Sofi Loans Review - Compare and Get the Best Loans and Mortgages Quotes

While Social Finance, known as SoFi, started out as a student loan refinancing company in 2011, they have quickly become a lending powerhouse. Today, the company offers financial products for a variety of needs, from their flagship student loan refis to personal loans and even mortgages through the recently launched SoFi Mortgage LLC.

Whether you are looking into this popular lender for a large home improvement project on the horizon, want to reduce your student loan repayments, or need to cover medical expenses, SoFi has you covered. They even offer investment management and life insurance options these days–today, though, we are only going to talk about loans.

SoFi’s options and rates are very competitive, and the company makes it easier than ever to manage your borrowing. Let’s take a look at exactly what SoFi has to offer, the features involved with each type of loan, and who this company caters to when it comes to refinancing and lending.

SoFi Student Loan Refinancing

The first service that SoFi introduced–and the one the company is best-known for–is student loan refinancing.

Their refinancing loans offer to save you both time and money on your overall repayment and are definitely worth a look if you have painful interest rates or still carry a significant balance.

The process for student loan refinancing through SoFi is easy, and approval is immediate. You can have a decision in less than two minutes when you complete the application online, and their process promises to be completely transparent. You can even apply and get your rate options without impacting your credit.

Check-out Some of The Best Student Loans Refinance Offers With SoFi

The Application Process

Applying for a student loan refinance through SoFi is pretty straightforward. You’ll be pre-qualified online in two minutes or less and offered a refi interest rate, all without impacting your credit.

You’ll need some pieces of information to start the rate-shopping process. This includes your:

- Name and address

- Date of birth

- Email address

Once you enter this information, you’ll also be asked to add an account password. This way, you can sign in and resume your application or revisit your refi rate, if you’re not ready to complete the process today.

Then, you’ll be asked to provide your:

- Citizenship status

- Homeownership status

- Highest education level completed and degree program information

- Annual income

- Refinance loan amount requested

Once you’ve entered all of this information, you’ll be able to check your refi rate through SoFi. If you like the numbers you see, you can complete the process for the loan on the spot. Before your loan origination is complete, SoFi will also pull a hard inquiry on your credit. This is the first time that your credit report will be impacted throughout the application process, though.

If you want to continue shopping around for rates or aren’t happy with what SoFi offers, then no harm, no foul. You can exit the application (signing back in to complete it later, if you choose) without any impact to your credit or finances.

Fees

There are no origination or application fees involved with your SoFi student loan refinance. Nor are there any fees for prepayment. This means that if you have extra room in your budget–or experience a cash windfall–you can pay off your refinanced loan a little early without any penalty.

The only added costs you will see with your refinanced student loan(s) are, of course, the charged interest on the new loan.

Interest Rates

A student loan refinances through SoFi is essentially rolling a number of smaller loans into one bigger loan, in an attempt to save both money and time across the repayment. And while you can save some serious cash by refinancing through SoFi, you can still expect to pay interest fees over the course of the loan.

Your individual interest rate will depend on a number of personal factors. These include:

- Your credit history (including its length, whether you have any negative reports, and your credit utilization)

- Your existing loans’ repayment history (how long you’ve been paying them off, whether you’ve struggled to pay the minimum due, etc.)

- Your income

- The repayment length you’re requesting with the refinance loan

- Whether you’re applying with a co-signer

Interest fees are available as fixed-rate or variable, depending on your needs and the type of loan repayment you seek. Interest rates are changing all the time, but SoFi currently offers rates ranging from 3.899% to 7.949% for fixed-rate and 2.470% to 7.170% for variable rate loans. Both loan types offer a 0.25% discount for signing up for AutoPay. This is specific to student loans.

The shorter the repayment term, the better your credit history, and the higher your credit score, the lower your interest rate will be. You will also be able to see the interest rates you’re being offered by SoFi before they pull a hard inquiry on your credit report.

Who It’s For

SoFi is an excellent option for refinancing your student loans, but it isn’t for everyone. In fact, some borrowers may have a tough time getting approved for a refinance, until they’ve built up a solid enough repayment history.

If you are a U.S. citizen or permanent resident and have a credit score of at least 650, you’re invited to apply for a SoFi student loan refinance. A credit score lower than that is almost sure to result in a denied application, so you may want to apply elsewhere or work to bring your credit score up prior to submitting an application.

SoFi is also geared to those borrowers who have a proven history of positive loan repayment. If you’ve just recently graduated and only have months–or a couple years–of loan payments under your belt, you’re less likely to get approved. Spend some time building that history and whittling down the balance if you want an approval from SoFi.

Loans are available through SoFi with a minimum of $5,000. If you owe less than that on your student loans, you won’t be able to refinance through the lender.

