Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

With all of the data breaches in recent years, it’s no surprise that many people are looking for ways to monitor their credit. Not only do you want to watch your credit for identity theft, but it’s also important to make sure your credit is in good shape so you can take advantage of the financial opportunities that come your way.

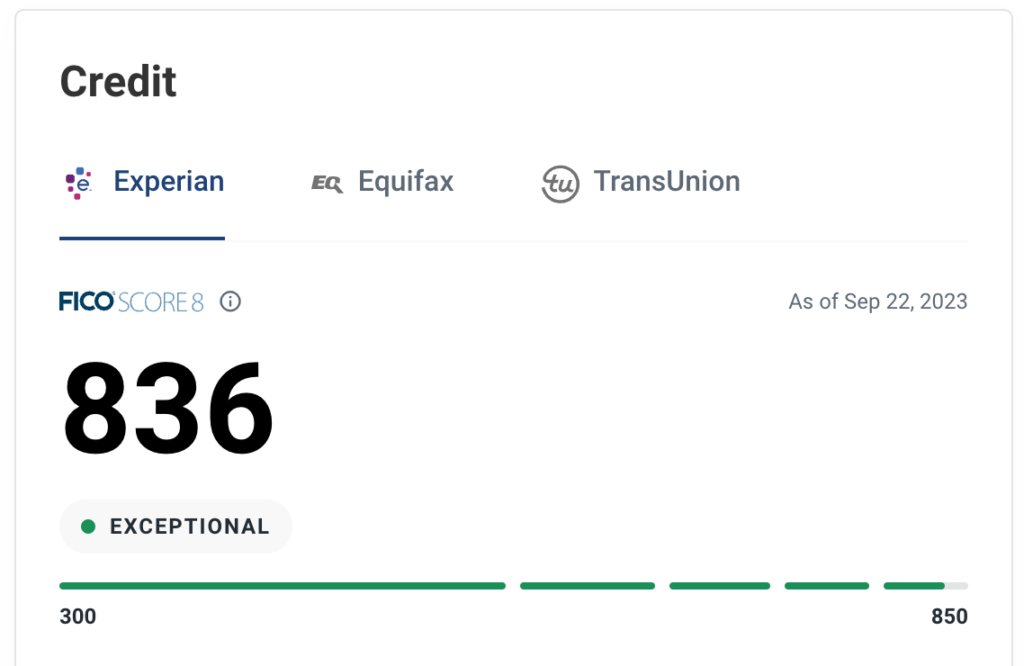

Experian offers credit services that can help you keep an eye on your credit progress and alert you when your information might be compromised. I’ve used Experian for several years now, and this review is based in part on that experience.

What is Experian?

Experian is one of the three major credit reporting agencies. As a credit bureau, Experian collects data about your credit habits and compiles that information into a credit report. In addition to maintaining a record of your credit history, Experian also has a scoring model for producing a credit score. Experian can produce scores based on the FICO model, which is the most popular.

Related: How to Get Your Credit Score for Free

Experian Product Features

Experian offers three main products, each with its own features. Additionally, you can also sign up for the IdentityWorks product. Here’s what you can expect.

Experian CreditWorks Premium

- Monthly access to credit reports from Equifax and TransUnion in addition to your Experian credit report

- FICO Score monitoring across all three credit bureaus

- CreditLock allows you to control access to your credit report

- Interactive dashboard designed to help you track your credit score

- $1 million in ID theft insurance

- Ongoing access with a monthly fee

3-Bureau Credit Report and FICO Score

- Look at your credit reports from all three bureaus

- Compare your FICO Scores across the bureaus

- Overview of how your credit report is affecting your credit scores

- Live help for questions and preparing disputes

- One-time access and one-time fee

Experian Credit Report and FICO Score

- See your Experian credit report

- Find out who else has been looking at your credit report

- Overview of your FICO Score, along with the factors influencing it

- Ability to dispute inaccuracies online for free

- One-time access and one-time fee

IdentityWorks

- Access to CreditLock, which allows you to lock and unlock your credit report, controlling when others can view it

- Identity theft monitoring and alerts

- Dark web surveillance

- Fraud resolution

- Up to $1 million in ID theft insurance

- Ongoing with a monthly fee

Experian has products available for just about any need–at least when it comes to keeping track of your credit situation.

Experian Pricing

Your pricing depends on the product you choose. Both CreditWorks Premium and IdentityWorks have ongoing monthly fees, while the report and score options have one-time fees. Here’s what you’ll pay for the different products offered by Experian:

- CreditWorks Premium: $4.99 for the first month, $24.99 for each month after

- IdentityWorks Plus: Free for the first month, then $9.99 a month after

- IdentityWorks Premium: Free for the first month, then $19.99 a month after

- 3-Bureau Credit Report and FICO Scores: $39.99, one-time

- Experian Credit Report and FICO Score: $19.99, one-time

Experian also offers free support and education by offering a number of tools and articles on various topics related to credit and identity protection.

