How to Afford Healthcare in Retirement

Retirement is a huge financial undertaking. It requires plenty of planning to ensure that all of your needs will be met once your career, and working income, ends. Your accounts need to cover your costs of living, some fun money to actually enjoy your years, and expenses such as healthcare. Of course, the latter becomes even more important as we age, but many seem to overlook the magnitude of this expense in their planning.

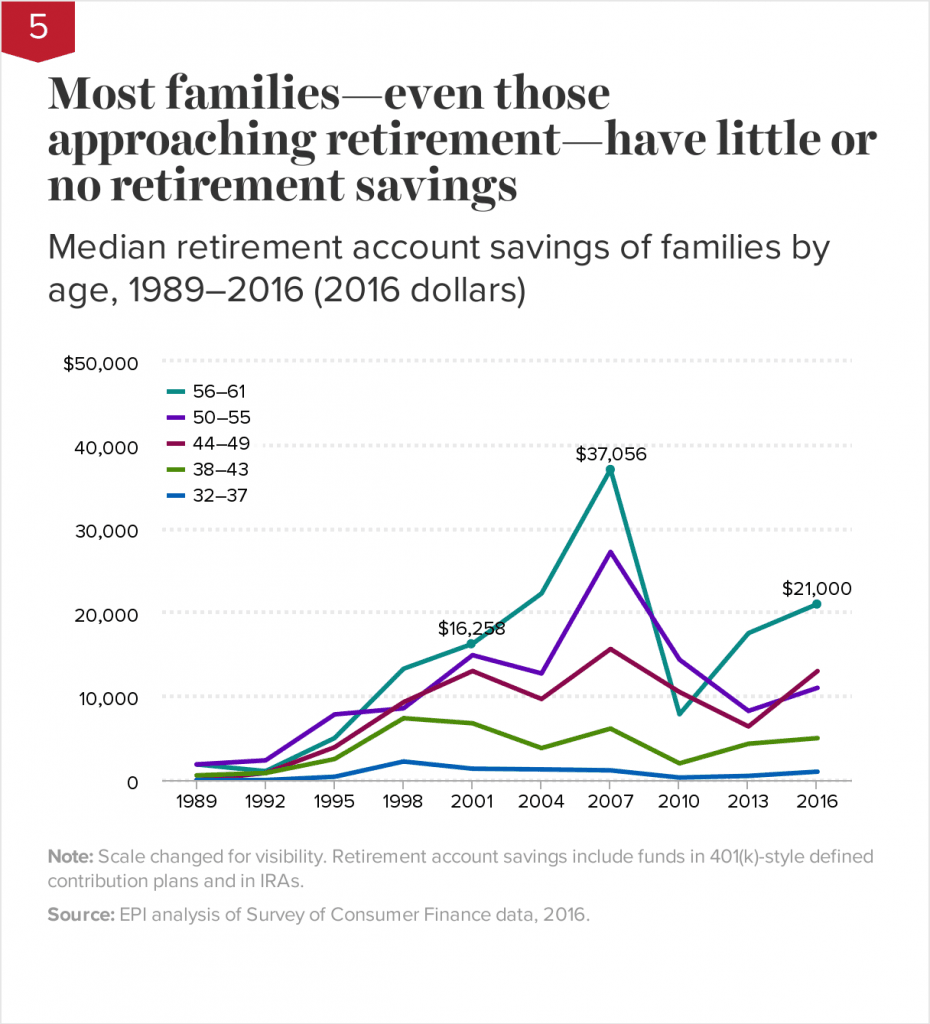

Baby boomers have tucked away only about $150,000 for retirement. What’s even more concerning is that almost half of all households have no retirement savings at all. Another study found that those nearing retirement had a median savings of just $21,000.

Those with retirement savings tend to also have other resources to depend on, such as non-retirement investment accounts. On the other hand, those without retirement savings tend to have less of those resources, too.

What does this mean for costs associated with retirement? It means that many Americans will struggle to afford to retire at the standard age of 65. And those who do will have trouble meeting their monthly expenses, including healthcare.

In fact, in one survey, 38% of boomers cited healthcare costs as their top fear about retirement. Another survey found that more than half of people will postpone or work during retirement because of a lack of medical coverage and that only 39% of people are confident in their ability to pay for medical expenses during retirement. Even though many are aware that healthcare costs will be substantial when they retire, they don’t understand the actual costs. And without knowing the cost, you can’t plan properly.

How Much Does Healthcare Cost in Retirement?

According to a study by HealthView Services a couple, both aged 65 and in good health, can expect to spend about $387,000 on healthcare during their retirement. Of course, the breakdown of those costs increases as you age, so at 65, that couple may be paying a little over $12,000 a year but by 85 are paying almost $35,000 a year.

