Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

There are plenty of budget tools available to help you manage your money. Many of them are free. Spending less than you make is the most important habit to develop if your goal is financial freedom. In this post, we’ll take a look at more than a dozen online tools you can use to help gain control of your money.

Overview of the Best Budget Apps

| Budget App | Monthly Fee | Best For |

|---|---|---|

| Empower | Free | A Complete View of Finances |

| Simplifi | $2.99 per month | Mobile App Use |

| Tiller | $79 per year | Spreadsheet Budgeting |

| Rocket Money | Free to $12 per month | Reducing Subscription Costs |

| PocketSmith | Free to $26.66 per month | Forecasting |

| YNAB | $8.25 per month | Long-term goals |

| Quicken | $2.50 or $3.50 per month | Overall Budgeting |

1. Empower: Best for a complete view of finances

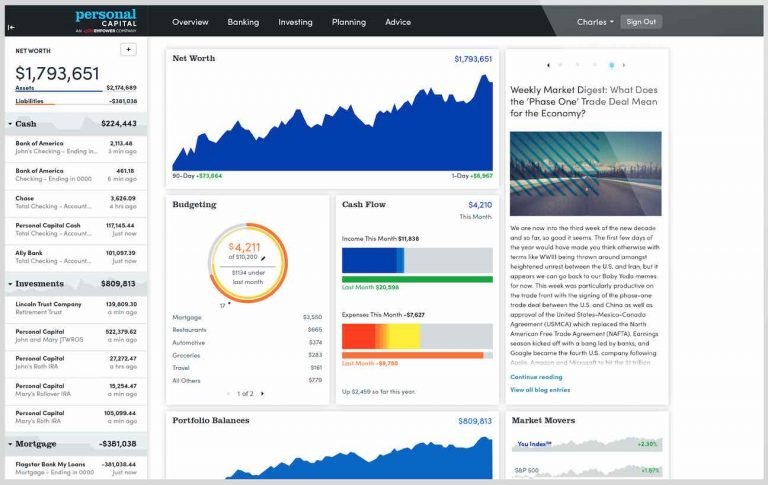

Empower is the online tool I use to track everything from budgets to credit cards to investments. I recommend this tool if you have 401(k), IRA, or other investments to track. It has a great-looking interface, it’s easy to link your accounts, and it gives you some great insight into how you spend your money and how your investments are performing.

Empower is excellent if you need an all-in-one financial dashboard. Since it tracks investments along with budgets, it’s a good option for getting a handle on all your finances. However, its strength is investment tracking over budgeting. You can customize and track your budget, of course. But if you want a more budget-focused tool, check out the other apps on the list.

