Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

If you want to manage your money from anywhere, looking for good mobile banking is your best bet. In fact, many banks provide access to a full range of services–right at your fingertips.

We will take a look at some of the best mobile banking options available to consumers and discuss what you can expect when you use these apps on your devices.

The Best Mobile Banking Apps

Mobile banking offers the opportunity for you to access important products and features no matter where you go. Some of these mobile banking options are available only through the app, while others are banking apps that complement online access.

Here are our favorites.

| Bank Name | Best Feature |

| Chime | Spot Me |

| Capital One | Zelle Payments |

| Discover | Credit Card Freeze |

| Ally | ATM Locator |

| Varo | No Fees |

| SoFi Bank | Rewards |

| Chase | QuickDeposit℠ |

| CIT Bank | Check Deposits |

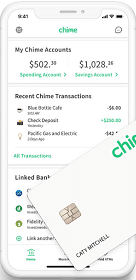

1. Chime

Chime is an award-winning financial app that allows you to manage your money on the go with an easy user interface and a clean design. Not only that, but Chime offers additional perks, including the ability to get your paycheck up to two days early when you have direct deposit.

With this mobile banking app, you can also automatically save every time you get paid. You can also see automatic savings when spending using your Chime Visa® Credit Card. Your purchases are rounded to the nearest dollar, and the difference is deposited into your savings.

Chime offers a variety of other products and features, including a Spot Me service that can cover you to ensure you’re not charged for an overdraft and the Chime Credit Builder Visa Card, which helps you build credit without having to make an initial security deposit.

- Google Play – 4.7 average score / 540k reviews

- Apple Store – 4.8 average score / 673k reviews

- Current Savings Account APY – 2.00%

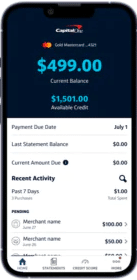

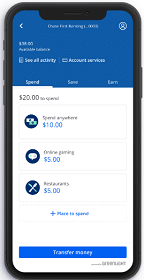

2. Cap One 360

The Cap One 360 mobile banking app is always rated highly on the JD Power annual rankings report. Part of the reason is due to the fact that this app is very easy to use. You can easily check your balances, use Zelle to make digital payments and transfer money, and manage other aspects of your finances.

Cap One 360 offers a full suite of financial products including a savings and checking account, plus a checking account designed specifically for teens. The app offers parental controls for this account so you are always aware of your child’s spending habits.

- Google Play Store – 4.6 average score / 1.49MM reviews

- Apple Store – 4.9 average score / 7.7MM reviews

- Current Savings Account APY – 4.25%

3. Discover

For a full-service bank experience from your phone, Discover is a good choice. Not only can you get information about your Discover savings account, but you can also see any credit card accounts and other accounts. Plus, you can use the app to transfer money between Discover accounts as well as external accounts.

Perhaps the greatest feature the Discover mobile app offers is the ability to freeze your credit card accounts with the click of a button. Anytime you’re worried about your account or left your credit card somewhere, you can quickly ensure the card is temporarily deactivated until you’re able to locate it.

Discover also offers a competitive APY on its savings product and has a full suite of CDs including IRA CDs.

- Google Play Store – 4.6 average score / 285k reviews

- Apple Store – 4.9 average score / 4.2MM reviews

- Current Savings Account APY – 4.25%

Read our Discover® Bank Review

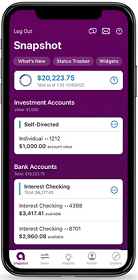

4. Ally

Because Ally has no physical locations, it has made it a point to develop its mobile banking app to the point where it is very easy to manage your money. You can use the app to find access to cash-back locations and receive ATM fee reimbursement as needed. I have a savings account through Ally and I check the app at least a few times each week.

Ally is also good for transferring money between Ally and non-Ally accounts using Zelle. This can help you get your money in a more convenient place and there is no fee whenever you’re transferring internally or externally.

- Google Play Store – 3.5 average score / 26k reviews

- Apple Store – 4.7 average score / 66k reviews

- Current Savings Account APY – 4.20%

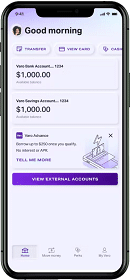

5. Varo

Varo allows you to do a little bit of everything. Whether you need to save, spend, build credit, or borrow, the Varo mobile app allows you to keep a close eye on your accounts with real-time transaction alerts and balance updates. Real-time customer support is available via chat and you can set up a call quickly if you need a live agent over the phone.

Like a few of the best mobile banking apps on our list, Zelle is the preferred transfer method of choice for Varo. When opening a Varo savings account, there are no monthly fees, overdraft fees, or as they call them, WTF fees.

- Google Play Store – 4.7 average score / 197k reviews

- Apple Store – 4.9 average score / 166k reviews

- Current Savings Account APY – 5.00%

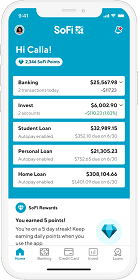

6. Sofi Bank

The SoFi Bank mobile app is an all-in-one place to keep track of all your SoFi financial accounts. From student loans to credit cards to savings accounts, SoFi Bank has created one of the most diverse online banks today.

When using the mobile app, SoFi bank will give you reward points (blue diamonds) for good behavior. Paying your loans on time, getting your credit card balance to zero, and adding more to your savings account all qualify for reward points. Those points can be redeemed for cash, fraction shares of stocks, and added payment toward your student loans.

