E*Trade Review and Current Promotions

E*TRADE set the bar as one of the first online discount brokers. But is it the broker you should be using? We help you answer that question in our E*TRADE review.

It’s curious that the editorial team here at Consumerism Commentary has never reviewed E*TRADE before today. I say that because we have written about how to close an E*TRADE account. E*TRADE is also one of the largest and most innovative investment brokerage firms available, making this review long overdue.

- About E*TRADE

- E*TRADE Review Summary

- E*TRADE Features and Benefits

- E*TRADE Managed Accounts and E*TRADE Adaptive Portfolios

- E*TRADE Bank

- E*TRADE Pricing

- E*TRADE Current Promotions

- How to Open an Account with E*TRADE

- E*TRADE Pros

- E*TRADE Cons

- Should You Sign Up With E*TRADE?

- How to Manage Your E*TRADE Investments

About E*TRADE

Founded in 1982, it was one of the first companies to offer online trading. It’s one of the very best investing platforms for active traders, but it also offers managed investment options for investors who don’t want to manage their own portfolios.

E*TRADE has more than 3.5 million individual brokerage accounts, and more than $49 billion under management. In August 2017, E*TRADE acquired OptionsHouse, which is one of the top options investment platforms available. This makes the E*TRADE platform even more beneficial for active traders.

E*TRADE Review Summary

After reviewing dozens of investment platforms over the years, E*TRADE comes up as one of the better ones. What I like about E*TRADE is that many brokerage firms specialize in self-directed investing, others in managed portfolios and robo-advisors. E*TRADE offers both.

And the My Virtual Advisor tool can provide you with a portfolio allocation for your self-directed investing, using the same methodology as robo-advisors.

Where I find that E*TRADE falls a little short is that it has a definite orientation toward the high-volume trader. For example, E*TRADE Pro is one of the most intuitive trading software programs around and would be particularly beneficial for new and small investors. But it’s only available for active traders.

The same is true of their reduced pricing, at $4.95 per trade. It’s also available only to very active traders. By contrast, Ally Invest also offers discounted commissions for high-frequency traders, but $4.95 per trade is standard for all investors.

Compare: See how E*TRADE stacks up to other online brokers

E*TRADE Features and Benefits

Available Accounts. E*TRADE offers individual and joint taxable brokerage accounts, trusts, estates, conservatorships, custodial accounts and Coverdell education savings accounts. They also offer a futures trading account, as well as a Forex trading account. Accounts can also be opened under business corporate LLC accounts.

Retirement accounts include traditional, Roth and rollover IRAs, beneficiary IRAs, IRAs for minors, and SEP and SIMPLE IRAs. They also offer small business retirement accounts and 401(k) rollover accounts

Investments Offered

E*TRADE is available to invest in stocks, bonds, mutual funds, exchange traded funds (ETFs), target date funds, options and futures, and fixed income securities. The firm offers more than 9,000 mutual funds, including 4,400 no-load funds with no transaction fees.

Minimum Initial Investment

You need a minimum initial deposit of $500 to open up a trading account. However, there are no minimums required for either retirement accounts or custodial accounts.

Calculators and Tools

E*TRADE has one of the most extensive trading platforms in the industry. Some of what they offer includes:

- E*TRADE 360–This is the firm’s do everything platform for traders and investors. It offers streaming real-time quotes, customizable planning tools, and access to free independent research. That includes research from TipRanks, Credit Suisse, Thompson Reuters, and more.

- E*TRADE Pro–This is E*TRADE’s main platform for active traders. It includes enhanced speed, insight and performance, including its Enhanced Options Analyzer to evaluate positions and strategies. Use a point-and-click order entry system, which enables you to trade more quickly and easily. You can use it to trade stocks and ETF’s, in addition to options.

- Stock and Fund Screeners–Use this tool to cull thousands of funds and stocks to find the investments that you’re looking for. There are individual screeners for stocks, mutual funds, ETF’s bonds, and bond funds.

- My Virtual Advisor–This is a tool that will recommend an asset allocation for you. It will evaluate your risk tolerance, financial goals and investment time horizon, and then make recommendations in a matter of minutes.

E*TRADE also offers the E*TRADE Community, which is a social media outlet where you can swap investment strategies, and discuss specific investments. It includes discussion boards for personal exchanges, and even gives you the ability to monitor community sentiment.