- Cost: Free

Read our Empower Review

2. Simplifi: Best for budgeting on a smartphone

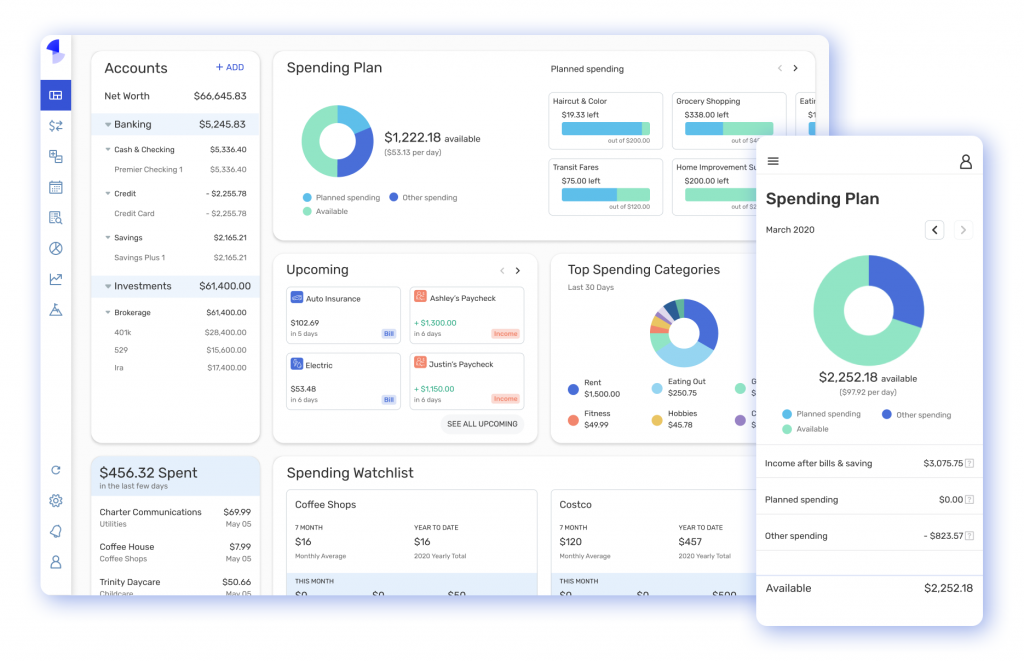

Simplifi is one of our favorite budgeting apps designed for mobile. In fact, for a while, the only place you could use Simplifi was on a smartphone. They didn’t have a desktop web browser option. More recently they’ve added one, and it looks as good as the mobile version.

The design is beautiful and very easy to use. You can see all of your finances in one place. Features include goal setting and tracking, budgeting, and investment tracking. Simplifi also includes excellent reporting.

In my experience using Simplifi, it does an excellent job of automatically categorizing expenses. It doesn’t get them all 100% correct, but it gets most of them right. You can create watchlists to track specific spending categories. And Simplifi notifies you of upcoming bills.

- Cost: $2.99/month

3. Tiller: Best for spreadsheet budgets

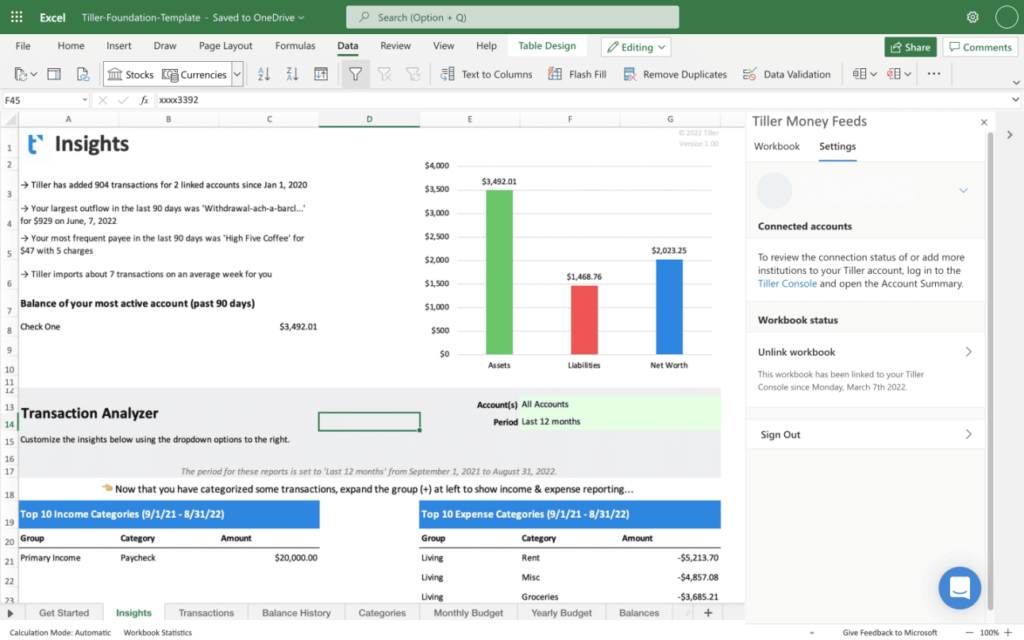

Tiller is unique among all of the other options listed here in that it uses spreadsheets. With Tiller, you can connect your bank, credit card, and investment accounts. Tiller then downloads your transactions into either Microsoft Excel or Google Sheets.

