EverBank Money Market Account Review

A little while ago, I noted the interest rates offered by EverBank and decided to open the Yield Pledge Money Market Account to take advantage of the generous “bonus” interest offered in the first three months of holding an account. The account opening process, beginning on July 8th and two weeks later on July 23rd, was more of a chore than I planned, but there is an explanation for most of my dissatisfaction.

Initial online banking application

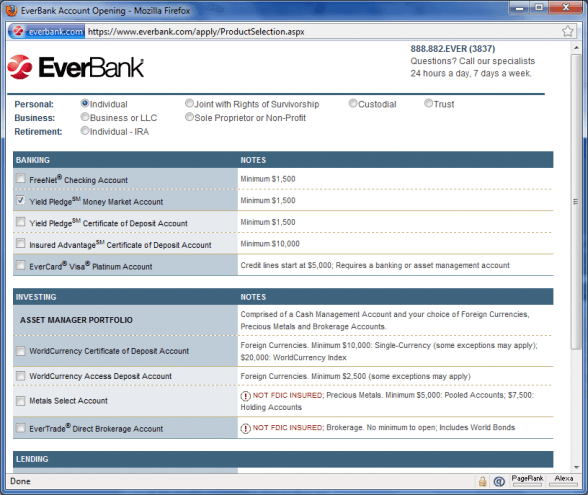

The beginning of the process was much like that for any other bank. I visited EverBank.com and proceeded to apply for my account online. The first step was to choose the account type. Everbank offers a number of products, including a money market account, a checking account, certificates of deposit, credit cards, and investment accounts. I like starting small, so I chose the aforementioned Yield Pledge Money Market Account, noting the $1,500 minimum deposit required to open the account. (Many online banks do not have any minimum deposit requirement.)

Banking Deal: Earn 1.55% APY on an FDIC-insured money market account at CIT Bank. See details here. CIT Bank. Member FDIC.After choosing the account, I provided my personal information. EverBank asked for the same information I usually see on other banking applications including Social Security Number and my mother’s maiden name as security measure. I was also asked to provide an additional security code and hint.

Everbank asked for my employer’s name and phone number, though they offered alternative responses such as self-employed, retired, homemaker, and student. I could not choose both self-employed and name an employer, so I named the company I work for during the day. Questions about employers are occasionally asked on banking applications, so this did not raise any concerns.

The next step required a credit check. Applicants can choose whether to allow an instant credit check during the application process or to delay this part of the process. I was anxious to begin banking quickly, so I authorized a real-time credit check. In order to further validate my identity, a number of questions were generated based on the information on my credit report and I answered all to satisfy EverBank’s requirements. Though I am starting to forget old addresses, employers, and loan issuers, I succeeded in answering the questions correctly. This is a common method for proving identity.

Funding options

Having satisfied all of EverBank’s curiosity, or so I believed, I was offered with the options for funding my account. My initial $1,500 could be deposited with a written check or by bank wire. There were no ACH or EFT options provided to me. This would be explained to me later, but at the time of application, I was disappointed.

With modern online bank accounts, I expect technology to provide me with instant options. I expected the entire account opening process might take three business days at most, with the bulk of that time spent waiting to verify an external account for transfers.

I chose the check option, and wrote a check from my personal account. Note that I wrote the check for $1,500, the amount listed as the account minimum. If my average balance were to fall beneath this amount during any month, I would be charged a fee. I know this because EverBank required me to agree that I read about their rates and fees before continuing. Keep this in mind for later.

EverBank asked me whether I’d like to print the application or received an application in the mail within five to seven days with my information pre-filled. Again, this was too much paperwork for what is supposedly an online bank account.

Filing the application and troubleshooting

On July 12, four days after beginning the process, I received the pre-filled application in the mail. I signed and dated the documents, included my check for $1,500, and mailed the package back to the bank. I received no further communication for more than a week, when on July 20 I received an email to let me know that my application was received and my account had been opened, but I would not be able to access my account until I received a second package from the bank in the mail to welcome me as a customer.

After receiving this email, I expressed my disappointment with the account opening process here on Consumerism Commentary. This article attracted the attention of the bank, and on July 21, the same day I posted the article, I received an email from the Vice President of EverBank in charge of “acquisition marketing” at EverBank. He was concerned with the delay I was experiencing and he said he would look into my application to determine if there was a problem.

The next day, we spoke on the phone. This was Wednesday this week. He explained that my credit report showed that there is a business registered at my mailing address. Although there was a typo in the name of the business, there is certainly a registered business here, representing this blog and other internet development work. As I signed up for a personal account and there was a business associated with my address, that produced a red flag.

Due to the fact that my address is “mixed-use,” I was not able to take advantage of the ACH initial funding option or electronic signatures. According to the VP, most new account holders will not have to go through the lengthy process that I experienced.

I would be interested to hear from those who have had a smoother experience opening and funding their account. I do have to wonder whether I received attention from the bank that other customers without popular personal finance blogs might not receive. This story is not yet over, however.

