Ally Invest Review

Ally Invest offers is a low cost and very easy to use online broker. Formerly TradeKing, we cover all of its features and costs in this review.

You’ve probably heard about Ally Bank. They’re perhaps the best-known online bank, offering some of the highest interest rates available on savings accounts and certificates of deposit. As of last year, Ally Bank has an investment branch–Ally Invest. And like the Bank, Ally Invest is one of the better investment platforms now available.

About Ally Invest

Ally Invest came about in 2016 when Ally Bank acquired TradeKing. TradeKing was a well-known brokerage firm in its own right, offering some of the lowest trading commissions available anywhere. It was a perfect investment platform for self-directed investors, who trade frequently, and looked for the lowest trading commissions possible. TradeKing fills that niche and filled it well.

Ally Bank took all that TradeKing had to offer and only made it better. The platform offers stocks, bonds, fixed income securities, options, exchange-traded funds (EFTs), and more than 12,000 mutual funds, both load and no-load funds. They also offer Ally Invest Cash Enhanced Managed Portfolios robo-advisor, and for more sophisticated investors, Ally Invest Forex & Futures.

Ally Bank has over $71 billion in customer deposits and more than 7,500 employees. Ally Invest now has over 250,000 customer accounts, with a total of $4.7 billion in assets under management. The two divisions are each owned by Ally Financial, Inc. which was founded in 1919, and is currently headquartered in Charlotte, North Carolina.

Ally Invest Basic Features and Benefits

Available Accounts. You can hold individual and joint investment accounts, as well as traditional, Roth, rollover, SIMPLE and SEP IRAs. They also offer trust, custodial and Coverdell accounts.

Minimum Opening Account Balance. If you’re opening a self-directed account, there is no minimum required initial deposit. The minimum for the Cash Enhanced Managed Portfolio is $100, and for the Forex & Future account, it’s $250.

Customer Service. Representatives are available by phone, email or online chat, 7am-10pm ET, 7 days a week.

Account Protection. Your account is protected by SIPC for up to $500,000 in cash and securities, including up to $250,000 in cash. There is additional coverage available for up to $37.5 million, although the Forex & Futures accounts are not covered by this insurance.

Mobile App. The app is available for Apple iOS and Google Android. It is offered for both Ally Bank Mobile Banking and Ally Invest.

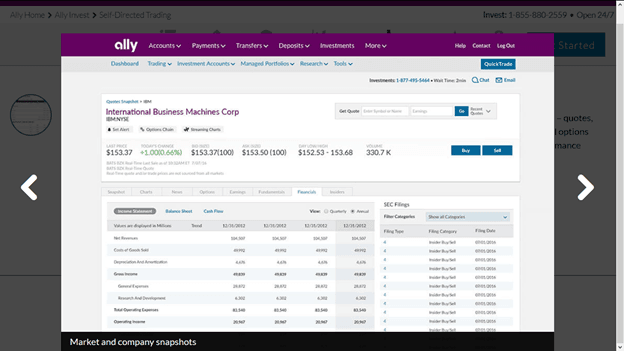

Investing Tools. Ally Invest equips you with streaming charts, market data, market, and company snapshots, watch lists, a profit and loss calculator, a probability calculator, and options chains that enable you to easily place options trades.

Ally Invest Cash Enhanced Managed Portfolios

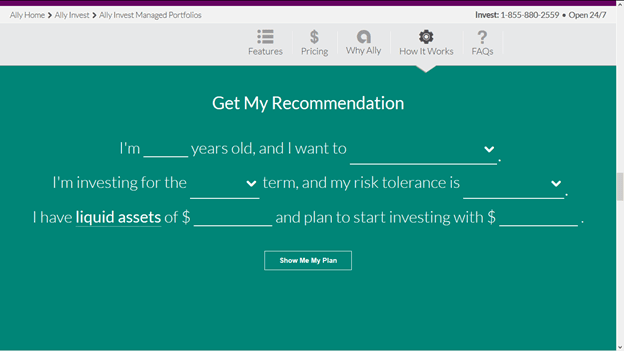

Cash Enhanced Managed Portfolios are Ally Invest’s robo-advisor service. It is designed for investors who are not comfortable with self-directed investing. The service provides professionally designed portfolios that are personalized to fit your risk tolerance, time horizon, and investment goals.

Like virtually all other robo-advisors, Ally Invest Cash Enhanced Managed Portfolios build your portfolio using low-cost index ETFs. These keep investment fees very low while providing your portfolio with exposure to entire markets and sectors.

Cash Enhanced Managed Portfolios includes automatic rebalancing, and enable you to adjust your risk tolerance, which allows the portfolio allocations to be changed.

Cash Enhanced Managed Portfolios are available for individual and joint taxable accounts, as well as custodial accounts, and IRAs. Each account requires a minimum initial investment of $100 and has no annual management fees!

Ally Invest Forex & Futures

For more experienced investors, Ally Invest offers its Forex & Futures platform. There you can trade more than 50 currency pairs, including gold and silver. Since Forex and futures investing is more technically involved in other investment types, the platform offers a full range of trading tools, research material, and educational guides.

