Personal Capital and Empower Retirement Created a Survey About Financial Worries Due To COVID-19 - Here's Why It's Important

With the COVID-19 pandemic still bogging down the majority of the world, financial worries continue to mount.

Even for those who have been lucky enough to maintain some level of financial stability over the past 12 months, it’s natural to have concerns about what the future will bring.

Personal Capital recently published results from its “Back to (Financial) Basics” survey. It details how Americans are responding to an unprecedented 2020, with a strong focus on financial concerns.

Before we go any further, here’s a statistic showing how the attitude of Americans toward their finances has changed:

At the end of 2020, Americans’ attitudes toward money shifted from optimism to survival. In April, 29% of respondents were optimistic. This figure dropped to 22% by December, while the percentage of respondents feeling merely stable increased by 10%.

In other words, many people are no longer as financially comfortable as they were pre-pandemic.

What the Survey Says About Financial Worries and Stability

Conducted by The Harris Poll on behalf of Empower Retirement and Personal Capital, 2,008 respondents met the following criteria:

- United States resident

- 18 years of age or older

- Employed full-time or retired and not currently working

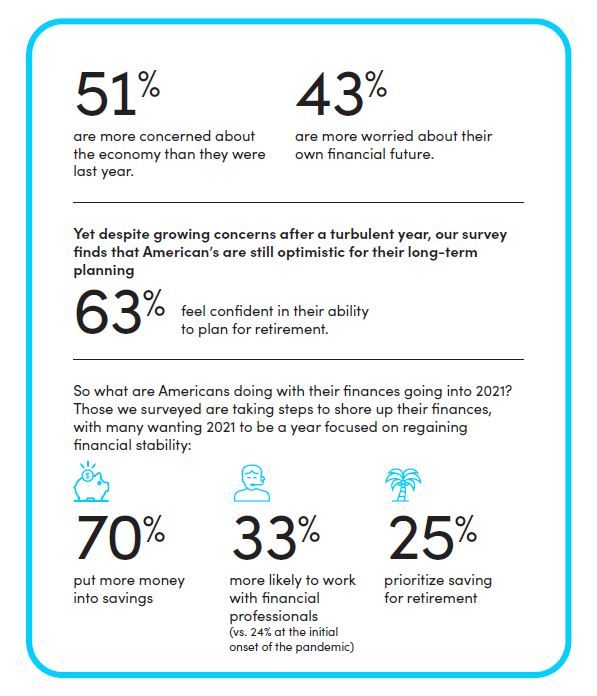

One of the most telling statistics is that 83% of respondents said “they want to try and minimize worrying about their finances” in 2021.

Here are four additional statistics related to the one above:

- Half of the respondents are seeking assistance with their financial strategy, with 52% admitting this is a direct result of the uncertainty of 2020.

- Approximately 33% are more concerned now about their ability to retire at their target age.

- 43% are more worried now than before about their financial future.

- 21% of Millennials note that they’re seeking more guidance on their financial strategies, compared to only 7% of Baby Boomers.

All of these statistics tell the same story: a large portion of Americans are concerned about their current financial circumstances, the strategy they have in place, and how it will impact them in the future.

The Impact of the Pandemic on Retirement

With the pandemic turning the world upside down, many people are questioning whether they have enough money to retire at their desired age.

Here are some reasons why:

- Unemployment has impacted the ability to save for retirement.

- Unemployment and pay cuts have forced people to rely on retirement savings to get by.

- Financial uncertainty has led to many people pulling back on retirement contributions.

Of the people surveyed, 44% adjusted their retirement plan investments in 2020. This is in addition to 39% who adjusted their retirement plan time horizon.

Craig Birk, CFP, Chief Investment Officer at Personal Capital, added the following:

“The good news is, for many, it’s not too late to turn things around. Working and retired Americans are saying they want to save early, often, and aggressively.”

This goes along with the survey’s finding that 63% of Americans are still confident in their ability to plan for retirement.

2021 Financial Priorities

All of the above leads to a very important question: what are Americans doing with their finances in 2021?