Accessing the money market account

I received the welcome packet last night and used the information provided to access my new money market account online. Once logged in and viewing my balance, I immediately double-checked the fee schedule to ensure I would never be charged fees for maintaining this account. To my surprise, the minimum average daily balance for the Yield Pledge Money Market Account was now $5,000 instead of $1,500!

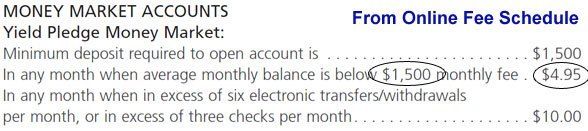

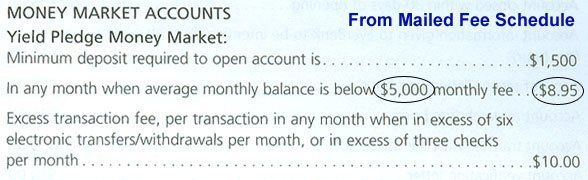

The welcome packet I received contained a schedule of fees that does not match the schedule online, which I linked to above and will link to again. At the time I am writing this — because anything can change — the PDF linked here lists $1,500 as the minimum average daily balance required to avoid a $4.95 monthly fee. The document I received in the mail lists $5,000 as the minimum average daily balance required to avoid an $8.95 monthly fee.

I hope that the mailed schedule of fees (with the higher minimum balance and the higher monthly fee) is older than and has been superseded by the schedule I see online. Here is visual proof of this discrepancy.

Does anyone else see the problem here? I’m preparing this article, like I do many for Consumerism Commentary, in the middle of the night. It’s unlikely that customer service is available to settle the dispute between documented fees, but I will update this article once I receive an explanation. Note: I have included an explanation at the bottom of this article.

Linking an external account for transfers

Anxious to ensure I was avoiding a fee for using an account in a banking environment in which it is so easy to find fee-free money market accounts, I immediately began configuring a linked external bank account to transfer $3,500 more into my EverBank money market account, which was looking decreasingly like a good account to maintain. I chose to set up a link between EverBank and ING Direct.

There were two options to create this link. I could either enter my ING Direct login information or wait for EverBank to deposit two small dollar amounts into the ING Direct account which I could then verify later. I chose the instant option, but ING Direct did not accept my login information as I entered through EverBank. I think this is related to ING Direct’s security policy that restricts other applications, like Mint and Quicken Online, from linking to ING Direct. (You can hear ING Direct’s chief operating officer Jim Kelly explain this on this coming Sunday’s Consumerism Commentary Podcast).

I resorted to linking the account via the slower deposit verification method, and it will be a few days before I can complete the process of adding to my balance.

Conclusion, thus far

I decided not to wait for the final transfer before writing this review. While I understand that it is possible that having a business registered at my address will raise warning signs to the bank I realize that EverBank’s anti-fraud policies have been successful for the company, the process has been inconvenient overall.

If you have experiences with EverBank, whether positive or otherwise, please feel free to share.

Update: Explanation of the minimum balance and fee discrepancy

On July 8 when I first accessed EverBank.com and began my application for the Yield Pledge Money Market Account, I was re-routed to a back-up or redundant server, and that server had not been updated with the latest fee schedule. With my luck, I managed to access the redundant server when I activated my online access as well. Perhaps this is due to my tendency to work late at night when redundant servers are more likely to be active while the main production servers undergo maintenance.

It was actually this post that brought the issue to the attention of the server administrators at EverBank. At 1:00 pm on July 24, the back-up server was updated to link to the new fee schedule, which includes the minimum $5,000 average daily balance and the $8.95 account fee.

Article comments

Am from Kenya I was introduced by afriend of mine about everbank,idecided to join the bank through refferals after some days they promised to give me daily bonus of percentage I invested,of course they did as they promised but you cannot transfer your money from their account to my account..(if you withdrawal money the transaction is completed but no money credited in my account) to those who knows this bank can they be scummers or frouds???

Hi Everyone, I’m putting some feelers out there to see if there’s anyone interested in making a pretty substantial amount of cash in a short amount of time. Only thing this requires is that you have an active bank account or credit card. No cash is required up front to start. Which means your account can be on a zero balance and that’s completely fine.Text +1(314) 856 1730, lets talk about the next deal

I’m trying to open an Everbank CD but when almost finished with the application process, I got a message saying they have an error and cannot complete or something like that. I emailed them, they emailed back saying they can’t discuss secure info in an email. I only wanted to know what’s the problem, not discuss secure info. Plus they now have the last 4 digits of my SSN, my signature which I sent electronically, my bank account #, routing info, etc. Today I tried to access my application on their site and they wanted the FIRST 5 digits of my SSN. REALLY? When they said the last 4 were only for ID purposes and they wouldn’t share it? So they want my WHOLE SNN now? I don’t want to talk to these people on the phone, I wanted a quick process at their 1.95% CD rate. By today the rate’s down to 1.95%. I’m uneasy that they have so much of my information. Now what??