OptionsHouse Platform Access

This past summer E*TRADE and OptionsHouse began enabling investors to access their OptionsHouse trading platform from their E*TRADE accounts. This is a significant upgrade, since OptionsHouse offers one of the most advanced options trading platforms in the industry. The OptionsHouse platform provides Integrated Trading, Advanced Charting, Trading Ladders and Options Chains.

Mobile App

The E*TRADE mobile app provides the same information and tools that are available on the web app. That includes accessing the personalized retirement center. The app is available on iPhone, Android, tablets and Apple Watch, and can be downloaded at Google App and the App Store.

Local Branches

The company has 30 branch offices available in and around major cities.

Customer Service

Available 24 hours a day, seven days per week, by phone, email and online live chat. E*TRADE has investment advisors available at all times to help you with your investment decisions.

Account Protection

E*TRADE provides SIPC insurance on all accounts, with coverage up to $500,000, including up to $250,000 in cash. There is additional coverage through a London insurer for up to $150 million. Both types of coverage protect against broker failure, and not against losses due to market factors.

E*TRADE Managed Accounts and E*TRADE Adaptive Portfolios

If you’re not comfortable with self-directed investing, E*TRADE offers several options to have your account managed for you.

First is the Unified Managed Account. This is an actively managed portfolio, that invests in stocks, mutual funds and ETF’s. It’s for larger investors, requiring a minimum investment of $150,000. The annual fee for the service is not more than 1.25% of the value of your portfolio.

E*TRADE also offers E*TRADE Capital Management, to actively manage your portfolio. This is similar to investment management services provided by other traditional investment managers. For that reason, and because your account will be actively managed, the fees for the service range between 0.65% and 0.90%, depending on size of your portfolio. The minimum investment for the service is $25,000.

Finally there’s E*TRADE Adaptive Portfolios. This is E*TRADE’s robo-advisor service. It provides a fully automated investment account for the person who wants hands-off investment management. The account is managed through E*TRADE Capital Management, who both creates and manages your portfolio, including periodic rebalancing.

Adaptive Portfolios actually involves two distinct portfolios. The first is comprised entirely of ETF’s. This makes it a completely passive portfolio, since the funds represent markets and market segments. The second is a hybrid portfolio, that includes both ETFs and mutual funds. The mutual funds add an actively managed component to the portfolio, in an attempt to provide higher returns than index funds alone.

E*TRADE Adaptive Portfolios requires a minimum initial investment of $5,000, and an annual management fee of 0.30%. It’s available for taxable individual and joint brokerage accounts, all types of IRAs, custodial accounts, and even traditional and Roth 401(k)’s.

E*TRADE Bank

E*TRADE’s bank was created specifically for its investment customers. It offers free checking with no minimum balance requirement, although there is an initial deposit requirement of $100.

The bank also offers an interest-bearing checking account, but requires a minimum monthly balance average of at least $5,000, otherwise there is a $15 per month service charge.

With either account, you also get a free Visa debit card, as well as unlimited checking. Your account can be accessed online or by mobile app. Transfers between accounts, including your brokerage account, are free. In addition, E*TRADE Bank offers unlimited ATM fee reimbursements.

The bank also offers mortgages. In addition, all accounts are protected by FDIC insurance, for up to $250,000 per depositor.

E*TRADE Pricing

E*TRADE offers the following pricing:

- Stocks, options and ETF’s–$6.95 per trade; $4.95 per trade with 30 or more trades per quarter. E*TRADE also offers a number of commission-free ETF’s

- Options–$0.75 per contract; $0.50 per contract with 30 or more trades per quarter

- Futures–$1.50 per contract

- Bonds–$1 per bond, subject to a $10 minimum and a $250 maximum

- US Treasury securities–no fee

- Mutual funds–$19.99 per trade, but more than 4,400 no-load, no transaction fee funds

- Broker -assisted trades–$25 per trade

There are no annual or monthly account fees for regular brokerage accounts.

