Quicken 2013 Review

The new Quicken 2013 adds an extensive mobile experience to the software. This is a must-have upgrade for long-time Quicken users. For the latest version, see this Quicken 2015 for Mac review.

Starting today, the new version of Quicken is available for purchase. While Mint.com and other online services are now very popular for tracking personal finances, I’ve stuck with Quicken for many years. This desktop software from Intuit has many advanced features — and basic features dealing with investments — that will never be built into Mint.com. For people serious about tracking personal finances, Quicken is the only software to use.

Although Quicken isn’t the only desktop software for tracking personal finances still being developed, Quicken’s biggest competitor, Moneydance, is much less sophisticated. Quicken’s former toughest competitor, Microsoft Money, has been defunct for several years. The lack of real competition and Intuit’s plan to focus more on Mint.com have both contributed to Quicken’s slow progress over recent years.

With Quicken 2013, the story is different. There are incremental changes to some features with a number of slight improvements — and these are improvements that the community has been requesting for several years — the biggest change is the addition of a mobile experience.

Improvements to budgeting functionality

Improvements to budgeting functionality

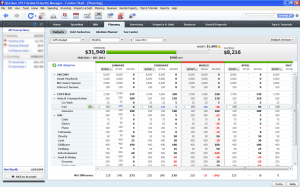

Intuit pays attention. The new budget planner was introduces last year and offered a much improved experience for planning full-year budgets and visualizing actual spending and income against the plan. In last year’s review, I wrote the following:

One drawback to Quicken’s budgeting tool is that it does not include a rollover feature. For example, if you budget for an expense of $200 in groceries each month, but you only spent $150, the extra $50 is lost. In real life, and in other budgeting software, that $50 would be available to add to the following month’s spending on groceries, but Quicken does not automatically handle surpluses.

This problem has been solved in Quicken 2013. Budget surpluses can be assigned to different spending categories within the same month or rolled over to the next. There is less of a focus on strict monthly numbers than a broader view of the concept of budgeting.

Although the full-year budget screen appears to be somewhat complicated, it’s very easy to create, edit, and review progress against the budget. The full-year view adds more flexibility in adapting the budget to fit your circumstances.

Although the full-year budget screen appears to be somewhat complicated, it’s very easy to create, edit, and review progress against the budget. The full-year view adds more flexibility in adapting the budget to fit your circumstances.

This solves the problem of a budget in Quicken being too rigid to fit real-life situations, where budgets need to be flexible in order to be useful.

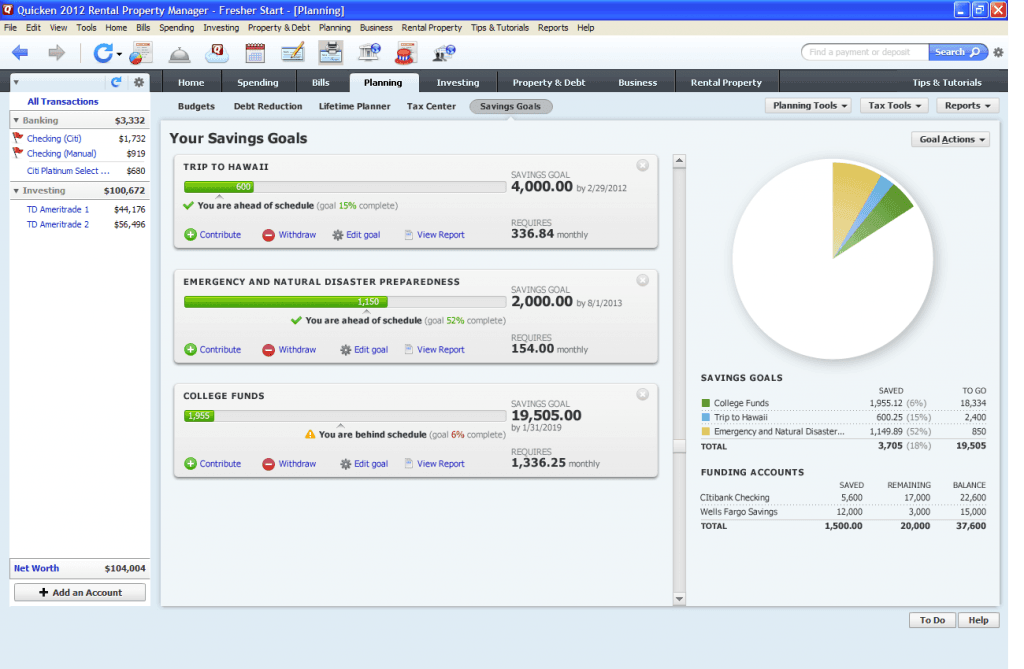

Related to budgets, Quicken has an improved area for savers who wish to define and contribute to specific savings goals. This is a move away from the mechanical transaction-recording premise of Quicken towards the more personal end of personal finance.

Through Quicken 2013’s updated savings goals feature, you can put money aside, virtually, for any future expense you or your household desires. Some expenses, like a down payment on a house, a vacation, or a child’s education, often require a gradual or slow increase in savings over time. Quicken creates a savings plan to help you stay on track.

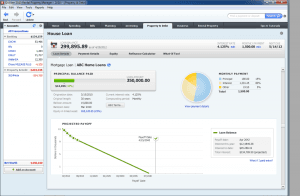

Loans

Quicken 2013 offers an improved process for setting up new loan and mortgage accounts. Just like setting up new checking or savings accounts, you can download your basic loan information, including interest rates and other pertinent information, directly into the software.

Quicken 2013 offers an improved process for setting up new loan and mortgage accounts. Just like setting up new checking or savings accounts, you can download your basic loan information, including interest rates and other pertinent information, directly into the software.

To the right is an example loan overview screen in Quicken 2013. This screen offers a new visualization of what it will take to pay off the loan or mortgage according to its terms. This visualization allows users to easily understand the cost of debt, and it can help to encourage those in debt to do what it can to eliminate it quicker.

Quicken mobile

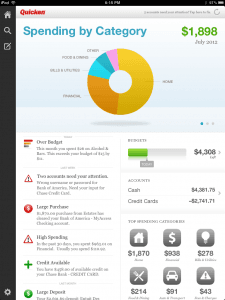

People spend more time on mobile devices than they do on desktop or laptop computers, and if any software plans to stay relevant in the future, there must be a mobile component. The latest developments in the software show that Intuit has learned the importance of mobility from its acquisition of Mint.com.

