Haven Life Review: The Balance Between Price and Service

Thinking about life insurance isn’t exactly a topic that’s fun to talk about, but it’s necessary. After all, you want your loved ones to be taken care of, and choosing the right life insurance is an important decision.

While it can be overwhelming trying to find the best option, there are some serious contenders in the space like Haven Life Insurance Agency that offer a speedy application process and competitive rates.

As an online life insurance agency offering term life insurance, customers can receive a decision within an hour if you need less than $1 million in coverage and are under 45 years old. Haven Life also takes applications from those with pre-existing conditions–though your rates could be higher. The company also offers added perks not offered at other life insurance companies.

But is it worth it going with Haven Life? Read our review so you can make an informed decision based on your situation.

Features

Haven Life offers term life insurance only–you can renew each year until you’re 65 at which your premiums will increase if you decide to renew. If you’re younger than 60, you can purchase up to $2 million in coverage and $1 million if you’re 60 and older. You can purchase initial terms of 10, 15, 20, 25 or 30 years.

*10, 15, 20 , 25 or 30 years available to those ages 20 – 49 years old.

*10, 15, or 20 years available to those ages 50 – 64 years old.

The policies are underwritten by MassMutual but you can change account details through Haven Life–policy owner, payment information, beneficiaries and changes in policy’s face value.

*Policies are issued by MassMutual or its subsidiary C.M. Life. MassMutual is one of the country’s oldest and most reliable insurers.

Extra Features

Haven Life is offering extra free features just for carrying a policy with them–there aren’t many life insurance companies that offer them.

These include:

- Legal services: You can get wills and healthcare power of attorney through the company Trust & Will to help you create documents to carry out your final wishes.

- Discounts on health care services: You get 15% off services at MinuteClinic across the U.S. at CVS and Target locations.

- Document storage: You get a free LifeSite membership, which is a service that offers a secure and simple way to store your important documents and share them across multiple devices and platforms.

- DNA testing: Get a discount on TeloYears, an at-home DNA test that shows your biomarkers which can help you with information on how you can improve your health and other issues in your lifestyle.

- Emergency services: You’ll get a free subscription to LifeLink which is to help you get in touch with emergency services simply with the touch of a button. Then it’ll contact your emergency contacts automatically once your call with emergency services is over.

Policy Add-Ons

Haven Life offers policy add-ons, or policy riders also available from most life insurance companies. These are optional and doesn’t mean that you’ll be better protected. Keep in mind these are the only two available so far. If you want a different rider, you’ll need to look elsewhere:

- Waiver of premium: This policy rider (only available if you buy a policy before 50) will make sure you’re still covered if you cannot work and have trouble paying your premium due to disability. If you’re completely disabled before you’re 65 years old and the disability is for a minimum of six months, then Haven Life won’t make you pay premiums.

- Accidental death benefit: If you’ve been diagnosed with a terminal illness, you can receive part of our death benefit while you’re still alive. There’s no additional cost to add on this rider policy and you can receive up to 75% of your policy’s death benefit or $250,000, whichever is less.

Haven Life’s Application Process

Haven Life’s application process is pretty straightforward. Once you fill in their online application form with your personal details, life insurance requirements and information about your health, you’ll be able to find out what you could qualify for, including your monthly premium.

The good news is that Haven Life offers a type of policy called InstantTerm, which means you don’t need to have a medical exam if you have excellent health–you may be able to get a policy within hours. Even if you’re a smoker, you may not need to go through a medical exam if you qualify.

However, if you don’t qualify for InstantTerm, then you’ll need to complete a standard medical exam procedure within 90 days–you could be approved for temporary coverage, though this isn’t guaranteed. As previously mentioned, you can apply if you have a pre-existing condition, but your application could be denied if you have a higher risk of early death or have poor health.

Who Can Apply For a Haven Life Policy

If you’re a non-military U.S. citizen and are between the ages of 20 and 65, you can qualify for a Haven Life policy. You’ll also need to have a valid driver’s license and reside in any of the 48 states (including the District of Columbia).

Your insurance policy is intended for personal use (as in, you can’t use them for business purposes) and you can’t convert it to a permanent life insurance policy once you’re older.

At the end of the day, the cost of your policy depends on factors such as your age, your health, and how much coverage you want to buy.

Haven Pricing

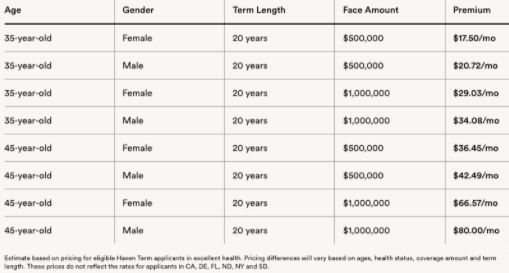

See the below table for information on Haven’s pricing:

Final Verdict

Even though Haven life is a fairly new company (it started in 2015), it’s been receiving rave reviews from customers for their service and competitive rates. Its parent company, MassMutual (and its subsidiary C.M. Life.), is a large company that’s also well-rated.

If Haven Life is available in your area, it’s worth at least getting a quote to see what you may qualify for and how much a policy would cost.

Haven Term is a Term Life Insurance Policy (ICC21 Haven Term in certain states, including NC) issued by C.M. Life Insurance Company (C.M. Life), Enfield, CT 06082. In New York (DTC-NY) and California (DTC-CA), it is issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001.

Article comments