The Price of Oil is on the Rise. Is That Good for You?

After a lull in the price of a barrel, we are seeing the cost of oil begin to once again increase. With it comes increased revenue and, in turn, money being pumped into both the stock market and the economy. So, is this good news for the average person? Well, the immediate answer is no, probably not.

It’s All Part of the Plan

Just a few weeks ago, the Organization of the Petroleum Exporting Countries (OPEC) — and even some countries who are not members of OPEC — was able to create an agreement that reaches far beyond what many economists thought they could accomplish. The goal? To reduce the supply of oil around the globe by at least 1.2 million barrels a day. Assuming the demand for oil remains unchanged (at least initially), the reduced supply will create a rise in price. This will, in turn, jump-start the oil industry.

As the price of oil continues to rise, it’s suspected that some of the countries involved will jump ship on the agreement. They may see the profits in front of them and begin pumping out more barrels than initially agree. So far, though, everyone is sticking to the arrangement and the price of oil has consistently risen since the start of the month.

No commodity is more discussed in the world of finance than oil. No commodity has more of an impact on your day-to-day personal finances than oil. Turn on any market-driven television channel, and I’m willing to wager that within 10 minutes, the analyst will have brought up oil at least five times. It’s a true driving force behind the global economy, and its shift in price can have drastic changes on you and your family.

Some economists are extremely bullish on oil predictions, saying it will reach $75/barrel before the end of the year. However, even the bears don’t see oil going anywhere but up (albeit slowly) for the next few months.

Now that the price of oil has stabilized and is steadily rising, is this good for your wallet? Your future?

The Bad News

When the price of oil goes up, it affects the American buying consumer primarily in three negative ways:

The Price of Gasoline Rises – According to AAA, this week’s average price of unleaded regular gas is $2.21 per gallon. This time last year, that price was $2.02. At its lowest point this year, the price was $1.62. If you’re someone who takes an hour round-trip commute to work or drives the kids to football practice in the minivan, you will notice more money coming out of your wallet when you fill the tank.

Average Americans fill up w/ roughly 700 gallons of gas per vehicle, per year. Because of this, even a small increase of 25 cents per gallon will put you out an extra $200 or so per vehicle. You can mitigate this loss by owning a cashback credit card (some of which offer up to 5% rewards on gas purchases). Even after saving a little bit more there, though, rising gas prices are an inevitability of higher oil prices.

Price of Travel and Other Goods Rises – When the cost of gasoline goes up, the cost of goods also goes up. This is to coincide with businesses having to pay more money to get their goods to them. And of course, that cost is passed on to you, the American consumer.

For example, a round-trip flight from LA to Chicago may be $110 today, but closer to $120 in two months when oil goes up another $5. Truckers moving products across the country, grocery stores taking in daily shipments of produce… there is no shortage of consumer goods affected by a higher cost for oil.

Price of Heating Oil Rises – This is the one that impacts me the most, but overall impacts the fewest number of consumers. I live in central Connecticut and every year, I buy between 700 and 800 gallons of oil to heat my home through the winter. My parents, who own a much older (and slightly smaller) home, purchase over 1,300 gallons of oil per winter. When oil prices go up, the price per gallon of heating oil also goes up. The cost of oil is very similar to the cost of gasoline per gallon.

To combat these prices, I locked in a rate of $1.89 per gallon in July and prepaid for the winter. This should help me avoid having to pay inflated costs when the cold weather hits. However, I also lose the ability to pay lower costs should the price of oil go down.

The Good News

It’s not all bad, though, I promise. When the price of oil goes up, there is a lot of good that comes from it, too.

Retirement Savings Accounts Increase – Because oil is a heavily traded commodity, it’s likely included in any retirement portfolio you own. Whether it’s in a commodity mutual fund, or a direct stock ownership of Exxon Mobile, Chesapeake Oil, etc., higher prices in oil mean higher value in your portfolio. As rising oil prices generally (and I say that loosely) means a stronger economy, it would also likely have an impact on the other investments you’ve made. So if the world is paying more for oil, and the demand for oil remains high, most investments are happy.

The Economy Grows – The oil industry is one of the largest in the world, and higher prices mean higher profits for oil companies. These profits lead to the hiring of more employees to produce more oil (or expand the business in other ways, still hiring more employees). This means more jobs for not only American citizens but also abroad.

With more people employed, more money is spent inside the US economy. Goods that would not normally be purchased are now starting to move off the shelves. My example is the most basic way in which the economy will see a positive effect of higher oil prices. However, there are countless other ways to quantify it as well. (For an added example of global wealth, Goldman Sachs provides perspective.)