A student loan refinance from SoFi is also ideal for those borrowers who have high-interest rates on their loans and want to reduce the time remaining on their loan repayment, the amount they will pay in interest, or both. If you currently have loans with reasonable interest rates or are almost finished paying them off, SoFi might not do much good. However, if you are currently paying back loans with interest rates above 9%, or have thousands (or tens of thousands) still owed, you could potentially save yourself quite a bit with SoFi.

Parent PLUS Loans

Parent PLUS loans are a bit tricky when it comes to refinancing, as they are not always able to be consolidated into the same refi as private student loans. With SoFi, though, you can refinance both your private student loans and your Parent PLUS loans in one.

As long as you meet the standard loan criteria set forth by SoFi, you’ll be able to refinance your Parent PLUS loans. This includes being a U.S. citizen or permanent resident, having a job or guarantee of employment in the next 90 days, holding an associate’s degree or higher from an accredited university, and meeting minimum income-vs-expenses requirements.

Residency Student Loans

SoFi has, in recent years, begun offering residency student loan refinancing, which wasn’t previously available. So, if you are a dental or medical school resident and have at least $10,000 in student loans to repay, you can apply for a SoFi refinance loan.

You can have up to four years left in your approved residency program and still be eligible to apply. You must be a U.S. resident or permanent citizen with at least two years left until your status expires. You must also have graduated with an MD, DO, DMD, or DDS from certain U.S.-based Title IV accredited universities or graduate programs.

Underwriting requirements still apply for residency loan refinances. Your income, expenses, employment, and credit history will be taken into account, which will impact both your approval and the interest rates offered.

SoFi Personal Loans

You might consider a personal loan for a number of reasons. There might be a big home improvement project on the horizon, you may want to embark on a new business venture, or even just plan an exciting wedding or family trip. Or, if you’re currently paying off high-interest debt (such as credit card balances), a personal loan could be a way to both eliminate that debt and reduce your interest rates at the same time.

Whatever the reason may be for needing a personal loan, SoFi might be able to offer you the right loan at the right rate… and the process is a piece of cake.

The Application Process

The process of applying for a SoFi student loan is quick and easy. Just like the student loan refi above, the personal loan application process can be completed online in mere minutes, all without impacting your credit.

When applying online, you’ll need to provide a few pieces of personal information. This includes your:

- Name

- State of residence

You’ll then be asked to add a password, so that you can revisit your loan application (and offer) later on.

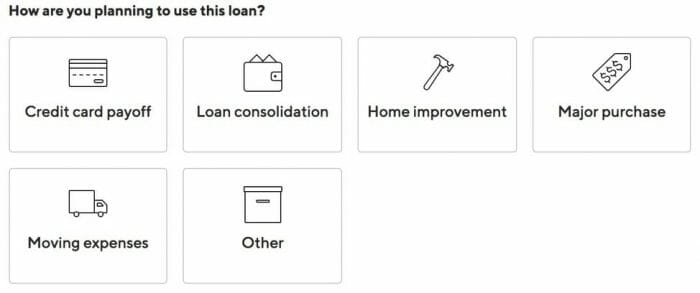

Next, you’ll need to let SoFi know how much you want to borrow and why. Personal loans are available in amounts ranging from $5,000 all the way up to $100,000, depending on whether you qualify.

Give it a Try! Finance Your Goals With SoFi Now

You’ll also need to give your date of birth and citizenship status. Next up is your personal information–your address and phone number, whether you’re renting or own your home, your annual income, whether you’re applying with a cosigner, and an acceptance of SoFi’s terms.

SoFi will then run a soft pull on your credit to determine eligibility and offer you a rate. This won’t impact your credit at all. If you choose to accept the offer and proceed with the loan, though, they will also conduct a hard pull (which will show up on your credit report).

Fees

There are no origination or application fees with SoFi personal loans. You also won’t encounter any fees for prepayment. This means that if you choose to repay your loan early for any reason, you won’t be penalized for doing so.

The only fees you’ll encounter with a SoFi personal loan are your interest charges.

Interest Rates

As with all loans, interest rates will vary depending on the loan requested and your own personal creditworthiness. As of this writing, SoFi’s personal loan interest rates vary from 6.54% to 15.49% APR. A discount of 0.25% is also available for those borrowers enrolling in AutoPay.

Your own personal loan’s interest rate will depend on:

- The loan amount requested

- The reason for your loan

- Your personal credit history

- Your income versus your monthly expenses (cash flow)

- Whether you have a cosigner

- Your credit score

- The loan repayment term you request

The better your credit, the higher your credit score, and the shorter the loan repayment you choose, the better your rate will be. Adding a cosigner can also help lower your rate, as can signing up for AutoPay.

Who It’s For

As with all SoFi loans, you’ll have a better chance at approval if you have a solid credit history and income.