But doesn’t the government provide health coverage to those over 65 for free through Medicare? Not quite. While the government provides some insurance for free, that’s a bit of a misnomer. Free here refers to monthly premiums, not the actual amount you’ll need to pay out of pocket (for more on government healthcare programs, I go over that in detail in the next section).

Why is coverage so expensive? If you want comprehensive medical insurance, you’re talking about getting supplemental insurance. Then when you factor in copays, out-of-pocket costs, and dental and vision care, you’ll easily see how the numbers add up quickly.

What’s more, HealthView Services found that healthy retirees end up having higher costs in total than unhealthy retirees. How is that possible? Because healthy retirees live longer and even though they may pay less each year, it adds up (just how saving a little bit each month for your retirement account ends up with a bigger balance than saving a ton each month for a short time).

How to Understand Your Healthcare Options and Costs in Retirement

So you know healthcare costs are going to be high – but where is all that money going? Isn’t insurance supposed to make things more affordable?

Once you hit 65, you are generally eligible for Medicare, the government insurance plan for older Americans. Make sure you have a plan to sign up right away–the sign-up period is limited–you have three months before your birth month, the month of your birthday, and three months after. If you miss that window, you’ll have to wait until the next sign up period, typically January – March, and pay a late enrollment fee or higher premiums. You can find out if you are eligible or what your premium would be here.

If you got your health insurance through your employer, you probably had only a few options: a high deductible and low deductible plan. Once you hit retirement age, health insurance looks different. There are four main types of Medicare:

- Medicare Part A – Hospital Coverage. Free for most Americans who paid payroll taxes (free as in monthly premiums, not what you end up paying for using the insurance). This is often referred to as “hospital insurance” because its main purpose is to cover you if you end up in the hospital. If you qualify for Social Security, you’ll also qualify for this. If you end up in the hospital, Medicare Part A covers some, but not all of the costs. You’ll still pay your deductible–in 2020, the deductible is $1,408.

- Medicare Part B – Doctor and Outpatient Services. Unlike Part A, this is referred to as “medical insurance” and is probably looks more like the insurance you have now. Part B covers some preventative care, some medically necessary services (though you may have to pay coinsurance), and lab services. There is a monthly fee–in 2020 it is $144.60 but may be higher if your income exceeds $87,000.

- Medicare Part C – Medicare Advantage Plans. This is private health insurance that contracts with Medicare to provide Part A and B benefits. Some include prescription drug coverage, but not all. Additionally, these plans may cover vision, hearing, and dental care, which is not covered in Part A and B. Medicare Advantage comes in four forms: a Health Maintenance Organization (HMO) Plan, a Preferred Provider Organization (PPO) Plan, a Private Fee-for-Service (PFFS) Plan, and a Special Needs Plan (SPN). The cost of these plans varies by provider.

- Medicare Part D – Prescription Drugs. This is an add-on to Part A and B for prescription drug coverage and is bought through a private insurance company. The cost of these plans varies.

| Type of Medicare | Also Known As | What it Does | How Much it Costs |

|---|---|---|---|

| Medicare Part A | Hospital Coverage | This is often referred to as “hospital insurance” because it’s main purpose is to cover you if you end up in the hospital. If you qualify for Social Security, you’ll also qualify for this. | Free for most Americans who paid payroll taxes (free as in monthly premiums, not what you end up paying for using the insurance). If you end up in the hospital, Medicare Part A covers some, but not all of the costs. You’ll still pay your deductible - in 2020, the deductible was $1,408. |

| Medicare Part B | Medical Insurance | Doctor and Outpatient Services. Unlike Part A, this is referred to as “medical insurance” and is probably looks more like the insurance you have now. Part B covers some preventative care, some medically necessary services (though you may have to pay coinsurance), and lab services. | There is a monthly fee – in 2020 it was $144.60 but may be higher if your income exceeds $87,000. |

| Medicare Part C | Medicare Advantage Plans | This is private health insurance that contracts with Medicare to provide Part A and B benefits. Some include prescription drug coverage, but not all. Additionally, these plans may cover vision, hearing, and dental care, which is not covered in Part A and B. Medicare Advantage comes in four forms: a Health Maintenance Organization (HMO) Plan, a Preferred Provider Organization (PPO) Plan, a Private Fee-for-Service (PFFS) Plan, and a Special Needs Plan (SPN). | The cost of these plans varies by provider. |

| Medicare Part D | Prescription Drug Plans | This is an add-on to Part A and B for prescription drug coverage and is bought through a private insurance company. | The cost of these plans varies. |

If this all seems confusing, that’s because it is. You can spend hours trying to understand all the different aspects of Medicare and still make mistakes.