While no two people are the same, there are some trends that stand out from the crowd:

- 70% of people plan to put more money into savings

- 33% of people are more likely to work with financial professionals (vs. 24% pre-pandemic)

- 25% of people are making retirement savings a top priority

What you don’t see in the survey is people saying they’ll spend money freely, such as on entertainment and travel. At least for now, it appears that many people have put discretionary spending on the backburner.

What About the Future?

It’s difficult enough to live in the “new normal” without thinking about the future. However, when you turn your attention to your near and long-term financial well-being, it’s a challenge to remain optimistic.

Here are some results of the survey:

- 44% of men and 33% of women feel optimistic or in charge of their money

- 26% of men and 16% of women are more optimistic now about the stock market than in 2020

When broken down by generation, some are feeling the financial impact of the pandemic more than others:

- 58% of Gen Z is optimistic about their money

- 30% of Gen X is optimistic about their money

- 28% of Baby Boomers are optimistic about their money

In short, these numbers show that the older you are, the more concerns you are likely to have about your financial future.

Top Financial Issues and Concerns

Everyone has their own financial issues, but some are more common than others.

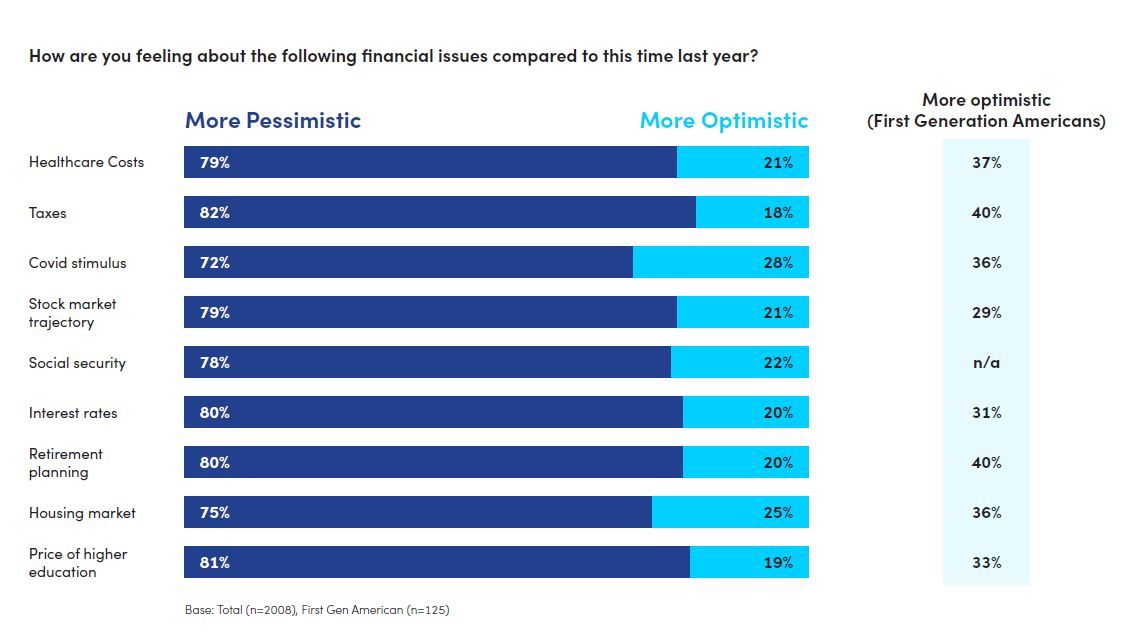

One of the most important questions of the survey was:

How are you feeling about the following financial issues compared to this time last year?

Here’s what the 2,000+ respondents had to say:

- Healthcare costs: 79% are more pessimistic

- Taxes: 82% are more pessimistic

- COVID stimulus: 72% are more pessimistic

- Stock market trajectory: 79% are more pessimistic

- Social Security: 78% are more pessimistic

- Interest rates: 80% are more pessimistic

- Retirement planning: 80% are more pessimistic

- Housing market: 75% are more pessimistic

- Price of higher education: 81% are more pessimistic

These numbers are not encouraging. They show that the majority of people are pessimistic regarding the most important financial issues.

What Do These Results Mean?

It’s one thing to read these results, but another thing entirely to understand what they mean to your current and future financial health.

Since no two people are dealing with the exact same circumstances, no two people should take the exact same approach to managing their money during the pandemic.

