Six Steps to Starting Your Own Business

Many people dream about running their own business. You know, working for themselves, not having to answer to someone else’s rules, not having to rely on someone else for income, making their own hours, and not getting this hated retort: “You should just be happy to have a job.”

The dreamer who wishes for an existence free from these shackles is someone who wants to be his or her own boss. And no matter your skill set, interests, or career, there’s no reason you can’t reach that goal.

Here are six basic steps toward starting your own business and becoming your own boss, and what each one entails.

Step 1: Get Some Experience

Those who follow a vision with an entrepreneurial spirit are often eager to get started. They are willing to assume risk, and rarely want to listen to anyone who seeks to ground them in reality. However, one of the biggest building blocks toward your career independence is sometimes being, well, dependent.

Gaining experience by working for someone else is a foundational step that will benefit you throughout your working life. Not only will it teach you to appreciate what it’s like being at the bottom, but you can also gain firsthand knowledge and basic experience in the field.

These could really come in handy later on when you have your own business. You’ll be able to relate to all of your future employees, no matter how entry-level they may be. You’ll also have intimate knowledge of the problems that arise, and can brainstorm ways to fix them.

If you’ve never done the grunt work, how can you solve the grunt work-related problems?

Even Gates and Dell Did It

Let’s look at one type of budding entrepreneur: meet the young aspirants.

Perhaps they are fresh out of high school or college, or still in the midst of their studies. There’s an itch to start a business and make money, and they can’t ignore it.

Bill Gates and Michael Dell fit this description when they were starting out. Unsatisfied with the opportunities that were available to them, they had talent and saw a need for what they would eventually create.

But here’s the thing: they gained experience before venturing out on their own.

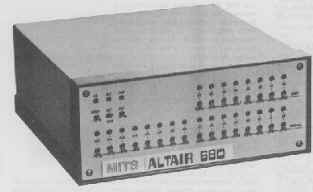

Gates began programming computers when he was thirteen. His earliest programming jobs including writing calendaring software for for his high school principal. Another job earned him and a friend $20,000 — at age fourteen — for creating traffic-counting software.

Gates began programming computers when he was thirteen. His earliest programming jobs including writing calendaring software for for his high school principal. Another job earned him and a friend $20,000 — at age fourteen — for creating traffic-counting software.

He adapted the BASIC programming language for the newly developed personal computer while studying at Harvard. His skills set him apart at the time, but he developed his experience working on jobs for other people.

Here is what MSN had to say about gaining experience before stepping out on your own:

If you’ve never clocked a day of work in your life, you might consider taking a job before striking out on your own — even if the thought of doing time in a cubicle makes you shudder. Work experience in the field you want to break into may be the most productive use of your energy. Think of it as a paid research position.

Not Doing It Could Actually Hurt You

Learning about the real world is important. You’ll be at a serious disadvantage if you try to learn about the nuances of the business while also trying to run a company or function on your own. Grinning and bearing it for a few years before going out on your own is a way to mitigate the risk of a quick and painful failure.

Also, keep in mind that those who fund you want to see some experience.

If you’re lucky and can fund yourself, you don’t have to worry about this. However, most people who start a business will need to take out a loan or receive upfront investment. Those who can give money to you will want to ensure that their risk is minimized, and one thing they will look for is experience in the field you are entering.

In fact, the number one reason why new small business fails, according to the U.S. Small Business Association (SBA), is lack of experience.

So, the first step to being your own boss is to work for someone else first.

Get some experience in the niche in which you want to work independently. Network. Build on your basic skills while learning the ins and outs of the industry.

Resource: Should I Quit My Job? Ask These 8 Questions First

Step 2: Build A Winning Team

Sure, you can go out and found your own company without any else’s help. However, just remember that you are only one man (or woman), and going at it alone is a surefire way to stunt your business’ growth and set yourself up for failure.

Building and growing a strong team in the early stages should be a very important business goal.

You should find people whose skills complement yours — in other words, they fill in the gaps in your own skills and experience.

Let’s say you want to design a new shopping app. You have all of the programming experience in the world, and know that it will translate well to your app’s success. However, you have zero knowledge of marketing.

You know that marketing is going to be a big aspect of your business model. After all, it doesn’t matter how great your app is if no one knows it exists. So, you bring on your friend Mike.

Now, Mike doesn’t know anything whatsoever about programming. However, he is a whiz at social media and product marketing. The two of you make a great team, dividing and conquering the things that are imperative to your business’ success.

You Might Not Be the Best On the Team

In regards to the team that you build, I want to add the following thoughts.

Try to find people who are as passionate about your idea and your particular business niche as you are. Their passion will translate into their work, and the fact that they’re invested in your company means that they will be truly rooting for its success.

You should also surround yourself with people who are smarter than you are. After all,”if you’re the smartest person in the room, you’re in the wrong room.”

Being the smartest person in the group ensures that you aren’t learning from those around you. Also, you may not get any fresh ideas to allow you, and the company, to grow. Your success would be more secure if you have the ability to learn as much as you can from others… and this means bringing on those that know more than you.

Don’t be afraid to work with people who will disagree with you, either. Conflict is a good thing, but it’s important to manage it wisely. That doesn’t mean avoiding it and ceding your position to another, but it also doesn’t mean allowing a combative environment where everyone feels stressed and under attack.