Once downloaded, you can view your data in any number of prebuilt templates. The templates allow you to categorize your transactions, review monthly spending, and create an annual budget. I’ve used Tiller for three years and have been very pleased.

There is a learning curve to Tiller, but support is excellent and so is the help documentation.

- Cost: Free trial, then $79/year

4. Rocket Money: Best for Managing Subscriptions

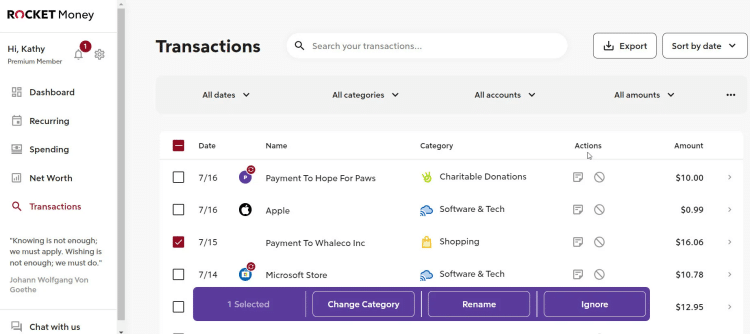

I use Rocket Money to track my finances and find their interface and layout to be the best for my needs. I have automated alerts set up so that I receive an email the second a transaction posts to any of my bank accounts (or credit cards) and can easily follow all my day-to-day spending.

The coolest feature that sets Rocket Money apart from other budgeting apps is that it tracks the subscriptions you have (by finding repetitive charges) and offers you a path to reduce the monthly cost. This feature is only available on the Premium subscription which costs between $4 and $12 per month.

- Cost: The basic service is free, but the premium subscription has a pay-what-you-want model, ranging from $4 to $12 per month.

5. Pocketsmith: Best for projecting future balances

Pocketsmith is a cloud-based budgeting app, that makes accessibility easy. Connect your bank accounts, investment accounts, loans, and credit cards to get a big-picture look at your finances including your net worth.

Some stand-out features include forecasting your money by running “what-if” scenarios to project your future balances. You can also create budgets and set up alerts to let you know if your accounts are running low on funds. While you can’t pay your bills with Pocketsmith, you can schedule due dates in the app’s calendar to help you avoid late payment fees.

There are a couple of different price options including a free version so you can take this app for a spin and see if it’ll work for you.

- Cost: The basic package is free and Pocketsmith offers three premium packages ranging from $9.99 to $26.66 per month

Read our PocketSmith Review

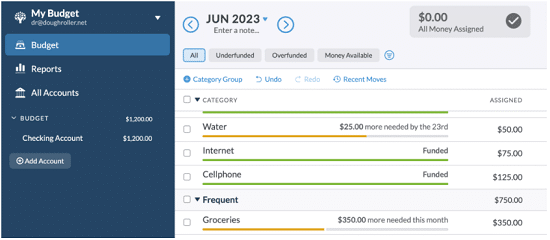

6. YNAB (You Need A Budget): Best for long-term goals and customer service

YNAB (You Need A Budget) has a clean and simple interface that functions a lot like a spreadsheet you could create (or perhaps have already created) yourself. Linking your accounts creates automated transaction tracking and helps you set up your budgets so you can see what categories you are spending more in, and where you have extra money.

If you overspend in one area during any given month, YNAB allows you to move money from a different budget category to cover the expense. You can also link your credit card accounts, which could be very beneficial if your goal is to pay down debt.

For some, the drawback may be the price (especially considering that there are other free budget apps out there). YNAB charges $11.99/month or $84/year (this option will save you $59). You can cancel at any time. It does have a free intro period of 34 days so you can give it a try and determine for yourself if it’s worth it.

