M1 Finance Review: Free Online Robo Financial and Investment Advisor

It seems like there is a new robo advisor popping up every week. Each one promises to be better than the rest, providing you with a platform that helps manage your retirement portfolio today and beyond.

M1 Finance is one of these newer platforms and has gained popularity in recent months. They offer a free service that is more of a robo advisor blend, helping you to balance, rebalance, and properly allocate your investments according to your time horizon and risk tolerance. But is it really any different than the products you probably already use?

About M1 Finance

Introduced in Chicago in 2015, M1 Finance is self-described as a hybrid robo advisor. While it has many similarities to the companies already on the market, it’s also touted as being the future of the sector because of its unique approach to investing.

M1 Finance works similar to most other robo advisors, in that you can easily manage your portfolio according to your risk preferences, even if you have limited investment knowledge. The application allows you to build your own custom portfolio or self-select into professionally curated portfolios tailored to your financial goals, time horizon, and risk tolerance. It then places trades and maintains your asset allocation automatically. Oh, and did we already mention that M1 Finance is free to use?

This is where the similarities between M1 Finance and other robo advisors stop, though.

Try M1 Finance Right Now, Without Any Commitment

Features

If you’re looking to build a diverse portfolio that’s easy to manage and will lead you successfully into retirement, M1 Finance can help. This robo advisor can manage any number of investment account types, including:

- Taxable accounts

- Joint accounts

- Traditional, Roth, SEP, and Rollover IRAs

- Trusts

So, whether you want to build a strong retirement portfolio or manage a trust, and whether those accounts are individual or joint, M1 Finance can help.

M1 Finance has close to 2,000 ETFs to choose from, giving you plenty of diversity for your personal portfolio. They also offer you the ability to buy and sell shares of any NYSE or NASDAQ individual stocks (excluding preferred stocks). Portfolio changes can be made online or through the mobile app, and you can log in to either platform to set up automatic deposits.

Your money is secure with M1 Finance, too, giving investors the peace of mind that SIPC protection brings.

Lastly, you can also take advantage of M1 Borrow if you need a loan for any reason. There are no credit checks, no denials, and you can borrow up to 40% of your portfolio at any time. M1 Borrow is available to M1 Finance customers for 6.25%–7.75%. Investors with at least $10,000 on the platform automatically qualify.

The Process

When signing up for an account through M1 Finance, you’ll go through three primary steps.

In the first step, the platform walks you through how to pick investments to build a “Pie” (more on this in the next section).

The second step is to create your brokerage account. You’ll link up your funding sources, such as a checking or savings account from an external bank, and provide your personal information in this step of the process.

Last, you’ll fund your new account. There is no minimum deposit required to open your M1 Finance portfolio, so you can add as much or as little as you want.

The Pies

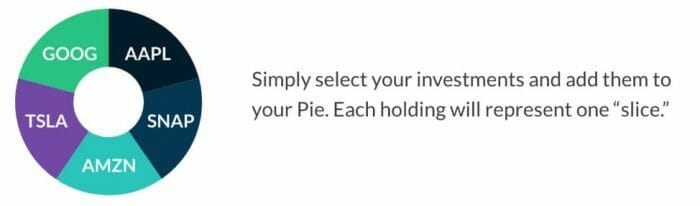

M1 Finance manages your portfolio a bit differently. Whereas most robo advisors will give you a questionnaire to establish your risk tolerance for investing and then serve you a pre-built portfolio, M1 Finance allows you to build what they call The Pie.

Pies, as we all know, are made up of slices. Well, M1 Finance Pies are no different.

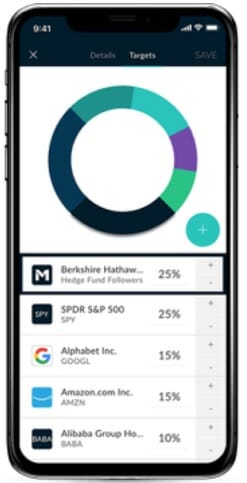

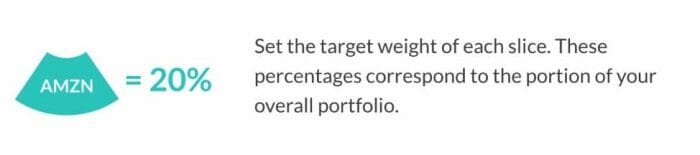

You can choose from pre-made Pies that M1 Finance has already configured, or select your own stocks and funds to build the Pie that best suits you. After choosing your investments (which will make up the “slices” of your Pie), simply set the target percentages for each to determine the size of each slice in your portfolio.

Another benefit of using M1 Finance to manage your portfolio “Pie” is that they allow you to buy fractional shares. The ability to buy partial shares of a stock, versus being forced to buy whole shares, allows you to maximize your earnings potential. It also makes diversification easier when you can work with only fractions of stock shares rather than waiting until you have the funds available to rebalance your portfolio with only whole shares.

