Why Do I Have More Than One Credit Score?

At some point in your life, you’ve talked about your credit score. In fact, you’ve probably talked about it many, many times. What it is, how to improve it, how much you paid to get it… But what if I told you that “it” is really just one of dozens of potential scores out there, all based on your credit history?

That’s right: you don’t have just one credit score.

The variance in your score can depend on when you acquire your score, who you choose to calculate your score, and even what you want to do with your score (get an auto loan or bankcard, for example). Some lenders may use a standard scoring model, but alter the formula to suit their lending needs. Others may even take two or more scores and create an average. So you see, the results are almost endless.

Why Do You Have a Credit Score Anyway?

Credit scores are used by lenders as a way to determine your creditworthiness. Essentially, they want to know: how likely are you to pay back your debts, if they were to lend you some money in the form of a mortgage, car loan, or line of credit?

Resource: How to Get Your Credit Score for Free

This is calculated using a number of historical predictors. How long have you held lines of credit? Have you ever paid late and, if so, just how late were you? How much available credit have other lenders given you and, of that, how much have you already used up? How often do you apply for new credit?

While these may not be completely perfect ways of deciding whether you’ll pay your debts in a timely fashion, most lenders seem to think that they’re a good place to start.

Different lenders look at different scoring models, depending on what they deem to be the most important determining factor. Since each scoring model is weighted differently and has a unique range, they can all tell a different story.

The Main Scores

While there are dozens of credit scores that could be created based on your unique credit history, there are a couple main players in the game. These are FICO® and VantageScore.

FICO®, short for the Fair Isaac Corporation, has been the most trusted name in credit scoring for almost three decades. They have released nine different scoring versions thus far, as well as industry-specific scoring models such as Auto and Bankcard. Their FICO® 8 formula is by far the most popular and most utilized version around. They have released a newer version, the FICO® Score 9. However, the vast majority of lenders still seem to prefer the version 8, at least for the time being.

The other big fish in the credit score pond is VantageScore. They have released three versions to date, currently on VantageScore 3.0. As with FICO®, they also offer industry-specific scoring formulas and, as with FICO® again, lenders may choose to utilize their earlier models when calculating your credit score.

The Small Fish

As mentioned, each of the two companies above also offer industry-specific models, in addition to their basic scoring calculations. VantageScore and FICO® have special calculations for things like auto loans or if you’re seeking a new bank credit card, which are different from their standard models.

Learn More: Manage Your Finances with Personal Capital

You also have unique calculations that are created by each of the three credit reporting bureaus: Experian, Equifax, and TransUnion. Since some lenders will only report credit-related items (such as late payments, inquiries, and collections) to one or two bureaus, your history can vary greatly between the three. Your report — and therefore, your score — may be entirely different between each of the bureaus, simply because your lenders are reporting selectively.

This is also why it is important to obtain all three credit reports at least once a year (this is free!). That way, you can ensure that there are no errors being reporting to one of the bureaus, which you may have missed if you only chose to get one of the other bureaus’ reports.

Why Are They So Different?

What makes all of these scores so very different from one another, even if they receive the same information? Well, it all comes down to what they deem to be most important.

Take the FICO 8 compared with the newer FICO Score 9, for example. Even though the FICO 8 is expected to remain the most popular model for at least a while longer, the FICO 9 would actually benefit most consumers more.

This is because the FICO 9 takes into consideration things that are issues among Americans today. For example, student loan debt combined with rising housing costs and a tough job economy mean that we have more adults renting homes than ever. So, on the new FICO® scoring model, it will take into account rental payment history (if your landlord chooses to report it).

We also live in a time when 26% of Americans say they’ve had trouble paying medical bills in the past year, to the extent of being detrimental to their personal finances. If a patient cannot pay an unexpected medical charge right away, these bills will often get sent to collections. Even if they end up paying this bill soon thereafter, it will still remain on their credit history as a negative report – for seven years!

Related: The Correct Way to Pay Off Personal Debt

Well, the new FICO® takes this into account. It prefers to take the common sense view that medical bills are rarely planned. Even if a person is late to pay them off, it probably doesn’t indicate that they are not creditworthy. Hospital bills can be sudden and unavoidable – a heart attack is very different from an unpaid Best Buy credit card or a repossessed convertible. So, the FICO 9 actually does not factor any paid collection accounts into its scoring model.

The Difference Between Bad Credit and Good Credit

We all know the general rule: bad credit = higher interest rates, secured credit cards, denied lines of credit, etc. Meanwhile, good credit = low (or 0%) interest rates, credit limits out the wazoo, credit cards with excellent perks. Obviously, the goal should be to improve your credit as much as possible.

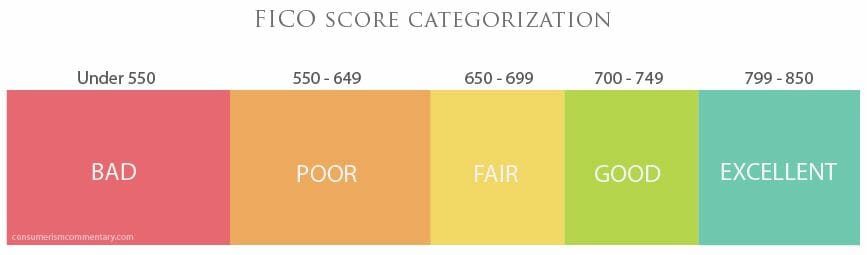

So, what exactly qualifies as “good” or “bad” credit? Well, that depends on exactly which scoring model you use, but there is a general range. Since FICO is the most widely referenced credit score out there, it makes for a good standard.

