

I’d never heard of JemStep, thanks for pointing it out. If I was making the list I’d also add Ready For Zero and Credit Sesame

Thanks for mentioning us Ben!

Dwolla is very intriguing to me. If it would allow small businesses to pay a lot less in processing and transaction fees this could greatly help our profit margins. Also, Sharespost is really awesome also. I really wonder how Facebook shares will fare on the open market and now that the IPO is imminent, it seems that shares bought on the second market should skyrocket…we shall see!

Dwolla used to be the preferred transaction provider for the Bitcoin community. Bitcoin dropped them after they had a problem with chargebacks. I’m not sure if this has been resolved but many of the groups that dropped them have not picked them back up yet.

What about Adaptu?

There are a lot of start-ups I couldn’t include if I wanted to narrow the field down to ten and keep the overall focus broad enough. There are probably ten general personal finance management and advice engines that could be featured in a separate list… but for this article, I narrowed it down to a couple of the most compelling.