E*TRADE Current Promotions

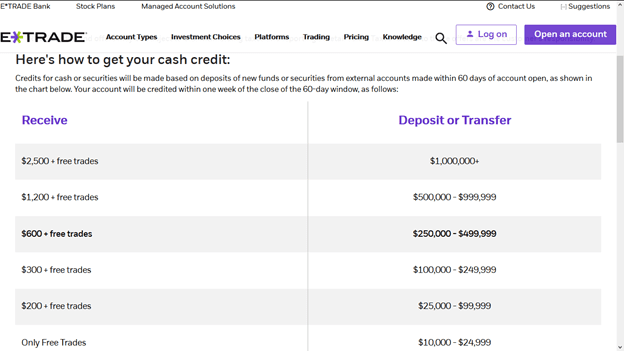

E*TRADE is currently offering a cash credit starting at $200, and going as high as $2,500. The promotion works on a sliding scale, so the largest credits will go to the largest deposits or transfers. The scale looks like this:

You can get up to 500 free trade commissions for each stock or option trade completed within the first 60 days of the deposited funds being made available for investment in your new account. You will pay the trading fees as normally required, but the account will be credited within one week. Also, the transferred or deposited funds must come from a third-party source (bank, brokerage etc.), and not from another E*TRADE account.

SPECIAL OFFER–E*TRADE is currently offering a $600 bonus if you open up a new trading account with at least $10,000. This is specifically for non-retirement accounts, and the account must be opened no later than December 31, 2017.

How to Open an Account with E*TRADE

The entire sign-up process with E*TRADE takes place online. The application asks for general information, such as your name, address, occupation and income. You must have a valid Social Security number. You will also be requested to provide financial information, including liquid assets available, your net worth, and how much you expect to contribute to your account.

Once all of the general information has been entered, you will be asked to select the type of account that you want to open. That will also bring up a series of investment-related questions. E*TRADE tries to determine your level of experience, particularly in regard to more sophisticated trading, such as options and futures.

You will be asked specific questions, such as what types of investments you have previously held, and how much experience you have in managing them.

Once you have completed the application, you will create an account ID, and fund your account.

E*TRADE Pros

- Excellent fee structure for active traders–$4.95 per trade is at the lower end of the industry fee structure.

- 24/7 customer service, plus 30 local branches. Most investment brokerage firms only offer regular business hours, or extended trading hours. And few have any brick-and-mortar branches at all.

- Top-of-the-line investment platform, that offers the kinds of tools needed by both novices and experienced investors.

- 4,400 no-load, no transaction fee mutual funds.

- The ability to maintain both a self-directed account for trading purposes, as well as managed options for those who lack the ability or desire to manage their own accounts.

- The sign-up bonus ranging from $200 to $2,500–plus up to 500 free trades–is one of the most generous promotions in the industry.

E*TRADE Cons

- The management fee of 0.30% on E*TRADE Adaptive Portfolios is at the middle range for robo-advisors, but higher than the 0.25% charged by popular robo-advisors like Betterment and Wealthfront.

- Trading fees are only at the middle of the investment brokerage range if you are not an active trader.

Should You Sign Up With E*TRADE?

Due to the reduced trading commissions, E*TRADE will work best for very active traders (30 or more trades per quarter). The availability of investment options and platform tools is one of the very best in the industry. The E*TRADE Community also gives investors an opportunity to interact directly with other investors. This is a major benefit for both new investors and highly experienced ones.

But one of the biggest advantages with E*TRADE is the fact that it offers both a robust self-directed investment platform, as well as managed investment programs. This gives the user the ability to allocate his or her portfolio between self-directed and managed portions. An investor can decide to have some of their portfolio professionally managed, while keeping a portion for do-it-yourself investing.

Whatever type or level of investor you are, E*TRADE is an excellent choice. If you’re a new investor, you can start out using a managed option. But as your experience and your portfolio grow, you can seamlessly transition over to self-directed investing.

If you’d like more information, or if you’d like to sign up with the service, visit the E*TRADE website.

How to Manage Your E*TRADE Investments

Track and Analyze your Investments for Free: The easiest way to track and analyze all your investments, regardless of where they are located, is with Empower’s free financial dashboard. By far the best financial tool we’ve ever used, Empower enables you to connect all of your 401(k), 403(b), IRAs, and other investment accounts in one place. Once connected, you can see the performance of all of your investments and evaluate your asset allocation.

You can also see the fees you are paying through Empower’s Retirement Fee Analyzer. I was stunned to learn that the fees in just my 401(k) could cost me over $200,000, requiring me to put off retirement for three years! They also offer a free Retirement Planner. This robust tool will help you plan for retirement and show you if you are on track to retire on your terms.

(Personal Capital is now Empower)

Article comments