I don’t think this “business at your address” issue is true. I just opened a CD there and a check or wire was the only option. I am not going to bother with all the paperwork. It’s not worth it.

My Neverending Everbank saga (March 2016).

Well it appears funds can be sent electronically to fund yield pledge money market accounts now, but that doesn’t mean the process works smoothly. The security check questions seemed to be more lengthy than other banks, but these were answered correctly (although one question referred to an event 15 years ago which I thought was excessive- to each his own).

I’m now into day 10 of the account opening process- still no account number, but I did receive 3 emails saying they are working on it and I will hear back soon. After a week passed I e-mailed them asking why the delay and received a reply 3 days later… call us. So I did. The call center person was very friendly and then admitted- wait for it- the account opening team had not begun processing my application. WTF?!? UFB direct is now my preferred option and I’ll be cancelling my Everbank application tomorrow.

FYI the foreign currency CDs… what Frank says above is nonsense. You would have to have rocks in your head (or be doing something extremely dodgy) to invest in these with the garbage exchange rates and added fees.

Thanks for what you do. You have saved me some effort. I was about to embark on setting up a substantial, new money market account under the Everbank Yield Pledge imprimatur. Your comments and those of others have dissuaded me. I have a large money market account with Sallie Mae that was a breeze to set up entirely online compared to what I have read about the process at Everbank. By comparison, Everbank is not truly deserving of being called an online operation. It is, at best, some kind of hybrid of online and USPS!

just curious. Has anyone ever made money with ever Bank’s CDs or the gold CDs or the energy CDs.

I APPLIED AT EVERBANK TOO, AND STEP BY STEP MY ACCOUNT HAS FOLLOWED THE SAME PROCESS. I JUST WANT MY MONEY OUT .EASIER SAID THAN DONE. ITS BEEN 6 MO. SINCE I ASKED FOR A WITHDRAWEL AND NOW NO ONE CAN FIND ACCOUNT!IMAGINE THAT!

Everbank is probably one of the worst banking institutions one could deal with . I am in the finance industry and got scammed into doing a HARP11 on an investment property. Rate changes at closing and the $3599 promised to me for the escrow return was promptly and wrongfully pocketed after the closing. This was verified by my own attorney and confirmed it would be returned. I wrote to the CEO and got a form letter back telling me in fifteen days I would hear something and if a more complex issue thirty days. Enough is enough. Anyone having issues with this institution should explore a class action lawsuit and or file with the CFPB. This is a government watchdog for the finance industry that goes after monsters like this that violate the banking laws. The are money driven and I believe this is a perfect instance. They violated RESPA. These laws are not elastic, and the CFPB doesn’t even answer to Congress.

I don’t have any money to move around; however, I do have an opinion about Everbank. We bought a house from Everhome/Everbank a few years ago. After receiving a letter from them stating they made a mistake in our escrow calculation, they foreclosed on the property. This is still going thru the final stage of the Independent Foreclosure Review process. TAKE YOUR MONEY AND RUN from this company!!

I heard about Everbank from The Apogee Advisor which is part of Argon Financial. Everbank seemed like such a creative alternative to other banks with some different types of investments. But I really do not want to get tied up with the apparent slow banking system as reflected by some of these reviews on Everbank.

I’m a new Everbank customer and am finding that every step of the way, there has been a problem. They “hold” money over a certain amount for five business days minimum, even though it was withdrawn from my other bank already. They blame it on the clearing house. Yes, those electrons take a long time to get from my other bank to Everbank. Some of their phone reps are pleasant, but mostly snotty with a “screw you” attitude- “that’s the way we do it- you should have read the terms and conditions” as I was told. Everbank truly does suck and I’m profoundly sorry that I ever went through the nightmarish process of opening accounts with them. Beware- they are everything you don’t want a bank to be. I will be gone soon.

We, too, are new to EverBank, and hoping for the best. As others have stated, we were not able to do ACH transfers to open the accounts which slowed down the process. We filled out applications on line, signed them and mailed them with our $5,000 to open the account (to avoid monthly fees). We are also trusting that EverBank will continue to offer higher rates than other banks. If not, our accounts can be closed even faster than they were opened. We also use Ally Bank and the Customer Service and ease of opening an account and making transfers is so much easier and customer friendly.

I signed up for an online money market account and ran into the same problem everyone else had of no ACH transfer option. In my case, I called the bank and was told I could specify “check” on the application, but once the account was setup, I could switch to ACH transfer and do my initial deposit that way.

I do have one question , though. I received my information packet and it included several blank checks to use with the account. I never requested or ordered these blank checks, and I actually have no need for them. My only use for the account is to park my money there for six months to earn the bonus rate. Does anyone know if I will be charged for these blank checks?

Does EverBank require an external bank account to make a deposit to open an account?

