Monevo Personal Loans Review: Financing Marketplace & Platform

Personal loans are fast becoming one of the preferred financing options. You can borrow a large amount of money, finance it over several years with both a fixed interest rate and monthly payment. You can also use the money for nearly any purpose. The most popular is debt consolidation–rolling several high-interest credit cards into a single, lower rate installment loan. But you can also use these loans to purchase a vehicle, start a business, make home improvements, or pay for a wedding, vacation, or large, out-of-pocket medical expenses.

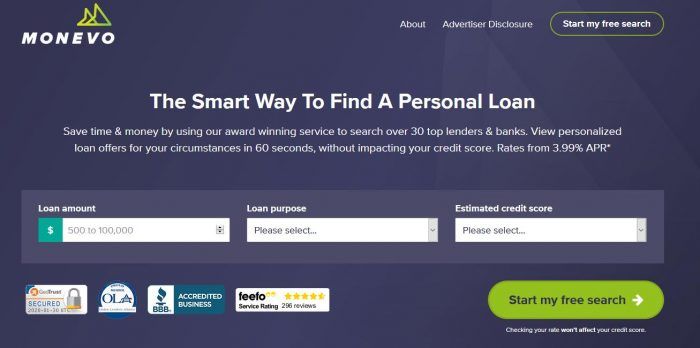

There are now dozens of online companies, banks and credit unions offering personal loans, all under different terms. But an online platform like Monevo provides you with an opportunity to search for several personal loan lenders at the same time. After filling out an online form, you can receive offers from participating lenders. The companies Monevo works with are some of the biggest in the industry.

Monevo puts the power of competition at your fingertips. If you’d rather just fill out one form for a personal loan and wait for the lenders to come to you, Monevo is a platform where you can do it.

Who and What is Monevo?

With U.S. operations based in San Diego, California, Monevo is an online personal loan marketplace–a one-stop shop. The company reports participation from more than 30 lenders and banks, providing loan services to more than 250,000 consumers each month, funding more than $1 billion.

And that’s just from its operations in the United States. It’s actually Europe’s largest lending marketplace, with participation from more than 150 lenders. The company currently operates primarily in Australia, Poland, the U.S. and the UK, funding approximately $10 billion in loans per month.

The company began operations in the U.S. early in 2017, but got its start in the UK in 2009.

Monevo has a Better Business Bureau rating of “A+”, the highest on a scale of A+ to F. It has been accredited by the Bureau since early 2018.

Monevo Loan Details

Loans available: Personal loans, with fixed interest rate and loan terms, and no collateral required. However, some of the participating lenders do offer other types of loans.

Minimum/maximum loan amounts: $500 to $100,000

Loan terms: 3 months to 144 months (12 years)

Loan fees: No fees payable to Monevo; see Monevo Interest Rates and Fees section below for general rate and fee ranges charged by individual lenders.

Required credit range: Fair to excellent (credit score of 600 to 850). However, Monevo reports options are available for all credit scores, but you should expect offers to be less numerous if you have poor credit.

Loan purposes: Debt consolidation, home improvement, vacation, autos, large purchases, paying off credit cards, student loan refinancing (not available with all participating lenders), education, special occasions, cosmetic procedures, moving and relocation, household expenses, medical and dental expenses, taxes, business-related purposes and other uses.

Loan funds disbursement: The website indicates you can receive your loan funds as early as the next business day after approval.

