Roofstock Review: Crowdfunded Investing in Rental Properties

Have you been itching to get into real estate investing, but don’t like getting your hands dirty? If so, Roofstock is the platform you’ve been looking for. You can purchase single-family rental properties through the platform, in much the same way you buy stocks and other paper investments. But you’ll actually own the underlying real estate.

Roofstock does all the research and leg work for you. You just select the properties you want to purchase. And since it’s also a place where investors come to sell their properties, you’ll always have a wide selection of potential investments. It’s an easy way to add real estate to your investment portfolio.

About Roofstock

Based in Oakland, California, Roofstock began operations in March 2016. But in just three short years, it’s become one of the primary single-family rental platforms on the market. This is what makes it unique in the real estate investing space. While the majority of platforms (real estate crowdfunding sites) focus on investing in large commercial projects, like shopping centers, office buildings, and apartment complexes, Roofstock investments are closer to the ground.

But what also makes Roofstock stand out is that investors are taking a direct ownership interest in the properties they’re investing in. Many other real estate platforms focus primarily on providing loans for real estate investors, then enable participants on the platform to purchase slices of those loans.

The advantage of equity investment is that it holds the possibility for much more generous returns than you can earn with interest on loans, even high-yielding loans. As a Roofstock investor, you’re actually investing in individual properties, but doing it without getting directly involved in the process. You can own, but you don’t need to find and purchase properties, or manage them along the way. It’s almost like you’re purchasing stock in a single-family rental.

Roofstock provides an online marketplace with access to 40 markets across the U.S., and has already completed more than $1 billion in transactions. In fact, Roofstock is actually a real estate marketplace, and not a real estate crowdfunding platform. That’s because it functions as a platform where investment properties can be either bought or sold.

How Do You Qualify to Invest with Roofstock?

One of the major advantages with Roofstock is that you’re not required to be an accredited investor. That requires you to meet certain income and net worth requirements that most investors don’t. Many other real estate platforms do have that requirement.

In addition, there is no minimum investment requirement. However, each property you invest in will have its own investment requirement, so you’ll need to choose those that fit within your investment budget.

Since you’ll actually be owning one or more individual properties, it is of course best that you have knowledge of real estate investing. In that way, Roofstock may be best suited for those who have prior real estate investing experience, or currently own investment property, and are looking to diversify into different markets, or to invest without getting directly involved in individual property management.

How Roofstock Works

As mentioned earlier, Roofstock is an investment real estate marketplace. That is, it’s an online platform where you can purchase investment properties. The platform itself functions mainly as a tool to facilitate that process. Unlike real estate crowdfunding platforms, Roofstock doesn’t directly manage your investments. You select and purchase properties of your choice. If a property is in your own local market, you can manage it directly. But if it’s a remote location, you also have the option to hire out a property management firm, which Roofstock will offer.

But just because you’re purchasing properties directly doesn’t mean you’re going it alone. You’ll decide how much you want to invest, and whether you want to buy with all cash, or use financing. If you do use financing, you’ll generally be required to put up 20% of the purchase price as a down payment.

Once you decide the parameters of your investment, Roofstock provides the tools and support to help you identify properties you want to invest in.

Since Roofstock is centered on single-family properties, investment activity is concentrated in 40 markets deemed to be the strongest for single-family investing. Those markets are concentrated in 19 states–Alabama, Arizona, California, Delaware, Florida, Georgia, Illinois, Indiana, Michigan, Missouri, North Carolina, Nevada, New Jersey, Ohio, Pennsylvania, South Carolina, Tennessee, Texas and Wisconsin.

