Be Generous Now to Save on Estate Taxes Later

Whether you’re an investment guru with billions to your name or a small business owner who has seen years of hard work finally result in success, you definitely don’t want to see even more of your money eaten away by estate taxes. To combat this, you may be looking to spread the wealth now. This could include gifting your children with the down payment on their new home, buying your mom a new car, or simply writing your nephew a generous check at Christmastime.

Could You Be In Luck? Trump’s Tax Reform Proposal

Making large disbursements such as these can be a simple and effective way to reduce your future taxable estate, benefiting your heirs considerably. Here’s why you should consider the annual gift exclusion and how your generosity can be utilized in the most tax-efficient way possible.

What is the annual gift exclusion and how does it work?

Each and every U.S. citizen is allowed to give anyone of their choosing up to $14,000 a year (as of 2017), without incurring either a gift tax liability or being required to report the gift. This means that if you’d like to spread the wealth to your children, you are able to give them as much as $14,000 each per year without any sort of tax implications. Married couples are allowed to compound this benefit, gifting as much as $28,000 to any individual of their choosing without any gift tax being applied.

Example: Let’s pretend that you and your wife have five kids, but are also very close to your best friend’s two children, as well. You have recently retired and sold your company and would like to give them all the gift of a vacation fund this summer. (What a generous fellow you are! By the way, I need a vacation, too…)

As a couple, you and your wife are allowed to give each of your children and each of your friend’s children as much as $28,000, effectively reducing your taxable estate by $196,000 this year. There is no limit to the number of people to whom you can give these annual gifts, and you can do it each and every year. If you were to write them all a comparable check every year for the next ten years, you could easily reduce your estate by $1.96 million… without it counting toward your lifetime gift exclusion or being taxed as part of your estate.

Related: How to Avoid Estate Taxes on Life Insurance Proceeds

Individuals or married couples who make gifts above the $14,000/$28,000 limits do have a reporting requirement, and must file IRS Form 709 on which they tell the IRS about the excess. This does not mean that either the donor or the donee needs to pay gift taxes on the amount over the annual exclusion limit. It simply means that anything above $14,000/$28,000 will count toward the donor’s lifetime gift exemption.

What is the Lifetime Exemption?

Essentially, every American is allowed to give away as much as $5.49 million of their estate (as of 2017), without it being subject to estate taxes. If you are to pass on an estate to your children that is worth more than $5.5 million, they will likely owe taxes on the excess.

So, where does the annual gift exclusion come into play? Well, if you were to give away bits and pieces of your estate on an annual basis, up to the exclusion limit, you would reduce the value of your estate while essentially giving your money away “early.” This means you can bypass some of these taxes and make the money available to others, like your children, right now… when they may need it most. If you give them more than the $14,000/$28,000 limit each year, though, the IRS will keep track of the surplus given, and it will count against your $5.49 million Lifetime Exemption.

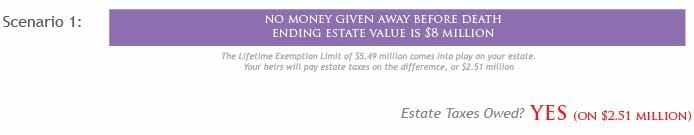

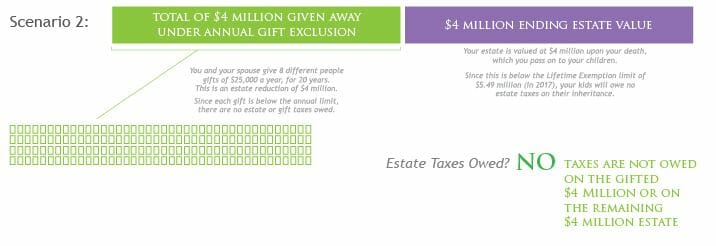

Here are some examples, assuming that you have an estate worth $8 million.