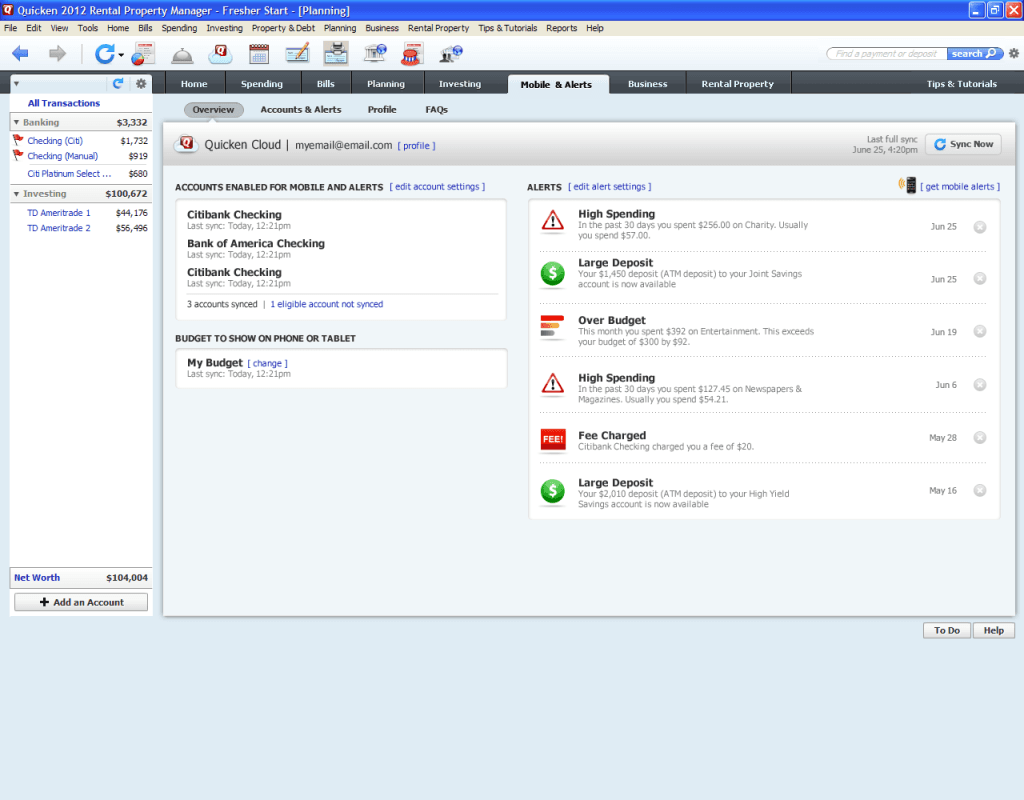

Pictured above is the Quicken 2013 screen that allows you to enable mobile access to your Quicken information, accessible in the software by clicking the Mobile & Alerts tab in the upper right-hand corner of the interface.

To activate mobile access to your Quicken data, Intuit requires you to create a new set of log-in information. In some places this is called a Mobile ID, and in others it is a Cloud ID. Creating this account will sync the spending information in your Quicken data file with your mobile devices, and AndroidOS and iOS are both supported. Tablet apps, both AndroidOS and iOS, are enhanced for those display types, taking advantage of more screen space.

To activate mobile access to your Quicken data, Intuit requires you to create a new set of log-in information. In some places this is called a Mobile ID, and in others it is a Cloud ID. Creating this account will sync the spending information in your Quicken data file with your mobile devices, and AndroidOS and iOS are both supported. Tablet apps, both AndroidOS and iOS, are enhanced for those display types, taking advantage of more screen space.

The purchase of the Quicken software includes access to the mobile apps. They are free for users of Quicken.

The mobile applications support only your spending accounts. You can’t access your investing or foreign currency accounts with the mobile apps. This allows you to handle most of Quicken’s features while on the go, including recording transactions, reconciling data against the information downloaded from your banks, and check your budget on the go to help you make spending decisions while you’re away from your computer. If you’ve enabled online access to your spending accounts through Quicken, your bank transaction data will be downloaded in the background so you can use your mobile device for reconciliation.

Rather than collecting a pile of receipts over the course of the month, the mobile applications will allow you to enter spending information as you spend, increasing the chances of accurate tracking. The applications allow you to split transactions into several categories just like the desktop software, and this could theoretically save you from facing the daunting tasks of trying to remember details at a later date.

These are the highlights of the new mobile apps for Quicken 2013:

- View a chart-based visualization of your spending.

- Review a snapshot of your budget, and edit your budget if necessary.

- View your top spending categories for the month.

- Record and edit your transactions while away from your computer.

- Access new mobile alerts.

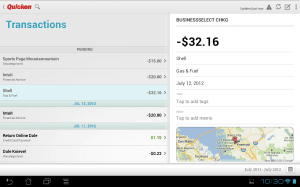

To the right is the transaction detail view for AndroidOS tablets. All information on this screen is editable.

To the right is the transaction detail view for AndroidOS tablets. All information on this screen is editable.

Part of the new mobile experience includes alerts, as mentioned above. Thanks to the cloud, your data is constantly being crunched.

You no longer need the desktop software to be open and running. With the mobile features enabled, you can create email or text alerts to notify you of changing conditions affecting your budget, like low balances or an approach towards a spending limit.

The mobile applications should be available from their respective stores today, but as of publishing this review, they are not yet available. You can, however, set up your Mobile ID or Cloud ID and begin the process of enabling mobile access. Update: The mobile apps are now available as free downloads from Google Play and the iTunes Store.

These new mobile features are very different than other mobile applications for managing your money, like Mint.com. This is a robust experience designed for users who appreciate the level of tracking and analysis possible with the desktop version of Quicken, impossible with other mobile applications. I would prefer to be able to at least view investment activity in the Quicken mobile experience, but spending and saving certainly deserve extra attention from developers.

Quicken 2013 download and giveaway

For users who have been waiting for a reason to upgrade from a prior version of Quicken, and perhaps dissatisfied with the incremental changes from one year to the next, the Quicken 2013 update including mobile may be a compelling reason to install the new update of the software. That statement applies to users of Windows only. Intuit has yet to finalize an update for Mac users, who must run Quicken in a Windows virtualization if these new features are important. Intuit is eager to support these new updates to the software natively for Mac users, and the company is “evaluating Mac opportunities in the coming year.”