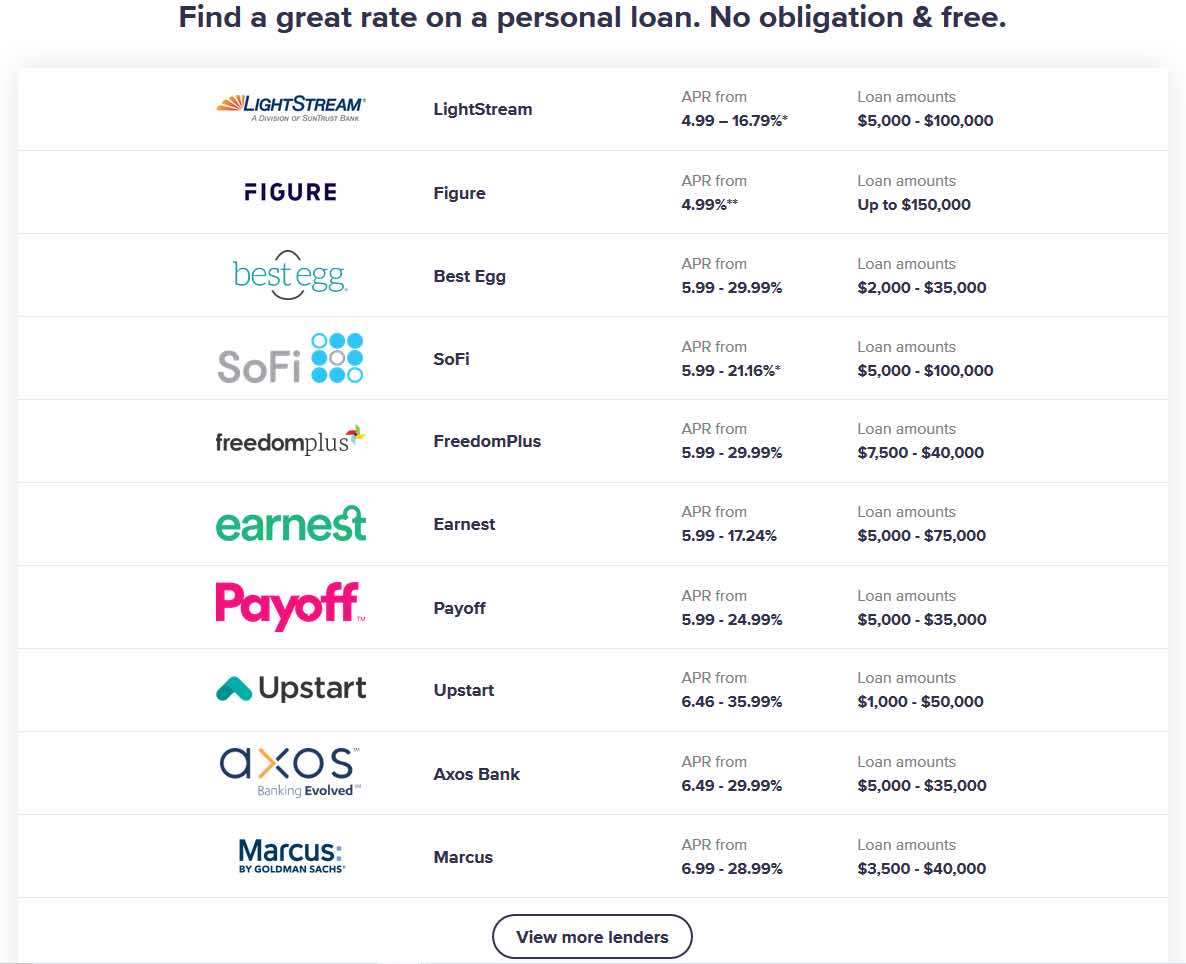

Participating lenders: 30+, including LightStream, Best Egg, SoFi, Upstart, Marcus by Goldman Sachs, Prosper, Lending Club, Avant and many others.

Monevo Features and Benefits

“Soft credit pull”: When you use the Monevo service, a soft credit check is done, which will not impact your credit score. However, if you agree to proceed with a formal application with any lender participating on the website, a hard pull will be performed, resulting in a minor negative impact on your credit score.

Process: Online form only–there is no option to use the Monevo service over the telephone

Monevo security: The website uses Secure Socket Layer (SSL) encryption technology with the transmission of all sensitive data over the Internet. They also use firewalls to prevent external access into their network. Access to your personal information is limited to employees, contractors, service providers and agents who need the information to operate, develop or improve the service.

Customer service: Contact is available by email and live chat only. But it’s important to remember that Monevo is only an online loan marketplace and not a direct lender. They will not be able to assist you with specific issues relating to your loan application with a direct lender.

NOTE: Though Monevo customer service is limited, you can use the Monevo service to search for a loan on a 24/7 basis, and receive results in under 60 seconds.