Property Selection

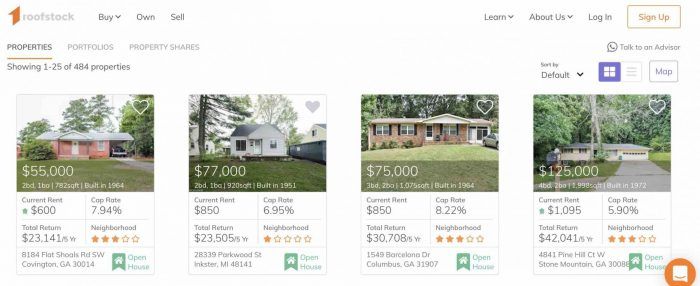

As of the date of the screenshot below, Roofstock had 345 investment properties listed for sale. You’ll notice the majority of properties are priced at under $200,000.

The platform is set up to make it easy for you to isolate the type of property you want to invest in. It gives you parameters based on list price, monthly rent, and state of location. If you choose, you can also get more specific information, such as neighborhood rating, school rating, year built, minimum square footage, occupancy status, Section 8 eligibility, and location in a homeowner’s association.

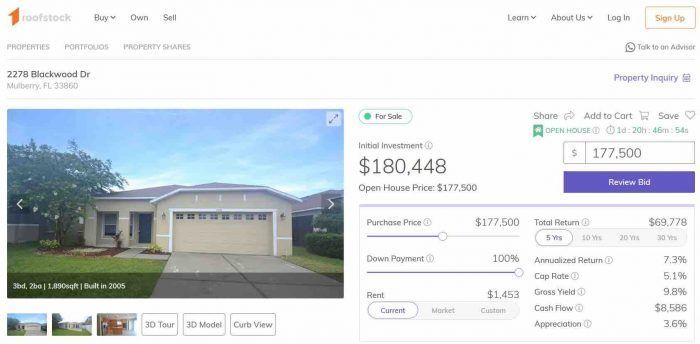

When you select an individual property, you’ll be given a highly detailed report on each property that will include the specific financials for the home. You’ll also have access to pictures, floor plans, 3D tours and models, property inspections and valuations, title reports and insurance quotes, current leases, tenant details and payment history, and interactive tools for visualizing return and cost estimates.

They’ll also provide local property management options, which will help anyone who plans to purchase an investment property in a non-local market.

Once you decide to make a purchase, you can make an offer on the property. Roofstock will charge a fee equal to the higher of 0.5% of the contract price or $500. You’ll have an opportunity to either make a full price offer, and complete the purchase immediately, or negotiate for a better price.

Roofstock will help you finalize the purchase, offering providers for financing, insurance, and property management. They have a service and transaction team to guide you through the closing process, until the purchase is finalized.

They advise that an all cash deal typically takes 15 days, but one with financing will generally take 30 days.

Financing

If you need or prefer to use financing to purchase investment properties, you can get it through the Roofstock platform. Roofstock doesn’t provide direct financing, but they work with several mortgage companies that do. There are different loan programs available, and they do offer prequalification.

The obvious advantage of using financing is that you can purchase more properties than you can with all cash transactions. In addition, financing involves leverage and that can increase your returns.

For example, if you purchase a property for $100,000 all cash, then later sell it for $150,000, you’ll have a 50% return on your investment. But if you finance the same property, and make a down payment of 20%, your actual cash invested will be $20,000. That will produce a return on investment of 250% (the $50,000 profit divided by your $20,000 down payment).

You also have the option to obtain financing on your own. But that may be difficult to accomplish if you’re purchasing a property outside your own local market.

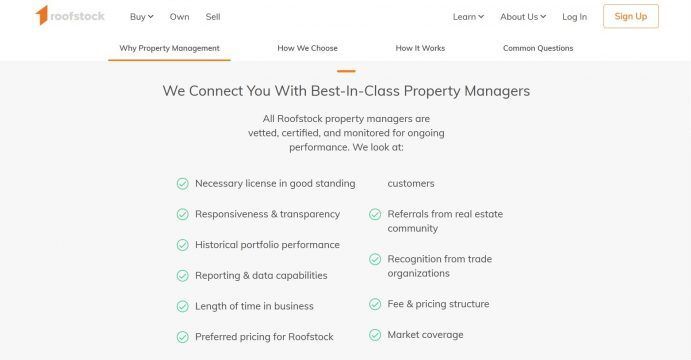

Property Management

Since many investors will buy properties in remote markets, Roofstock places special emphasis on helping you to select the best property manager. That will enable you to own the property, without needing to be involved in the day-to-day details of managing the property. For a small percentage of the rent income on the property, the property manager will handle it all for you.