I went thru the same as you but never went as far because I was trying to open an account for my liiving trust. Their info requirements included providing the entire trust documents not the first & last pages which include that it revocable and signature w/dates & witnesses which is requirement by most institutions. According to my attorney they have no legal right to request the entire document which included schedules of assets and beneficiaries of the trust and is none of their bloody business.

Big Brother has way too much info on us without us voluntarily giving them everything!

Thank you for the detailed review!

I was going to open an account today, this review was very useful and saved me from some major aggravation.

By the way one of the questions to open the account is : where did you hear from us?

Well Everbank, I heard about you from The Sovereign Society, that obviously has some major interest in the Bank.

Shame on you Sovereign Society for your lack of objectivity and recommending this Everhassle Bank!

I don’t think Everbank’s main goal is to provide premium money market returns. The reason I bank with them is that they have a lot of innovative products which let me do brokerage, hedge my cash with foreign currency CD’s, buy physical metals, etc. Frankly, I don’t mind a relatively cumbersome account activation process if it seems as if they are covering their (and my) collective arses. Just a thought.

Glad I read this. A friend told me about EverBank and I wondered about their fee schedules. I too shall pass.

+pb

I have had an Everbank account for a while and am very satisfied with the service, phone support, and excellent foreign currency options that I can’t get anywhere else that I am aware of. My concern is for the safety ratings. In January the Weiss Safety Ratings dropped from C to D-. I hope that this is temporary and that a new improved rating will be out at end of this quarter, which is the end of March. Does anyone have more information about this? I wasn’t able to get other info from the Bank. I am impressed that the president, Mr. Frank Trotter, took the time to respond to others on this site. I hope to finally get some answers as I really like this bank and want to continue doing business there.

I have my sig card and check filled out for Ever bank but I keep hesitating against it… Keeping 5000 in my account to avoid fees seems very high to me. Such a prob getting things started with them also. Also I am having problems with one thing. The check is to be made out to Everbank not me (beth) is that strange ?????? anyone else find that a little weird.

In searching for high yield cash options, came across Everbank. Thanks for the review. I’ll be interested to compare my experience with yours. The rates are the best I’ve found today.

Wow. And to think that this is my first exposure to EverBank. I’ve been seeing that they have good rates, but thought “I’ve never heard of this bank.” Unfortunately for EverBank, yours was the first review I found. I will probably still take advantage of their rates, but am thankfully forewarned of the headache I shall be expecting to endure.

Thanks for the information on EverBank! I’m currently researching them against ING and Ally Bank. Ally is winning in most categories, but what I really like about EverBank is their “pledge” that their rate will always be in the top 5% of “competitive” products.

I think I’ll go with EverBank and hope for the best. Hopefully after the initial sign-up process things will be smooth and my rate will always be in the top 5% of other savings/money market accounts. I’m looking at the long term, since I don’t feel rate chasing is worth it.

You helped me to make my decision to use EverBank after researching all options and reading the many blog entries. Thanks.

Everbank has been nothing but problems for me and my mother. We both have separate accounts with Everbank. However, I also have a Power of Attorney on file with EverBank that allows me access to everything my mother owns aka a Durable Power of Attorney. After the POA was on file for about a year I called to set up some CDs for her. They pulled up the account and the POA and we discussed my options. I faxed in the paperwork to move some money from the MMA to some CDs, my mother signed the paperwork herself. A couple days later I called to inquire as to the status of the application. They said they had the POA but some paperwork the bank required had not been filled out thus they would not allow me to do anything with the account. This is likely not legal in light of Bank of America’s loss in court concerning this matter:

http://www.ncestateplanningblog.com/2009/11/articles/estate-planning/bank-of-america-liable-for-failure-to-honor-power-of-attorney/

Anyway 4 days later and still no CDs have been set up. All they had to do was move it from her Everbank MMA to the CDs. My mother and I have spoken to them at length about these problems to no avail. I have never been so frustrated with a bank in my life. Their CSR’s are rude and even the supervisors were no help. I would recommend avoiding this bank. It is doubtful we will stay with Everbank past the maturity of the CDs, that is if they ever even open the CD accounts as we instructed. If not then we can get rid of them that much quicker.

Dear Call Me Bill –

We take a proactive stance on customer service. When we see an issue like yours in social media we take action. Please reply privately to my email address and we will provide someone to follow up on your issues.

