Rule for Building Wealth: Ditch Credit Card Debt

If you’re looking to get a handle on your finances, getting your credit card debt under control will go a long way. But how do you prioritize what credit card debt to pay off first? And what if you have other, more significant debt? How do you figure out what to pay each month?

I’ll go over three methods to get out of credit card debt: a credit card balance transfer, the snowball method, and avalanche method.

A Note on Interest Rates

Not all debts are created equal. And neither are interest rates.

First, make sure you understand the interest rates with all your debt. If you have a mortgage or a student loan, the interest rates on those are likely to be lower. The average interest rate for a 30-year fixed-rate mortgage ranged between 3.6% – 4.69% over the last decade. Student loans are similar.

Plus, some debts are thought of as good. For example, mortgages and student loans are thought of as “good” debt, while credit card debt is thought of as “bad.” In fact, if you have credit card debt and apply for a loan, you might be turned down. Go to the mortgage broker with the same amount of debt for a student loan and you’re likely to be approved.

And interest rates on credit cards? Those can vary wildly. You may have signed up for a card with 0% APR for the first year. But then those interest rates shoot up to 17% or more.

If you have credit card debt – you’re not alone. In fact, most Americans have it. So now the question is, how do you go about tackling your debt?

Think About a Balance Transfer

If you want to get out of debt, the first thing to check is if you can open a new credit card account with a 0% interest rate (for at least the first 12 months) and transfer your credit card debt there. This allows you to chip away at the balance each month without having to worry about accumulating interest. It should go without saying – though I’ll say it anyway – that you don’t want to use this credit card for new purchases.

How does this help?

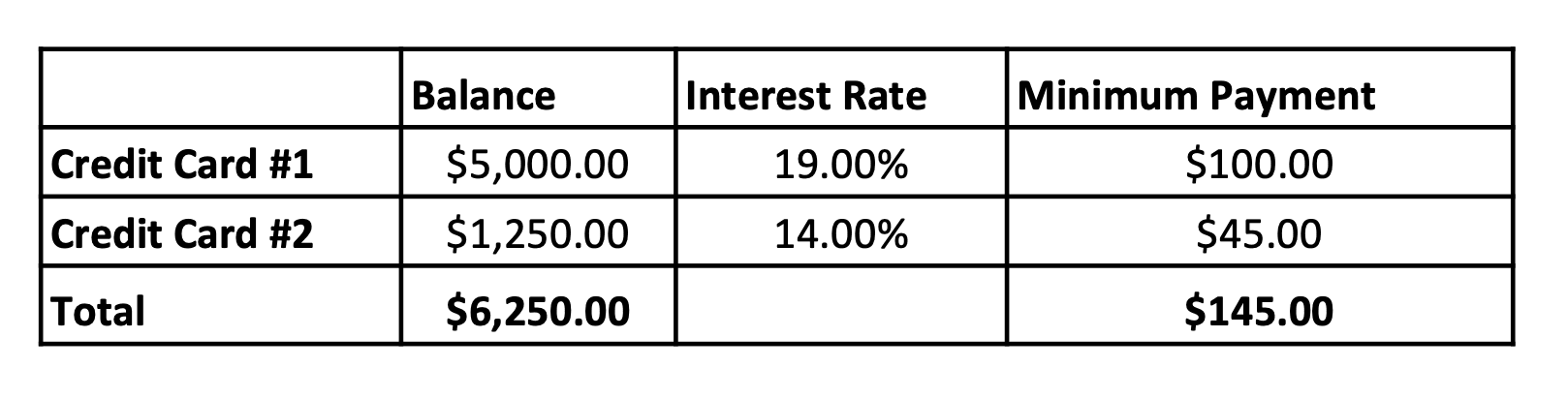

Let’s say we have two credit card debts totaling $6,250. (The average credit card debt for Americans in 2019 was about $6,200.) The balances, interest rates, and minimum payments are:

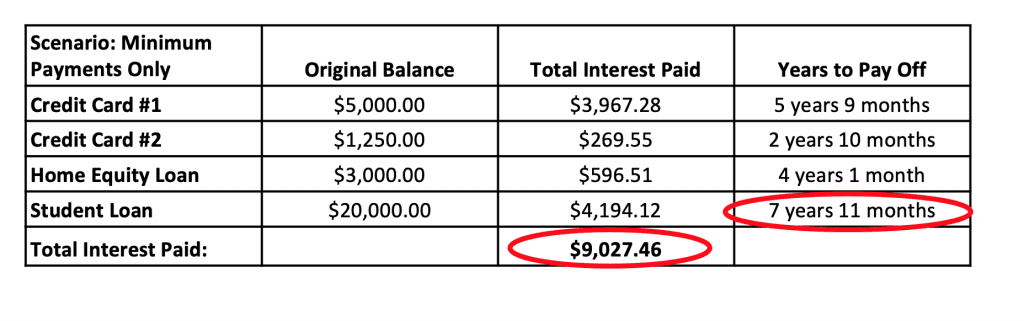

In this scenario, we need to pay $145 a month just to keep up with the minimum payments. But by paying only the minimum, it will take almost six years to pay off both cards.

In this scenario, we need to pay $145 a month just to keep up with the minimum payments. But by paying only the minimum, it will take almost six years to pay off both cards.

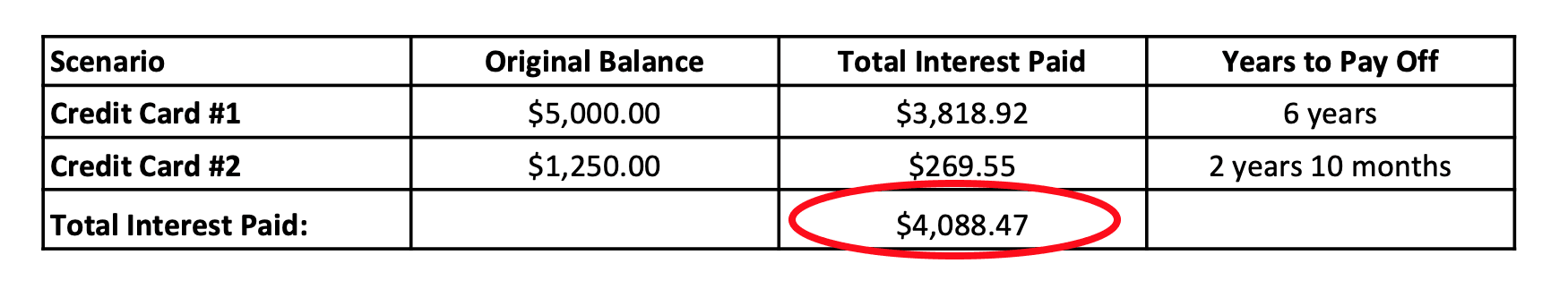

The worst part – on a total debt of $6,250, we’re going to pay an additional $4,088.47 in interest. (If you’re doing the math, that $6,250 worth of credit card debt just became $9,946.52).

But let’s say we reign in our budget and find an additional $150 a month to spend on paying down debt (so we’re paying a total of $295 a month). Now, we’ll pay those credit card bills off in just over two years and pay only $1,394.58 in interest. That’s a huge difference!

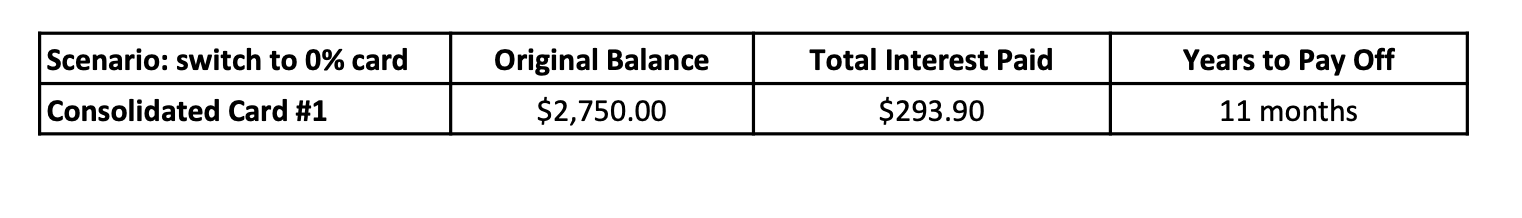

Now if we can transfer those balances to an account with 0% interest for 12 months, we can chip away at $3,540 of the debt interest free. That leaves us with $2,710 as a remaining balance.