The new version of Quicken comes in all the varieties of the past: Starter Edition, Deluxe, Premier, Home & Business, and Rental Property Manager. The prices have increased over last year’s release. All versions are available for download from Amazon.com or from Intuit directly. You can also buy the box and have the software delivered on a CD-ROM.

October 10: Intuit has already released an updated to Quicken 2013. If installing the software for the first time, if you are connected to the internet, you will be required to download the update when launching the software. If you have already installed Quicken 2013, you will be prompted to install the update the next time you open the application.

November: Although my experiences using Quicken 2013 have been trouble-free, other users are having a very different experience. Intuit’s user support forums and Amazon reviews are full of complaints from users of the new software. Visitors to Consumerism Commentary have also been reporting bugs and problems. Please read the comments on this article before making your purchasing decision.

If you have a problem to report and have notified Intuit or otherwise checked for a resolution, please describe your problem here as well by leaving a comment. This will help other users resolve their issues, or it will warn potential customers about other problems with Quicken.

Note: While some of the screenshots above say Quicken 2012, they are in fact from the newest version, Quicken 2013.

Quicken 2013 giveaway

This giveaway is now concluded.

For a limited time, Intuit and Consumerism Commentary are giving away one copy of Quicken Home & Business 2013. Here’s how to participate in the Quicken 2013 giveaway.

Article comments

I have used Quicken for the Mac since the beginning. I upgraded to this latest version and I am completely out of my element. I could easily navigate the old version; but this one is too sophisticated for me. All I want is to enter my transactions, attach a Category, and at tax time be able to print out a report for my tax man that shows all of my donations. I am unable to format the report, i.e. adjust margins, eliminate columns, have transactions on one line. Also, I have trouble viewing the screen. The old version had lines and shading … I’m 74 years old and wish I hadn’t upgraded. I’ll need to find another program.

I am a long time user of quicken and wait until they stop supporting the version I am using and then upgrade. I am having problems with the 2013 install which sticks at the converting price histories part and will not complete the install.

Ok, so I see there was an update for quicken 2013 the other day. I updated. Hoping…… Went to go and print an envelope from the address book and expecting the envelope to print correctly. F%$# NO! Same crap. STILL NOT FIXED. How do we go from older versions working to new versions NOT WORKING?! If it ain’t broke, don’t fix it. Why did I ever upgrade?

I’m not sure where Mr Landes come with “extensive”, because from what I can see the only adjective I can think to use is “limited”, “basic”, needs a lot of work.” And, to keep everyone honest here, all the screen images are from the PC version of Quicken – and, while the mobile ap does have a nice appearance, you do NOT have any of the pretty graphs, reports, and other analysis tools on the mobile ap – you sync the mobile data to the PC, and then do all of that on the PC.

First, and this is to be expected since the memory on mobile devices is limited, the mobile ap is ONLY for entering transactions. You can review the currently unsynced transactions, but once they’re synced I think they’re gone from the mobile device. I could be wrong on that, though, I only tested it so far.

Second, you MUST be connected to the Internet to use the ap at all. This means you can’t enter transactions while on your device when out of range and upload later when connected.

Third, Quicken Mobile is almost completely useless with Quicken Business because it does absolutely nothing with A/R and A/P accounts – which, if you’re using Business, is 80% of what you’re doing!

Fourth, It does not sync any of your memorized transactions down to the mobile device. So, you have to enter each (and remember what they were, how they were spelled, and what the details were if the transaction happens to include splits).

Fifth, you have to do 4 or 5 different steps if you want to enter a Split transaction! a) Enter the “overall” picture – date, Payee, total amount. B) save it, C) move to Edit, D) Edit the Transaction, E) add the Split detail. I realize I’m way on the far end of OCD/A Retentive, but 90% of my transactions are split!

Sixth, and possibly the worst, is that it REQUIRES that all of your data be saved on Intuit’s servers. I had envisioned something that simply synced “saved” mobile transactions to the “parent” pc when you were back home(liek Windows ActiveSync). But, in fact, your entire Quicken file is uploaded to Quicken, and everything syncs to that. In this world of hackers, crooks, and thieves (not to mention Politicians!), I, personally, have a huge problem placing all of my personal financial data on a remote server. Which, incidentally, is available anyone with an internet connection and hacking skills. As a matter of fact, I read a couple of months ago that a Russian firm announced that they had broken Intuit’s encryption key – true or false, I don’t know. I do know that you can pay Intuit to unlock a file you’re forgotten the password for, so at the most it can only be as secure as you trust Intuit data processing people.

In my opinion, don’t waste the upgrade money on Q2013 if all you’re looking for is the Mobile feature. The Quicken software itself has had almost no changes on it in over 5 years. So, If you’re not running into Operating System issues, you’re better off saving the cost of the upgrade until someone comes up with a more secure and robust.

I switched months ago with no problems. I don’t do extensive securities tracking – although I do have all my 401k data for many years entered. My file goes back to 1993. I have had no problems at all.

All I have to say is go to CNET and read the reviews before you EVEN THINK of buying Quicken 2013!!!!

I got notifications from Intuit that after April my 2010 quicken would no longer work with my bank. If I wanted to continue using this feature I would need to upgrade to 2013. So much for vendors providing upward compatible software.

I think 90% of the people on this thread are in this situation. Every 3 years or so Quicken forces those who use its online features to link with financial institutions or download stock prices to upgrade to its latest version. That’s their way of generating continuing revenue, as little as we like it. But Q2013 is particular in that so far it appears to be a downgrade rather than even a marginal upgrade to Q2010.

I just converted my data over from Quicken 2010 to 2013. Only problem I’m seeing so far is my previous stored reports aren’t working. I have a monthly report that shows income and expense for a month. In Quicken 2013 they show as no expenses and no income. However if i reconstruct the report from the new Quicken 2013 menus they come out fine. they look like the settings are identical in both reports. It’s as if the old report is maybe pointing to the old 2010 data file internally?

Anyone else had this problem?

You will have to recreate those stored reports. Since the budget module was changed Intuit had to fiddle with the reports as well. I had to recreate over 45 reports but they are now working. However be aware that if you change a saved reports (say collapse all of the categories and then save it) will not truly be saved. When you reopen the “saved” collapsed category report it will have all of the reports expanded again.