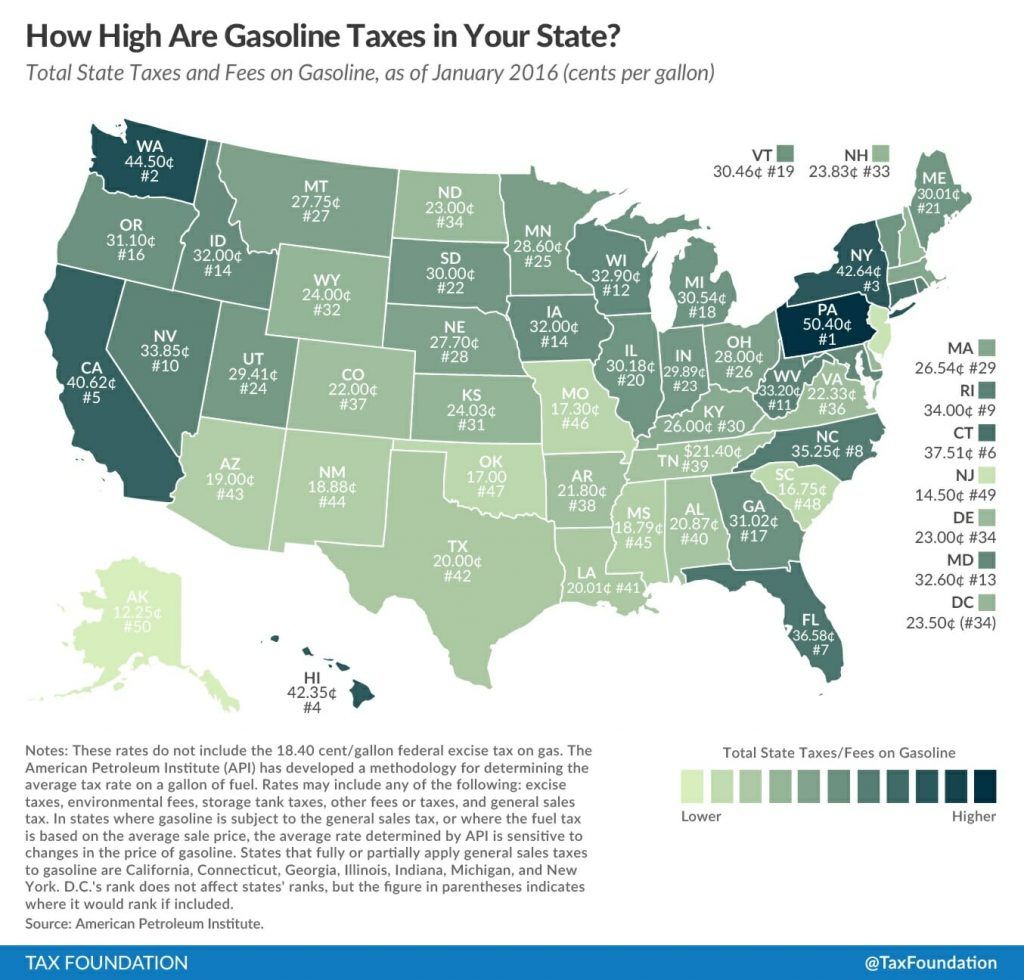

The Government Doesn’t Get the Extra Revenue – When you see the price of $2.25 for a gallon of gas, you might assume that the money you pay the gas station stays with the gas station. However, inside of that gallon is heavy taxes collected by both the US government and the state government. Below is a map that shows just how much money you pay in “tax” when you buy a gallon of gasoline (as of January 2016). The good news here is that these taxes are not based on a percentage of the gallon, but a flat amount. For example, the US government gets a flat 18.40 cents per gallon, no matter the cost of a barrel. So, the added revenues earned by the gas station are revenues passed economically, without additional government taxes.

You’ll notice that the good news is very macro-themed while the bad news is very micro-themed. When the cost of goods goes up, there’s just no way around having it immediately and negatively impact the day-to-day spending of the consumer. So, whether or not the price of oil going up is good or bad for you likely depends on your current financial situation.

If you’re well-to-do with money in the bank, savings for retirement, and are secure in your employment (or your employment is oil pump-related), oil prices going up is a good thing. It goes a long way to secure a stronger economy in the long-run and boost retirement savings. However, if you’re currently struggling to make ends meet, and things like retirement seem like a dream versus a real goal, then higher oil only means less spending money in the near future. Either way, the rise in oil prices is likely to garner mixed emotions nationwide.

Article comments