Frank Trotter

President – EverBank Direct

Frank,

This is the first time I have posted on this site but I am unable to find your email address to reply to. I just checked back here because just yesterday I decided we would finally fill out the forms that you require to add a POA. As you know the form is not a POA form but you must use the Add Account Holder form and modify it by marking through the incorrect portions because you do not have the proper form. Well because of this there are questions I have about how to fill this out correctly. I called and asked for a Supervisor because I keep getting so many different and contradictory answers. One of the questions I had pertained to “account numbers”. It seems simple enough right? Wrong. First of all there are 5 accounts which I could just list. However I was told that future accounts we might open (for instance more CDs because we are laddering) would require this form to be filled out and mailed all over again for EVERY new account. Do you see how this bypasses the whole point of a POA? She stated that if we wrote “all accounts” that would only apply to curently opened accounts. I was also told that entering “all current and future accounts” was not acceptable. Well I found that unacceptable, the last straw, so I hung up on her out of frustration. Then I proceeded to move all her money out of Everbank save the CDs (because of penalties) and I stopped her monthly deposit to Everbank. Unless something drastic changes the CDs will be transferred out at maturity. I also have an account with Everbank and I have been looking for another bank due to these issues. I remember when Everbank had good customer service because I have banked there for quite some time.

Everbank will not accept my POA unless I add my agent to my account. This is their rule and not required by law. My agent and I do not want a joint account so I am closing my Everbank account and using a bank that is less overbearing.

A week back, I went through a part of Everbank’s sign up process in the hopes of transfering my money. I actually didn’t mind the credit check and the request for employment details, even though it seemed like overkill just for setting up an MMA to handle my money. (If anything, they should provide me their credit ratings to indicate that they are qualified to handle my money!) But I became concerned when they did not have the linking up of an ACH account as part of the sign up and initial funding process. The only way I could fund it was to send a check or wire the money. That was a red flag.

So began a more extensive research on this bank — visited several sites, read hundreds reviews by different people. Reviews dated 2006 and before were overwhelming positive, while more recent reviews were overwhelmingly negative. Shoddy customer experience seems to have been the norm with them for the past few years — in the MMA/CD-type accounts as well as in mortgage accounts. Many reported experiencing a horrid sign up process. I counted at least two dozen ’stay away from Everbank’-type warnings recorded just within the past year. In short, Everbank’s customers are screaming Buyer Beware. In the end, I decided to heed their suggestion and not to sign up.

Though my money earns less now, I decided that the additional few decimal percents was not worth all sign up and customer service hassles that seems to be the norm with Everbank. At this day and age, any bank that does not allow the setting up of an ACH account during the sign up process seems suspicious.

If banks can sign me up for a credit card account with over $20,000 of their money, effect balance transfers in less than 10 days and send me the card in less than a week, surely they should be able to do better when dealing with my money. Everbank’s shoddy sign up processes and shoddy service strike me as designed and intentional incompetence to milk customers in every little way they can. How such a bank has been well-rated by some sites is beyond me. I suspect that some of these reviews were posted by Everbank’s own people as someone suggested.

I’m posting this here so some may potentially benefit off of my research — hopefully, it will at least minimize the amount of research for some.

Everbank is legit although antiquated in their processes. They are the only bank I know of that you can invest in foreign currency and yet remain FDIC insured.

Read the fine print of that BRIC CD though. It’s true that you will get your full deposit back if the foreign currencies lose money. But once you open that CD, your money is committed to the full term. They reserve the option to deny you an early withdrawal.

Two more things about Everbank:

1) watch out for the way the returns are calculated on the BRIC CD. They take an average of how the currencies are doing vs. the dollar every six months, and your final payout is based on this average after 3 years. For example, say the BRIC currencies go up 2% every six months, so after 3 years the index is up approx. 12% vs. the dollar. Your payout on the CD is only 7% (the average of 2, 4, 6, 8, 10, and 12%). Very tricky and not well explained.

2) Everbank foreign currency CD’s have horrible exchange rates. Depending on which currency you look at, expect 2-4% off the market exchange rate. There are other ways to invest in foreign currencies that don’t rip you off as much. Do you homework, and buyer beware.

Dear Don –

I would like to make a technical correction and make a comment.

1 – The BRIC CD’s are in fact calculated on a point to point basis. For a look at all the the terms and conditions for MarketSafe(r) CD’s click “MarketSafe Product Term Sheets” in the right bar of this page: http://www.everbank.com/001CertificatesMS.aspx.

2 – As to conversion rates we feel that they are amongst the best available to investors in the marketplace. Per our disclosures EverBank does not have a “2-4%” variance from market rates but in general conversions are in the range of 0.75% even for very small amounts. We also provide depositors with the opportunity to wire in the foreign currency if they feel they can obtain better conversion rates elsewhere.

Please feel free to email me directly if you have further questions.

Thank you

Frank Trotter

President – EverBank Direct

Frank, if what you say is true why all the secrecy about what you call Market Rate and Spread??

Frank

Hope you got the message of people who were thinking of becoming customers of EverBank. I wouldn’t become a customer until the bank waives the monthly fee with minimum balance and eases the business process.

I was plan to open account and backed off after reading user experience

Mitel

well, at least now i know this bank is legitimate. i received an offer (through a financial newsletter)to deposit $$ in a 3 yr.CD which invests in BRIC nation currencies. supposedly, your principal is guaranteed 100%. sounds too good to be true; especially in the Madoff generation. but if this is a legitimate bank guess i can take the risk. i’m glad i found your site.