Printing checks to blank stock is not a problem with Q13. I have used Checkmagic through several versions of Quicken with three accounts. Since the formatting is by the Checkmagic software, no problems with the transition.

I got the upgrade. I wished I didn’t!!! To many bugs in the software. Tech support says there is nothing they can do right now and that the engineers are working on it. This is the second time that after I upgraded I had major issues happen. It has ended up taking up way more time to fix the issues than I can afford to spare. So, I have decided to take this moment and warn anyone that if everything is working fine currently then don’t upgrade unless you really, really have to.

And another thing! It really really really sucks that I can’t go backwards in versions with data.If I could I would go back in a heartbeat.

I agree, Bryon. I am still flummoxed by items that I entered in Quicken on iOS that don’t show up on my desktop or show up in inappropriate accounts, and by problems with Q13 itself (such as mortgage entries). If I could go back I would. For anyone forced to upgrade due to their access rights expiring, I would be conservative and update only to Q12, accepting the extra long-term cost for the immediate assurance of adequate performance. In the meantime, let’s hope that Quicken is listening, so others don’t go through such a miserable experience.

However, a technical question. You say you can’t go backwards in versions of data. Quicken does save previous versions intact, so if you have not deleted these backups, if you install Q12 you can resume from there.

If I didn’t reorganize my accounts, catagoies, and input a bunch of data that would be great. But I don’t have the privilege of extra time. I was trying to cut down backup time by starting over fresh from Jan 1. I had way to big of a file.Going back almost 10 years. The other issue I had is one that I had once before when I did an update about 4 years ago. I have a check printing software that will alow printing on blank check stock. I have multiple accounts that I print ckecks from and using one printer with the blank stock saves time and money. So each time I update quicken, I then have to update the check printing software also. That really can be an issue. I wish quicken would allow blank stock printing rather than pre-printed checks. That can cause issues with printing on the wrong checks which takes more time and money.

This program is useless if you have a loan that began before installing quicken 2013. there is no way to take into account any changes in the payments in the past (this happens if the amount of the escrow changes, as it does every year) The program assumes that the past payments were all the same, that is not true and very misleading since the amount of escrow will always be WRONG

I did my upgrade to 2013 and haven’t had any problems. Everything functions pretty much as it did before. I’ve been using (and upgrading) the same QDF since 1993. I don’t do much with stocks other than what’s in my 401(k) but I haven’t noticed anything that is incorrect. Some of the workflow changes bother me…(memorized transactions don’t put you right into the amount field – you have to tab over now, for instance).

I have been a long time Quicken user and like many others I have bought an upgrade every 3 yrs or so. This time they have really ticked me off. I got a message saying the financial institution syncing in my Quicken 2010 will be turned off on 30 Apr. So I bite my tongue and go check out 2013 on Amazon, and then look at these comments to your article. What a horror story. Is anyone trying to put pressure on Quicken to clean up their act?

Folks say don’t by 2013, so what is the best option to retain the same functionality I have become used to?

This is one of the worst releases Intuit has put out. Budget module is very hard to use and on January 31 one graph had my spending year to date as X and a different graph supposedly of the same information showed X + $138,000! Another graph showed spending year to date 2013 as $838,000 and income of $300,000. These figures are so far off. The file validates fine.

The projected balance feature is useless unless you schedule all of your income and expenses for the year in advance, who does that?

At one point it lost 5 + months off investment information. I did not discover this until a month later when I wanted to reconcile the account. I checked all of my backup files, one day it was there, the next gone. This was all with Quicken 2013. I thought I would try the Quicken Live Community and was flamed by a supposed “SuperUser”, very nice first contact indeed.

The annual budget screen showed scheduled transactions for future days in the Actual column as if they have already taken place, when they have not. Totals with subcategories has been flaky with the total of subcategories not equaling the total in the parent category even when following the “rules” as stated by Intuit after hours and hours of research.

Reports are showing totals that are wrong and I am having to double check every report with a calculator. This is not progress at all. DO NOT BUY THIS VERSION.

Bad news, Matt. While I originally ranted here about the loss of investment information in the conversion which I must do to maintain internet security price access, I too continue to use Pocket Quicken 2.5 on my Palm while awaiting a better iPhone version of Windows. I also keep the Palm for my password safe which I have not yet attempted to move. But, PQ2.5 will not sync with Q2013, it just locks up. So, until a better iPhone version of Q2013 comes along, your workaround is the only way to go. Sorry.

Not to worry, Rick, I didn’t buy 2013 after I saw all the negative reviews, I still have 2012 Premier. I did retire my Dell PDA, though, (and Pocket Quicken 2.5) and I’m simply using my smartphone’s notepad feature to record transactions when I’m away from home. It turns out that I really don’t have very many of those kinds of transactions at all, so I’m good to go for now.

One of the main reasons, if not THE reason, I wanted to upgrade to Quicken 2013 was to get the mobile app.

Up until just recently, I used a 10-year-old Dell Axim PDA and ActiveSync with Pocket Quicken 2.5 to record transactions while I was away from my computer and sync them with Quicken when I got back to my desktop. This works even on my current computer running Windows 7 and Quicken Premier 2012.

However, it is long past time to retire my trusty PDA, since the only reason I was keeping it around was for Pocket Quicken. I wasn’t using it for any of the other things I originally got it for, those tasks were now being handled by my smartphone. So, to minimize the number of little electronic boxes I carry around, I decided the Dell had to go.

But this means I need someway to record transactions while I’m away. Right now, I just use the memo pad on my smart phone, but then I have to type them in again when I’m at my home computer, and that’s double the work. When I saw that Quicken had a mobile app, I thought this was the solution I was looking for.

But then I read all the negative reviews, on Amazon, on this page, and elsewhere. It has totally scared me off of upgrading. I think I will stay right where I am and use the memo app on my smart phone for now.

As of my testing last week after receiving an email on 1/23/2013 from Barry Saik, VP & GM for Inuit Personal Finance Group, there are still bugs in Quicken 2013 that generate erroneous account listings, erroneous balances and the balances it reports to the mobile app are not 100% accurate. In other words, I’d trust my bank info to a terrorist before I’d move my data from Quicken 2012 into 2013.