SoFi applicants are required to have a credit score of at least 650, with the average borrower having a score of 700+. SoFi also looks at your cash flow, as opposed to only looking at your income. So if you have high expenses each month and not much wiggle room in your budget, you might have trouble getting approved.

SoFi Mortgages

SoFi might not be the first lender you think of when buying a new home, but their mortgage options are quite enticing. For example, you can get a home mortgage up to $3,000,000, for as little as 10% down… and, you don’t even have to worry about PMI.

The Application Process

Whether you’re already house-hunting or just want to know what you can afford, SoFi can make the application process easy.

You can get pre-approved for your next mortgage online in as little as two minutes, without any impact to your credit. SoFi’s easy online application will also offer you rates and mortgage terms, so you know exactly what you’re looking at with your home purchase

To start, visit SoFi’s website and start a home mortgage application. You’ll need to provide your:

- Name

- Email address

- State of residence

You’ll also be asked to create a password. That way, you can revisit your application or complete the loan process later on, if needed.

Next, SoFi will ask you for your:

- Address

- Phone Number

- Date of birth

- Citizenship status

- Whether you rent or own your home

- Acceptance of SoFi’s terms

- Education info

- Income

- Employment history

The next step is your mortgage eligibility. For this step in the process, SoFi wants to know:

- Whether you’re buying a new home or refinancing your existing home

- The property type

- The occupancy

- Where you are in the process

- County and state of the property

- Homeowner’s dues

- Marital status

- What you plan to do with your primary residence

- Number of occupants in the new home

- Co-applicant info (if applicable)

Once you submit all of this information, you’ll be offered rates and a pre-approval. You can choose the mortgage repayment terms that most appeal to you, as well as your down payment preference.

This will result in a soft pull on your credit, which won’t impact your report in any way. However, if you proceed with the loan, SoFi will also conduct a hard pull, which will show up on your credit report.

Fees

There are no application or origination fees involved with SoFi mortgage loans.You also won’t encounter any fees for loan prepayment. This means that if you want to pay off your mortgage early, you won’t be penalized.

The added costs that could be involved with a SoFi home mortgage include:

- A down payment (as low as 10%)

- Property appraisal

You’ll also pay extra fees for interest charges over the life of the mortgage.

Interest Rates

As with all mortgages, SoFi interest rates can vary quite a bit from one applicant to the next. They are calculated based on a number of factors, including your credit history, credit score, income and monthly expenses, whether or not you have a co-signer, your chosen mortgage terms, your down payment, the loan-to-value ratio of your home, and your employment status.

Interest rates change all the time. Currently, though, SoFi offers 15- and 30-year mortgage terms, as well as 7/1 ARMs and 5/1 ARM Interest-Only loans. Rates range from 4.716% to 5.249% APR.

Who It’s For

There are a few great reasons to choose SoFi for your home mortgage, as well as a few reasons to look elsewhere.

SoFi might be a good place to apply for your next home mortgage if you want to:

- Get pre-approval that doesn’t impact your credit score

- Buy a home with a price tag of up to $3,000,000

- Want the flexibility of a down payment as low as 10%, without PMI

- Want approval in as little as 2 minutes

- Have a credit score of at least 650 (ideally 700+)

- Close on your new loan in less than 30 days (on average)

However, if you have a less-than-desirable credit history, have cash flow problems each month or an unstable employment status, are not a U.S. citizen or permanent resident, or are looking at buying a rental property, SoFi isn’t the place for you.

Mortgage Refinance

To refinance a mortgage through SoFi, the application process is identical–you’ll simply choose “refinance my existing home” on the third page of the application, instead of “buy a new home.”

Refinanced mortgages are available to borrowers with at least 20% equity in their home. They also offer a cashout refinance, if you want to use your home’s equity for home improvements, to pay off other debts, or for a big purchase.

The House of Your Dreams? Make Your Dream Come True With SoFi

Is SoFi Right for Me?

No matter what type of loan you’re looking for, give SoFi a look. You’ll find student loan refinancing, mortgage loans, mortgage refinancing, and even personal loans–all fee-free. More than that, though, you can get your rates and a pre-approval offer without impacting your credit.

SoFi doesn’t have fairly strict guidelines regarding borrower’s credit and cash flow. You’ll want to ensure that you don’t have negative reports on your credit and a score of at least 650, though 700+ is ideal. Also, your income-vs-expenses ratio is even more important than your income alone, although the average SoFi borrower has an income of at least $100,000.

Rates through SoFi are very competitive and terms are flexible, offering you loans that meet your needs without fees or unnecessary expenses. Plus, the application process takes about two minutes to complete.

If you want to learn more about SoFi products or apply for a loan, you can do so here.

Article comments