The only thing worse then going through their process is their horrible customer service. You would think that with the limitations of an online bank they would make it up with superior service or flexibility.

I guess I’m not in as big a hurry as Scott, above. Prior to Everbank, I opened a CapitalOne Online banking account, and my initial funding took over 10 biz days to clear, though I knew this going in, per the bank’s upfront information. Once my account was more than 30 days old, then my funds cleared in roughly four or so biz days. And these were all EFTs, too. From what I understand, external EFTs (between unrelated banks) simply do not happen overnight. So, I just have to plan ahead. But, oh, planning ahead when it comes to money? Who does that?

As far as Everbank is concerned, I opened my account, had THE BANK print my application and mail it to me; I wasn’t in such a hurry that I had to print it myself, and then pay for overnight delivery. The forms arrived within a week, I wrote a check (guess today’s gen doesn’t know what checks are; banks typically now provide them for free — as long as you have money in one of their accounts) for my initial funding, and then mailed it off in THE BANK’s postage-paid biz envelope. A day or so after I initiated the account, I received an email from a rep of the bank offering to answer any questions that I had; I had one, and he indeed explained it sufficiently; though I wasn’t happy with the answer, it did correctly explain something that I had thought I understood (incorrectly, it turned out).

As far as Scott’s bill-paying goes, I’m using Everbank’s Money Market Acct strictly for savings and to earn the highest interest I can. Once my money goes in, I don’t plan to take it out except a) if they screw me too much dropping interest rates, or b) an emergency arises. Remember, I’m coming from Chase Bank, in which my Platinum account’s interest rate was dropped to 0.01 percent. One needs a magnifying glass to view a percentage that small. However, my bill-paying still comes out of a Chase free checking account; this is my “working” account, so to speak.

So I mailed my initial funding check in on Monday, along with the signed form, and we’ll see what happens next. So far, I have no problems with Everbank.

– marty

I have to say that Everbank is the worst bank I have ever considered using. I deeply regret the choice to open an Everbank account. The high interest rate was definitely the drawing point. But after filling out the application online, I had to PRINT it and MAIL it in. That should have set off alarms for me. Unfortunately, it didn’t. I paid $8.00 to get a CASHIERS CHECK for $25500.00 which then sent OVERNIGHT to the tune of $19.00. So far this cost me $27.00.

After a FULL WEEK, I FINALLY received notification that my account had been opened and that I would receive my account materials in ABOUT another week. OK, NOW ALARMS were going off. I emailed Everbank only to be told that I had to call to get my account number. Everbank “Doesn’t email account numbers because it’s not secure.” So, I phoned per the instructions. The response I got was “Everbank doesn’t give the account numbers out over the phone but you can request an email with the account number.” I still had the email from the first rep, so I read it to the second. After being put on hold to get approval, I finally got my account number so that I could set up online access.

I immediately logged in to set up online access, only to fine that ALL EFT transfers would take a MINIMUM of 4 BUSINESS DAYS!!!!! When you request the transfer, Everbank takes the money out of your account and holds it for 2 business days so that you can’t earn money but they have 2 days to keep using it. Then, on the 3rd day they initiate the transfer. So, either the 4th day or perhaps later, you will finally receive your money. ABSOLUTELY UNACCEPTABLE!!!!!!!!! But I’m not done.

Online bill pay is PAPER CHECKS CUT AND SENT. NOT EFT!!! As if this wasn’t enough, my $25500.00 CASHIERS CHECK was held for a total of 3 weeks!!!!!!!!!!!!!!!!!!!!!!!!! CASHIERS CHECKS ARE CASH. So, needless to say I immediately removed my money as soon as the hold was finally released. I’ve only told you the major points and I strongly recommend that you avoid Everbank like the plague. I guarantee you nothing but aggravation, fury, loss of money, and everything else. In the instant, electronic society that we live in, this antiquated bank needs to give it up and go out of business. Please help me spread the word and put them out of our misery. I opened a YIELD PLEDGE MONEY MARKET Account.

Scott,

This appears to be the price paid for a better rate. Everything you described was exactly the same for the 2 other online savings accounts that I have and is not strictly an Everbank thing. My current favorite, Capital One Online Savings took about 3 weeks to get the initial deposit “available” for use which had to be mailed in via a check. However, now that everything is in place, transfers *always* take exactly 3 business days beyond the day I initiate the transfer. Which isn’t too bad as long as you plan ahead and keep an additional emergency fund where you can get immediate cash if needed. Also, Cashier’s Checks and Money Orders are two highly counterfeited items today, so it is no surprise that they would take just as long to process as any other means of snail mail payment. To me, the three day waiting period is worth it to earn $25-$30 per month interest on my savings which was earning about $0.25-$0.30 per month sitting in my local Chase Bank savings account.

What date were these written? It’s now 3/21/13 and I’m looking at Everbank. But, maybe not after reading the comments?