Now if we can transfer those balances to an account with 0% interest for 12 months, we can chip away at $3,540 of the debt interest free. That leaves us with $2,710 as a remaining balance.

In the second year, let’s say that card’s interest rate shoots up to 22%. We keep paying the same amount ($295 a month) and end up paying only $293.90 in interest. Plus, we’ll pay off our entire debt within two years.

The cons of this approach – you’re consolidating your debt to an account that might have a higher interest rate. You also want to be careful that the interest rate is only on the remaining balance and you need to make sure you aren’t opening too many credit cards. But if you can do this wisely, it can save you a lot of money.

The cons of this approach – you’re consolidating your debt to an account that might have a higher interest rate. You also want to be careful that the interest rate is only on the remaining balance and you need to make sure you aren’t opening too many credit cards. But if you can do this wisely, it can save you a lot of money.

If transferring your balance isn’t an option, or you have more than a few debts, there are other ways to tackle credit card debt.

Snowball Method

Credit Cards Only

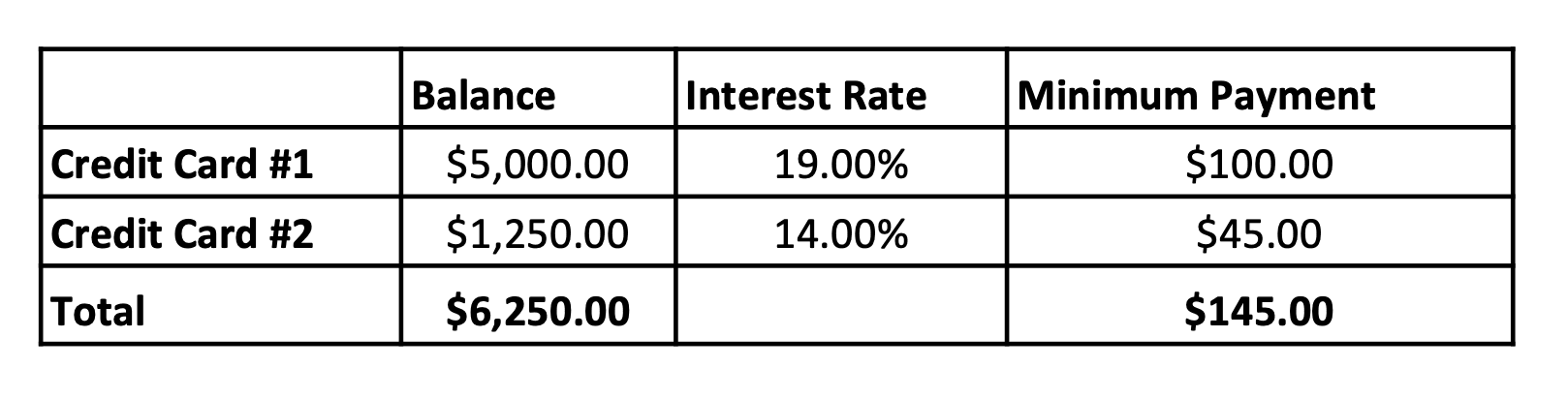

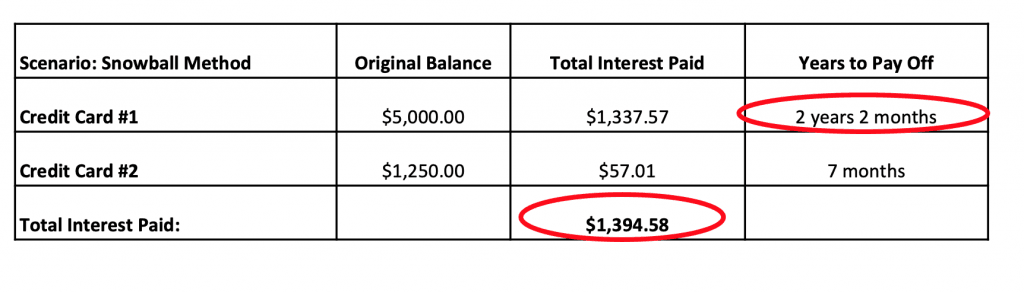

The snowball method is a way to attack debt by going after the accounts with the smallest balances. Let’s take our original scenario:

Here, our smallest balance is Credit Card #2, where we have a $1,250 balance. But you’ll notice the interest rate is lower on Credit Card #2 than the other one. The snowball method prioritizes paying off the smallest balance to give you an early win.