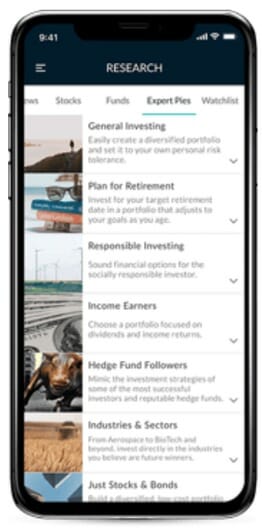

Expert Pies

If you aren’t set on specific shares or aren’t quite sure what sort of investments you want to include in your portfolio, you can utilize M1 Finance’s Expert Pies. These are professionally created portfolios with both established investments and weighted shares, designed to follow some of the most successful brokers’ and advisors’ methodologies.

Expert Pies can be chosen according to your own specific risk tolerance or how far away you are from retirement. You can also choose between Expert Pies that were created to cater to specific savings goals, follow the strategies of some of the industry’s largest hedge funds, or invest in specific industries.

If you have an idea of what you want your portfolio to do for you but aren’t quite sure exactly what you need to get there, the pre-designed Expert Pies from M1 Finance make the process easy.

Expert Pies are available in a variety of “flavors.” Categories to search and choose from include:

- General Investing

- Plan for Retirement

- Responsible Investing

- Income Earners

- Hedge Fund Followers

- Industries and Sectors

- Just Stocks and Bonds

- Other Strategies

Within each of the Expert Pies is a variety of specific Pie structures to choose from. This allows you to not only choose the type of Pie that suits you best, but also customize the allocation to meet your needs.

Custom Pies

What if you know exactly which companies you want to invest in, or which stocks you want to purchase for your portfolio? Then you can use M1 Finance to build a Custom Pie, even establishing your own weighted shares according to your own risk tolerance.

Custom Pies allow you to DIY your portfolio, building exactly what you want and need based on your exact specifications. You can choose individual stocks and ETFs, create your own weighed portfolio balance, and then let M1 Finance work its magic on the maintenance.

If you have a handful of stocks or ETFs that you want to buy but aren’t quite sure what to do with the rest of your portfolio, you can create a mixed portfolio. M1 Finance will allow you to use pre-established Expert Pies while also adding custom shares, to create the portfolio that is as unique as your future goals.

Dynamic Rebalancing

Once your slices’ target weights are established, M1 Finance will automate the rest of the process for you. As contributions are added to your account–daily, weekly, or monthly, based on what suits your budget–the funds will be distributed according to your set allocations.

Depending on how the market performs and which investments you’ve chosen, you may find that some slices will outperform others. If this happens (and it likely will), M1 Finance will automatically make adjustments to each slice’s funding to reestablish balance.

You can also change the slices chosen at any time, as well as the weighted balance of each. Based on the performance of specific stocks, your changing goals, and even your age, you may want to adjust your portfolio manually. However, if you want to take an entirely hands-off approach with your investments, M1 Finance can manage everything for you automatically.

Automatic Deposits

You can automate the funding of your portfolio through M1 Finance, quickly and easily. Automatic deposits can be set up online or through the mobile app in minutes, allowing you to allocate funds toward your investments daily, weekly, or monthly, depending on the time period you choose.

Establishing your deposit schedule is simple. You can choose the funding source and the deposit frequency according to your budget and pay schedule. You can even set up multiple automatic deposits and assign them to a specific day of the week or month.

M1 Borrow

If you need to take out a personal loan in order to complete home improvements, refinance existing debt, cover a big purchase, or pay for any other large expense, you will be glad to know that M1 Finance is there for you. Thanks to M1 Borrow, you have convenient access to as much as 40% of your total portfolio’s value, without the typical hassle of a personal loan. Any investor with $10,000 on the M1 platform automatically qualifies.

With M1 Borrow, you can bypass the usual mounds of paperwork and deal with a loan officer who requires seemingly-endless information for their underwriting process. You won’t be asked for any additional paperwork, and there’s no one else you need to deal with when applying for your loan. Even better is that there are no denials and no credit checks. How many personal loans can claim that?

The best part? All loans offered through M1 Borrow are at a repayment rate of 6.25%–7.75%.

Get a Quick & Competitive Financing Offer Now

M1 Spend

In addition to investing and borrowing, M1 now offers digital banking – or what they call M1 Spend. It’s an FDIC-insured online checking account with a debit card. There’s both a free and paid version. If you’re looking for a way to easily consolidate your banking and investing needs, it’s worth checking out. You can have your paycheck directly deposited into your account, pay bills from it, and use your debit card when you want to make other purchases.

With the free version of M1 Spend, you don’t need a minimum balance to avoid fees and you’ll get ATM fees covered once per month. Your money won’t make any interest in the checking account and there’s no cash back.