I have the same question. It’s now 10/30/13. Having a date stamp on the comments would be super helpful.

I mean it’s 10/20/13

I understand your frustration about things such as a 15 day hold; however, as a member of the financial community, which is in no way related to EverBank, there is a good reason. Many financial institutions implement a 15 day hold policy on any new money coming in, regardless of method, as a form of Risk Managment. First, The US Patriot Act requires that all financial instititutions have a reasonable idea of where money is originating from to prevent “money laundering and terrorist activities.” Second, most criminal activity involving banks occurs with organizations that do a bulk of their business online or through the mail. You add that to the fact that there is only a 5% recovery rate on monies redeemed from an account in a fraudulent manner, banks and other financial institutions are on the look out to not only protect their customers but their own wallet as well. Here is how it typically works;

1. You send in your check or other cash equivelent.

2. The bank places a 15 day hold on the money to protect against bounced checks, counterfeit or altered financial documents, stolen checks, or identity theft.

3. Your Customer Information such as name, date of birth, tax id number and physical residential address are run against a national data base per the US Patriot Act to ensure that you are who you say you are.

4. A confirmation statement is sent out to you the customer advising of the new account and or purchase. If you receive the confirmation statement in the mail and you did not participate in the process, it gives you enough time to respond and have a stop placed on the account.

While these procedures sound tedious and a pay in the you know what, they are really in place to protect you. You made a big deal out of Cashier Checks being the same as cash. This is true, but unfortunately, there is still a seedy eliment that will attempt to counterfit cashier’s checks, bank drafts, traveler’s checks, etc.

As far as refusing to give account numbers over the phone, again that is for your protection and it is not uncommon in the financial industry. Working for a major financial institution, you see criminals trying to get away with all sorts of stuff. Let’s say your house was robbed and fiancial documents were stolen. The criminal could potentially call into a financial institution to get information about you and have just enough info to pass phone verification. Financial institutions are moving away from printing entire account numbers or tax id numbers on paper documents because it makes it to easy for people to steal identities. If your account number were said over the phone, that places you at risk.

now this may not change your feelings about EverBank, and I don’t care. But keep in mind, these procedures are not there to make you work hard for the sake of it, but to protect you. Banks don’t want the process to be hard either, but they are tied down by necessity and federal regulations.

I have a follow-up: I just went through the Everbank online account creation process; it appears that I will have to do the check mail-in as well; it gave me no EFT/ACH option. However, what really pissed me off — I got through all the name/address/employer stuff, beneficiary, and to the screen where I select the mail-in check option and the amount of my initial deposit. I click the button to accept and move to the next screen —

And lo and behold I get a server error, unable to process, try again later. I started at 10:40am; it’s now 11:00am — I had to telephone my daughter to get her social security number for the beneficiary line, so that took a couple minutes. But all the data entry and time lost and I get to do it again. I guess Monday mornings is not the best time to do online banking: web sites too busy, too much input from customers, weekend processing, who knows… Sigh…

But, yes, I’ll try again later — but when I’m in a better mood!

– martyh

I had a Washington Mutual Platinum account for many, many years; used to make nearly $100 per month on interest; but over the past year or so I noticed the slow decline in the interest — until the first part of this year, once the Chase name took over, when my interest earned for the entire month was like 51-cents. That’s right: CENTS. I contacted the consumer person, Sue Kwon, at CBS-5 in the Bay Area and they actually brought a reporter and cameraman to my house to interview me. It made the 5:00 news; I then sent the link of the online article and video to Chase Customer Service so that they would know why I was taking all the money out of my Platinum account. I even got a telephone call from a Chase rep trying to give me alternatives, but the best they could offer was an online account just over 1%. So, I moved nearly all of my money to CapitalOne online banking: they had a special offer for Costco business customers for a 2.06% rate, plus a $60 signing bonus. Transferred my money, received the bonus, but within just a couple weeks, the rate dropped to something like 1.89%, then a couple weeks after that 1.78%; I just checked now and the rate is 1.64%. It’s not too far above the best that Chase was able to do! They get your money, they use your money to make their money, and they pay little or nothing for it — and yet when you borrow their money, the rates are 17% -24% depending on your credit card bank and credit rating. Atrocious.

I sent an email to CapitalOne online banking at the 1.78% drop and told them I was extremely disappointed, and if they dropped again I’d pull my money. Never heard from them, but regardless, I think it’s time to play the money transfer game. Maybe if enough people do this, even if there is a paperwork hassle that takes some time, the banks will get the idea and stop screwing their customers who entrust their money to said banks.

I appreciate your work here on the site — I found it during a search for information on Everbank. And like the other person above said, when I’m asked for a referal name, I’ll enter your blog. Maybe that toaster will be more than just chrome plated!

Cheers,

– martyh

Thanks for this in-depth review. I was looking into EverBank for both the Money Market and the BRIC CD’s.