Let’s take that same scenario from the transfer method — we have $295 we can dedicate each month to paying down this debt.

In the snowball method, we think about the difference between the minimum payment ($145) and the total amount we’re putting towards debt repayment ($295) as the snowball.

So in this scenario: $295 – $145 = $150. Thus, our snowball amount each month is $150.

If we follow the snowball method, we end up putting that extra (snowball) amount of $150 each month to our smallest debt. That allows us to pay off Credit Card #2 in seven months.

Then once Credit Card #2 is paid off, we take what we had been paying for Credit Card #2 (both the minimum balance and the snowball amount) and put that towards Credit Card #1.

Once we do that, we end up paying off Credit Card #1 after two years and two months.

Credit Cards and Other Debt

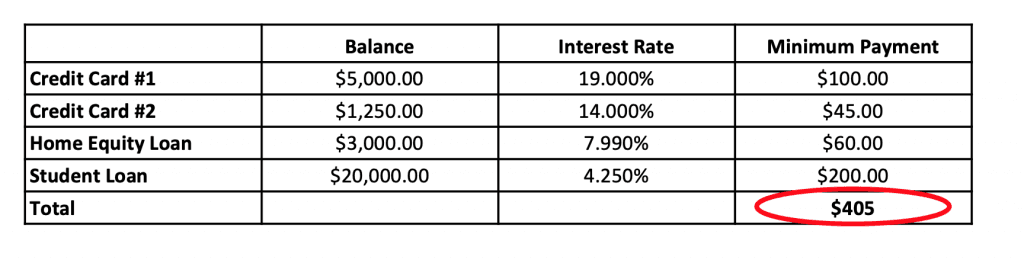

But what happens if we complicate this scenario by adding two more debts: a student loan and a home equity loan?

First thing to notice is that we’ve upped our monthly minimum total payments to $405 in this scenario.

If we only pay the minimum amount each month, it will take us almost eight years to pay this off. Plus, we’ll end up paying $9,027.46 in interest.

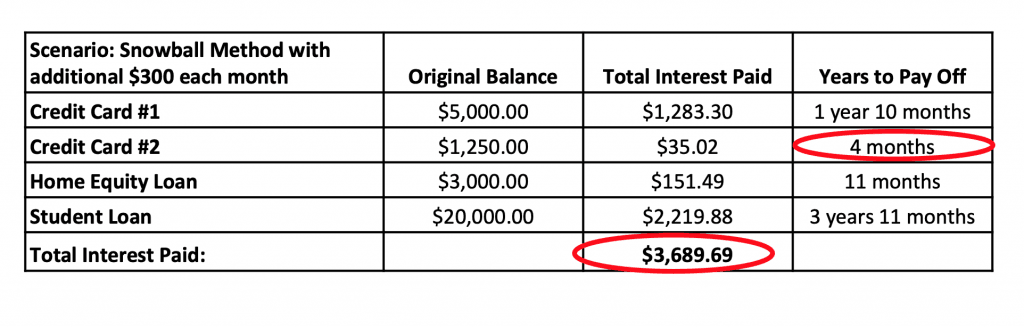

Let’s assume that we’ve tightened our budget and found an additional $300 to pay each month (for a total of $705).

Let’s assume that we’ve tightened our budget and found an additional $300 to pay each month (for a total of $705).

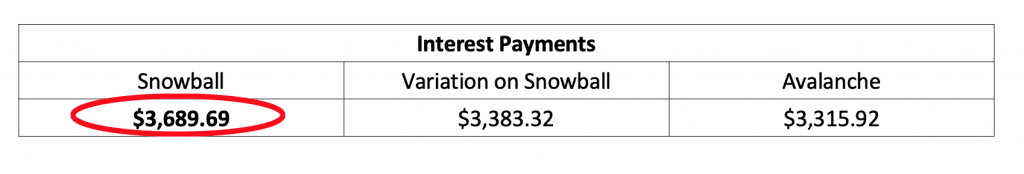

We could still attack this debt with the snowball method. By paying an additional $300 each month, we’d end up paying off our debt in just under four years with $3,689.96 in interest.