- Google Play Store – 4.1 average score / 30k reviews

- Apple Store – 4.8 average score / 280k reviews

- Current Savings Account APY – 4.60%

7. Chase

The largest bank in the United States (and 5th largest bank in the world), Chase offers an excellent all-around mobile app that lets you transfer money using Zelle, break up your card purchases into budget-friendly payments, and set up automated savings goals that will pull money from one account and deposit it into your Chase account.

The coolest feature the Chase mobile app offers is QuickDeposit℠. When you have checks that need to be deposited, you can take a picture, submit the check, and have access to your funds quickly. You can deposit from any location at any time of day, making it extremely convenient.

- Google Play Store – 4.4 average score / 1.79MM reviews

- Apple Store – 4.8 average score / 5.1MM reviews

- Current Savings Account APY – 0.01%

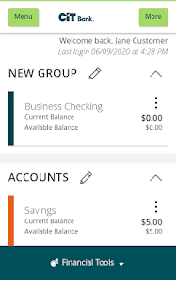

8. CIT Bank

CIT Bank became a division of First Citizens Bank in 2022 and it offers high interest rates on a variety of savings, checking, and CD accounts. The CIT Bank mobile app can help you find ATMs, open up new CIT accounts, track your spending, and provide a quick line to customer support if needed.

The app also allows you to check your balances and history, as well as transfer money between CIT accounts. You can even use the app to deposit checks to your Money Market and Savings accounts.

- Google Play Store – 2.7 average score / 3k reviews

- Apple Store – 4.6 average score / 11k reviews

- Current Savings Account APY – (Platinum Savings) – 5.05%

What is Mobile Banking?

Essentially, mobile banking is done from a mobile device. Rather than logging onto a desktop computer or going to a physical location, you manage your money from the palm of your hand.

With mobile banking, it’s fairly easy to manage your account and the best mobile banking apps make it easy to access everything you need. When used on a new iOS device, once you get your app set up by logging in initially, facial recognition grants you instant access. On other devices, you might be able to access the app with your thumb or fingerprint, or even just touch the app when logged into your mobile device.

The convenience of mobile banking, for the most part, means that you don’t have to regularly enter your username and password when you want to access your accounts and manage your money. There are some cases where an app might not be available, but you can still use your phone’s browser to access your account on a highly optimized version of the website. In this case, you might need to save your login info on your phone’s browser if you don’t want to be stuck entering it each time.

Related: Best Online Banks

How Mobile Banking Works

Because you don’t generally visit a bank when you rely on mobile banking, there are some things to be aware of.

Deposits

If you have Direct Deposit for your paycheck, there isn’t a lot you need to do. The money still goes to your bank, and you can use your mobile banking app to verify that you’ve received the money. Without Direct Deposit, you have other options for depositing your money:

- Mobile check deposit: The best mobile banking apps allow you to snap a picture of a check and use that to make a deposit in your account.

- Electronic transfer: Connect other bank accounts with your mobile banking account to be able to move money back and forth. You can also receive P2P payments from others using apps like Venmo and Zelle and connect those to your bank account so you can move your money.

- Physical deposit: If your mobile banking is an app from a bank with a local branch, you can bring your cash or check into the branch.

- U.S. Mail: Send your deposit by mail. You won’t see the money for several days if you choose this method, and it’s best not to send cash through the mail.

Withdrawals

Getting money when using mobile banking usually isn’t too difficult. Most banks issue debit cards. In fact, even banks like Chime and Ally that don’t have physical locations send debit cards that you can use to get cash back at stores or make withdrawals from ATMs.

You can also see if your account allows you to write checks. Finally, if you need to send money elsewhere, to pay bills, or to send money to another person, it’s possible to use your app’s bill pay function or connect your account to a payment app like Venmo.

Our Methodology for Choosing the Best Mobile Banking Apps

As we put this list together, we did our best to review more than 40 bank apps that had at least 10k downloads. The criteria for which we finally boiled our list down to is the following:

- Product Features – First and foremost, we wanted apps that had the best features and user experience. Does the app crash often? Can I do everything I need to in order to manage my account through the app? These were the important questions first asked and any mobile banking app that wasn’t 100% reliable didn’t make the list.

- User Reviews – Millions of downloads and millions of reviews allowed us to see what others believe are the best mobile banking apps. Only one of the banks on our list didn’t average at least a 4.5/5 star rating and unsurprisingly, Google reviewers were more likely to leave negative feedback.

- Costs + Integration – Some mobile banking apps charge a fee for certain services and others wouldn’t allow us to connect accounts or have a single dashboard for all products from the same bank. All of the mobile banking apps chosen above are fee-free and you can see all of your accounts from the app.

- Personal Review – All of the above apps (along with a few dozen other bank apps) have been personally used by our team.

Is Mobile Banking Safe?

In general, mobile banking is safe. Most developers use a high level of security when developing these apps, so your information is protected. Additionally, depending on how the app is set up, you might need facial recognition, a PIN, or a fingerprint to access the app and make any changes. So, if your phone falls into the wrong hands, someone is still unlikely to be able to access your apps and make changes.

Related: What Happens if Your Bank App is Hacked

Bottom Line

Mobile banking is a convenient way to manage your money from just about anywhere. All you have to do is download your bank’s mobile app, set it up for access, and then use it. If you’re looking for an easy way to take care of almost every aspect of money management, it’s possible from the palm of your hand.