The Impact of the Philadelphia Soda Tax

Earlier this year, I wrote an article discussing the new Philadelphia Soda Tax that had just been put into effect. At the time, the discussion focused on the possibilities the law would present: from having more people drink water and getting more funding for the school system, to Americans losing money to the tax and companies like Pepsi taking it on the chin. After almost three months of evidence, here’s what we know.

The Cash is Flowing (Early)

The revenue coming in from the Philadelphia Soda tax has exceeded early expectations, bringing in $5.9 million in January and another $6.4 million in February. However, the estimated annual projection was $91 million, which means for the next 10 months, the average amount of revenue coming in from the tax would average $7.9 million. This is certainly possible, but there are a lot of other effects from this tax that may cause revenue to drop drastically.

It will be interesting to see what happens if revenue begins to falter. Right now, the main selling point of the tax is that the majority of money generated will go to fund youth and school programs in Philadelphia. Should revenue decline, that means sales are declining (even more so that expected) and all of the other consequences from the tax are magnified in a negative light. Revenue MUST continue to climb — or at least remain steady — in order for this tax to succeed in the eyes of the policymakers.

Consumers are not healthier

One of the secondary advantages to the soda tax was the idea that more consumers would drink healthier products. Through 2+ months, though, there has not been any indication that it’s actually happening. In fact, bottled water sales have remained stagnant. It is certainly possible that more consumers are drinking water from their homes, but that’s not supported by any evidence.

In addition, as the revenue is coming in higher than was projected early on, it means that soda and sugar drink sales are also higher than expected. Plus, many consumers have already resorted to buying their beverages outside the city of Philadelphia. Either way, it doesn’t appear there’s a boycott of soda just yet.

Grocery Store Owners are Not Happy

Grocery stores have voiced their opinion about the tax over and over; they hate it. Many stores cite evidence that their sales on beverages have been cut by 30% to 50%, and layoffs are imminent. However, proponents of the tax suggest that after sticker shock sets in and consumers understand what the soda tax is all about, business will return. That may or may not happen, but sales data suggest that customers are leaving town for more than just their beverage sales.

The only option for grocery store owners to salvage their consumer base is to eat the tax themselves, and independently owned stores are unlikely to be able to shoulder that burden. Consider if you lived on the outskirts of the city: would you travel 2 miles to your local store to do your shopping — where all of your sodas, teas, and energy drinks are more expensive — or would you travel 10 miles to the store outside the city?

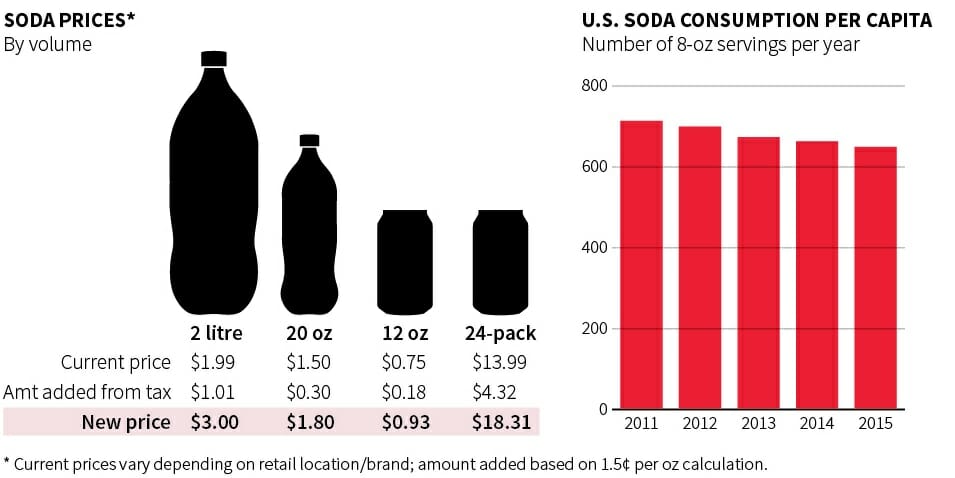

Soda Company Layoffs, Sales Down, Products Off Shelves

PepsiCo has already laid off ~100 workers in their Philadelphia distribution centers, and more are expected. In addition, they are the first company to decide to pull product off the shelves, determining that 12-packs and 2 liters no longer have value to consumers. This is likely to reduce sales even further and cause consumers to travel outside the area of Philadelphia if they want these particular products, affecting all of the other consequences we’ve already discussed.

Another option for drink manufacturers is to simply make them smaller. Instead of selling 16 ounce bottles, focus on selling mini eight ounce cans. Packaging costs decrease only slightly, but they will be able to minimize the tax felt by consumers (and accomplish the idea of being healthier by drinking less). As of today, the only real push-back from drink companies has been through PR; product development has not been impacted.

The Bottom Line

Whether for or against the tax, the results should not be a surprise to anyone. This IS a tax after all. The millions of dollars now going toward the Philadelphia school system have to come from somewhere, and that somewhere is made up of grocery stores, soda distributors, and people who buy the products they both sell.

This is what the tax was designed to do. So, if the revenue generated continues to come in at high dollar amounts, I think there’s a very good chance we see this tax surge in widespread use. In fact, come July 2017, soda taxes are expected to take effect in Oakland, San Francisco, and Albany, with dozens of other cities trying to pass the same legislation.

It’s coming for everyone. Get ready!

Article comments