That would give us the added bonus of paying off our first debt in just four months! The psychological benefits of this might be so helpful it keeps us going on our journey to get out of debt.

But that might not be the cheapest way to attack our debt. Let’s look more closely at those interest rates. The home equity loan has a much lower interest rate than either of the credit cards.

And that huge student loan? It has the lowest interest rate of all. Instead of attacking our debt with a snowball approach, we could use the avalanche approach. But before we get to that (more in the next section), there’s a variation on the snowball debt that’s worth mentioning.

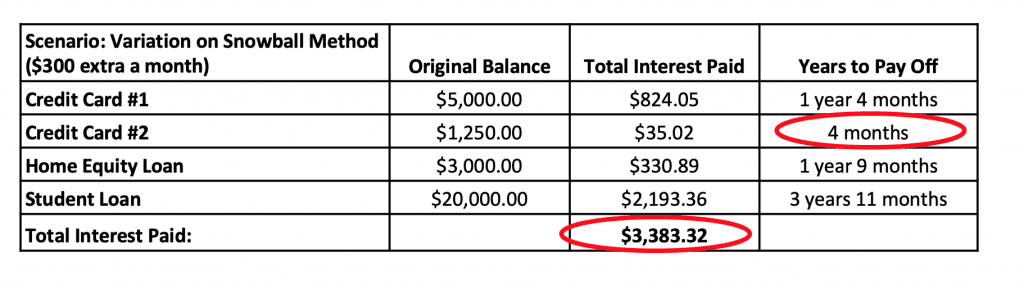

Variation on the Snowball Method

This method combines the snowball method – getting you a quick win – with an approach that prioritizes debts with the highest interest rate.

We pay off the smallest loan first, but then we switch to the Avalanche approach (more on that in the next section).

In this scenario, we paid off our smallest balance first – and in four months. But once that’s paid off, we go onto use our “snowball” payment to tackle the accounts with the biggest interest rates. So instead of paying off the home equity loan second (like we did in the Snowball method), we pay off Credit Card #1.

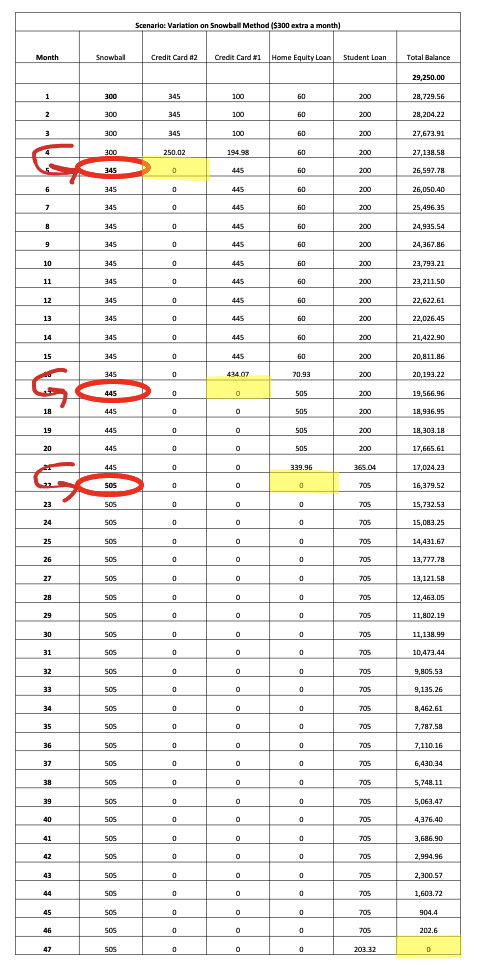

Let’s take a look at how this works, month by month.

Snowball Math

If you look closely, you’ll notice that our “snowball” amount in this chart increased – that’s because the spreadsheet I used to calculate the interest payments assumes you’ll keep paying the same amount – $705 a month. But once you start paying off some of your debts, this method prioritizes debt with the highest interest rate and puts all of the snowball money towards it. That snowball money “increases” since you no longer have your first debt to pay down.