Also Read: How to Improve Your Credit Score

How to Sign Up

On the Experian website, you can see several options. Use the dropdown menu to compare options and decide which service is likely to be the best choice for you. As you sign up, you’ll need to be ready with the following info:

- Full name

- Phone number

- Address

- Email address

- Social Security number

- Birthdate

- Payment information

You also need to be prepared to answer security questions. Experian will ask questions about certain loans you’ve had in the past or other addresses you’ve had in order to verify your identity. Once that’s done, you’ll create a username and password.

Security

Experian is a legitimate company and takes its security very seriously. High-level encryption is used, and Experian takes steps to safeguard your information. Not only that, but Experian’s monitoring of the dark web can help you identify how much of your data is available for sale on shady websites.

Experian can also help you protect your credit report by making it easy to freeze your credit using CreditLock. You can also improve your own personal security with the help of IdentityWorks and other tools.

Mobile Support

You can get the Experian mobile app for iPhone and Android. It’s easy to use, and allows you access to all the products offered by Experian. You can sign into your account from the app, accessing the products and services you’re used to. It’s also possible to view a free copy of your Experian credit report once every 30 days.

When using the mobile app, you also get access to CreditMatch, which allows you to see which credit cards you might be eligible for, based on your credit report and score. This is a nice feature that can help you get an idea of where you stand financially.

Customer Service

Experian offers an extensive and searchable database of topics related to different aspects of credit and fraud. You can usually find what you’re looking for in the help topics. However, it’s also possible to use the Contact Us page to get email help with certain questions.

- 1-866-617-1894 (general customer support line)

- 1-877-FACTACT (credit report support line)

Representatives are available from 6 a.m. to 8 p.m. Pacific on weekdays and 8 a.m. to 5 p.m. Pacific on weekends. Unfortunately, there does not appear to be any live chat options available.

Experian Pros and Cons

Pros

- Flexible choices: Choose to sign up for different products, based on what you need. You can get ongoing credit support and monitoring, or pay for a one-time snapshot.

- Includes the FICO Score: Some of the other consumer credit monitoring companies won’t offer a FICO Score, but it’s available through Experian.

- Lots of information: If you’re looking for a lot of information, Experian has it. When you get the credit report and score products, you’ll also receive information that can help you make better decisions in the future.

- The dashboard is easy to use: When you sign in, whether you’re on the computer or the mobile app, you can use an intuitive dashboard. It’s easy to see your financial and credit information in one place.

Cons

- It can be expensive: Some of the products will cost you. CreditWorks Premium is especially costly. You have to decide if it’s worth it for you.

- No online cancellation: If you want to cancel your ongoing subscriptions, you’ll have to do so by phone.

- You might not get alerts: Not all of the products come with ongoing alerts. You might get alerts related to fraud, but not other credit report alerts.

Experian Alternatives

There are other providers that offer similar services to Experian, although you might not get the same comprehensive offerings as you see with CreditWorks.

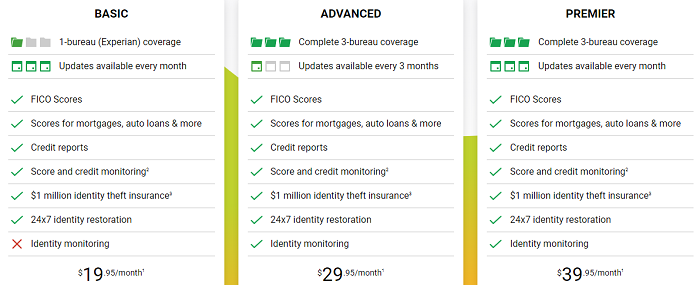

myFICO

myFICO offers quarterly access to scores, as well as analysis, but doesn’t give you monthly access. You have three different products to choose from and each service offers a level of credit score access and two offer identity protection.

Outside of the product, another great feature myFICO offers is its FICO Forums. There are more than 4 million topics posted where users and credit experts have offered advice and opinions on how to improve your credit and fix your credit.

Mint

One additional fee-free option is using Mint to track your credit score. With Mint, you’ll receive an updated credit score weekly (through TransUnion) and you’ll also have access to most of the information in your credit report. Mint tracks account balances, inquiries, open and closed accounts and lets you know what derogatory items you might have.

You can also use Mint to create a proper budget for your finances. After you connect your financial accounts to Mint, you will be able to track purchases to ensure no unauthorized charges are coming through.

Because this is free, you will be served ads on the platform for financial products while using the app.

Who Is Experian For?

Experian offers products designed to help you maintain your peace of mind. If you want a comprehensive and ongoing credit monitoring product, CreditWorks Premium can be a good choice, especially since it includes some of the features included with IdentityWorks. You can get a good value.

If you’re more interested in casually keeping track of where your credit stands, though, you might be better off using a free consumer credit website, and then occasionally paying for the 3-Bureau product when you want to get more specific information.

Bottom Line

Overall, Experian does a good job of offering a variety of different credit and identity monitoring services, as well as offering a number of tools that can be used to monitor and improve your finances. While the premium product is a little pricey, it can be worth it if you want peace of mind and full and unfettered access to what’s happening with your credit report.

Experian

Summary

Experian is one of the three main credit bureaus and they know how to offer you the info you need to improve and monitor your credit.