This is a followup on my submission of the other week. After a lot of back and forth with Intuit I sent them my Q2010 data file. After a few days they responded that the reason securities prices did not copy is because the data file is corrupted, and though Q2010 had not trouble with displaying or calculating with it, it could not be translated into Q2013. I must manually enter any prices I want to keep that are not part of the 5 year history of securities with an exchange symbol, though there may be a workaround with a CSV file. Clearly I am not happy with this response since I am “upgrading” to Q2013 only under duress in order to keep on-line price access, but others may not have this problem. I’ll have a few long evenings ahead doing at least quarterly postings for my securities.

If I go to my bank website, download a file of transactions, and open in in Quicken2010 is Intuit going to somehow start blocking that in April? As far as I know I am not connecting to Quicken.com (am I?)

Question:

I purchased a 2010 copy of Quicken but never installed or used it. Can I still use it or do I need to abandon and jump to 2013? Will Turbo Tax 2013 work with the 201 Quicken data?

You can still use Quicken 2010 except for the online connectivity and downloading bank activity features. TurboTax should be able to import Quicken info from any version.

As contentious as Quicken 2013 seems to be I’ll be purchasing it anyway since my copy of 2010 will soon stop working for online updates. Got a thing in the mail from BJ’s – you can buy the deluxe version for only 29.99+tax if you are a member (while supplies last). I don’t think there is a lower price for the deluxe version anywhere (it’s usually at least $10 more).

How many people will read all the way down to this post in the thread and how many will actually read to understand? I don’t know but here’s a post for the diligent. There was a MAJOR bug in the earlier releases of Quicken 2013 related to a very cool nifty looking feature: the sync to mobile devices. I have an iPhone and an iPad. It was beautiful to see the data on those devices and I was enthralled. In trying to reconcile the numbers to what I had on my desktop I visited Quicken support and learned that a clean and large datafile was corrupted. I lost literally thousands of transaction entries over many years. This situation could have been prevented. There should have been an optional switch to OK every write back from the mobile devices to the original data. Instead, the mobile devices sent back and incorrectly corrected the data, presumably by a missing column and shifting the data inappropriately. It’s going to be too much work to manually correct the entries but also too much work was done since the fail so I’m stuck using a corrupted database. Beware, make back up copies before a sync to a mobile device, checking the data after a sync and don’t relax if you have years in your data like I did. The initial releases get an F- from me. The new ones still don’t sync correctly. Very very very disappointed.

I updated to 2013 because Quicken doesn’t support 2010 on-line access after this April. The conversion does not convert securities prices. When I complained, customer service said Deluxe is not the correct verson and provided me Premier. First, Deluxe does track securities, so the interpretation was incorrect. Second, I then had the same problem in Premier. I still have not resolved this after 2 days of chat and 1 day of email exchange (the latest email exchange repeats the instruction I received 3 days ago that did not work, so I’m working with the script-readers rather than the knowledge people.)

Thanks, Rick. Please continue to report on your problem. I don’t want it to become my problem too and am waiting to install Quicken Deluxe 2013, now in my hand on a CD, till I know your outcome.

Rick, did you ever get your problem of conversion of securities prices to Quicken 2013 Premier solved? I’m still looking for information about your problem before daring to install 2013 Premier for fear of losing transaction data, including prices on a few securities back to 1985! I hope your problem was solved. Tom

Tom, no I could not I posted later in this stream. Intuit staff analyzed my data and said that a corruption in my Q10 data files, while not preventing Q10 from working, prevented conversion to Q13. My workaround has been (1) using Yahoo finance CSV files for securities that are still listed to go back more than 5 years, (2) retrieve what I could from the “Edit price” panel of Q10 to convert to CSV, and (3) acknowledge that I’ve lost the unlisted and no-longer listed securities. I cannot recommend Q13, I was forced to accept it to continue to have download capability.

Many thanks, Rick. Maybe I’ll just have to throw away the Q2013 Premier I paid for or try to get my money back and look for an alternative come April. I’m too scared to install the 2013. Gratefully, Tom

This is going to be the last contribution I make to this thread. Just to let you know that I was able to export all the prices of my bonds and unlisted securities from Q10, spent hours reformatting them in Excel, then temporarily change the status of all these securities in Q13 to “stocks” so I could give them pseudo-symbols corresponding to what I had created in Excel and download the CSV data I had created. That worked. Whew.

Except I’m not finished. On my home page, I have 3 portfolio performance graphs. The retirement portfolio appears to be correct with an IRR that lies within the separate account values. The personal portfolio shows positive entries for each account but an IRR of 0 overall. The graph for my overall portfolio, personal plus retirement, shows an IRR of 4,500% (Don’t I wish!…) with the individual accounts so smooshed down onto the x axis that they can’t be read. I clearly have some more data digging to do, and remain unhappy with the current version of Q13.

When will quicken allow a sync to a mobile phone through a usb? I don’t trust “the cloud” to maintain the security of my data that a hard line gives.

I agree with Ross. I have totally lost confidence in my data since upgrading to Quicken 13 and syncing with the Cloud. I have had to reenter and audit everything several times due to lost and corrupt data. I gave up on syncing with mobile. But I am still nervous about the integrity of my data going forward on this release. I am now reconsidering another option, which is too bad as I have used Quicken for a decade now.

Given all the problems people are having with Quicken 2013 should I buy the 2012 version since I suspect will lose the online update with my 2010 version?

i’m very happy with Quicken 2012 both in Windows Xp and Windows 8. HOWEVER, if you plan on using Intuit’s Turbotax 2012 to do your taxes this year and have Windows 8, install the Turbotax BEFORE you install Quicken 2012 or TurboTax may fail to install due to Intuit’s poor use of Windows .NET framework.

Might not be a bad idea. Although the budgeting isn’t nearly as good as 2013 there are still a lot of 2013 problems that you won’t have to deal with. Today I updated to release 8 and although they claim to have fixed many of the “Cloud” issues none of the report(s) issues have been touched – so much for their “all hands on deck” statements about the efforts to resolve all of the problems.

I just finished upgrading from Quicken 2010 to Quicken 2012 under Windows XP with no problems. This will keep me going with all I need from Quicken for another three years to include online updates.