YNAB pledges that people save $600 within a month, so you may very well find that it is. If you are serious about getting into financial shape and don’t mind investing some extra money, then YNAB could be very helpful to you. It offers a web app plus apps for iPhone, iPad, Apple Watch, and Android.

- Cost: Free trial, then as low as $8.25 per month (when paid annually).

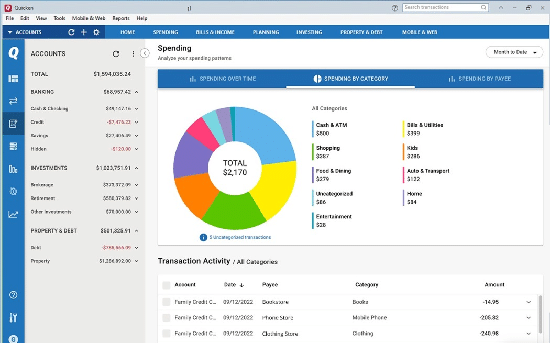

7. Quicken: Cleanest budgeting software

Most of the apps in our list are, well, apps. Quicken is both software and an app. You can download the PC or Mac versions of Quicken, and you can also access Quicken online. For those who like the software option, Quicken may be the answer.

Best known for budgeting, Quicken can handle any budget. Transactions are automatically categorized, but you can recategorize an expense as needed. It offers reporting by category or payee. It also offers income and income & expense reports.

Beyond budgeting, the Quicken app can also track your investments. In this regard, we don’t like it as much as Empower, but it gets the job done. You can link your investment accounts, but reporting is very limited.

In the end, Quicken offers solid features, but its reporting and user interface are dated. For that reason, you might want to check out some excellent alternatives to Quicken.

- Cost: $2.50 to $3.50 per month.

Read our Quicken Review

Other Budgeting Tool Options

In addition to the above options, here are some other budget apps worth considering.

PocketGuard: Best for generating a budget

This app-based option is great if one of your issues is knowing what money you have left to spend. It lets you put your bills and savings goals into the app. Then it tracks your spending automatically. At any point, you can see what’s in your pocket. This is the money you have left over after you’ve paid your bills and put money into savings. That way, you can spend wisely and confidently.

PocketGuard is also great if you don’t want to deal with making your budget. You put in your bills, and it analyzes your spending and savings goals to create a personalized budget for you. You can, of course, make changes to it. But it’s a good place to begin. It will also give you ways you can save, including negotiating on your bills, moving money to high-interest savings accounts, and more.

For a mobile-first approach that makes budgeting simpler, PocketGuard is a great option.

Buxfer: Best for setting spending limits and tracking your progress

This online and app-based option lets you set spending limits in a unique way–weekly, monthly, or yearly. So you might set up monthly limits for grocery spending, weekly limits for eating out, and annual limits for gifts or big-ticket home renovation items. The system can auto-tag transactions as they come and then send you mobile alerts when you exceed a particular budget. It can also remind you about upcoming bills.

Buxfer is budget-first but also pulls in information about your investments. It also generates some nice-looking reports that help you get a feel for your spending and savings activity over time. And the best part is that it’s free.

BudgetPulse: Best for savings goals and social sharing

If you’re concerned about the security of integrating your budgeting software with your credit card and checking account, BudgetPulse may be for you. With this software, you get an easy-to-use interface but have to manually enter your transactions. That can take extra time but also can make you feel more secure if you’re suspicious of even bank-level encryption.

PearBudget: Best for spreadsheet-based budgeting based on the envelope system

This budgeting tool is great for people who are new to budgeting or just overwhelmed by it all. The spreadsheet-based budget lets you customize all of your category names. It uses the envelopes system of budgeting. When you run out of money in a category, you just stop spending. And it’s got an interface that’s easy to understand.

PearBudget costs just $4.95 per month, and it claims to let you keep your budget up to date in just 20 minutes of work a week.

Free Excel and Sheets Budget Templates

If you prefer spreadsheets over online software, there are several free budget templates available from Microsoft and Google Sheets. A quick Google search of budgeting templates for your preferred interface will turn up tons that you can use to keep your budget in shape over time.