![]()

Scenario 1: You have an estate that is still worth $8 million when you die, so your heirs will pay estate taxes on approximately $2.51 million of that.

Scenario 2: You and your spouse have been effectively reducing your estate each year, giving each of your children and siblings a $25,000 check at Christmastime. Over the final two decades of your life, you manage to disburse a total of $4 million (8 people, each getting an annual $25,000 check over 20 years).

This means that estate has been reduced to roughly $4 million by the time you pass, which is below the Lifetime Exemption limit… therefore, your heirs will not be subject to estate taxes on the remainder. You’ve just saved your heirs a ton of money.

Scenario 3: You (not you and your spouse) have given each of your four children a $114,000 check every December. The first $14,000 of each check counts toward your annual gift exclusion. The remaining $100,000 of each, though, needs to be reported on the IRS Form 709 and will be tracked as part of your Lifetime Exemption.

Let’s say that you pass away ten years later; you will have given away $4.56 million, reducing your estate to $3.44 million. However, since you went over your annual exclusion each year, you have already used up a whopping $4 million of your Lifetime Exemption. This means that your children will now be subject to estate taxes on $1.95 million of the remainder ($5.49 million Lifetime Exemption – $4 million already gifted = $1.49 million left of your exemption…. $3.44 million estate – $1.49 million Lifetime Exemption left = $1.95 million overage for which taxes are due).

Other benefits of using the gift exclusion

Aside from reducing your taxable estate and saving your heirs money, the other advantage of using the annual gift exemption is sheer simplicity. Using this method you get the perks of:

- Not giving up control of a large portion of your assets.

- No administrative costs i.e. trust tax returns/legal set up costs.

- Only needing to file a gift tax report if making a gift in excess of the annual limit.

- Control over how much to gift each year.

- Control over who to gift to each year.

- No requirement to a make gift every year.

What are the potential issues with an annual gifting strategy?

One possible drawback is that the person you are making a gift to is incapable of managing their financial affairs. In this case, you may want to use a trust to protect them from themselves or creditors. Also, this strategy does not make sense for anyone with a child with special needs. Gifting them money outright may jeopardize their governmental benefits. In that case, the correct way to give to them would be via a special needs trust.

Making the Most of Your Money: Can You Get a Solid Financial Plan for $96?

Finally, a potential issue is if the donor couple has a shorter-than-expected life expectancy, which would diminish the amount given. However, the couple’s untimely death would be somewhat offset by decreased growth in their investments.

Related: Trust and Will Review – Affordable Online Estate Planning

The annual gift is a humble but effective solution to wealth transfer. For those of you with larger estates, it can still be an effective tool in your estate planning toolbox.

Article comments

You fail to mention that married couples can pass $5.49M each, so your example of $8M only applies to a single individual, not a married couple

A couple of additional points for readers is that if spouse joins in the gift it can be $26,000 per donee. Remember a gift tax return should and in the case of a spousal joinder must be filed.

Additionally, there is a little known unlimited gift tax exclusion for gifts for education or medical expenses if certain conditions are met, such as payment directly to the school or hospital.

This is a topic that most of us don’t like to think about often, but the info here shows that you must keep up with the changes. The drop that will occur in 2013 is quite substantial. Thanks for the reminder, I’m already contemplating some action on this.

If I remember correctly, the gift tax exclusion doesn’t only apply to your own children. So if you have grandchildren you could gift them money as well.

The annual exclusion of $13,000 applies to every man, woman and child on earth, whether or not they’re related to you. Also don’t forget that direct payments made for health and education are not taxable gifts either.

Be careful on gifts to grandchildren if they’re above the annual exclusion amount, the GST then comes into play.

This really has made sense and every country should follow it and make a law that could cross their limit and save from the tax through investments of gifts. Although, it also helps to the individuals to be save from the extra gifting which put him in trouble financially.

Excellent advice! This could be so helpful to young people in the family who have student debt.