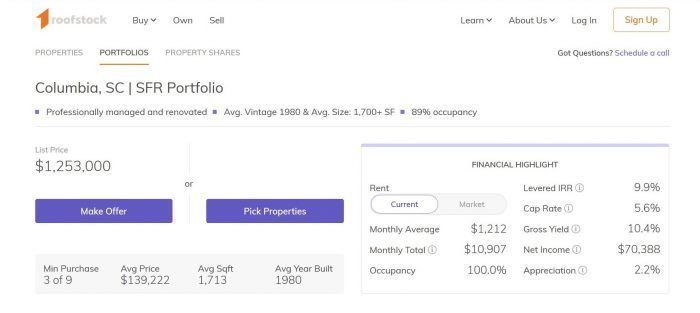

Roofstock Portfolios

Roofstock doesn’t just offer individual property investments. Roofstock Portfolios enable you to diversify your holdings across several different rental properties with a single investment. This will provide instant diversification, and lower your risk of taking a loss on any single property.

Roofstock currently offers 25 portfolios ranging in size from two properties to more than 100.

Roofstock Property Shares

If you don’t want to invest in individual properties, you can go a more real estate crowdfunding related route with Roofstock Property Shares. You can invest with as little as $5,000 into a diversified portfolio of fully managed rental properties.

This is a new offering, and it does require accredited investor status for participation.

Roofstock for Investment Property Sellers

Since Roofstock is an investment real estate marketplace, investors can also sell their properties through the platform. Roofstock charges a fee of the greater of 2.5% of the sale price or $2,000. You should generally expect it will take between 15 and 35 days to get the property listed. And while you will ultimately set the sales price of the property, Roofstock will provide tools and resources to help you determine the appropriate market value.

In exchange for the fee, Roofstock will market the property to a large network of both domestic and foreign real estate investors. That includes gathering property information and creating an attractive listing. The entire transaction will be completed through the platform, which means you don’t need to get involved in the details of the sale. There’s no need to place a yard sign in front of the property, hold an open house, or get involved in showings.

Signing up with Roofstock

Signing up with Roofstock is free, as is using the platform. You only pay a fee when you buy or sell a property.

You can sign up by completing the brief online application, or with either Google or Facebook. You’ll enter your name, phone number, and email, then create a password. You’ll also be asked if you want to buy or sell properties, or invite clients as a broker or agent.

You won’t be required to deposit any funds with the platform. However, you will need to put a credit card on file. This is required to assure property sellers that you’re serious about making an offer. Also, if your offer is accepted, your card will be run immediately to make sure you don’t lose the property from someone else coming in with a better offer. Once your marketplace fee (0.50%) is paid, the property is taken off the market.

Customer contact is available by phone, in-site email, and live chat. No indication is given on the days and times of availability.

Why Invest with Roofstock?

Roofstock offers an opportunity to invest in individual properties, rather than in real estate investment trusts or crowdfunding shares in loans. You’ll be the sole owner of the property, as well as the sole beneficiary of both rent income and capital appreciation upon sale. That will give you complete control of the investment process, but with the assistance of professional property management.

The ability to invest in properties in remote markets is an especially important advantage. Many investors live in markets where rental real estate is not performing particularly well. But Roofstock provides an opportunity to participate in better performing markets. Properties presented for investment generally have high rents compared to their purchase prices. That creates greater opportunity for both positive cash flow and long-term capital appreciation.