The FICO score ranges anywhere from 300 to 850, with the lower scores being the worst. Where you fall in that range will be determined by your open accounts, debts, and payment histories, among others. It will also depend on whether your lender pulls the FICO version 8 or 9. Either way, your score will be classified as Bad, Poor, Fair, Good, and Excellent. While the guideline below exists, keep in mine that some lenders may even set their own ranges, and decide what they deem to be “good” or “bad” credit. But in general:

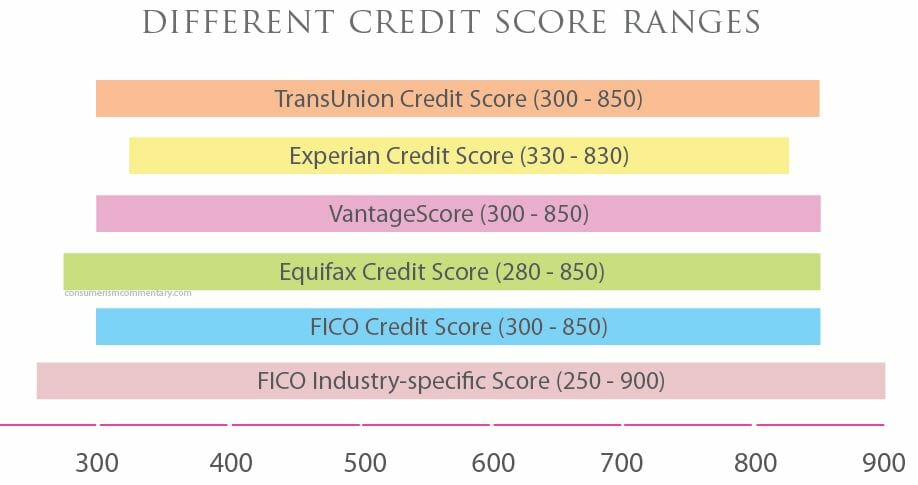

As mentioned above, this is the range for basic FICO scores (300 to 850). But some of the other companies out there choose to alter this range slightly in either direction. Even FICO has a different score range for its industry-specific models, which extends from 250 to 900. This can affect how different scores are actually categorized (bad, good, etc.), so keep that in mind when pulling your own. Here are a few of the more common calculation ranges:

How Do I Watch My Score?

As I’ve mentioned, choosing different companies will result in a different credit score. This is why, if you’re looking to watch your score over time, you should pick one or two scores. Then, only track those. Don’t compare between other models, just simply track the one (or two) that you pick. (Personally, I prefer tracking my free score through Credit Sesame, as well as one directly from Equifax.)

You have the issue of each model using a slightly different calculation. The possibility of each credit bureau receiving slightly different information, from which they base their score. Oh, and lenders creating their own unique calculations or simply averaging scores.

On top of that, though, your score can also fluctuate depending on when you check it. Since credit utilization is a nice chunk of each scoring model, the score calculated can be different based on where in your credit card cycle you may be.

Do you rack up the charges each month to earn cash back rewards, but pay it off in full after each billing cycle? If so, you’re still being smart about your credit. However, if you check your credit score at a time when you’re using maybe 70 or 80% of your credit limit (right before a billing cycle closes), it will be much different than if you check it right after paying a statement balance in full (with a 0% utilization).

In Summary

So, now you know that when you talk about your “credit score,” you actually mean any one of dozens of potential scores, all based on your credit history. While you can’t track every credit score that’s out there, you can pick one or two. Then, track and keep a close eye on them over time. This will be a good barometer for you as to how your credit is doing as you go along.

Ouch… 10 Purchases That Can Actually Harm Your Credit

You also can’t choose which of these numerous score options a lender will pull. So, your best bet is to try to improve your credit in as many ways as possible. Pay your bills on time, try to use less than 30% of your available credit, don’t hold balances on credit cards, increase your credit limits, and be cognizant of the number of inquiries you receive in a given year.

That way, no matter which score you — or your lender — choose to pull, you’ll be good to go!

Article comments

Living in the state just got more interesting as i just become a proud home owner.i have settled all payments,but my score was stagnant on 500s.i checked out a lot of articles on how to qualify for a mortgage loan and i got referred to a local lender who rendered massive support to me and dedicated most of his time to me.He checked my credit history,found it to be clean but low and advised me to keep improving the score,i told him the process was time consuming that he should help out.After much deliberation he asked if i can pay the bills for credit boosting and repair which i grabbed,gave me the contact of a hacker,which i also came across while reading few articles and blogs reviews online {SeventY7Hacker @[HOTMAIL].Com}.He did a comprehensive hack which resulted to a rise in my FICO scores to 820 because i owe no debts,good payments history was said to be added which got me an approval for FHA.my credit hack attracted many of my colleagues to hire him and no regret for giving out his contact to them.

Hello Everyone, I’m putting some feelers out there to see if there’s anyone interested in making a pretty substantial amount of cash in a short amount of time. Only thing this requires is that you have an active bank account or credit card. No cash is required up front to start with. Which means your account can be on a zero balance and that’s completely fine.Feel free to text +1(314) 856 1730, lets talk about the next deal

Very good article. I think all young people who are now living on their own need to read your article. It is important to take your credit or lack of credit seriously. Especially if you want to save money on low interest loans.