Monevo Interest Rates and Fees

There is no fee required for using the Monevo website. The site earns commissions paid by lenders only on loans that have been approved and funded.

Monevo indicates interest rates beginning as low as 3.49% APR to 35.99% APR. The actual interest rate you’ll receive will depend on your credit score, the loan amount requested, loan purpose, your debt-to-income ratio, and other factors. In addition, credit evaluation criteria will vary from one lender to another.

The main fee involved in personal loans is an origination fee. It will typically range between 1% and 6% of the loan amount received, and will only be paid upon disbursement of your loan proceeds.

For example, if you take a $10,000 loan with a 6% origination fee, you’ll receive net proceeds of $9,400. This will be the $10,000 face amount of the loan, minus $600 for the origination fee. You will, of course, be responsible for repaying the full $10,000 loan amount.

Other fees will depend on the specific lender, but you generally will not be charged an application fee or a prepayment penalty if you pay off your loan early.

The Monevo Online Process

Once again, the entire process takes place online. To be eligible, you must be a U.S. citizen or permanent resident, be at least 18 years of age, and have a valid bank account in your name.

The process starts with pre-qualification. You’ll provide three pieces of information–the loan amount requested, loan purpose, and your estimated credit score range.

Then, you’ll receive a one-page form that will request the following information:

- Your full name

- Date of birth

- Email address

- Primary and secondary phone numbers

- Highest education level completed

- Indicate if you own your car free and clear

- Indicate if you would like to add a co-borrower (if so, that party will have to supply similar information)

- Your complete address

- Type of residence

- Monthly housing payment

- Time at that address

- Employment status (employed, retired, self-employed, student, unemployed)

- Annual gross income

- Your Social Security number

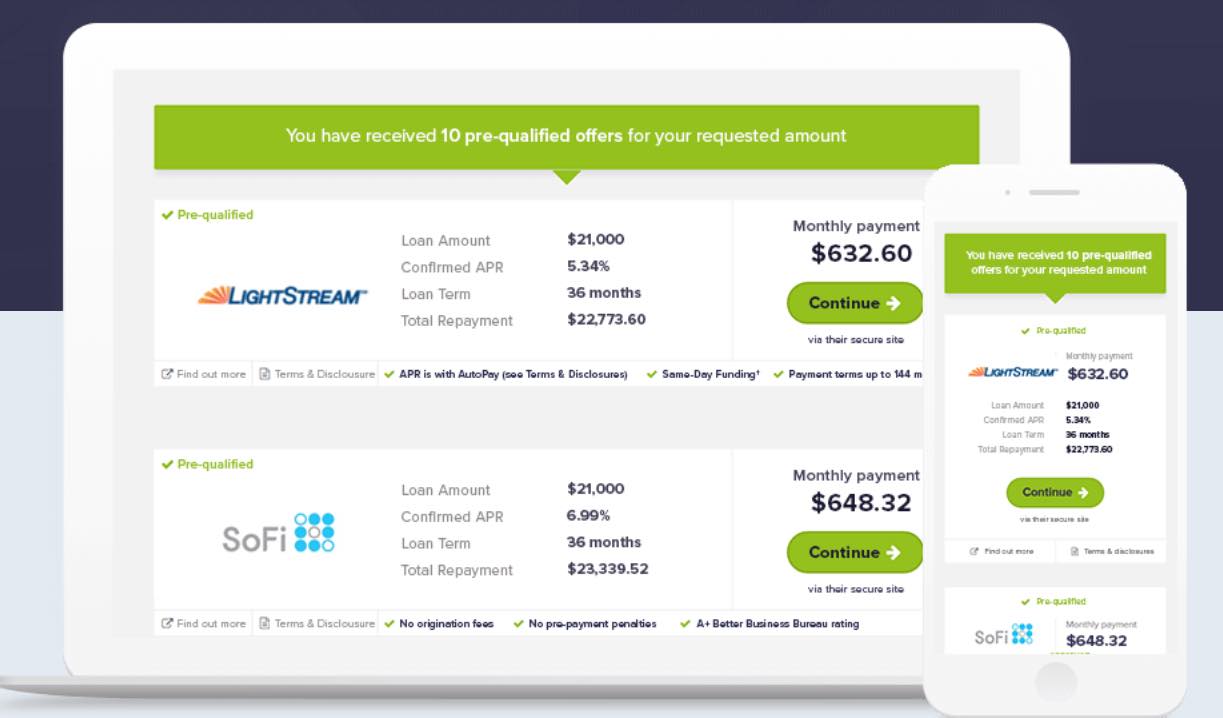

Once you submit your loan request, you’ll begin receiving loan offers from various lenders within 60 seconds. However, the website does warn that they cannot guarantee that everyone will receive offers.