That’s a lot to understand – so let’s go through a few steps.

When we begin, we have four accounts. We pay the minimum amount each month. We also have our snowball of $300.

Since we want to get a quick win and pay off Credit Card #2 first, we throw that extra $300 a month towards it. After four months, that card is totally paid off.

So now we move onto the debt with the highest interest rate. In this case, it’s Credit Card #1. We had been paying just $100 a month.

But now that we don’t have to pay the minimum balance on Credit Card #2 (which had been $45 a month).

Our original snowball amount– which again is the difference between what our minimum payments are and what we’ve committed to paying each month – has just increased by $45 (the payments we no longer make to Credit Card #2).

We continue with that pattern. So when we pay off our Credit Card #1 after a year and four months, our snowball payments increase to $445 a month.

The magic part is that we aren’t paying more each month – we are still paying that $705 a month we committed to at the beginning.

But you may be wondering why we aren’t tackling the debt with the highest interest rate first. So let’s get into that.

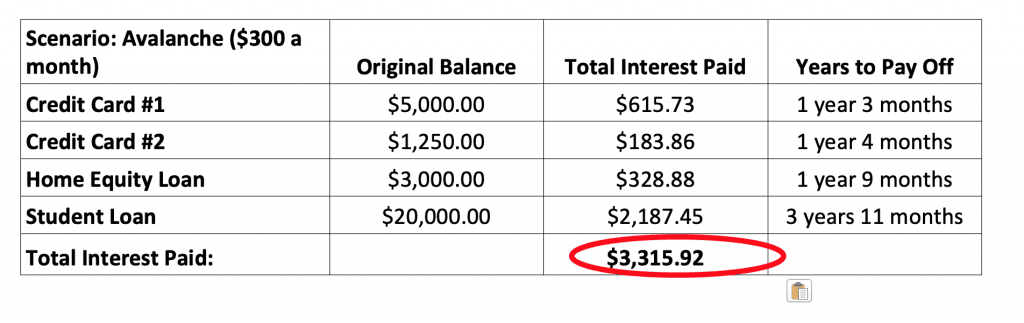

Avalanche Method

If you’re more interested in paying the least amount of interest, then you won’t want to use the snowball approach or the variation on it. Instead, go for the avalanche approach.

In the avalanche approach, you prioritize paying down the accounts with the highest interest first.

Let’s take our same scenario and reprioritize with an avalanche method.

In this scenario, you don’t pay off your first debt in a year and three months. But you end up paying off all your debt in the same amount of time – three years and eleven months. The benefit of this method is that your total interest paid is lower: $3,315.92.

Everything else remains the same – the way you pay down one debt and then move onto the next.

Comparing the Snowball and the Avalanche Methods

While the avalanche method is the cheapest, it might not give you the quick morale boost you need.

In the scenario we ran, the difference between the variation on snowball method and the avalanche method is just $67.40. If you need that morale boost, it may be worth it to pay off Credit Card #2 in just a few months.

Creating Your Own Debt Plan

If you’re overwhelmed by all the numbers and charts in this article, don’t worry. There’s FREE software out there to help you. For all your debts, you just need to know:

- Your account balance

- Your minimum payment

- The interest rate

You plug that information into software and it comes up with a plan for you! You can choose the snowball method, the variation on it, or the avalanche method. Or you can come up with your own plan.

The software allows you to play around with different scenarios. You can see what would happen if you were able to set aside a few extra dollars a month. Or what would happen if you get a bonus one month and use it all for debt repayment. You can even see what happens if you miss a payment.

You’ll get the basic data and a detailed spreadsheet showing when you start paying more to the next debt, which should make it easy to stay on top of your debt repayment plan.

The one I like is here – I like it because it’s free and customizable. (And here’s a quick, five minute tutorial to learn how to use it).

Bottom Line

If you’re trying to work down your debt, you’re already on the right track. Decide if you need some early wins to help motivate you. If so, take a look at the modified snowball method. If you’re more interested in paying the least amount of interest, then the avalanche approach is going to be better for you. And see if you can transfer some or all of your credit card debt onto a 0% interest credit card. Finally, use some free software to run scenarios so that you truly understand how to get rid of your debt and what you’ll need to pay each month.

Article comments