I have been using Quicken since the mid ’90s and have been shocked at how poorly this release was built. I have been chasing lost and corrupted data every since I installed Quicken 2013. I never experienced these problems in earlier releases. Intuit has really hurt their reputation. Maybe they thought they didn’t have to work as hard after MS Money was discontinued?

I love quicken and have used it since a couple years after the first version came out. I recently discovered a glich (unless I’m a moron and haven’t figured it out yet). Quicken won’t accuratley estimate transactions with split categories. I have tried several times in vain, some with Quickens help, to have quicken estimate a deposit I have once a week. Since I am retired and work part-time, my paycheck from week to week is different and as such, the deductions are different as well. For some reason Quicken cannot estimate correctly off the last six deposits. It graps on of the last and uses the actual value from that transaction for the future estimated transactions. Quicken says it works – but I have not gotten it to do so correctly.

DoesQ2013 still store your data in a local file or does it all go to the cloud?

If there is still a local file, is the cloud just used for mobile apps? It sounds like all the financial institution download/updates are done by the cloud services. Does this mean the cloud is the main copy of your data and the local app is a sync’d replication?

All of your data is stored in a local file, as in previous versions.

I have been using quicken 2004 basic for a long time. Can I upload that data onto the 2013 deluxe?

Larry,

You can convert your Quicken 2004 file into Quicken 2013, and it will convert your data to work with the new software.

I had Quicken 2000 and COULD NOT transfer my files.

I have updated this review to include the fact that many users are seeing problems with Quicken 2013 that I did not experience and weren’t previously reflected in the article. Please continue to share any issues, problems, or bugs you’re finding with Quicken 2013.

In my review and daily usage, I have not seen the issues mentioned online. That’s not to say they don’t exist, just I haven’t experienced them myself.

Let me add the amount of accounts it supports online makes it nearly impossible to test all of them. From the reports/reviews I’ve seen online seem to be related to accounts with specific financial institutions. For the 50+ accounts I have, I haven’t seen the issues described.

In one of my earlier comments I mentioned the budget report issues when you try to use anything other than Budgeted Only. If it works properly for you than maybe I’ve got something wrong. Also we used to be able to group reports in the Reports Center and place the report group on the taskbar. When you click on the icon the list of reports was shown and you could select a report. Can you still do this? Right now when I try this (even with R6) the icon does nothing. As an example I have a group of reports for Investment Income with a Summary Report and then individual account reports. They are all grouped under Investment Income but when I put Investment Income reports on the taskbar it and click, it no longer list the reports.

I’m a big fan of Quicken and I’m happy with the changes to the budgeting process but there are many many issues with 2013 that reflect very poorly on their Quality Control process.

I will report back on that specific issue when I have a chance.

I think this review must have been written by a Quicken employee. I have read several buyer/user reviews and sound nothing like this. Basically the product appears to be a step backward, and “Kather” at Intuit even apologizes for the issues that will be be corrected in R3. But at R6 it is still a mess. I to have been using Quicken since dirt was invented, and now use 2012. I will stay with that.

I’m not a Quicken employee, but again, even with dozen of accounts, I haven’t experienced the problems other people are seeing. Maybe I have a “special” copy.

I feel bad since I was the one that commented about wanting to buy it and made you pick the winner early and then didn’t buy it based on the feedback above and on amazon (I will still buy it I just didn’t run out and buy it right then).

But I can totally commiserate with you Luke, I do IT and let me tell you I experience about 1% of the errors people complain about. Either because I don’t do things that make them happen or automatically fix stuff without even thinking about it.

If i had a nickel for every time someone complained about something crashing when that *never* happens for me, I’d have at least 50,000 nickels:)

I’m actively keeping track of the boards and forums on Quicken 2013 and although the “IT” guys might be circling the wagons they can’t blame it on the stoooopud users. How you would like to buy a car that within thirty days has had R2, 3, 4, 5 and 6 recalls/modifications. Poor quality control has bit Intuit in their butt and a whole bunch of their responses have been apologetic. You might have received 50,000 nickels but you would have had to spend 49,500 of them fixing your product.

I have been a Quicken user since MS Money stopped online security price updates and currently use Quicken 2011. Before I upgrade to the 2013 version, I need to know whether the product has improvements for tracking and analyzing investments. So far, all of the reviews and comments that I find are about other features not so important to me, namely budgeting, information from banks, and so forth. Is there anything new in the upgrade for people who use it to track investments?

Quicken 2013 is WORST experience I’ve had with Quicken in 22 years of using it. Read the reviews on amazon and epinions. MANY major bugs which Intuit has admitted and claimed to fix. As of 10/22/2012 they have NOT fixed the major bugs so if you want incorrect balances on your computer and mobile device, buy it now!

For what it’s worth, I have not experienced any of the bugs these reviews have been talking about. Since I wrote this review, I’ve been using the latest Quicken 2013 updates. I have been annoyed by the more aggressive method for renaming payees or payors when downloading bank activity, but a few adjustments to the renaming rules seem to have fixed that. I’ve never seen any version of Quicken report an incorrect balance, though that’s been a frequent complaint among users for years, and I have 50 to 70 accounts tracked in the software.

Try a simple budget report, then go to “Customize/Advanced/Categories”. Try anything other then Budgeted Only and check the results. Now you’ve seen one them there bugs. Quicken knows about this and say they’re going to fix it soon. I’m using Premier Release R 5 (22.1.5.2). I haven’t found any bad math either but there are more than enough bugs to go around. Not being able to group reports on the taskbar and then have a drop-down list was another one that “bugs” me.

Just doing what you’ve described shows some strange numbers… at first glace it seems to include account-to-account transfers… so those are “categories” that not only shouldn’t be in the budget reports, the shouldn’t be “categories” at all. I’ll have to do the same with a simpler test file to see what’s really happening there.

When I do it a lot of my categories just disappear, although there is a total under Income all the income categories are gone and the only Expense categories that show up are Insurance and tax. I personally want to see the non-zero/budgeted selection work right. One thing I learned watching the boards was that I needed to use the TOOLS/CATEGORY LISTand make sure all of the categories I use where shown as being in either the Income or Expenses groups. They seem to have added a “Personal Expenses and Personal Income”. Being old and retired that kind of fancy accounting isn’t necessary for me and the file conversion seemed to assign groups in a random way. Making sure mine were in Income and Expenses rather than having any in personal ” ” seemed to help with many of the issues.