However, there are three important takeaways that everyone should take to heart:

1. Financial Issues are Likely

Some people have it worse than others, but most people are dealing with financial issues as they navigate the pandemic.

As noted above, the majority of respondents are pessimistic about important financial issues such as the cost of healthcare, retirement planning, and the housing market.

Adding to this, you may be pessimistic as a result of your current circumstances, such as a job loss or the inability to pay for further education.

Even if you’ve kept your financial concerns to a minimum, things can change in an instant through no fault of your own.

2. Now’s the Time to Plan for the Future

It doesn’t matter if you’re optimistic or pessimistic about the future, now’s the time to plan for the months and years to come.

Maybe you’re among the 43% of people who are more concerned today about their financial future than pre-pandemic.

You may not like where things stand right now, but you still have full control over your future. It’s the adjustments you make today that will impact what happens down the road.

Make changes such as:

- Reviewing your budget and eliminating unnecessary expenses

- Creating an emergency fund

- Putting more money into retirement accounts so you can retire at your target age

It’s a tough financial time for everyone, but the pandemic will pass. And when it does, you want to have a plan in place for reaching your financial goals.

3. Professional Help is a Good Thing

Here’s a statistic from above that we hope you didn’t gloss over the first time:

Half of the respondents are seeking assistance with their financial strategy, with 52% admitting this is a direct result of the uncertainty of 2020.

Even if you’ve solely managed your finances to date, the pandemic is a good reason to consider the benefits of consulting with a professional.

With professional guidance, you can answer questions such as:

- What’s your current level of financial health?

- Are you on target to retire on time?

- What’s the best way to track your spending and savings?

- What’s the best way to allocate savings for the future?

- What are the financial challenges you’re likely to face as the pandemic subsides?

Sometimes, a sounding board combined with a professional opinion is all you need to make more informed and confident decisions.

How to Maintain Financial Stability

The most frustrating part of the pandemic is a lack of control. Even with extreme focus, you don’t have full control of your financial future and health. This can make it difficult to maintain stability.

But of course, it’s not impossible. Here’s what you should do:

1. Review Everything

Now’s not the time to assume that you understand the finer details of your finances. It’s time to review everything with a fine-tooth comb.

At the very least this should include:

- Your budget, including essential income and expenses

- Your savings across all accounts

- Employment stability

- Unemployment benefits (should you be out of work)

- Your tax situation

Leave no stone unturned, as every detail is important to maintaining financial stability.

2. Make Sacrifices

In a perfect world, you’d never have to make sacrifices with your money. Unfortunately, there’s nothing perfect about the impact of the pandemic on society as a whole.

Don’t be too proud to make sacrifices in your day to day life. Remember, these don’t have to be permanent. Instead, think of these sacrifices as temporary adjustments that will help you maintain stability until the world recovers.

Here are some examples of sacrifices you can make:

- Cut back your entertainment budget

- Sell some of your non-essential luxury items, such as your sports car

- Spend less and save more

- Search for additional ways to make money

The sacrifices you make today will turn you into a better person.

3. Implement the Right Tools and Services

In the section above, we discussed how a growing number of people are seeking professional financial assistance.

Along with this trend, you can help maintain your financial stability by implementing the right tools and services.

Personal Capital, for example, is an online provider of financial planning and wealth management tools and services.

For example, its money management tools include those for:

- Retirement savings

- Emergency fund

- Debt paydown

- Account-level savings

This is in addition to a team of highly qualified, licensed fiduciary advisors who are available to provide guidance based on your needs.

When you combine powerful online tools with access to the services of a financial advisor, you’ll feel more confident that your finances are moving in the right direction.

Final Thoughts on the Personal Capital Survey

This survey isn’t meant to scare you, but to help you understand the current financial landscape and how others are dealing with it. It’s critical that you know how to best manage your finances during this unprecedented time.

It’s everyone’s hope that things will turnaround in 2021, but there’s no way of knowing what the future will bring.

For this reason, it’s imperative to take full control of your financial future.

If you’re one of the many people who are interested in becoming financially secure during this uncertain time, there are tools and services—such as those provided by Personal Capital—that can put you on the right track.

Article comments