Inc. Magazine agrees, as per this quote from their article, The Joy of Conflict:

Is it considered a “good meeting” when everyone agrees? That’s the worst. I’ve been in dozens of “good meetings” at which the important issues weren’t challenged — until after the meeting officially ended.

Bottom line: if you’re starting a business venture, bring in people who are committed to your vision, smart, and willing to speak up even if they disagree with you.

Step 3: Fight Inexperience With Advice

Step one was to gain experience. However, it will still be difficult for the “young aspirant” to gain experience in all aspects of business quickly.

Step two was to build a supportive team — but the smartest people, with whom you would choose to work, are often too busy to work for you.

So, what can you do?

One solution to this problem is to seek out resources and learn from the advice they give. Start by looking at universities, alumni networks, local organizations, and, of course, the internet.

No matter your field, you’re sure to find groups, message boards, and professional organizations online. These groups are a great resource to chat about industry changes, offer advice, share vendors, etc.

Find Someone Who’s Been There

Another way to seek advice is to work with a mentor.

Every entrepreneur should have a business mentor, according to Scott Allen from About.com. “A mentor is someone with more entrepreneurial business experience than you who, serves as a trusted confidante over an extended period of time, usually free of charge.”

In order to find a mentor, you can contact established networks to begin your search. Or, simply get in touch with a business owner you admire and ask if they would be willing to speak once a month. Many successful people will be flattered and happy to tell their story or pass along advice.

If you’re too shy to blindly email someone you admire, you can turn to SCORE. This website can put you in touch with those providing advice on your chosen topic. Simply type in a question on the front page of their website and get an answer from a business professional.

If your prospective business is one that is locally-based, check the Chamber of Commerce website for the town in which you live or do business. There will be a directory of other businesses who you can contact for advice.

The website will also list organization of which you can become a member. Attend meetings and get to know other small business owners in the area. Not only is this great for networking and finding suppliers or clients, but you might find someone who can provide the advice you need.

Step 4: Build a Bulletproof Business Plan

A young entrepreneur should want People Who Matter to take his or her business seriously. The way to do this is to create a complete, documented business plan.

A solid business plan is an invaluable process for your company. It is a forecast of your plans, as well as an acknowledgment of the risks involved. This can play a large role in future business problem-solving.

No, your business plan can’t be simply laid out in your head. Not only is this an incomplete planning tool, but you aren’t going to have much success getting a small business loan (or raising capital from investors) without one.

If you need money to start your business, and most entrepreneurs do, most likely you’re going to ask individual investors or banks for loans. Undoubtedly with banks and definitely with smart investors, you’ll have to present a solid business plan before anyone hands money over to you.

There are tons of business plan-writing resources freely available on the internet. One place to start looking is bplans.com. They have examples for various types of business to inspire your own plan writing. Entrepreneur.com has several articles that may be useful.

The other option is to look at the cost of business plan writing software as an investment that will help grow the value of your business quicker. One highly-regarded software applications is Business Plan Pro. Write the plan and package the presentation well, and it’s guaranteed that not only will your prospective investor be able to understand your business, but you’ll understand it more as well.

Step 5: Raise Money

Now that you have a solid business plan that outlines how much capital you need, it is time to actually find it. A few suggestions:

- Limit the amount of your own money you put into the business, in order to minimize risk.

- Steer clear of using credit card debt, because it is expensive.

- Go to a bank first. If your credit score is around 680 or higher and the loan is for $50,000 or less, your chances of being awarded the loan are good.

How about taking a loan from a friend or relative? Just be careful.

This could be a good idea if you simply don’t have the credit to qualify for a loan or line of credit for your small business. However, you should be sure to treat the loan as formally as possible. Conduct the transaction with a paper trail and contract. Note when the loan will be repaid and on what schedule, as well as any interest accrued.

If you’re afraid of damaging the relationship when the other person feels that a handshake is a sufficient agreement, simply tell them that your accountant needs to ensure everything is documented. When talking about money, even situations with friends and family can go sour, so tread carefully.

Another option is to utilize a peer-to-peer loan. One such website is Prosper.com, which offers ways to borrow money from multiple lenders.

Step 6: Set Goals

The biggest factor in setting financial goals is ensuring that they are actually attainable.

Do some research when establishing the benchmarks that you want your new business to strive for. Is it a particular number of sales in the first year? Building a social media following? Developing a certain number of new products?

Maybe your goals are less measurable and have to do with things like snagging a big blogger’s feature or seeing your company in print. Even different still, your goals may not be tangible at all. Maybe you simply want to replace your income while spending more time with your family.

No matter your goals, be sure to set them. Set benchmarks for the first year, the first 2-3 years, and the first 10 years. Then, post them up somewhere in your workspace, where you can see them daily.

Seeing your plans for your business, and knowing what you need to achieve in order to feel like you’ve reached “success,” can impact how you manage the company on a daily basis. As long as you’re working toward those goals and building a better, stronger business each day, you can rest easy knowing that you built something great.

What are other important factors in starting your own business? What would you tell an aspiring business owner before they start their new company?

Article comments