Do you have an update on how the actual banking process is going?

One reviewer I have read was convinced that the bank was actually holding onto their money for a few days to collect interest, because there was such a delay between depositing and accessing money, and between (for the checking account) the date of a scheduled bill pay, and the actual date of payment. Do you think this is likely?

Any opinion on the BRIC CD’s?

Thanks for the review. I was going to open a new account to get this bonus rate but decided to check some reviews at the last moment. Good thing I landed on this blog. I think I should stick with hsbc direct for the time being.

Thanks for the in-depth review. Found their rate at bankrate, but anything requiring me to mail in something and wait two weeks is just too much of a hassle for the benefit received… especially since the rate isn’t guaranteed after the first three months. May look at them again later, but I’ll stick with HSBCDirect for the time-being (1.55%)

I discovered EverBank through a financial site. I was not allowed an ACH transfer even though I answered all of the questions correctly. It is frustrating not being able to open an account with an ACH transfer. I am about to mail a check to see how long it takes to open the account. I will keep you posted.

Well, here is an update on my application. I did mail a check to open an account the next day, Wednesday, July 29th. By the following Tuesday, August 4th, I received a cell phone call asking my permission to look at my credit reports. (I have them locked down and they needed my verbal okay to look at them.) I then received my account information by Friday, August 7th. I do have to say that EverBank did respond quickly and efficiently in opening my account.

I do not like mailing a check to open an account but I do have to say that all of the steps needed to open an account does show that EverBank has good security.

I am now in the process of setting up the External fund transfer.

By the way thanks for mentioning the $5000 needed to avoid a fee. I was just looking at the minimum that was needed, $1500, to open an account. This was all I was going to send through the mail and then do an EFT/ACH transfer for a larger amount.

Thanx much!!!! I’m looking to move some money around, their high rate caught my attention, and I started the application process. Since I have little to zero patience, I quickly got frustrated, and exited the application. I then did a search for Everbank to see what others were saying, to see if perhaps I was too hasty too abandon them. I found your site, and read your story and the “comments” section. Needless to say, I won’t be going into their site to start the application again. Keep up the good work!

Thanks for the review– FYI, the Customer Service phone is open 24/7.

Until a few minutes ago, I never heard of EverBank. I was reading an e-mail from International Living (InternationalLiving.com). They had an article on investing in foreign currencies. This got my attention because of the dollar’s decline. IL’s e-mail was promoting foreign currency investment through EverBank. Instead of clicking on their link to EverBank, I decided to go through Google. That’s how I found Consumerism Commentary as well as EverBank’s website. After reading your commentary (which I found to be an eye opener) and other people’s comments as well, I am not sure if opening an account at EverBank is for me. I am big on customer service especially with financial institutions because they will be making money off of my money. In the meantime I will continue to search the web…

Yup sounds like utter complication to me. Pass.

I’ve been plodding through the Everbank account opening process for more than a week as well. After completing the online application, I had to mail them my signature and proof of my address, and now am waiting to receive the welcome packet with the wire instructions. I wouldn’t bother if the rate weren’t so good, and the money I”ll be depositing is sitting at TDAmeritrade earning nothing because my 3% 3-month CD with them expired and they couldn’t offer anything to match Everbank’s rate. (They did, however, offer to waive my wire fee.)

Yes…the rules have changed but I opened an account online today with no problem. Cant beat that rate. I am waiting for “small deposits” to my linked account, then I will fund it. THANKS for the tip about this bank. On the application where it asks “where did you hear about us” I entered “Consumerism Commentary Blog”. Maybe if enough people do this they will send you a free toaster 🙂

Thanks for the heads-up, I think I’ll pass on EverBank. They should reconsider the “no ACH because there is a business at your address” tactic because that statement may not even be true: Experian or Equifax (it starts with an ‘E’ but I don’t remember which one) insists that a business has been registered at my address even though it isn’t true. My first attempt to fix that error was rebuffed but your post here might give me the motivation to try again.

OMG! Thanks for alerting me to the change in minimum balance and fee! I’d been planning to go back down to the minimum because we bought a house. But we wanted to keep the Everbank account. I’m going to have to look into different options now. A $5,000 minimum is ridiculous!

Flexo,

Your post is the exact reason why I don’t understand rate chasing; literally the exact reason.

Time, Fees, and for what? An extra how much? an extra 40 bucks for the year?

I agree. Rate chasing is rarely or never a worthwhile way to spend time and effort. But it’s a good idea to always be on the lookout for the best place to put “new” money — and best doesn’t always mean highest interest rate. If I can do some of the work for readers, like opening up accounts and testing the waters, assuming readers trust me, it could save them time.

And I’m looking deeper into the issue of the differing minimum balance and fees. It looks like the bank changed their terms (too the less favorable option from the customers’ point of view) on June 1. The old fee schedule was available on their website as of July 8, but it is no longer linked. A new fee schedule is now linked, though the old still resides on the everbank.com server.