You must one of the only people with no errors on your mobile device. My desktop version is right on the money, but my iphone and ipad show I have about $1,000 more in both online and ending balances than I actually do.Too bad it won’t transfer back to the bank! I need a program for a mobile app that works, not one that may possibly make me overdraw my bank account. I am beginning to think this was a Paid Advertisement and not a user review.

Your comments on budgeting do not address the most significant change, my opinion, made in the 2012 update. Previous versions had alway considered budgets on an annual basis (calendar or fiscal). The 2012 version changed this to a rolling budget which made the budgeting process overly confusing. In particular, one could not change the budget for Feb if it were already Mar. I’ve seen comments saying this is possible by editing Feb of the next year, but that is simply poor design and concept. So my question is can one change the budged for Feb 2012 now that we are in Oct of 2012 in v2013?

Yes you can. The budgets are now based on a calendar year. I too hated the “rolling” budget and have used Excel for all budgeting excercises. Q13 does get away from that.

However, they still have to fix many many report generating problems. As an example if you generate a budget report and then change the report, in almost any way, 90% of the data disappears in the report although the totals are correct. I’ve been using the Quicken Live Community to keep track of all the numerous little bugs that are cropping up. It has been disappointing that the improvements they made have trashed so much of the basic fuctions we’re used to.

“You can’t access your investing or foreign currency accounts with the mobile apps.” My primary cash/spending account is in a foreign currency, while my other accounts are in US currency. So this actually means I can’t set up a foreign currency account with the mobile app to track day-to-day expenses (which you can do with other apps like PocketMoney)?

Upgraded from Quicken 2010, principally because of the promise of a usable mobile app.

It’s not here yet, folks. In less than a week, Quicken is up to R4 in fixes, and mine still isn’t working right. Balances are off for unexplainable reasons. Error messages for trying to link.

And the info goes into the Cloud, not a direct link between desktop and device.

Last, the published info is wholly inaccurate as to how to delete Cloud info or try again. Be very careful.

It is January 26, 2013, We are at R10 and the mobile app DOES NOT show correct online and ending balances. They are approx. $1,000 off. I am ready to request my money back as this was the sole reason for my purchase of this software. Quicken 2000 and iReconcile worked well enough – I just had to export the .QIF file and put it into quicken – but my checkbook on my phone (iReconcile) was always right on the money! If you do not need all the bells and whistles or really want a program with a working mobile app – then don’t waste your money on Quicken 2013.

Thanks for this comment. I have found the present version I am using to be adequate 2011 for my needs. The first version of an upgrade is usually filled with horrors. Not going to get this one, I do not need the mobile apps that seem to be the big thing in the 2013.

It is a well written review. However, I suggest that you also read some of the reviews on Amazon.com from people who have already bought the program, I am one of them. Intuit did not do a good job of testing this software release. They are on R3 in less then one week. I am sure once they work out all the bugs, this will be a great program.

Might just be me, but I would avoid doing a ‘review’ and having a giveaway of the same product in the review. Makes it seem like it maybe a paid advertisement instead of a unbiased review. I mean you aren’t going to say it sucked, and here’s a free copy.

I HATE the debt display. In fact, I recommend running from Quicken 2013 and find another program. The debt display takes up more than 1/2 of the upper screen and I can’t find any way to turn it off. I need to see the full register, not a couple of lines. It is fine to have this capability, but not everyone needs or wants to deal with it every time the debt area is opened with more than 50% white space. This is rather like all the bills being sent out recently that have been badly redesigned so it takes four, instead of one, page to find key information and wastes paper. Download Quicken 2013 and you will find the download needs an immediate update to load, you will wait 40 minutes to get help, then several hours to get the thing to transfer your files from a prior version if you are upgrading, then get weird error messages that turn out to be incorrect, and two days later you may get a patch. I used it for several versions and this is the WORST I have even encountered. In addition, it adds clicks that are not needed, like having to click and then enter on a popup to reconcile, when you could just click on the area and get an R for reconciled.

In Quicken 2011, there is a major bug with misassigned categories when exporting to Excel. Does 2013 release fix that? How about the one step update glitch? Problems like this with basic functions make me grind my teeth in frustration.

Since I travel a lot for work. I would like to see it have the ability to send alerts from Bill Minder. I have on-line access with my bill pay so its easy to pay bills while traveling. Occasionally I miss a due date because I’m out of town. and don’t have access to my desktop.

The mobile component is interesting. I’ll need to get better at using Q2012 before I upgrade though. I’ve already upgraded twice without really letting it “get hold”.

Does 2013 version handle BofA extra layer of security (PIN) to use WebConect for automatic updates from within Quicekn? Since I added this extra layer to the security settings (PIN sent to my iPhone) I can no longer use WebConnect for automatic updates. Since then I had to remove the update settings from the accounts and download the WebConnect format files and then manually update/upload to Quicken which is a much longer and cumbersome process. Fixing this isseue would be a good reason to upgrade.

I have had no issues with Bank of America and Quicken 2011. The only issue I have is BOA charges for Webconnect. The automatic downloads have worked fine for me. Maybe you just need to reset the accounts and sign back up in BOA. I do recall there being a temporary glitch some time ago, but I resolved it. Wish I recall what I did. Other than that, the short time I had 2013 and used the associated app, I had no trouble with downloads excecpt that when the app synced my data got way out of wack on my checking account. I am back running 2011.

Well, from reading all the comments it sounds like typical Intuit software. A buggy piece of junk that provides no real improvement over previous versions. I guess the mobile app is appealing if your into having your accounts screwed up. I don’t know about the rest of you but, I have always kept a parallel paper copy of all of my account information and transactions. Why? Because Quicken is not to be trusted. And, from the comments seen here, I have good reason to believe that.

Does the app support multiple devices such as mine and my wife’s iphone?

Been Quicken user since 1992 & was a avid user of Mobile Quicken on my Palm for number of years until 2010. Looking forward to upgrading so I can input spending/expenses mobiley again. Your review was very helpful, thank you. After reading some of the Quicker Forum posts think I’ll wait a week or three. Thank you again!

Hi Mike,

I have read plenty of complaints about this 2013 version, if you are upgrading. Currently, I am using Quicken 2008 and want to upgrade but many of those comments say that you cannot import the data files from this older version.

Please let me know if you have had any problems. Quicken support line is hardly accessible.