Trading on the platform can be done in real time. They also offer customer service for Forex & Futures on a “24/5 basis” – that’s 24 hours a day, five days per week. They are available from 10:00 AM on Sundays, through 5:00 PM on Fridays, Eastern Time.

The trading platform is fully customizable and offers trading in metals, indices, bonds, and agriculturals. It also has charting capabilities that are based on over 100 technical indicators. You also get real-time alerts in a tradable Market Depth Ladder.

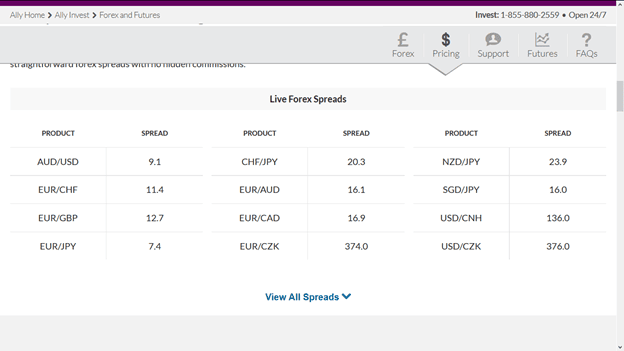

You can open a Forex and Futures account with as little as $250, but Ally Invest recommends that you have at least $2,500 in the account before you start trading. There is no fee associated with trading on this platform. Ally Invest is compensated by the buy/sell spread.

Forex & Futures Features and Tools

Practice Account. If you’re not an experienced Forex trader, Ally Invest offers a $50,000 practice account that enables you to access all of the features of the Forex & Futures platform for 30 days. There you can develop your skills as a trader, before committing your own real money.

ForexTrader. This feature provides real-time information, maximum flexibility, and robust tools for Windows users. It offers an intuitive user interface with advanced customization features, as well as professional trading tools. You can:

- Customize your trading environment

- Spot trends and plan for your next trade

- Automate your trading strategies

- Browse actionable research and trade ideas

- Access your account anytime, anywhere with the Mobile App

ForexTraderWeb. This platform is available for Mac (but also for Windows) and is a fully integrated charting tool that provides you with advanced trading with easy access to position and account information. It provides real-time quotes and instantaneous updates on your open positions, and other information.

It also displays a variety of single and contingent order types, including If/Then, If/Then OCO and Trailing Stops.

Mobile Solutions. The mobile app provides robust training capabilities, real-time news and commentary, charting tools, and the ability to get alerts and manage your account. And you can do it all while you’re on the go.

The platform also offers a large variety of educational resources that will help the Forex and futures trader learn everything from the basics of trading to technical and fundamental analysis. It also provides you a glossary of terms, to familiarize yourself with those that are necessary for the trade. Ally Invest offers plenty of resources for both the novice trader and the veteran who’s looking to sharpen his or her skills.

(SOURCE URL: https://www.ally.com/invest/forex-futures/)

Ally Invest Pricing

There are three basic ways to invest through Ally Invest, and each has its own pricing structure.

Self-directed Investing

Ally Invest’s Self-directed investment fees are as follows:

- Stocks and ETFs traded at no cost.

- Options, $0 per trade, plus an additional $0.50 per contract

- Mutual funds, load funds: no fee on either purchase or sale

- Mutual funds, no load funds: $9.95 on both purchase and sale

Ally Invest has no annual fee, inactivity fee, and even no IRA fee.

Cash Enhanced Managed Portfolios

Ally Invest Cash Enhanced Managed Portfolios has no annual management fee on all balances. This means that you will pay $0 per year on a portfolio managed by the service.

Forex & Futures

There is no commission involved with Forex trades, as Ally Invest earns their fees on the buy/sell spread.

Ally Invest Pros and Cons

Ally Invest Pros

No trading fees. The basic trading commission of $0 per trade is the lowest in the industry.

Self-Directed or Cash Enhanced Managed Portfolios. This combination gives you a choice, to either manage your own investments, or to have them professionally managed. You don’t have to make a choice, you can have part of your portfolio managed while being self-directed in the rest.

Ally Bank. The bank has some of the highest interest rates paid on savings instruments, as well as the availability of mortgages, a credit card, and their innovative auto financing portfolio.

Ally Invest Cons

We could not really come up with only one.

Should You Invest with Ally Invest?

Very low trading fees, a cash enhanced managed portfolio option, a robust Forex and futures platform, and the availability of all of the benefits of Ally Bank make Ally Invest a tough combination to beat anywhere. This can be a perfect investment platform for the self-directed investor, who may want to trade in options and Forex and futures, but also wants to add a managed option as well as high-yielding safe investments to the portfolio mix.

What’s more, Ally has very low minimum investment requirements, for the self-directed platform, Cash Enhanced Managed Portfolios, and their various bank investments. In that way, it’s also the perfect platform for the passive investor who might want to combine managed investments with high-yield savings, and maybe dabble in some self-directed investing along the way.

If you’d like more information, or you’d like to sign up for the service, visit the Ally Invest website. This is truly one of the best overall investment platforms available.

Article comments

So between TD Ameritrade and Ally who do you think has the upper hand. To me it seems like Ally Trading is just really good at trading. Whereas other platforms offer more in customer service, research, etc. So do you suggest using a service like Fidelity in addition to Ally since Fidelity has one of the best research and education platforms available?

Thanks