If you sign up for their M1 Plus account – it costs $125 a year – you’ll get 3.30% APY on your checking account, 1% cash back on purchases, and four ATM fees covered per month. You’ll also get a better rate on borrowing from M1 Plus (7.75% instead of 6.25%).

Security

M1 Finance works hard to secure not only your personal information but also your investment.

All personal information–your name, address, birthdate, and SSN–is encrypted in transit between your computer and M1 Finance. Once the company receives your information, it’s encrypted once again when placed on M1’s servers.

As far as securities go: M1 Finance is a member of SIPC, the Securities Investor Protection Corporation. This means that your cash and securities are protected up to $500,000, which includes a $250,000 cash limit.

It’s important to remember, though, that your individual securities are not protected against loss, including losing value in the stock market.

Customer Service

Have questions about M1 Finance, the features offered, or aren’t quite sure how to build the portfolio you need? You can simply schedule an advisement phone call, free of charge.

If you have questions at any time once your account is established, you can contact their customer service team by phone or email. Agents are available by phone Monday through Friday, from 9:00am to 5:00pm Central time. Or, if you’d prefer, you can email them anytime day or night, and get a response within 24-48 business hours.

Is M1 Financial Right For You?

At the end of the day, M1 Finance is what people think of as a robo advisor, but they have a twist. They offer the type of personalization that we hope to see from even more companies in the future.

Here are a few of the pros and cons of building your portfolio with M1 Finance.

Pros

One of the best perks of working with M1 Finance is that it allows you to invest for free. It’s chock-full of features but doesn’t charge a penny for the service, including no broker fees, commissions, or fees for buying or selling your securities. Plus, there is only a small minimum deposit ($100 for taxable accounts and $500 for retirement accounts), so you can open an account no matter how much or how little you’re looking to invest right now.

They offer the ability to invest in fractional shares. This allows for greater return potential and simplifies the rebalancing process, by fully investing your money. Other robo advisors may require the purchase of full shares, meaning that your account could regularly be holding cash that isn’t doing you any good… or earning you more money!

You can also choose exactly what you want with M1 Finance and their Pie strategy. Whether you want help choosing an Expert Pie that suits your interests or goals, want to create something entirely from scratch, or a blend of the two, M1 Finance makes it easy to customize your portfolio.

If you need help with the platform or working your way through the Pies, you can set up a free phone consultation. An M1 Finance representative will help you navigate the platform and understand your investment options.

Find M1 Finance Right For You? Open Account Now

Cons

There aren’t many downsides to M1 Finance, but they may be a bit limiting depending on your investment strategy.

For example, this robo advisor isn’t suited for day traders. If you are a very active trader, rather than taking a passive or automated approach, M1 Finance isn’t for you.

M1 Finance also doesn’t offer tax loss harvesting. This can be a very helpful feature–and is one that many robo advisors do already offer–but you won’t find it with M1 just yet. However, they do use a “lot allocation strategy” when selling your securities that helps to minimize your taxes owed at the end of the year. While this isn’t quite the same as tax loss harvesting, it could be beneficial to your bottom line.

Lastly, you might find it inconvenient that M1 Finance won’t be able to recognize employer-sponsored retirement accounts. Since these types of savings are typically factored into your overall investment strategy and could impact the risk tolerance of your Pies, you’ll need to find another way to factor those in.

Summary

Not all robo advisors are created equal, even though they appear to be very similar at first glance. And while M1 Finance offers many of the same features offered by other robo advisors on the market, this hybrid company takes your investment portfolio management up a notch.

M1 Finance not only offers a free investment portfolio management service, but they also offer you the opportunity to build a portfolio that is completely customized. You can choose from their Expert Pies–the “pie” approach being their own unique spin on allocations–or create a Custom Pie. Want a little bit of both worlds? No problem; M1 Finance makes it easy to blend their expertise with your personal preferences.

M1 Finance’s minimum deposite is low, and you can have as many as 30 Pies going at any time. Deposits can easily be automated, making your portfolio funding easier than ever.

On top of that, the allocation process is optimized for you and your money. Thanks to fractional shares, your money won’t sit dormant. Instead, it’s constantly being reinvested once it reaches your established cash limit, ensuring that your cash is always working for you.

Using M1 Finance for your portfolio management is free. There are no brokerage fees or commissions to use this robo advisor, and you don’t have to worry about expenses when you buy or sell shares, either. There are some limits to the types of accounts you can link to M1 Finance–for example, you won’t see your employer-sponsored retirement accounts in there–but otherwise, it’s a pretty comprehensive service.

To learn more about M1 Finance, or start building your own personalized portfolio, you can visit their website here.

Article comments

I truly like reading your post, You have such nice valuable information. Thanks for sharing information with us. Keep on sharing Blog like this.

Thank you very much for your great information. It really makes me happy and I am satisfied with the arrangement of your post.