With all these free and low-cost budgeting tools available, there’s no reason not to be tracking your income and spending, setting savings goals, and even keeping tabs on your investments from your computer or phone.

Related: Best Expense Tracker Apps

Dollarbird

Is your primary budget issue figuring out what you need to pay in the future? Maybe you’re afraid to spend $10 on lunch, even if your bank account is fairly flush, because you can’t remember when your student loans are due. Dollarbird can help with that.

Dollarbird is free with premium add-ons. The idea here is to put your budget into calendar form. You get an at-a-glance view of upcoming expenses. Color code transactions by category and easily enter recurring transactions, like your paycheck and utility bill. The app lets you see your projected balance, so you know how much money you can safely spend.

One limitation here, though, is that Dollarbird doesn’t sync with your bank accounts. You’ll have to enter transactions manually, but that’s pretty simple to do–and that means you end up with a more hands-on approach to your money.

Wally

Wally is a stripped-down budgeting app without a lot of bells and whistles. However, the unique features it does have are worth exploring.

First of all, Wally supports nearly all foreign currencies. If you’re a digital nomad, spending time outside the country, Wally can be a great help to you.

Next, Wally allows you to save pictures of receipts so you can keep track of important items related to taxes and business without dealing with paper.

Each time you log in, Wally lets you know how much money you have, and what’s left in the budget until the end of the month. With that information, and the ability to manage your finances without paper in almost any currency in the world, it’s no wonder that Wally is popular with millennials.

Good Budget

Goodbudget is built on the concept of an envelope budget. You get 10 envelopes for free, but if you upgrade to Plus, you get unlimited envelopes for $6 per month. As with most envelope-based systems, you have to stop spending when an envelope is empty or move money from a different envelope.

One of the biggest advantages associated with Goodbudget is that you can create a shared budget in your household. Goodbudget is compatible across iPhone and Android devices, so it doesn’t matter what others are using.

Use Goodbudget to set shared goals, keep each other accountable, and plan your budget in a way that everyone knows what’s happening.

Frequently Asked Questions (FAQ)

What does a personal budget software app do?

Personal budgeting software is designed to help you track your income and expenses. Some budget tools will allow you to connect to your bank, credit card, and investment accounts to automatically populate the information.

Other tools require you to manually enter your information. With a personal budget software app, you can keep track of your expenses, spot trends and identify places where you can improve.

What should every budget include?

When creating a budget, it’s important to include the items that you’re most likely to spend on. First of all, your budget should account for your income, including when you’re paid. You should then figure out what recurring expenses you have, including:

Housing

Utilities

Transportation (including your car payment)

Food

Savings

Retirement

Entertainment

Childcare

It’s also a good idea to consider one-time expenses, as well as unexpected expenses. Consider creating a budget that allows you to plan, just in case you have emergency needs like a car repair or some other issue.

How to start budgeting for the first time?

The easiest way to start budgeting for the first time is to take a look at your last two to three months’ worth of bank statements to get a feel for your income and expenses. You should have a rough idea of what money is coming in and where it’s going.

You can also use a free budgeting app like Mint that will pull your information and show you where you stand. But the first step to a successful budget is understanding where your money is going.

What’s the 50/30/20 budget rule?

The 50/30/20 budget rule is a framework for helping you figure out how to allocate your budget. In general, the rule suggests that you spend 50% of your after-tax income on needs, and another 30% on wants. The other 20% is meant for saving or paying off debt.

This is a general framework that can be adapted to your individual needs and situation. In some cases, you might tweak the numbers if you want to pay off debt faster and restrict the budget to 20% for wants and use the 30% for paying off debt or saving. You could further break the debt or saving category down to work toward both goals.

Final Thought on the Best Budget Apps

Your budget can help you take control of your finances and make the most of your money. When making a budget, some online tools can help you identify patterns in your spending, stay on top of your income, and make better choices about your money.