Roofstock Guarantee

All properties come with a 30-day money back guarantee. If you’re not satisfied with the property purchased, Roofstock will start the refund process as long as you contact them within 30 days of closing. The property will be relisted for free on the platform. When it sells, you’ll be refunded the original purchase price, even if it sells for less than you paid. If the property doesn’t sell within 90 days, Roofstock will buy back the property.

Guaranteed Rent

If the property you purchase is vacant, you’ll receive rent payments starting 45 days after closing, and up until the property is leased. Rent paid will be equal to 90% of the estimated market rent value. Monthly property management fees are waived during the guarantee period.

Roofstock Pros and Cons

Pros

- Unlike many real estate crowdfunding platforms, Roofstock does not require you to be an accredited investor to participate.

- You’ll have direct ownership of individual investment properties, which you can choose to purchase either all cash or with financing.

- The platform enables real estate investors to diversify holdings across different states and individual markets.

- It’s perfect for real estate investors who don’t want to get involved in the day-to-day management of their properties.

- Investments can be either bought or sold on the platform. This is a departure from real estate crowdfunding platforms, which typically don’t permit early withdrawals from an investment.

- Roofstock offers a low-cost way to both buy and sell investment real estate. And other than when you buy and sell, there are no fees payable to Roofstock.

- You can invest in Roofstock through certain IRA and Solo 401(k) plans.

Cons

- The platform is best suited for those who have experience with real estate investing. The main purpose of the platform is to enable you to diversify across different markets, as well as simplify the management process. It doesn’t remove the need for real estate investment knowledge.

- Though there is no minimum required investment, it can require a substantial amount of cash. You’ll need at least 20% down with financed deals, and 100% on all cash buys.

FAQs

- Question: Can’t I just buy any of these properties through a real estate agent? What about Realtor.com?

- Answer: Actually, no. The properties listed for sale on the platform are exclusive to Roofstock. Sellers list their properties to get the advantage of the very low selling fee (2.5%, compared to 6% for real estate agents). In addition, you won’t have the benefit of the property vetting provided by Roofstock.

- Question: Is Roofstock limited to U.S. investors only?

- Answer: No. Both U.S. and foreign investors can buy and sell properties through the platform. In fact, the availability of property managers makes it a perfect way for foreign investors to purchase and manage U.S. real estate.

- Question: Can I invest through my retirement plan, like a self-directed IRA?

- Answer: Under certain circumstances, you can invest through an IRA or a Solo 401(k) plan. The plan must be linked to a bank account, and provide you with checkbook control to fund the purchase. If your plan requires custodian approval, it’s recommended that you start the approval process well in advance of making any offers.

- Question: Do I need to have experience investing in real estate?

- Answer: It’s not a requirement, but it’s well advised. With Roofstock you’ll be buying individual properties, which is very different than investing in paper assets, like stocks and mutual funds. If you’ve never owned investment property in the past, it’s best to purchase your first investment in your local market. After that, you can consider diversifying to more distant markets.

Should You Invest With Roofstock?

Let’s start with this –Roofstock isn’t for everyone. It’s primarily for investors who want to purchase individual properties, particularly those that are determined to generate strong financial performance and are located in remote markets. It’s a perfect way to spread your real estate investments beyond your local market. That’s important because not all real estate markets performed equally.

But if you prefer more passive investing, such as real estate managed by others, or paper real estate investments, like real estate investment trusts, Rootstock probably isn’t for you.

As well, even though there’s no minimum investment requirement, it is relatively capital-intensive. Whether you make all cash purchases or use financing–which usually requires a minimum down payment of 20%–you’ll usually need to invest much larger sums of money than you will with mutual funds, real estate investment trusts and many real estate crowdfunding platforms.

But if you’re looking to own single-family rental properties outright, and don’t want to get involved in the day-to-day management details, Roofstock is the perfect way to get financially sound properties without “getting your hands dirty”.

If you’d like more information, or if you’d like to sign up to begin investing, visit the Roofstock website.

Article comments