Thanks, Lynn

This is a horrible combination with mobile app. If you are upgrading for the mobile application do not do it. Moneybank has a much better application for iOS and Handybank app for android. The mobile application and syncing is not just an unfinished product, but ridiculously slow and hosed my data file.

The new mobile info looks great

*Can you see supporting images that you saved through it

*Can You Pay Bills

Did i understand that the downloads are gathered on the cloud?

Zachary,

I attached an image to a transaction in the desktop software, synced, and then used my Android phone to review the transaction. There is no facility for viewing the attachment.

You cannot pay bills through the mobile application as you can through the desktop software.

thanks for the response

For the mobile app. Will it allow you to pay bills from your mobile device?

There’s no function for paying bills using the mobile application.

A mint.com user, I tried going to Quicken a year or two ago and found I couldn’t automatically download transactions like I could in Mint. Is this fixed?? Does the new quicken sync to all my accounts that are supported on Mint.com?

While I can’t test banks I don’t have accounts with, I can tell you the process of setting up online services has been revamped. For example, when setting up access with Wells Fargo, I was prompted to choose between Web Connect (a free service that is similar to the way Mint.com works to pull in account information) and Direct Connect (the fee-based automated solution that handles more than just transactions; Quicken charges the bank a fee and the bank usually passes the fee onto the customer).

Nice review. I guess it is time for me to update my desktop quicken. I tend to use the old versions for a long time!

It was great meeting you at FinCon12 too!

Great meeting you, too, Marie!

I’ve been checking it out for a couple of days now and although it has a few new quirks is has been improved quite a bit. The budget functions, which I had found unuable in earlier versions, are very good. They brought back “Saving Goals” as well – and in a very usable form. However they didn’t do a lot with reports, the cloud function is not functioning for me, and both the toolbar and the Accounts Bar have new changes/problems which are very annoying. Overall though I’m not unhappy with the purchase.

Finally this looks like a Quicken update worth getting.

I have Quicken 2005… I could use an upgrade.

Most of the annual changes over the past eight years have been incremental, but add them together — with this latest update to 2013 with the mobile features — it’s a different program now.

I see, and for many of the same reasons I respect being supportive of both Intuit and Quicken Loans but I thought you might be intresseted in my recent experience with them..

First let me state that I’ve been a quicken advocate since the late 90’s. Unfortunately when it comes to fixes I’ve seen them as a long tenuous movement forward at best. This is not to say that I’ve not received great technical support at times, because I have been astonished on just how sharp some reps have been.

There are two points I’m trying to make, second and of least importance; without exception India’s support center makes me cringe with apprehension. I get it, but I dislike it! The colloquialism in language both in the use of and lack of, combined with the scripts in lieu a working knowledge just leaves me in remorse. To me this is not an experience that leaves me feeling gratified or a way of building customer enjoyment. After all I use Quicken because I enjoy it!

My apologies, I don’t mean to be offensive, but just try it yourself. Try calling with any mid-level question and experience it for yourself or get the feedback from a focus group or two.. Enough said, it is what it is, right?

Now back to my first point of when it comes to fixes. The dilemma that a customer feels when they are being told that we are aware of a problem customers are having with the software (“it’s verified and documented”) and yet there is no quantification on its resolve, no hope that your problem will be fixed, not even to the release level. So again, just get over it, right?

Do you see where I’m going yet? After all I use Quicken because I enjoy it! Or not!

Anyways the problem I’m having is pretty ironic Quicken 2013’s (Home and Business) doesn’t work with Quicken Loans. You can sets up the Mortgage account; it syncs but says: “This loan is paid off.” I’ve not been able to resolve this problem with either company.. (Out of frustration) Their new “marketing slogan” makes perfect sense..

“Stop worrying about money. Get started with Quicken 2013”

I’m going to have to look into Quicken 2013 because right now I just use mint.com to track my expenses and investments.

I usually buy a version 2 or 3 years old once my current version does not support stock price updates. For example my 2009 version stopped the updates this year so I went out and bought a 2010 version for about $12. This 2013 version might convince me to upgrade just for the mobile features.

I agree on the mobile stuff (been waiting ages for that – anyone remember the godawful pocket quicken for windows mobile?).

Quicken online stuff stops working after about 4 years (2009 would have come out in 2008) – so while that’s cheap you will always be using the oldest version. You could buy a new one every 3-4 years and at least be not so far behind in features for some of that time.And the cost would be only slightly higher (depending on the version I guess…basic for sure would be around the same).

I hope you did not waste your money just for the mobile app. It does not show correct online or ending balances. Both of mine (on my ipad and iphone4) are almost a thousand dollars off. The desktop is correct on both. Does me absolutely no good no knowing exactly how much money I have when I am out because my desktop is not with me – my phone is!

I switched to Moneydance recently because I could no longer use the 2005 version of Quicken for Mac which I loved, loved, loved. Moneydance has been fine, and I like it, but I would jump at a fancy new version of Quicken with all the capabilities for Mac. For now, though, it looks like I’ll just wait and see what Intuit comes out with.

Get Parallels for your MAC and then run the Windows version of Quicken. Best thing I’ve ever done. My MAC runs the 3-4 Windows programs I need and otherwise is a full-time MAC.

Thanks for the review. I have been cleaning houses, office, and new construction on the side for extra money. I really need a new financial software program to see if this is worth taking any further. Quicken sounds like I great deal and I am really hoping to win the giveaway.

Luke, nice and thorough review you got here! I’m looking forward to the giveaway tomorrow, would def. like to have a copy 🙂

I think I might give this one a try. I need a good program that will help me and my wife improve our financial tracking.

Yeah I’ve been waiting for this upgrade too. I find that upgrading quicken every year is just silly – features are never really that big a change. I have been using quicken since 1993 and in the last 19 years I think I have only bought it maybe 6 times.

I agree. I’ve used Quicken since 1995 and haven’t had too many editions. I usually wait until they stop supporting the version I’m using. There isn’t any new functionality in the next version that you need to have.

I want this! Have been a Quicken user for years and am very excited about the updated budgeting and mobile tools! My wife and I used Quicken to help us set a plan to get out of credit card debt in 2010, and now we’re building an emergency fund. The budgeting tool was very limited and caused lots of frustration (and use of lots of little pieces of paper to write out monthly budgets!)