You can select the loan offer that’s most agreeable to you, then complete the application process with that lender. In doing so, the lender is likely to request additional information. This can include (but is not limited to) income documentation, pay off statements for any loans you want paid off through the new loan, previous employment or residence information, or any other information required by the lender.

You’ll be presented with all terms and necessary documents relating to the loan you’ve accepted. Funding will take place as early as the next business day, but does vary by lender.

Monevo Pros and Cons

Pros:

- As an online personal loan marketplace, Monevo gives you access to more than 30 direct lenders.

- Participating lenders are some of the biggest names in the personal loan space.

- You can borrow as much as $100,000, in terms of up to 12 years.

- Loan proceeds can be available as early as the next business day after closing.

- The site is completely free to use, so there is no cost to you if you don’t get the loan you want.

- Using the Monevo service starts with a soft credit pull, which will not negatively affect your credit score.

- Monevo has the highest rating possible from the Better Business Bureau.

Cons:

- Monevo is not a direct lender, so they will only be able to provide limited assistance in the use of the site, not for issues with the direct lenders.

- Your financing options may be limited if you have fair or poor credit.

- Monevo does not offer phone contact or the ability to apply for a loan by phone.

Monevo Alternatives

It’s undeniable that online personal loan marketplaces like Monevo are one of the very best sources of this type of financing. But if you prefer to try alternative sources, consider any of the following:

- Prosper is the second-largest independent online personal loan lender in the personal loan industry. Unlike Monevo, they are a direct lender. As one of the industry leaders, they offer some of the most innovative personal loans in the industry.

- SoFi is best known for providing student loan refinances. But they’ve branched out into other types of financing, including personal loans. As a specialized lender, they generally prefer borrowers with stronger credit profiles. But they will also look closely at your income, education, and occupation, rather than relying solely on your credit score.

If you’re looking for another online personal loan marketplace, check out Even Financial. They offer similar personal loans as Monevo, including loan amounts up to $100,000, with interest rates starting as low as 4.99%. But don’t be surprised if you see many of the same lenders participating in the Even Financial website as you do on Monevo!

Monevo Personal Loans FAQs

Should You Use Monevo to Search for Personal Loan Options?

Personal loans are quickly becoming a preferred financing source. That’s because they offer the following advantages:

- They’re completely unsecured–you don’t need to pledge any collateral to get financing.

- Both the interest rate and your loan term are fixed, so your payment will never change.

- Since each loan has a definite term, it will be paid off at the end of that term. This is completely unlike credit cards, which can continue for years and years.

- Personal loan proceeds can be used for nearly any purpose.

- Personal loans can be an excellent way to consolidate high-interest credit card debt, or to obtain financing for a business. Small businesses, especially upstarts, have great difficulty getting traditional business loans.

As valuable and flexible as personal loans have become, an online personal loan marketplace–like Monevo–is the best way to get one:

- You can search offers from one of more than 30 personal loan lenders on the platform.

- You can solicit loan offers from multiple lenders without affecting your credit score. A hard credit pull will only be performed if you choose to go with a specific lender.

- You can search from the comfort of your home or workplace–there’s no need to go to a lender’s office.

- There is no cost to use the Monevo website.

- You can search for a loan on a 24/7 basis.

You can think of Monevo as the loan equivalent of going to the mall–once there, you’ll have many options to take your business. It will even put the lenders in competition with one another for your business. And since there is no fee or credit consequences to search pre-qualified loan offers, the entire process is completely risk-free.

If you’d like more information, or to see your personalized results, visit the Monevo website.

Article comments