If you want help figuring out what plans are best, Assurance is a service I like because it can provide me the most relevant quotes, tailored to my specific needs, by a sophisticated algorithm. Like other health insurance marketplaces, it helps cut down on the time you’d have to spend contacting all the options available and can help you save money.

Another option is to use a health insurance marketplace like Policygenius, which provides many types of insurance.

Now that you know about the different types of Medicare and have a general sense of what they include and which ones require monthly premiums, there are ways to plan for these expenses. The main thing you can do is start saving early.

How to Plan for Healthcare Costs in Retirement

Your first plan of attack should be your employer’s retirement account – if one is offered. According to the American Benefits Council, nearly 80% of full-time workers have access to an employer-sponsored defined benefit account, such as a 401(k)/403(b). So if you’re one of many offered this benefit, make sure you take advantage.

Saving even just a small percentage of your salary will make a big difference if you start early. You can begin by saving a mere 3% of your salary, then gradually increase your contributions until you reach 10%. This is generally considered the target amount to save.

This is just a recommendation though. If you can contribute even more, by all means do so.

If you max out your 401(k)/403(b) by contributing $19,500 in 2020 ($26,000, if over the age of 50), investing in an individual retirement account (IRA) is a great next step. Although the annual contribution limit for IRA’s and Roth IRA’s is much lower than that of 401(k)s/403(b)s, the extra savings will help you cover the cost of your future healthcare.

Lastly, saving money in a Health Savings Account (HSA) is a great way to plan for covering medical expenses in retirement. If you are currently enrolled in a high-deductible health insurance plan, you are eligible to contribute to an HSA.

HSAs offer a triple tax benefit. First, HSA contributions are tax-deductible. Second, the interest earned on money in an HSA is tax-free. Third, you can withdraw money from your HSA for qualified medical expenses tax-free, as well.

HSAs can be considered retirement funds because there is no carry-over limit, unlike Flexible Spending Accounts. So, the money you contribute today can be used for healthcare costs in retirement years later.

How to Offset Healthcare Costs Once in Retirement

In today’s economic environment, retirement doesn’t necessarily mean relaxing on sandy beaches. The unfortunate reality is that many people must continue to work in order to supplement Social Security and their minimal retirement savings. In fact, one in four adults over 65 are still working–although some do it because they want to, not because they financially need to.

Working a part-time job during the early years of retirement can greatly offset the cost of healthcare. In fact, you could even save some of your earnings from your part-time job and put it into a retirement savings account to use in future years.

Here are a few ideas of part-time jobs you can take up that won’t be taxing on your health:

- Consultant: Transfer all the skills you accumulated from your day job over the years and use that expertise to help other companies accomplish their goals.

- Freelancer: Use your talents to do one-off assignments for businesses. This could include graphic design, writing, proofreading, and much more.

- Blogging: It can take a while to make money from a blog. But once you get the ball rolling, this gig can bring in a lot of income.

Other Things to Consider

Aside from Medicare, Social Security, and retirement savings, there may be other ways to cover the cost of healthcare in retirement.

If you’ve just lost your health benefits, you might be eligible for COBRA. Under the Consolidated Omnibus Budget Reconciliation Act, federal law requires that companies with more than 20 employees give them the option to continue receiving coverage under the employer’s health plan for at least 18 months.

With COBRA, however, you’ll be responsible for the entire cost of the health plan–up to 102% of the premiums. While working, your employer likely paid for a large percentage of the premium. This expense will be wholly your responsibility with COBRA.

And note that this is a short-term option. Still, you may want to consider continuing your employer’s health plan before enrolling in Medicare. Your employer’s health plan will likely cover more medical expenses.

On that note, if you want a more comprehensive health insurance plan after your COBRA benefits end, you can consider enrolling in a Marketplace health insurance plan. If you don’t enroll in Medicare, you may qualify for lower out-of-pocket costs and premium tax credits. You could also use the two in combination, but you won’t receive the same tax credits for the Marketplace health insurance plan.

Another thing to consider is that we didn’t even get to long-term care, which most American’s will need. The costs for a nursing home average $100,000 a year – money most Americans have not saved for. Consider looking into long-term care insurance as well.

Wrapping Up

There is a lot to consider on the topic of healthcare costs in retirement. If you’re young, the lesson here is to start saving early, because the cost of health insurance and medical care is only increasing. If you’re approaching retirement age, you may want to consider working part-time during your early retirement years, in order to offset the costs of healthcare. And if you’re already retired, it wouldn’t hurt to tuck away any extra money each month, in case unexpected health concerns pop up.

How are you planning to cover your healthcare expenses in retirement? Is it a big concern to you yet?

Article comments

Isn’t it expected that one would enroll in Medicare once eligible and if one enrolls in MC, is a Marketplace Health Insurance plan still an option or is it similar to the Affordable Care Act which is not available to MC enrollees